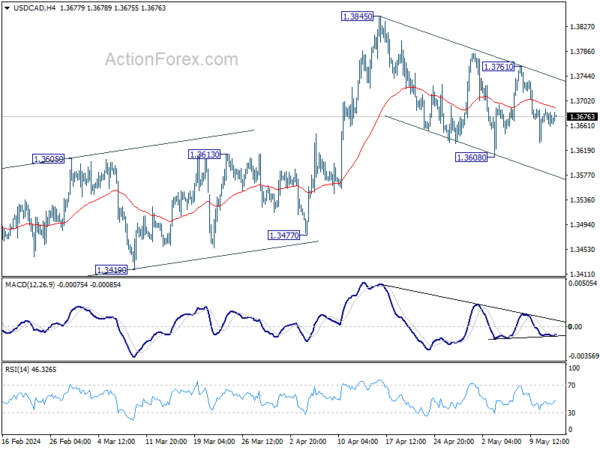

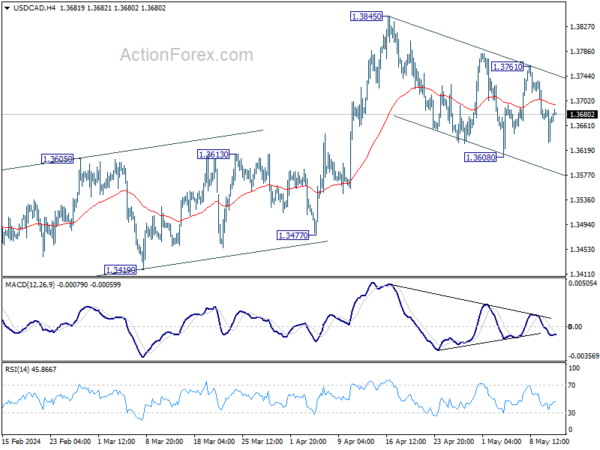

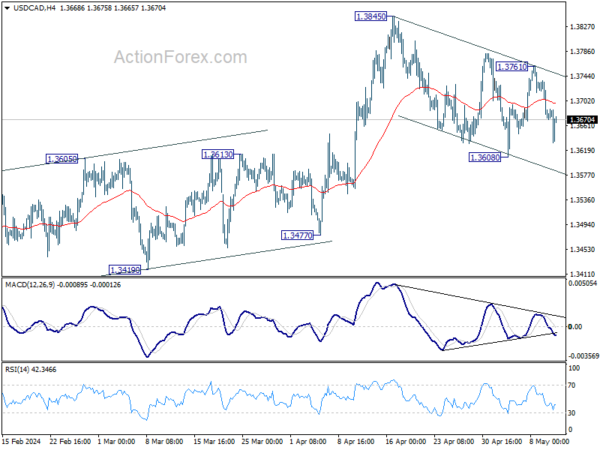

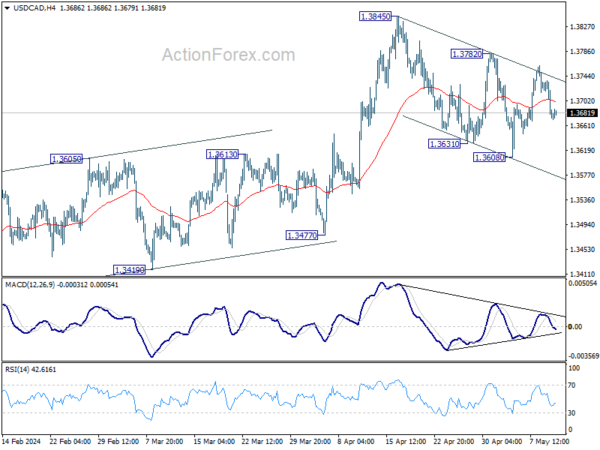

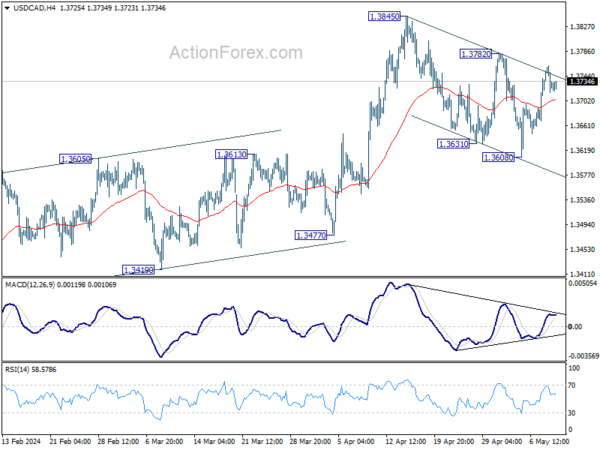

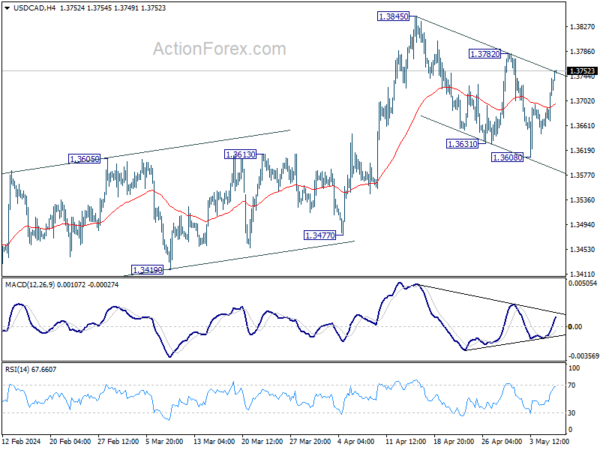

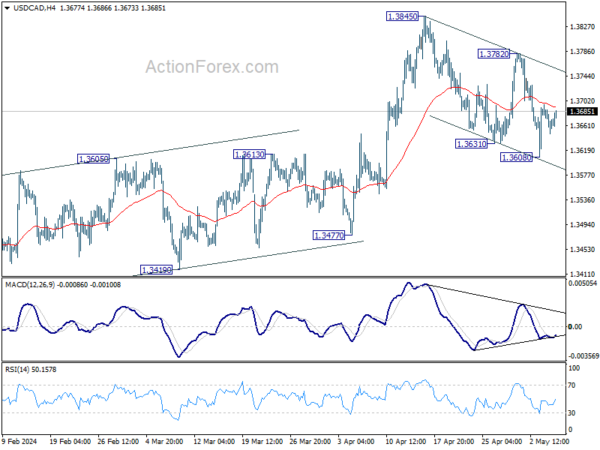

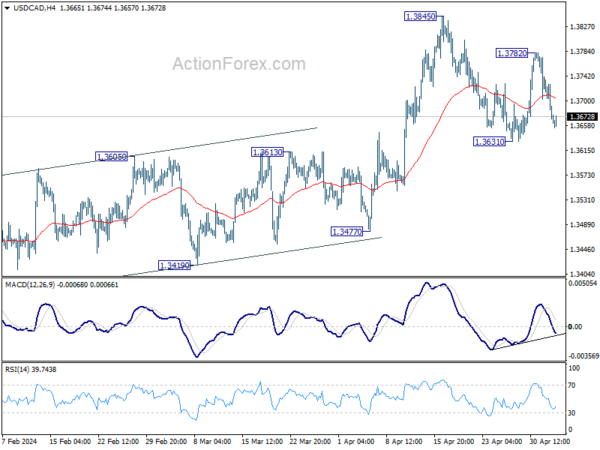

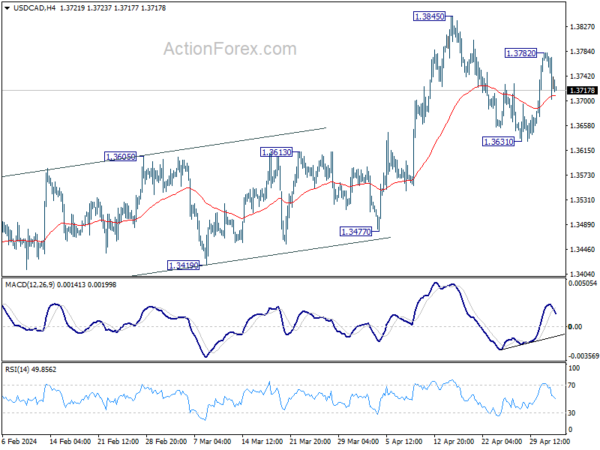

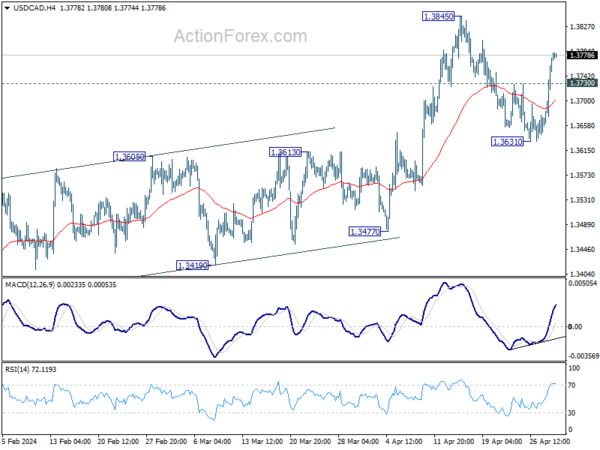

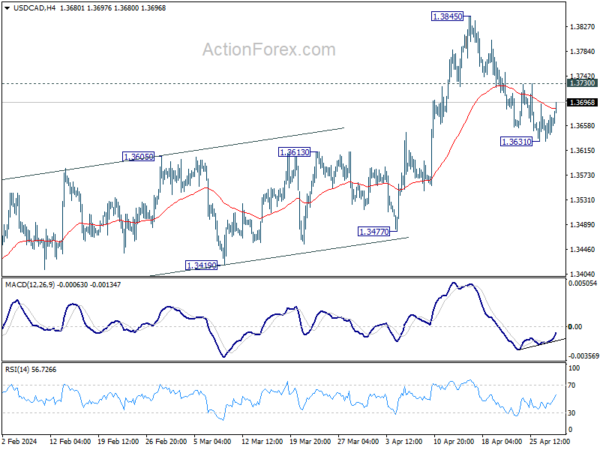

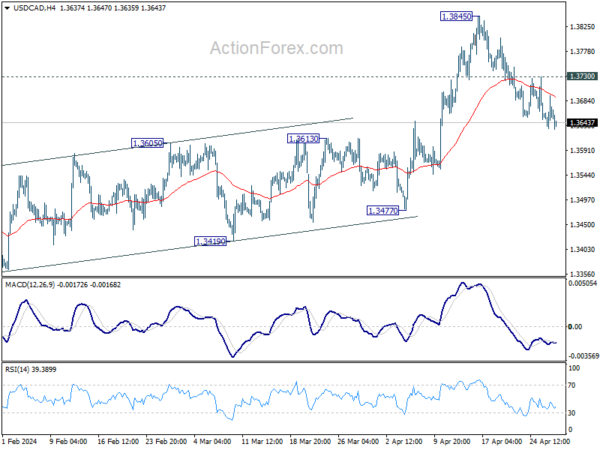

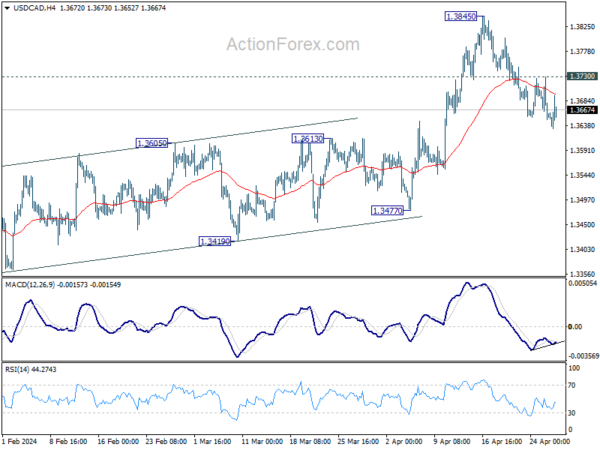

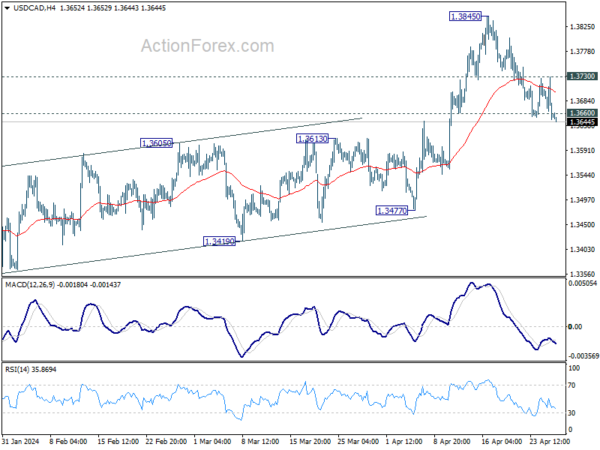

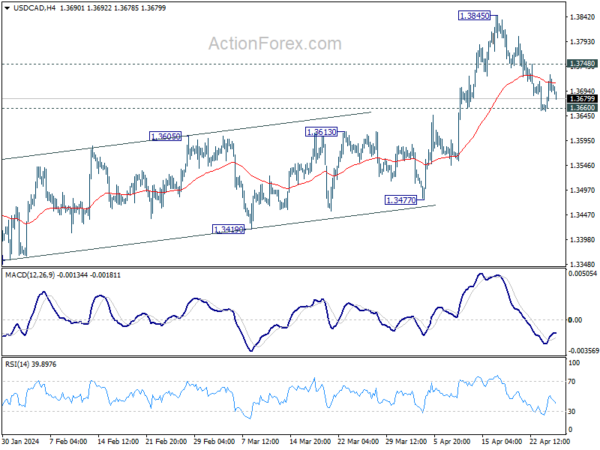

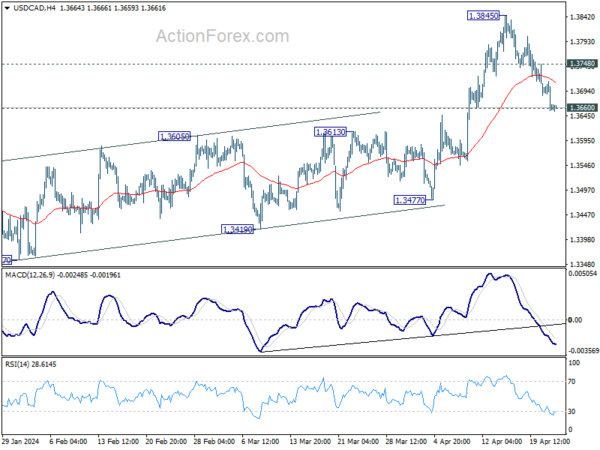

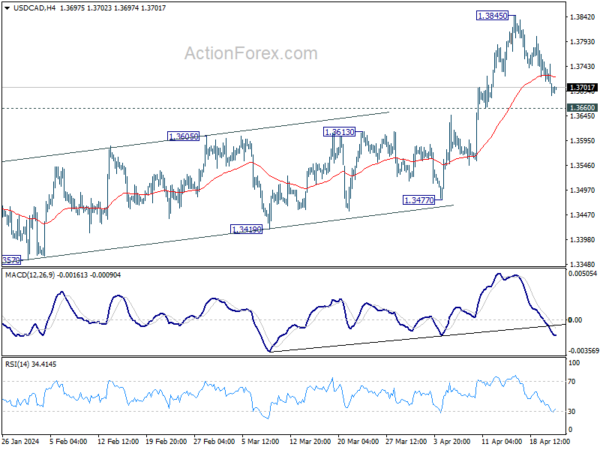

Daily Pivots: (S1) 1.3625; (P) 1.3658; (R1) 1.3684; More…

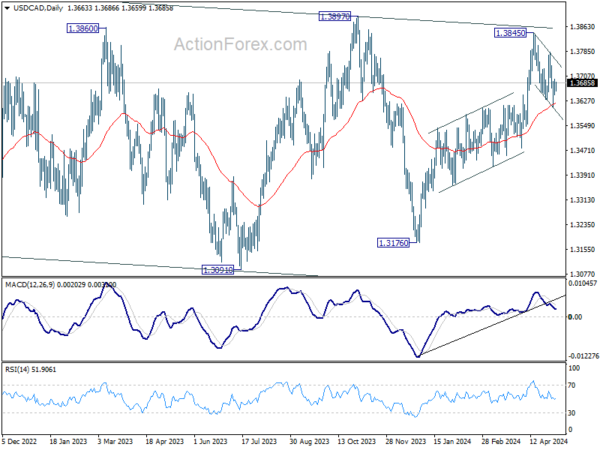

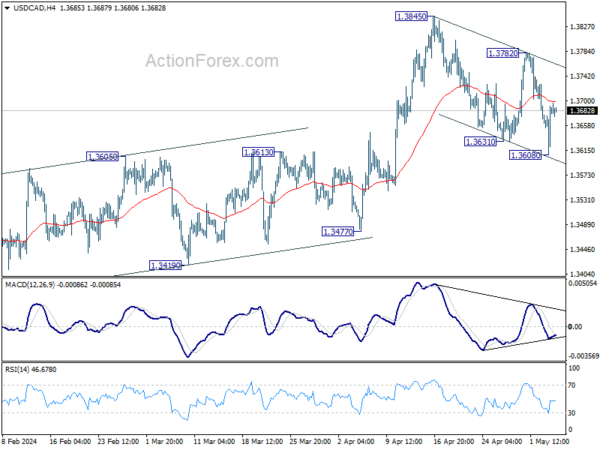

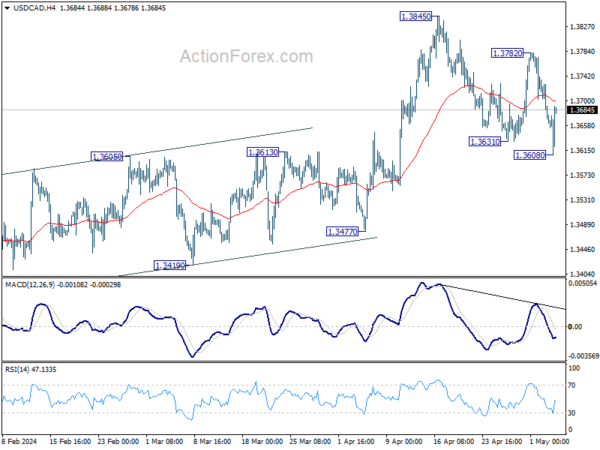

USD/CAD is staying in range above 1.3608 and intraday bias remains neutral. On the upside, break of 1.3761 resistance will argue that correction from 1.3845 has already completed. Intraday bias will be back to the upside to resume larger rally from 1.3176 through 1.3845. However, sustained trading below 55 D EMA (now at 1.3631) will argue that whole rise from 1.3176 has completed already, and bring deeper fall to 1.3477 support next.

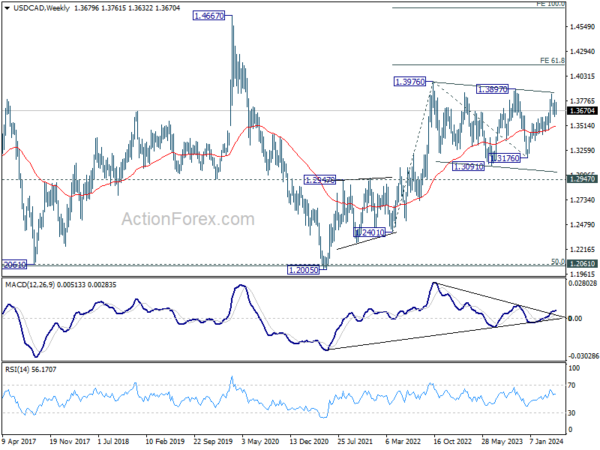

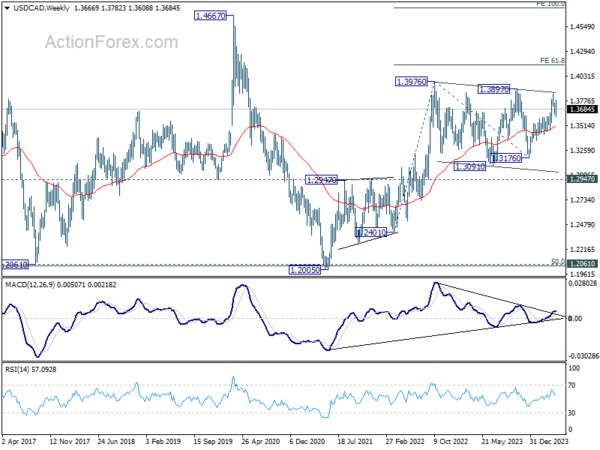

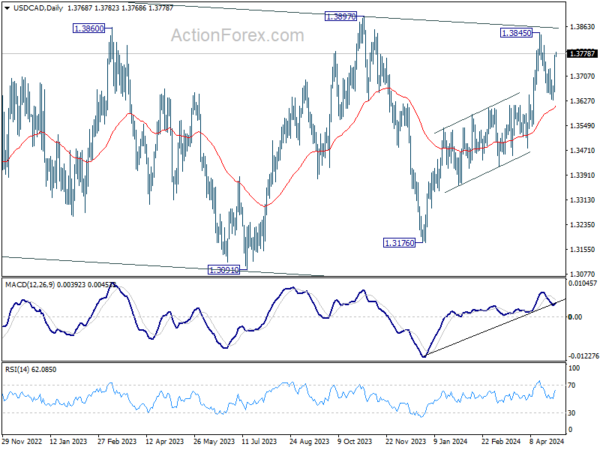

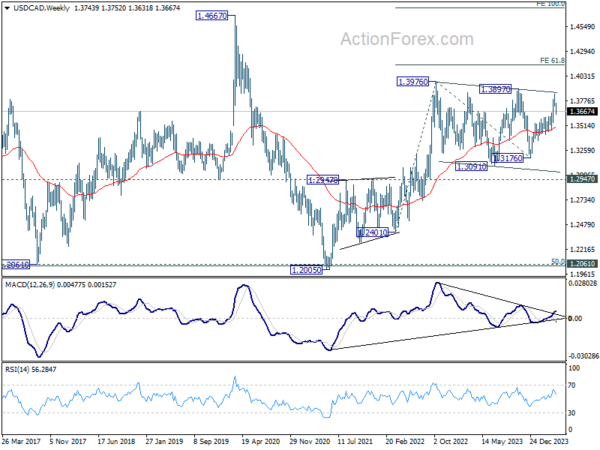

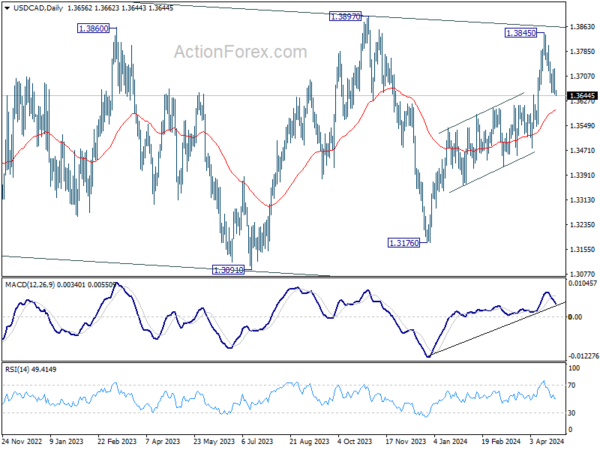

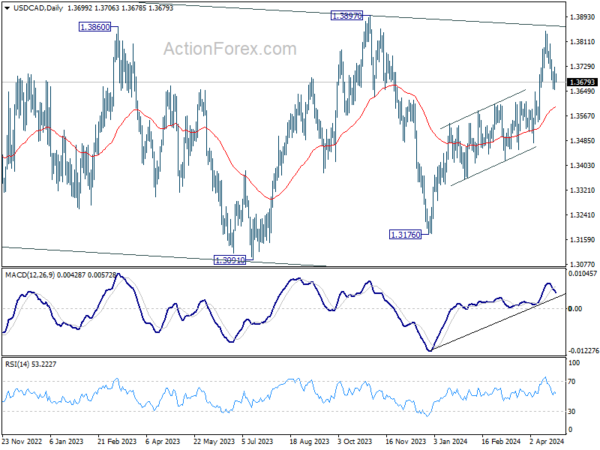

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern. In case of another fall, strong support should emerge above 1.2947 resistance turned support to bring rebound. Firm break of 1.3976 will confirm up resumption of whole up trend from 1.2005 (2021 low). Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3176 at 1.4149.