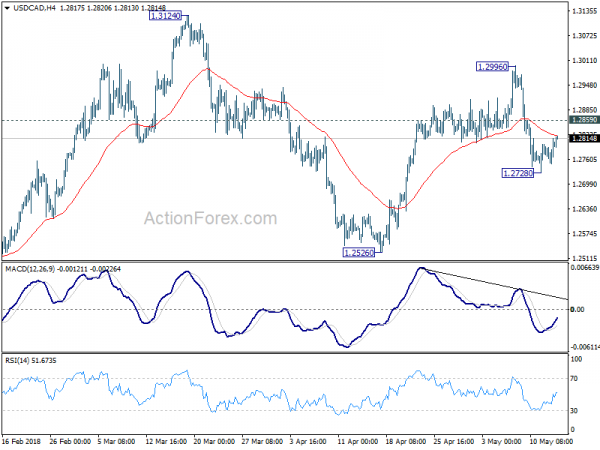

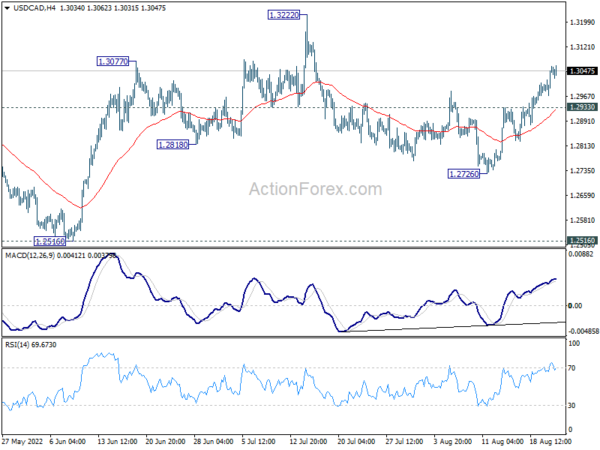

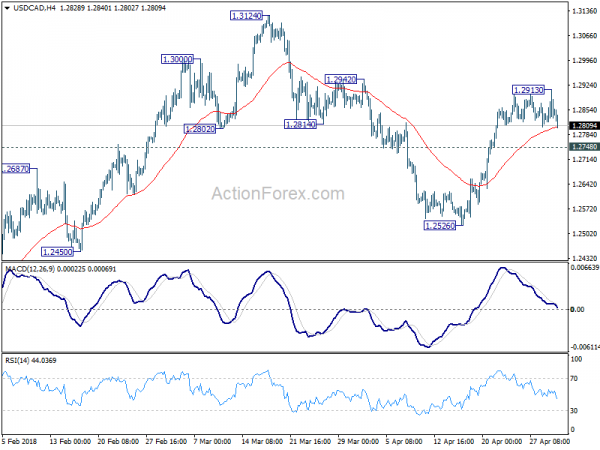

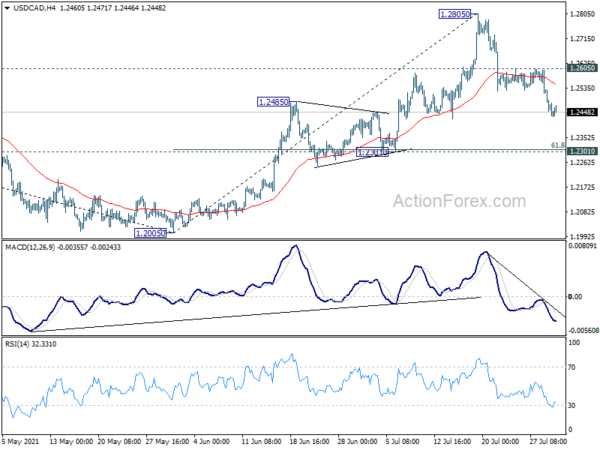

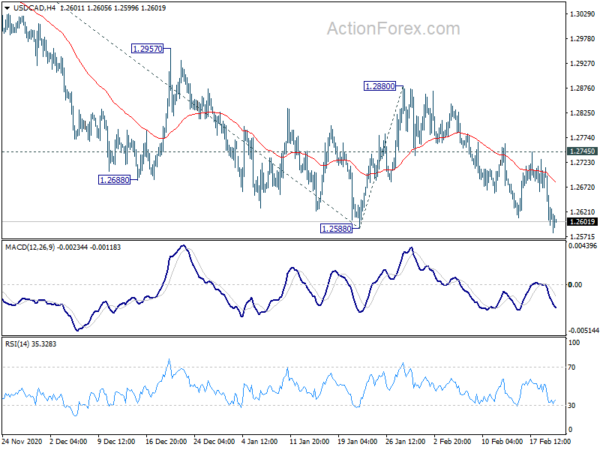

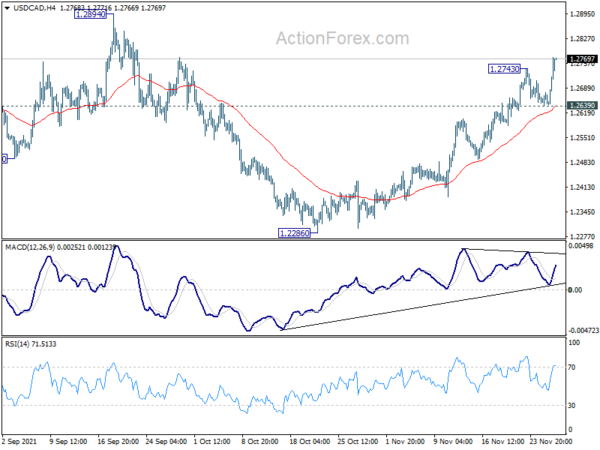

Daily Pivots: (S1) 1.2762; (P) 1.2793; (R1) 1.2843; More….

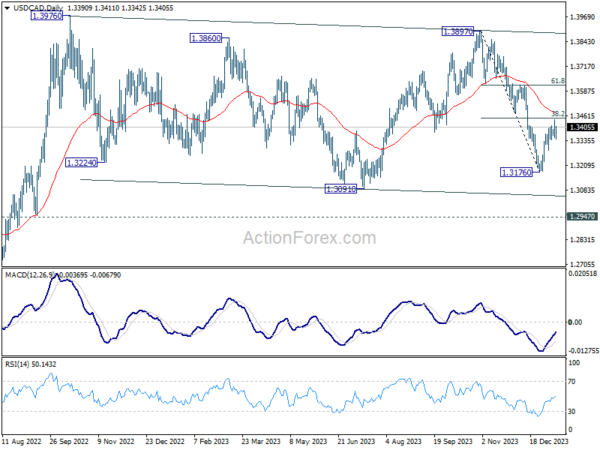

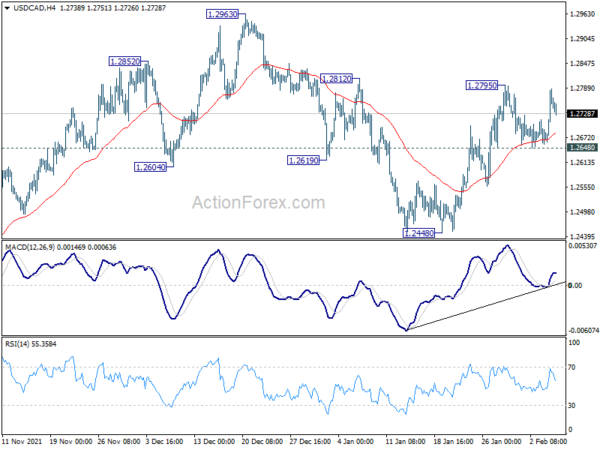

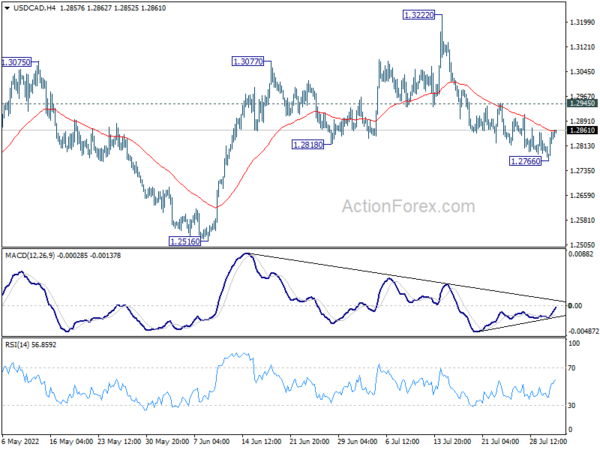

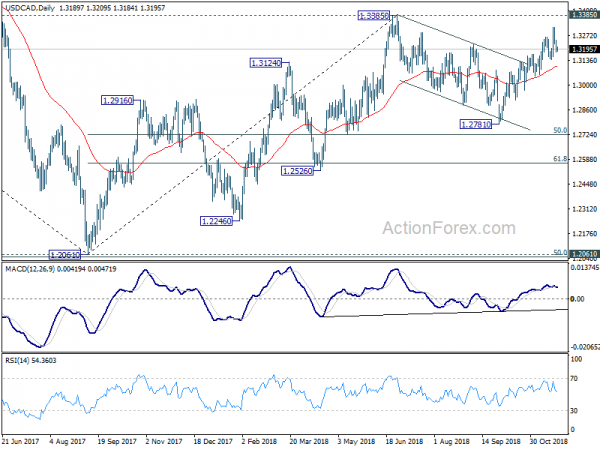

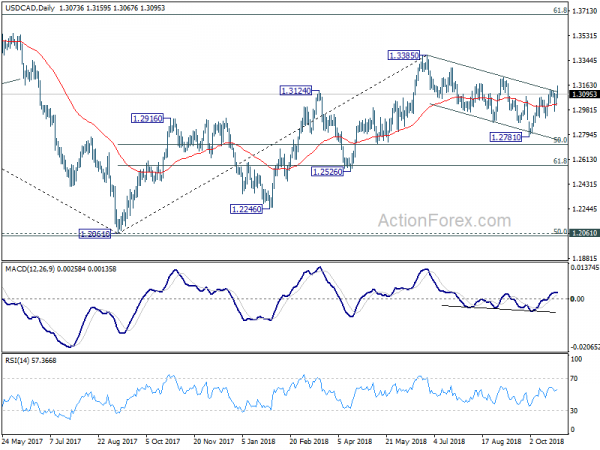

USD/CAD recovered after dipping to 1.2728 and intraday bias is turned neutral first. At this point, we continue to favor the bullish case that rebound from 1.2061 hasn’t completed. Therefore, in case of another fall, downside should be contained well above 1.2526 support and bring rebound. On the upside, above 1.2859 will bring retest of 1.2996 first. However, firm break of 1.2526 will resume the fall from 1.3124 to 1.2246 support and likely below.

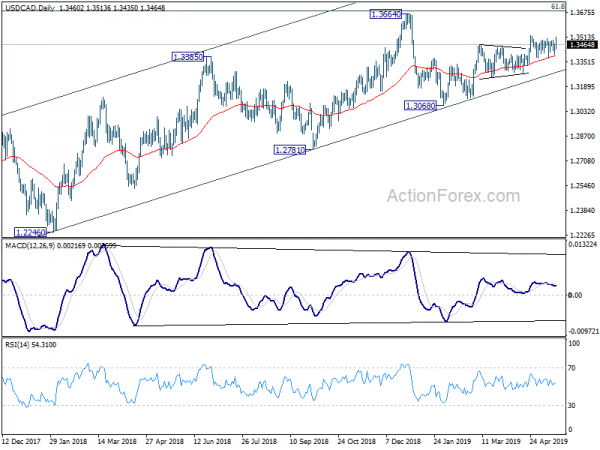

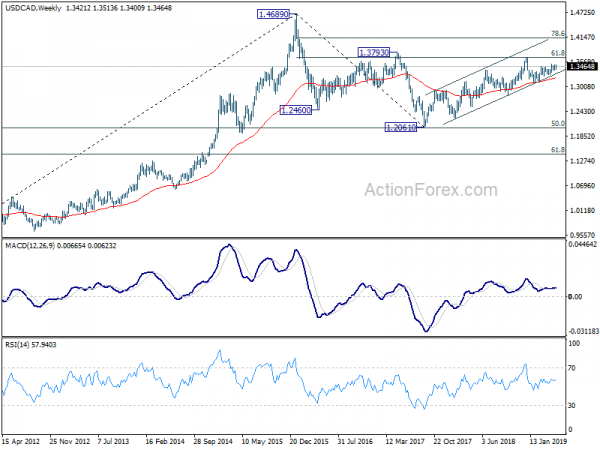

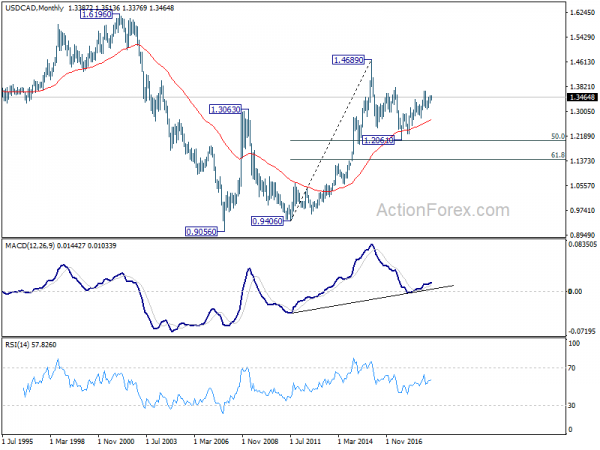

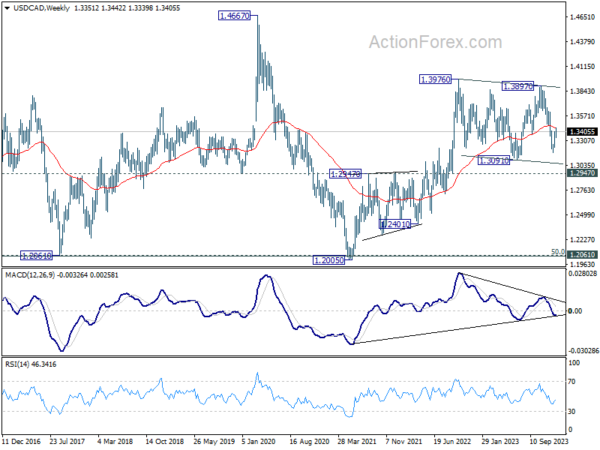

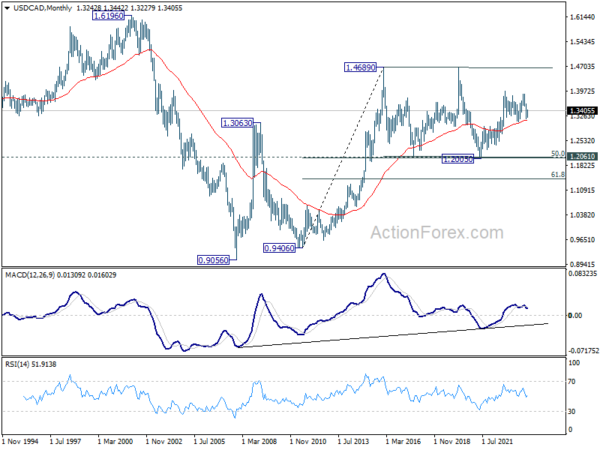

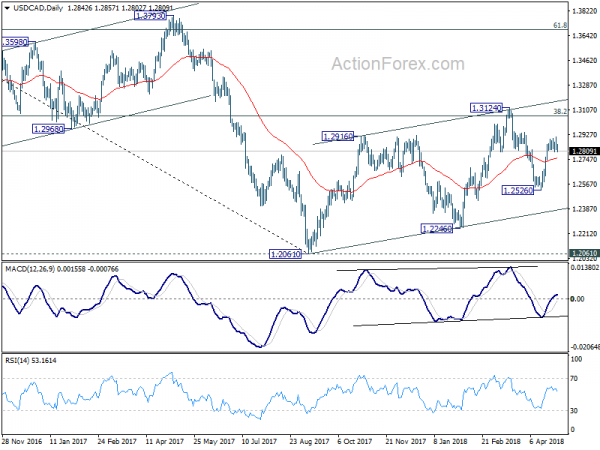

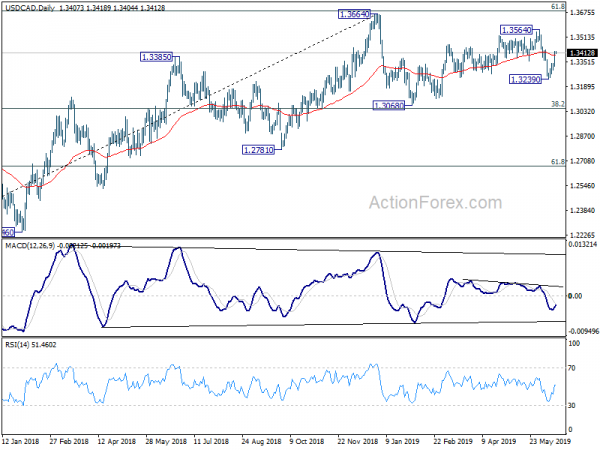

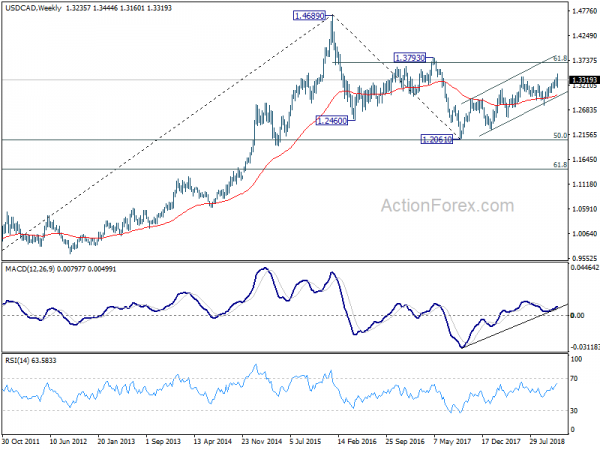

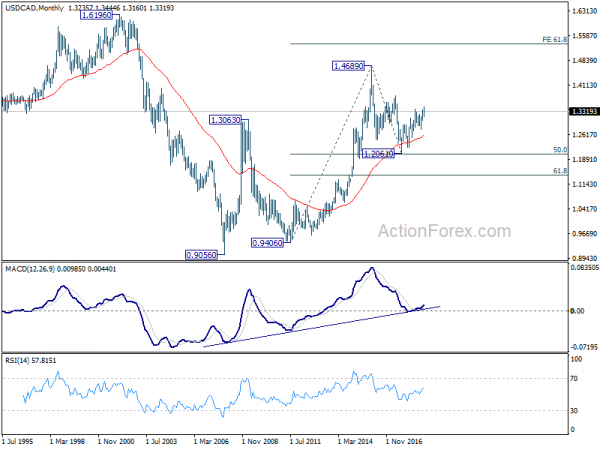

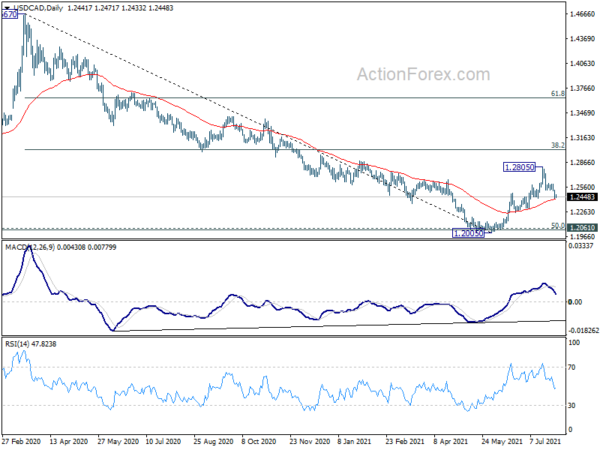

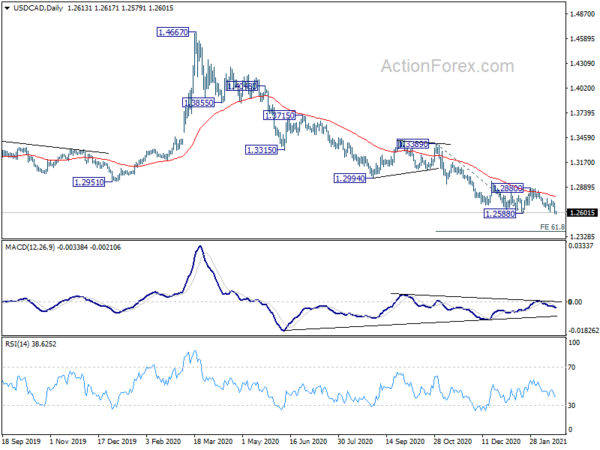

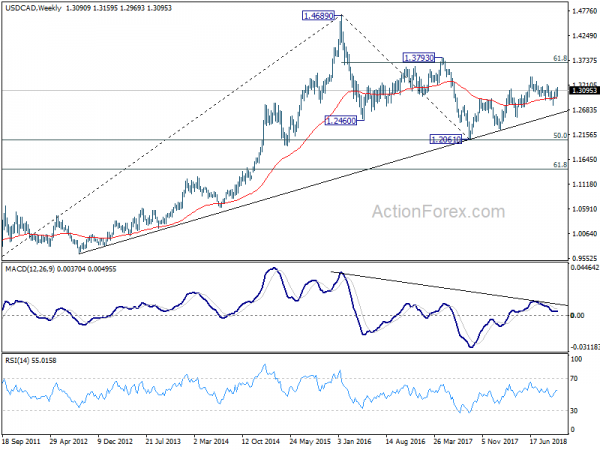

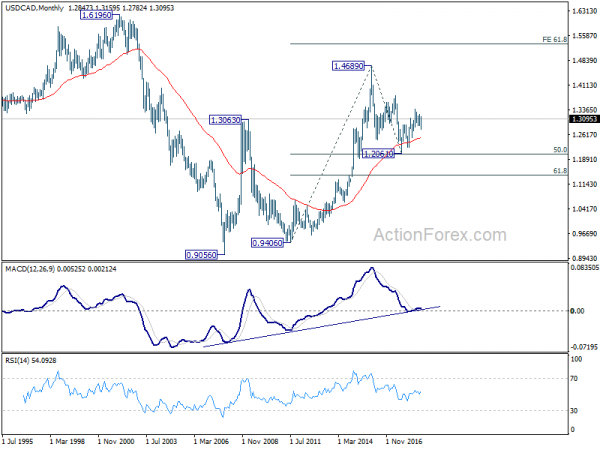

In the bigger picture, current development suggests that rebound from 1.2061 has not completed yet. Focus is back on 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Sustained trading above there will confirm medium term bullish reversal. That is, down trend from 1.4689 has completed at 1.2061 already. In that case, next target will be 61.8% retracement at 1.3685. However, break of 1.2526 support will dampen this bullish view again. And, focus will be back on 1.2061 key support level, which is close to 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048