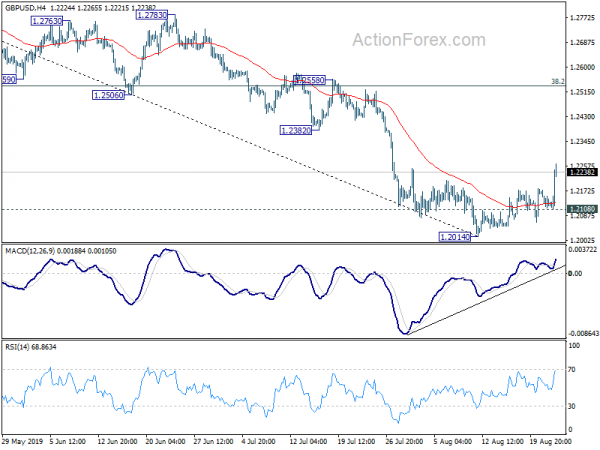

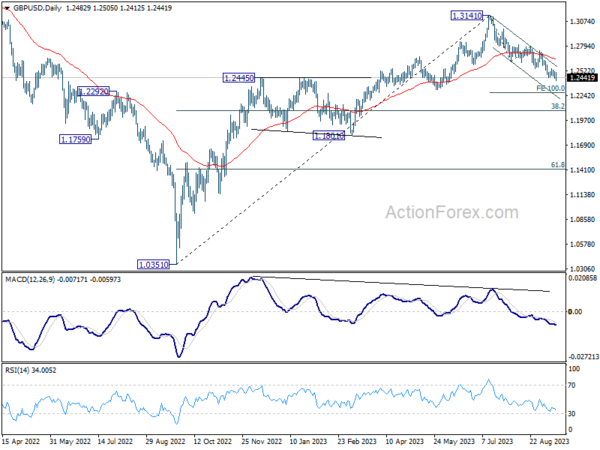

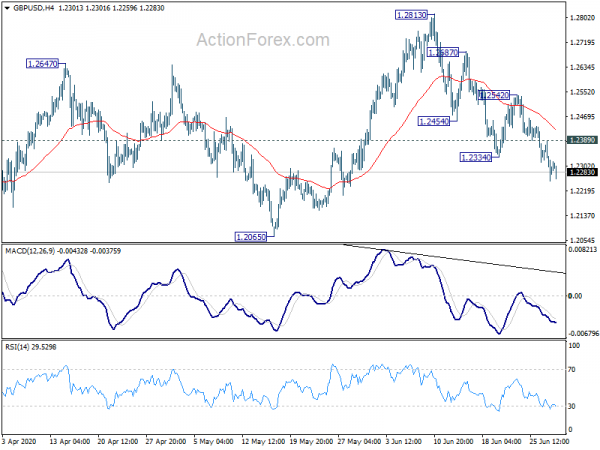

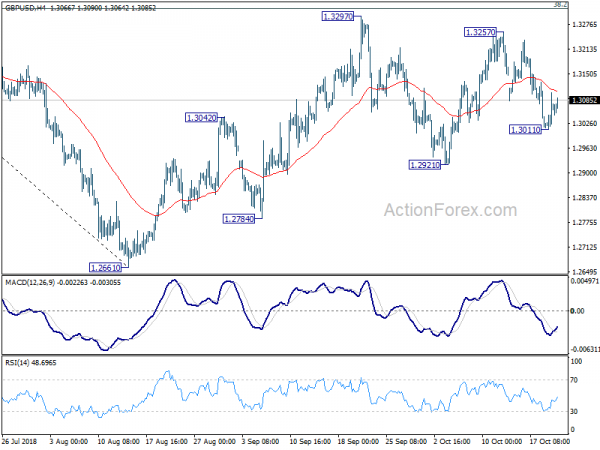

Daily Pivots: (S1) 1.2097; (P) 1.2136; (R1) 1.2160; More….

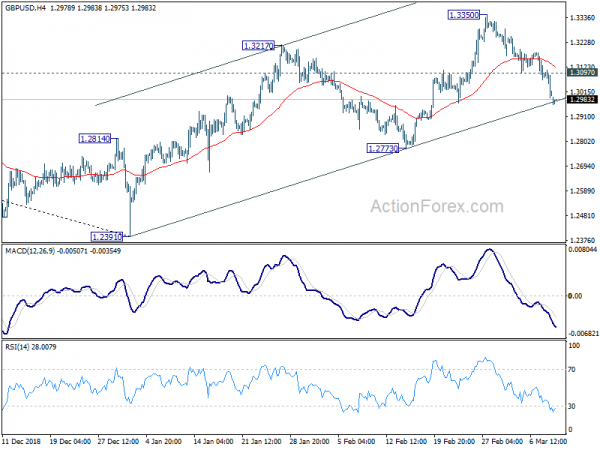

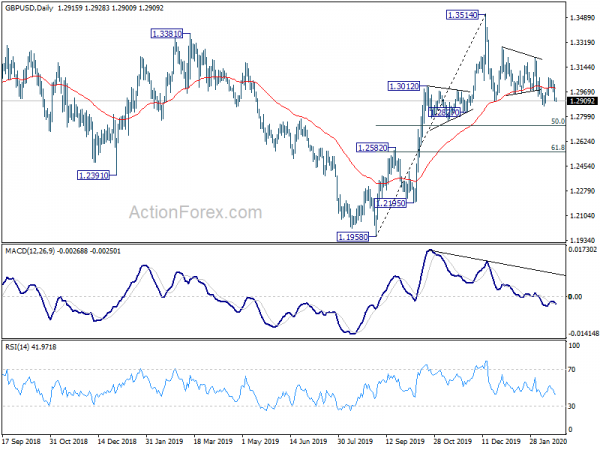

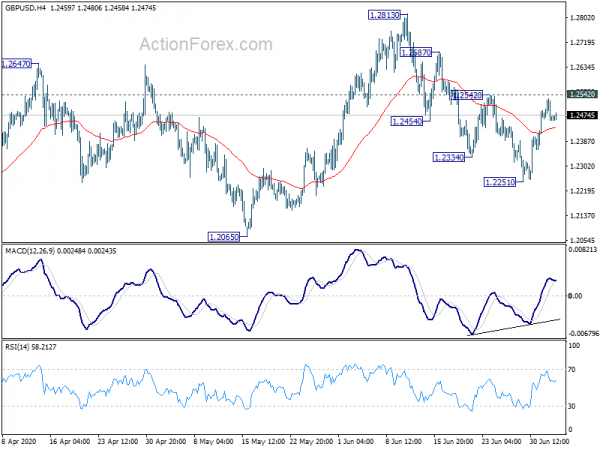

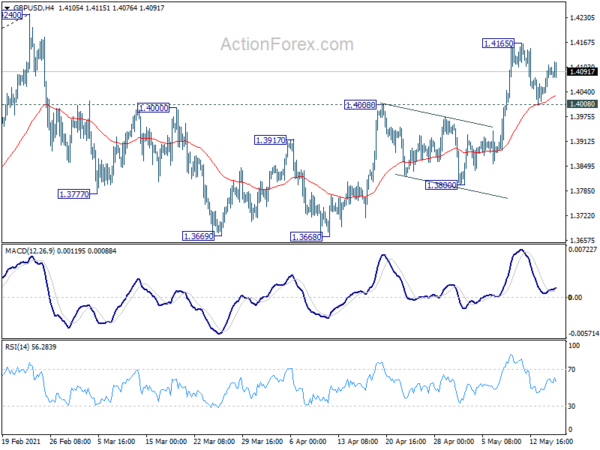

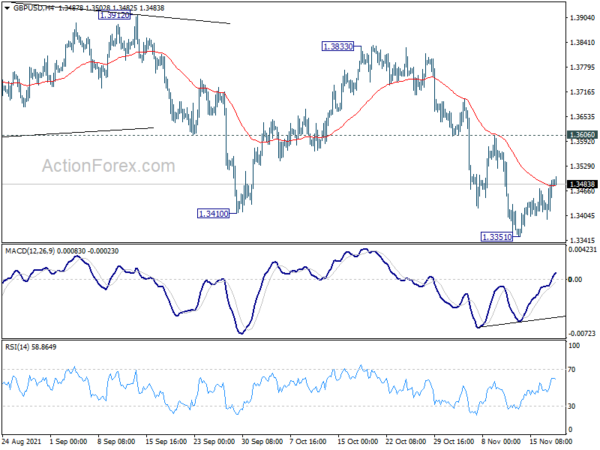

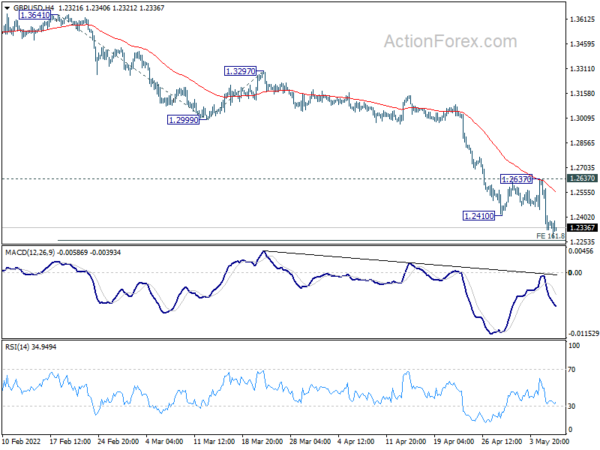

GBP/USD’s strong rise and break of 1.2209 minor resistance suggests short term bottoming at 1.2014. Intraday bias is back on the upside for 55 day EMA (now at 1.2380) and above. But upside should be limited by 38.2% retracement of 1.3381 to 1.2014 at 1.2536. On the downside, break of 1.2108 minor support will turn bias to the downside for 1.2014. Break will resume larger decline for 1.1946 low.

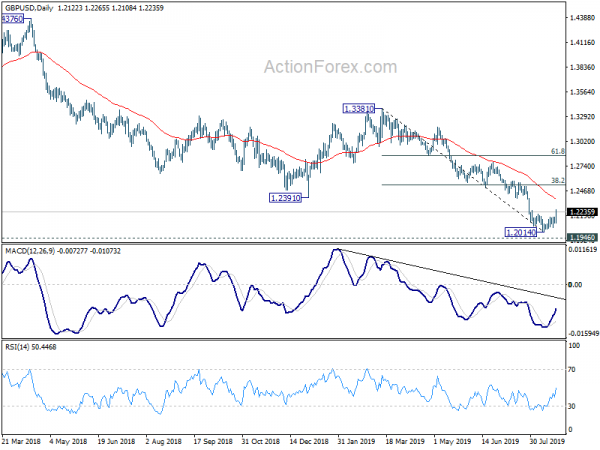

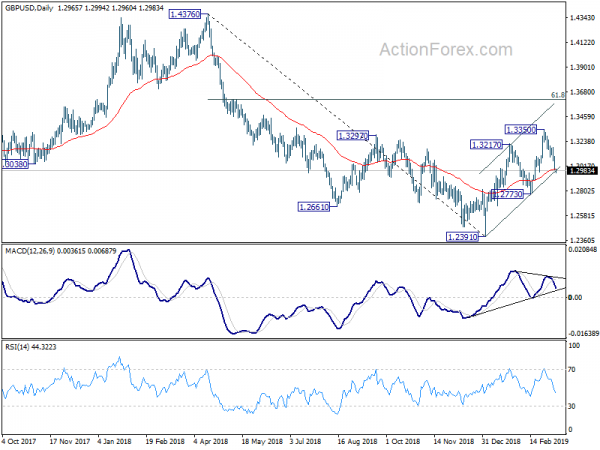

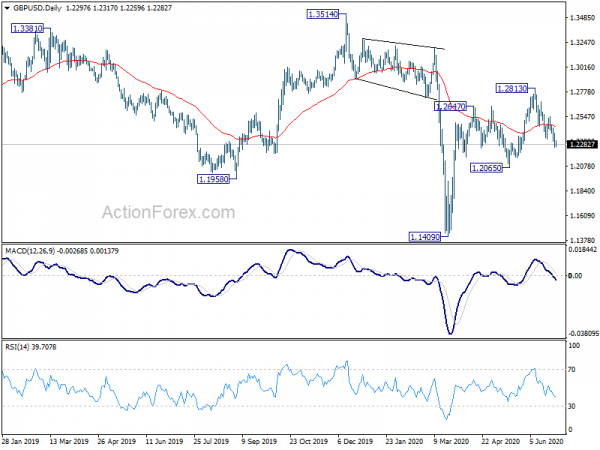

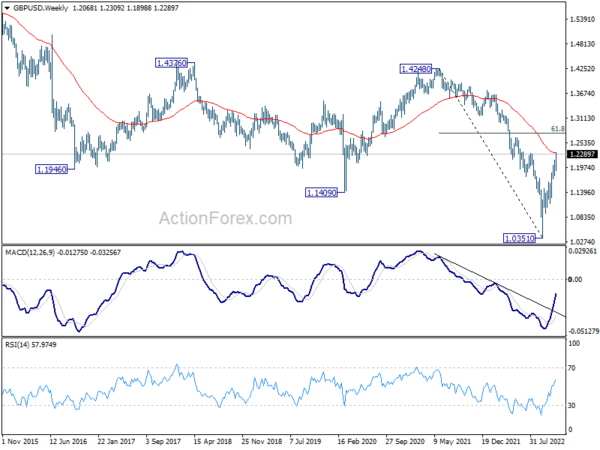

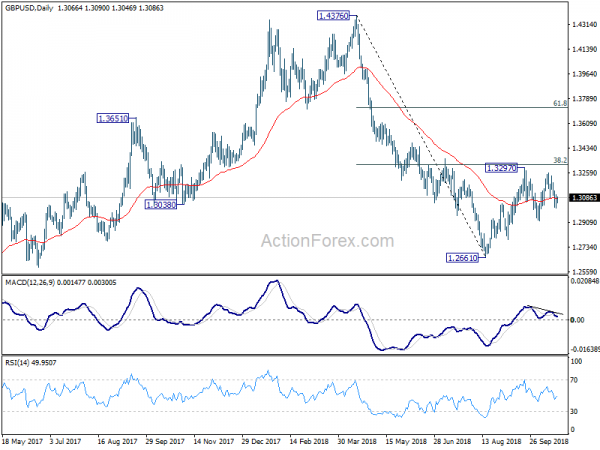

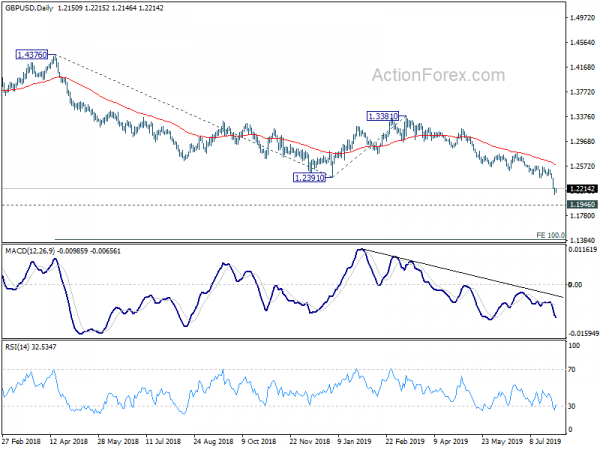

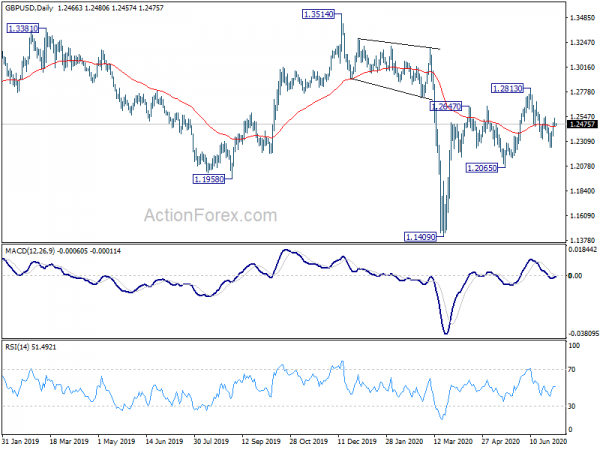

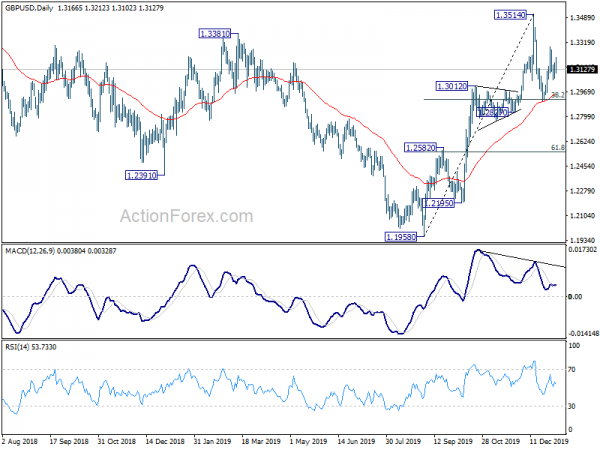

In the bigger picture, down trend from 1.4376 (2018 high) is extending towards 1.1946 low. We’d be cautious on bottoming there. But decisive break will resume down trend from 2.1161 (2007 high) to 61.8% projection of 1.7190 to 1.1946 from 1.4376 at 1.1135. In any case, medium term outlook will stay bearish as long as 1.3381 resistance holds, in case of strong rebound.