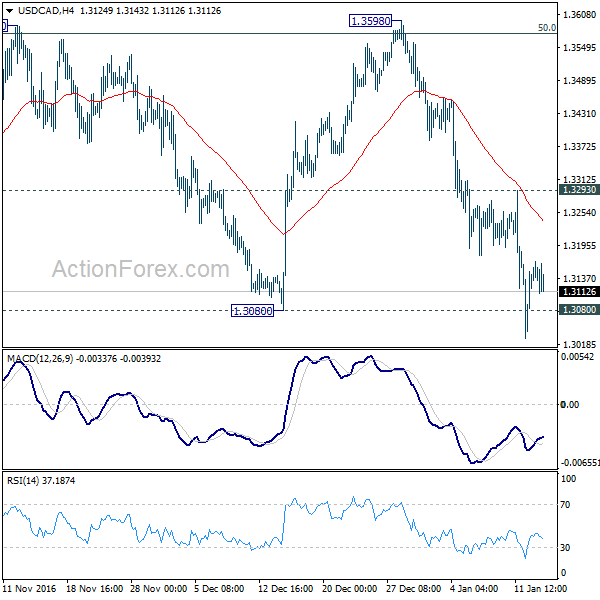

Daily Pivots: (S1) 1.3226; (P) 1.3293; (R1) 1.3345; More…

Upside momentum in USD/CAD remains unconvincing, as seen in the structure of the rise from 1.2781. In case of another rally, we’d be cautious on topping around 1.3385 to bring near term reversal. On the downside, break of 1.3187 support will argue that rise from 1.2781 has completed. And intraday bias would be turned back to the downside for 55 day EMA (now at 1.3127) first. Nevertheless, strong break of 1.3385 will confirm medium term up trend resumption.

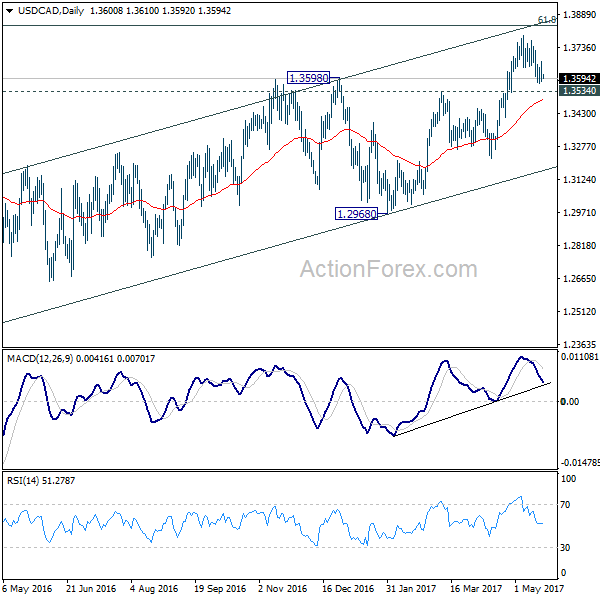

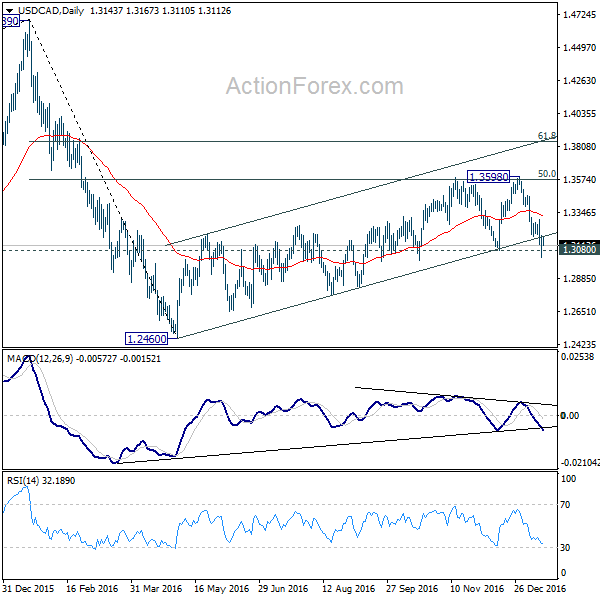

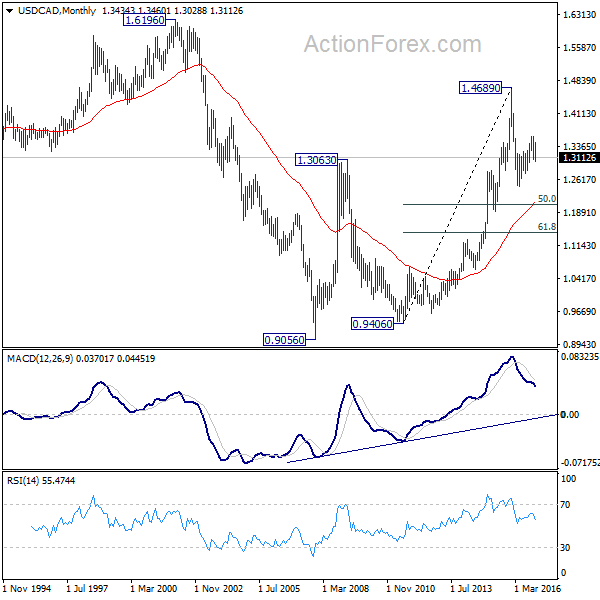

In the bigger picture, current development revives the case that corrective fall from 1.3385 has completed at 1.2781 already. And whole up trend from 1.2061 (2016 low) is ready to resume. Break of 1.3385 will target 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685. This will now be the favored case as long as 1.2781 support holds.