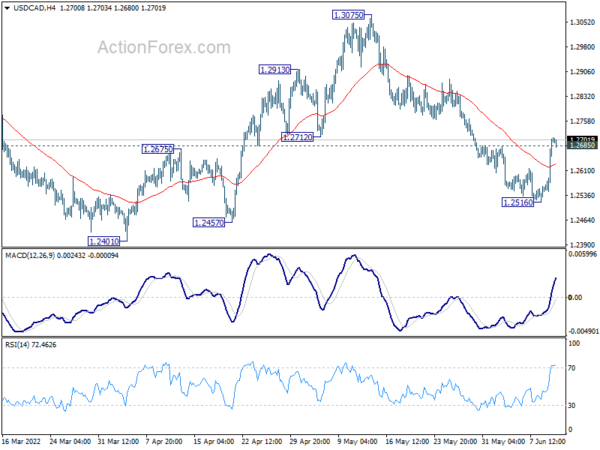

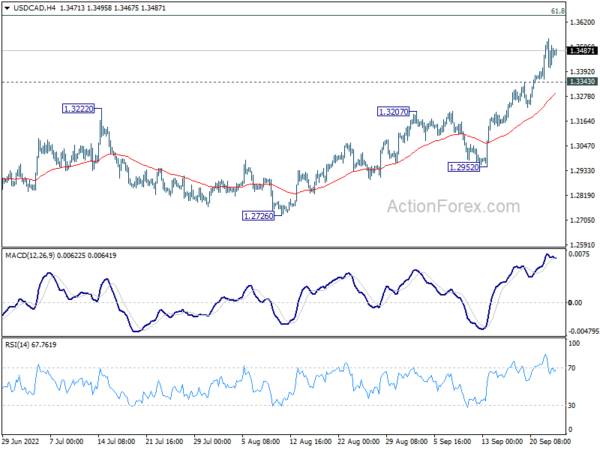

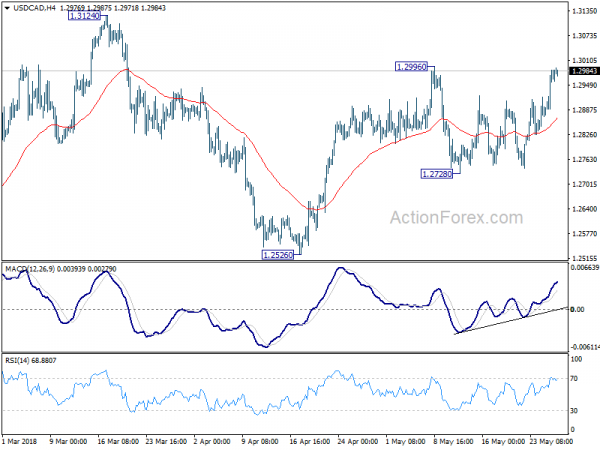

Daily Pivots: (S1) 1.2507; (P) 1.2551; (R1) 1.2627; More…

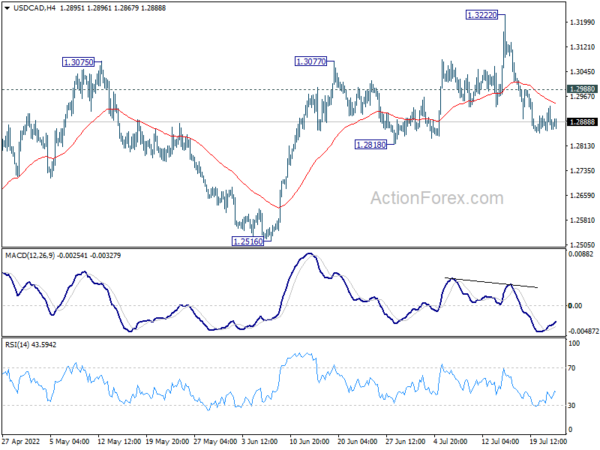

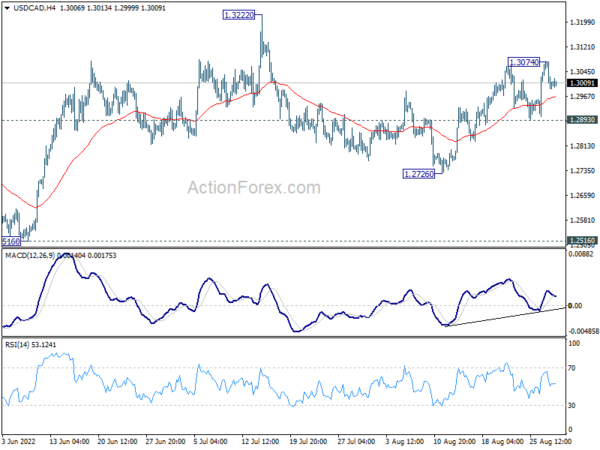

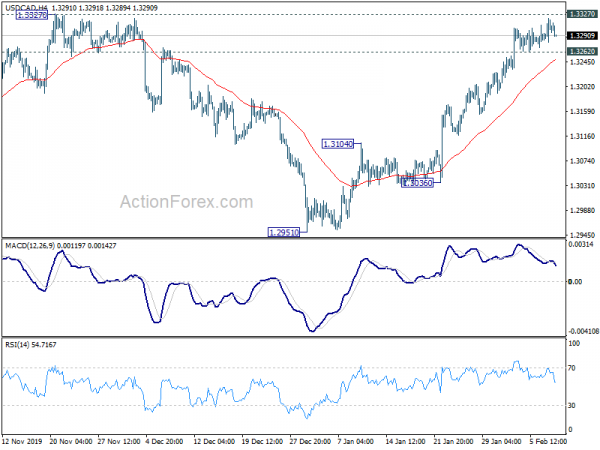

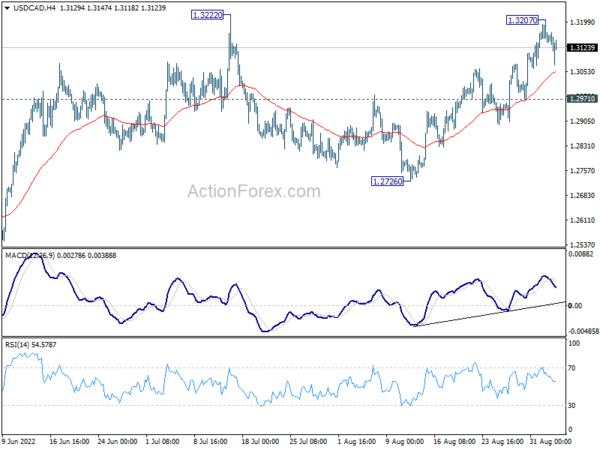

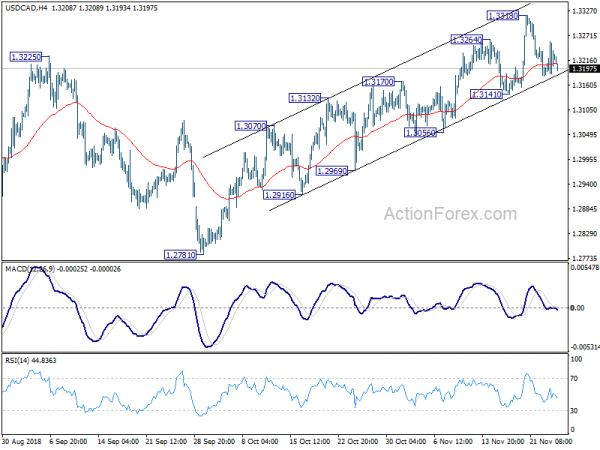

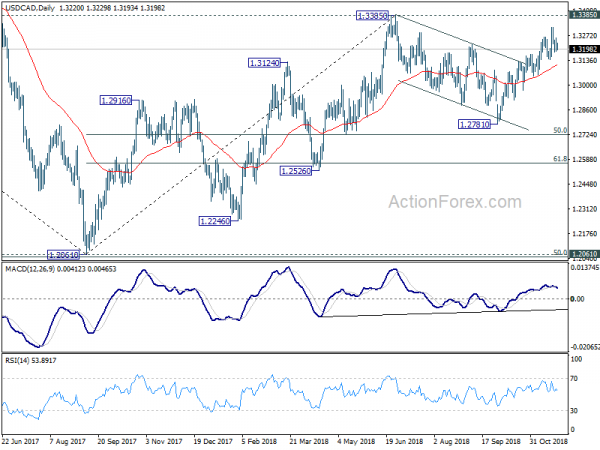

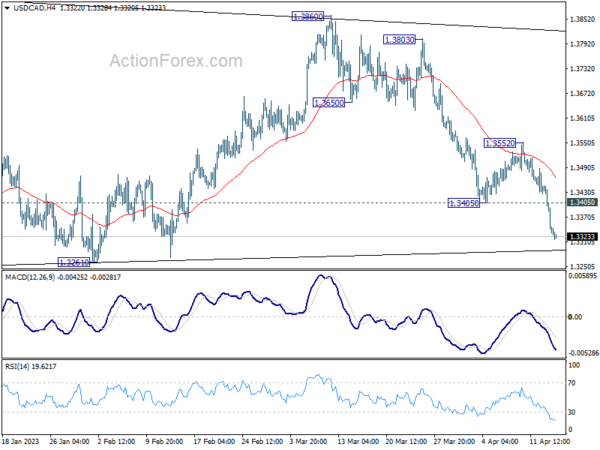

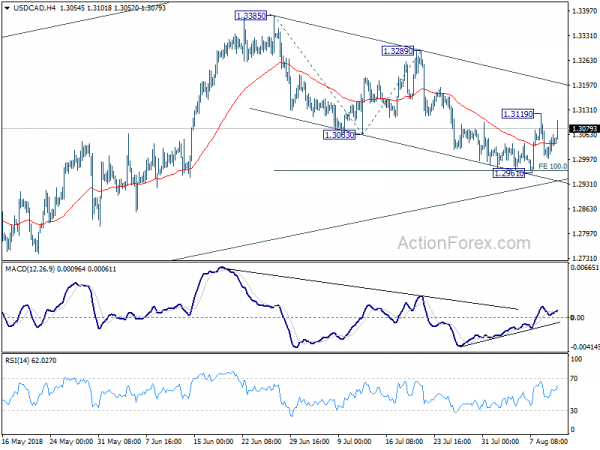

Intraday bias in USD/CAD remains on the upside for the moment. As noted before, fall from 1.2947 might have completed with three waves down to 1.2286. Further rally would be seen back to retest 1.2894/2947 resistance zone. On the downside, however, break of 1.2478 minor support will mix up near term outlook and turn intraday bias neutral again first.

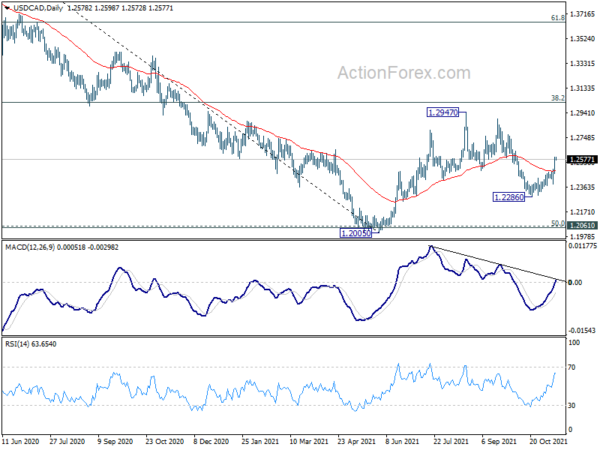

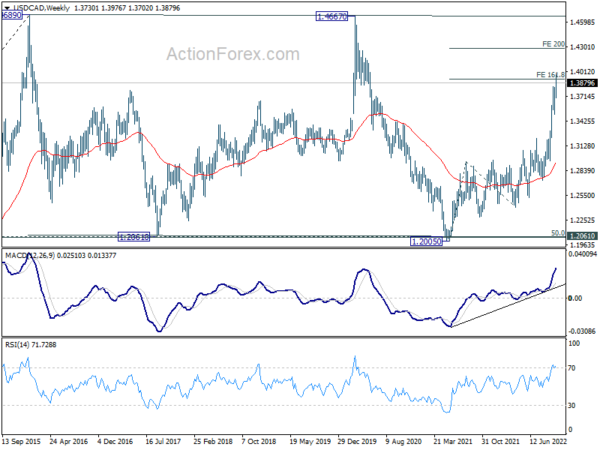

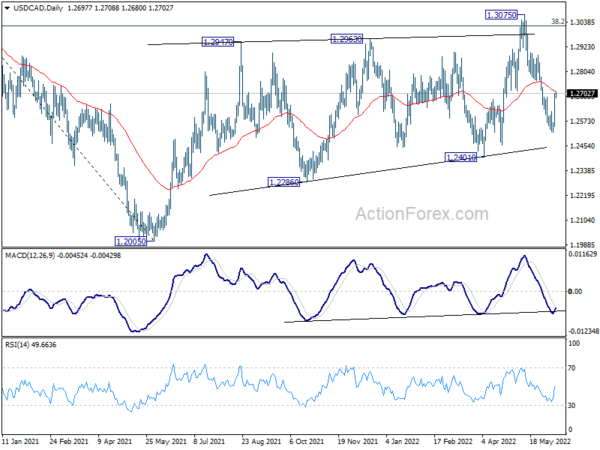

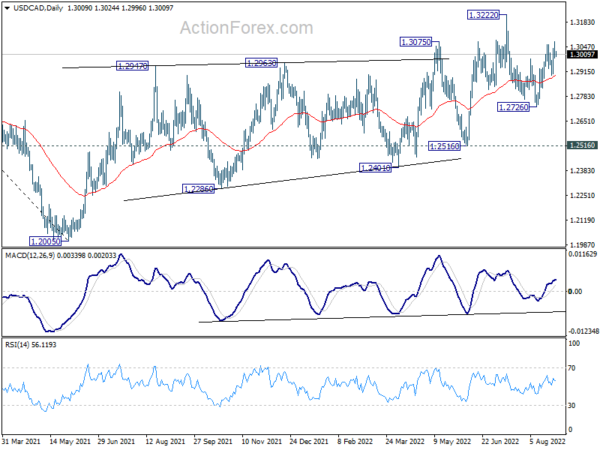

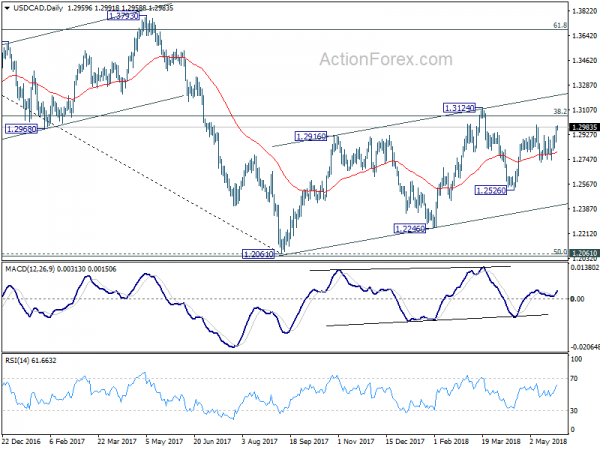

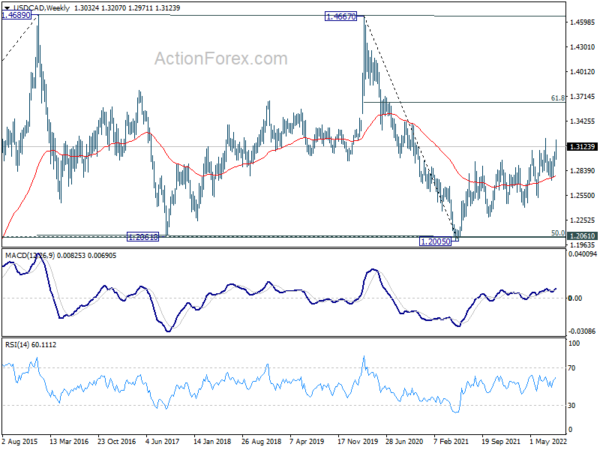

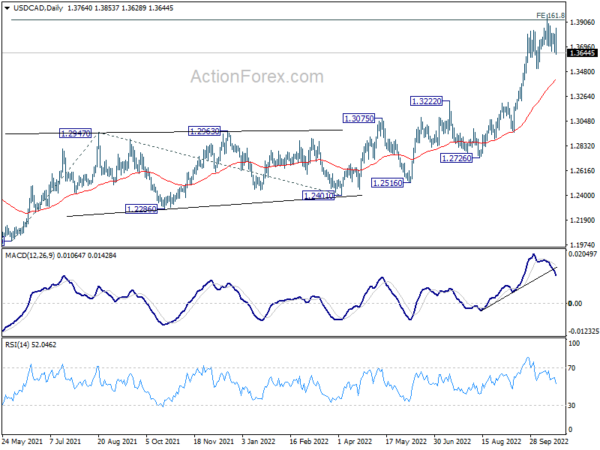

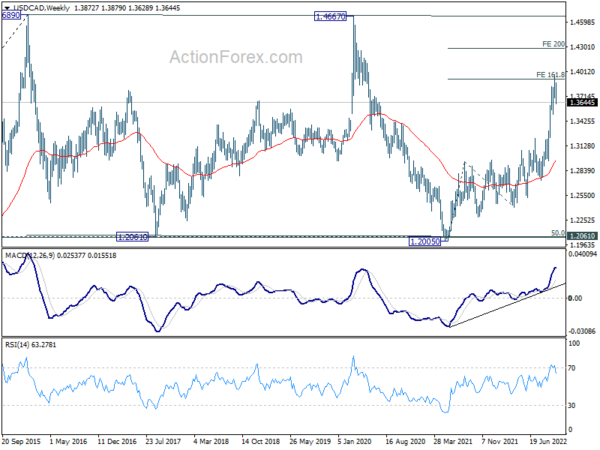

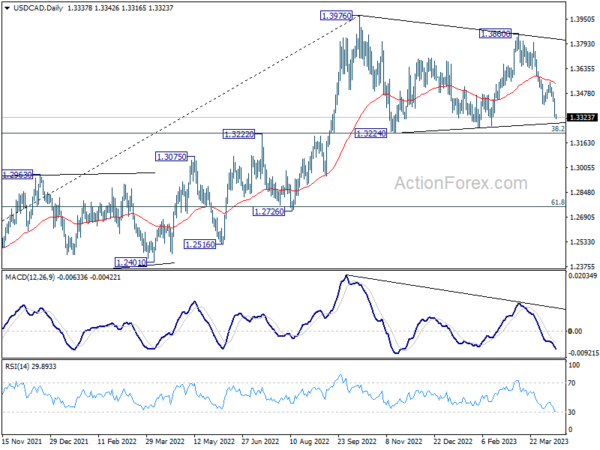

In the bigger picture, medium term outlook is neutral for now. The pair draw support from 1.2061 cluster and rebounded. Yet, upside was limited below 38.2% retracement of 1.4667 to 1.2005 at 1.3022. On the upside, firm break of 1.3022 should affirm the case of medium term bullish reversal. However, break of 1.2286 will turn focus back to 1.2005 low again.