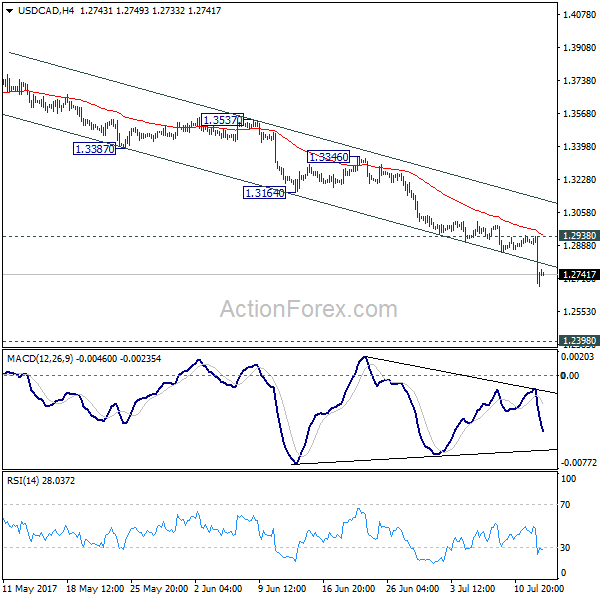

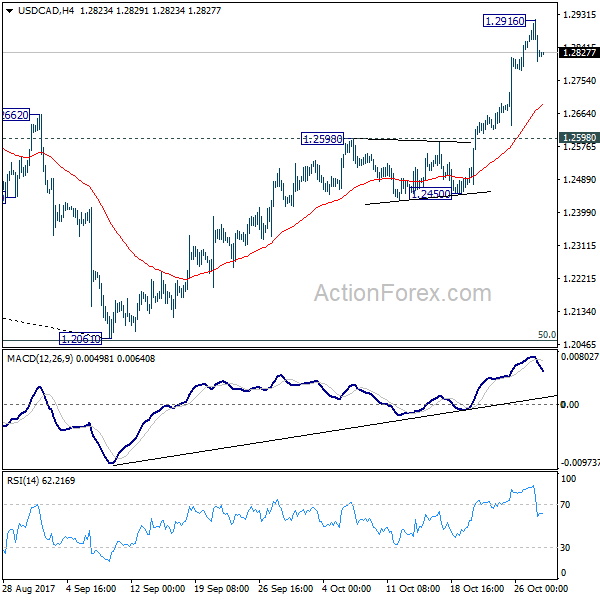

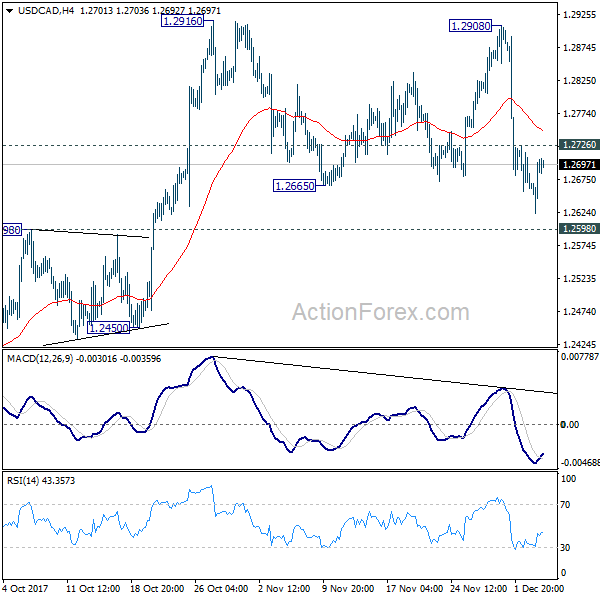

Daily Pivots: (S1) 1.2884; (P) 1.2914; (R1) 1.2943; More….

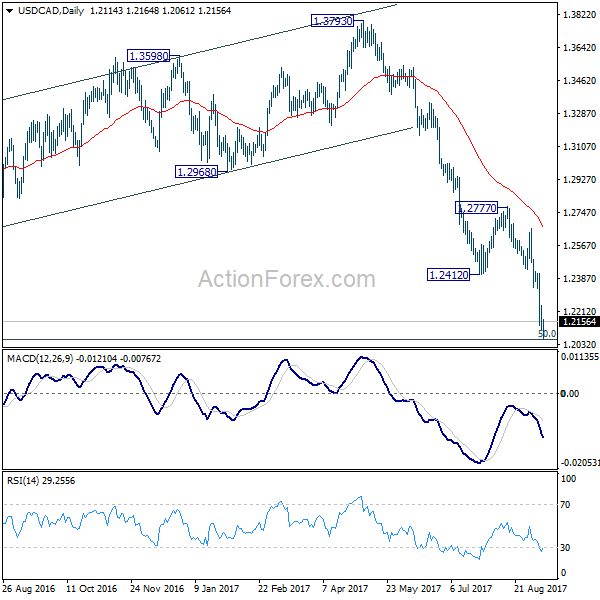

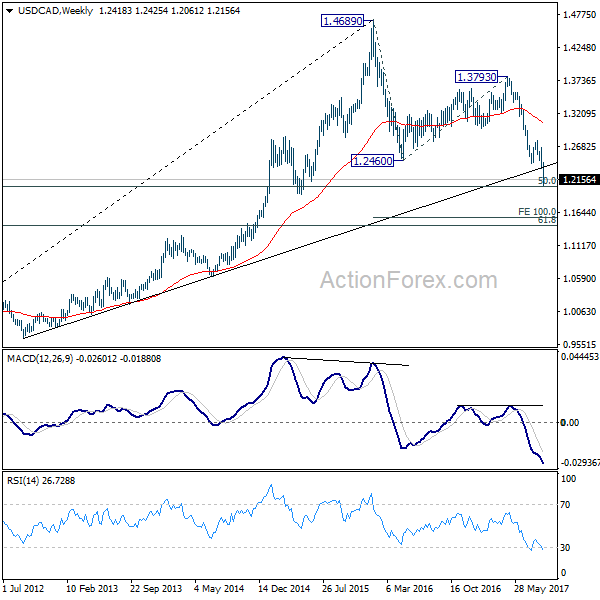

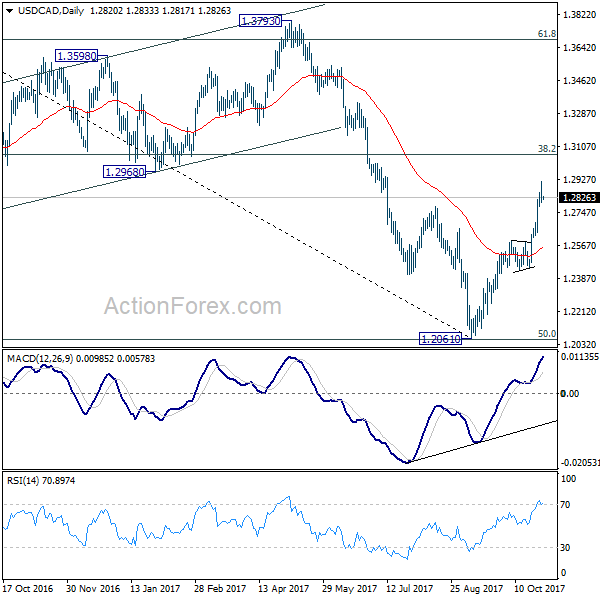

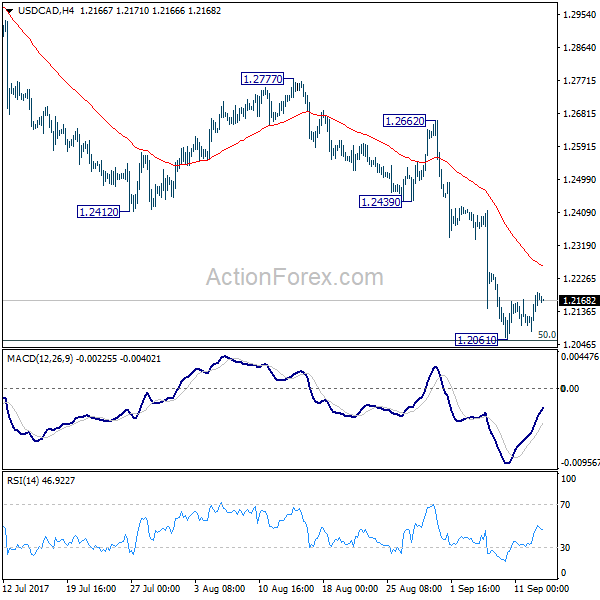

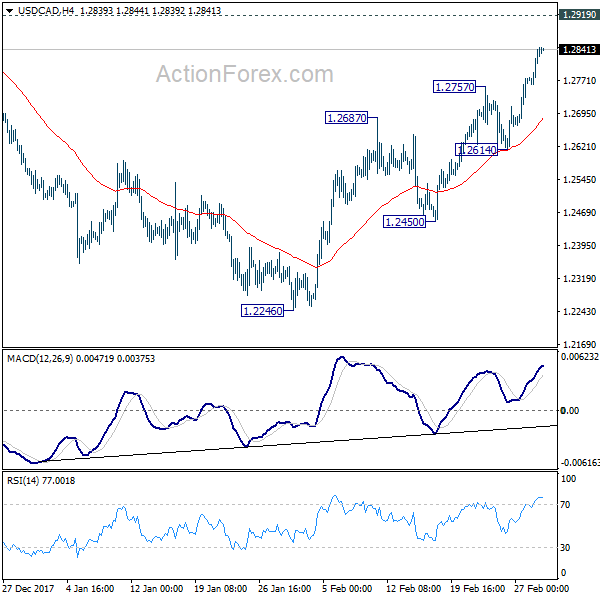

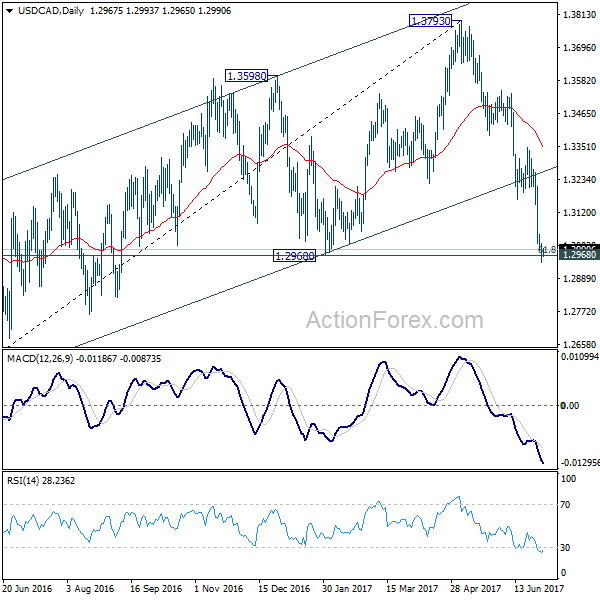

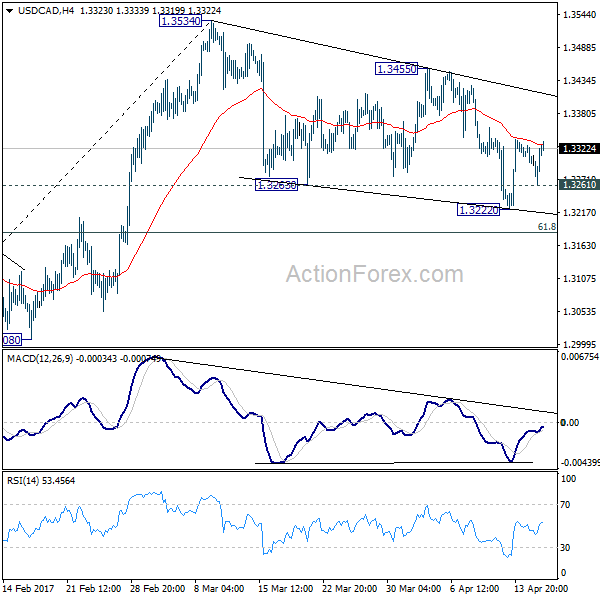

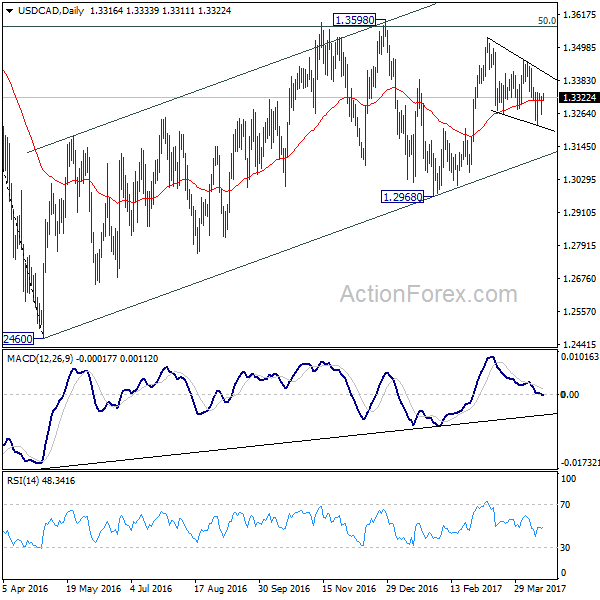

USD/CAD’s fall from 1.3793 is still in progress and extends to as low as 1.2679 so far. The break of near term channel support indicates downside acceleration. Intraday bias stays on the downside. Current decline should target a test on 1.2460 low. On the upside, break of 1.2938 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

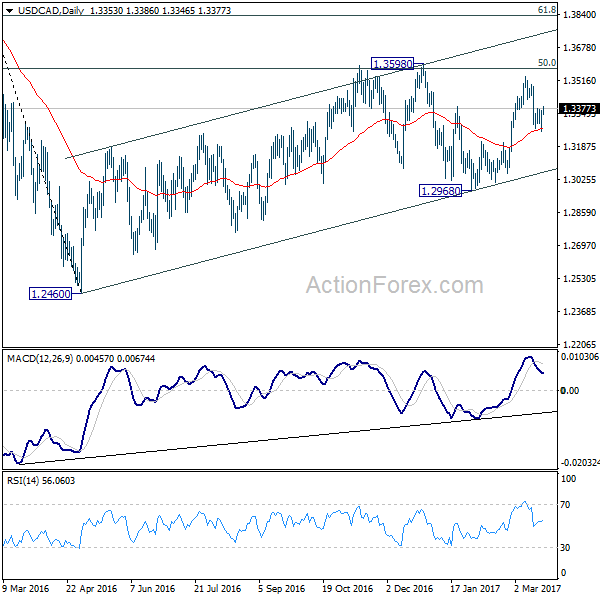

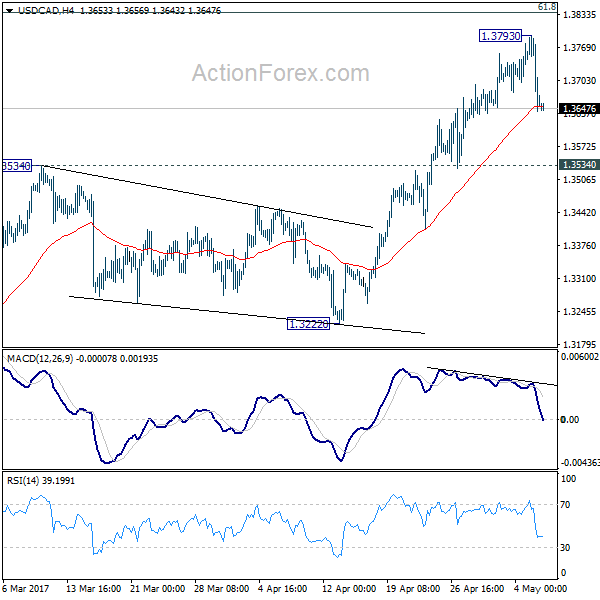

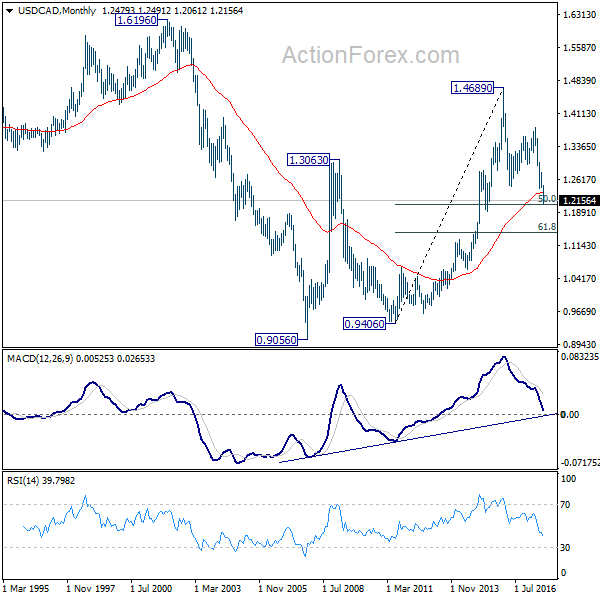

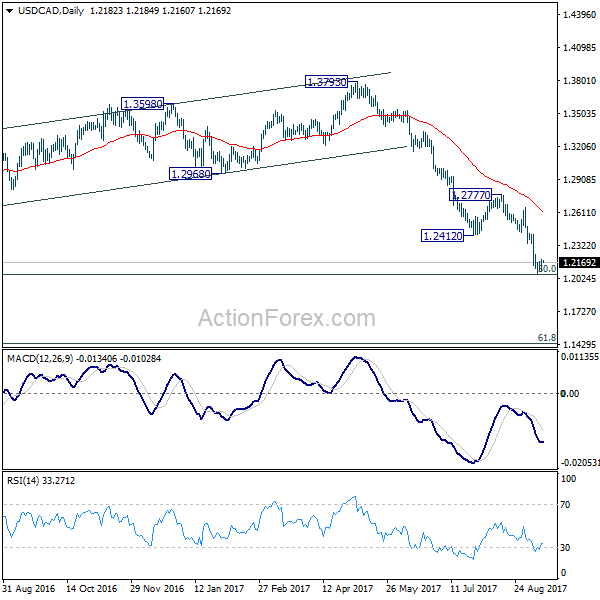

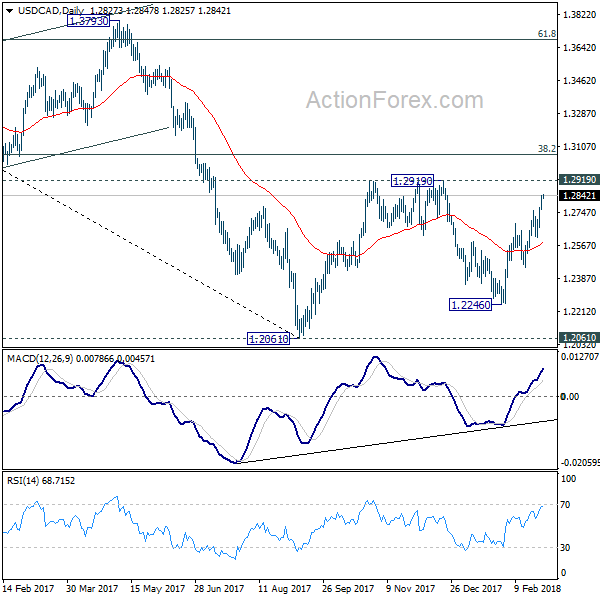

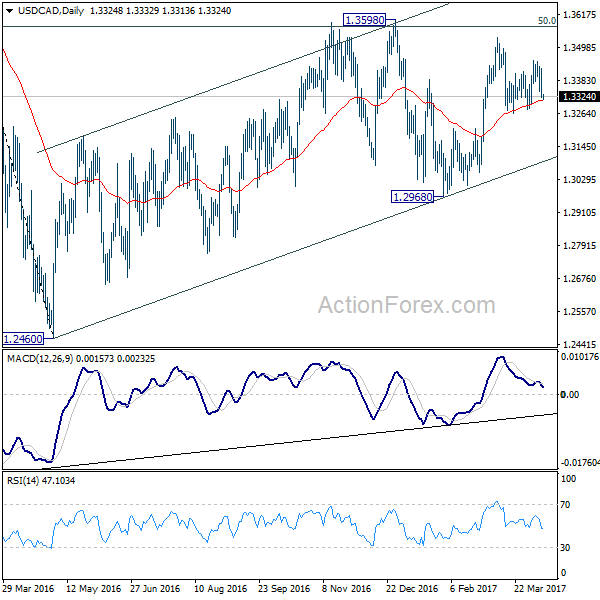

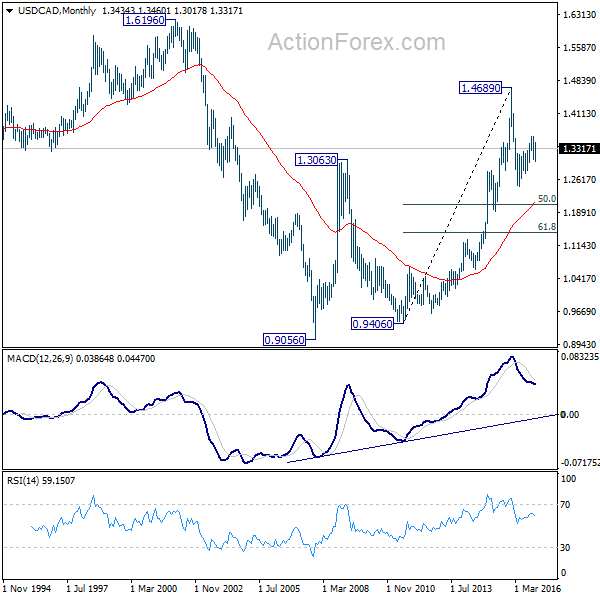

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The second leg should have finished at 1.3793. Break of 1.2460 will extend such correction to 50% retracement of 0.9406 to 1.4869 at 1.2048. At this point, we’d look for strong support from there to contain downside and bring rebound. However, firm break there will target 100% projection of 1.4689 to 1.2460 from 1.3793 at 1.1564.