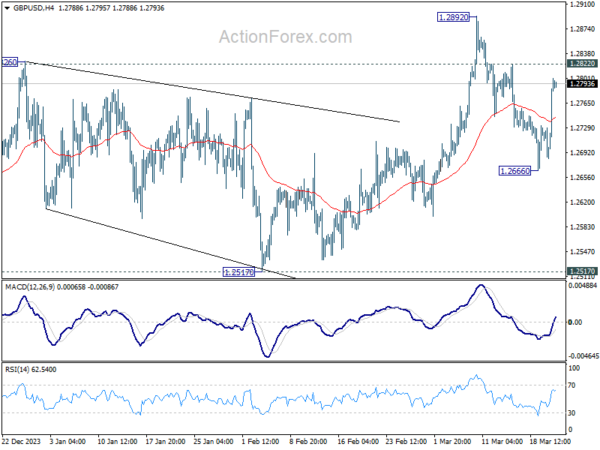

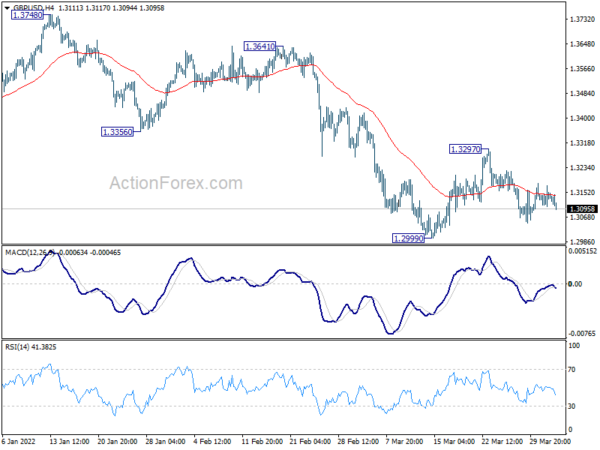

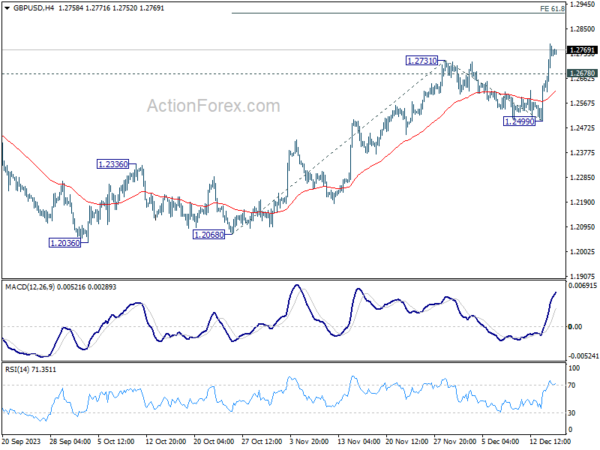

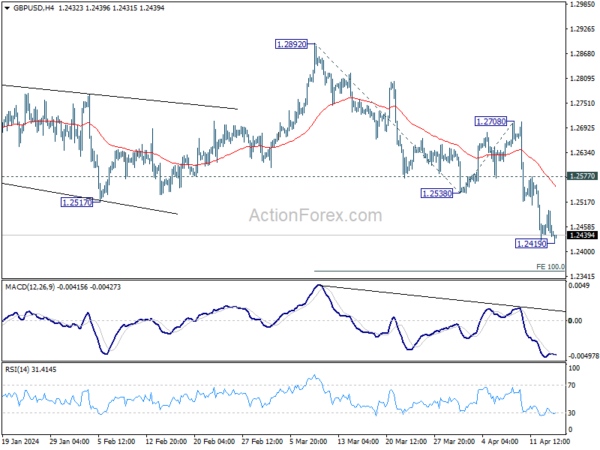

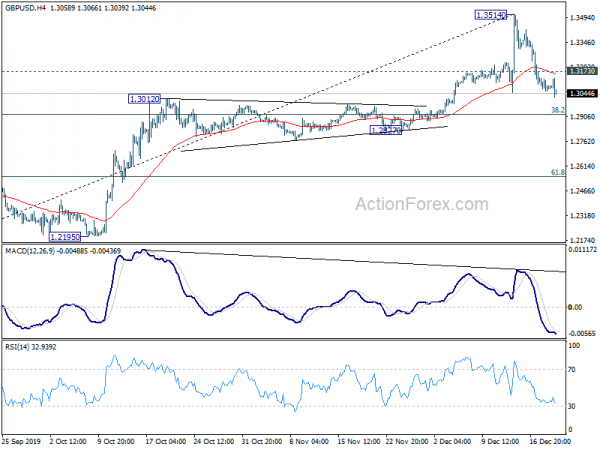

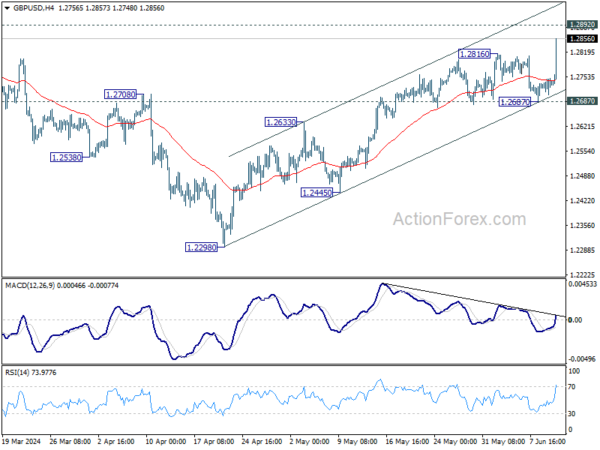

Daily Pivots: (S1) 1.2411; (P) 1.2449; (R1) 1.2508; More…

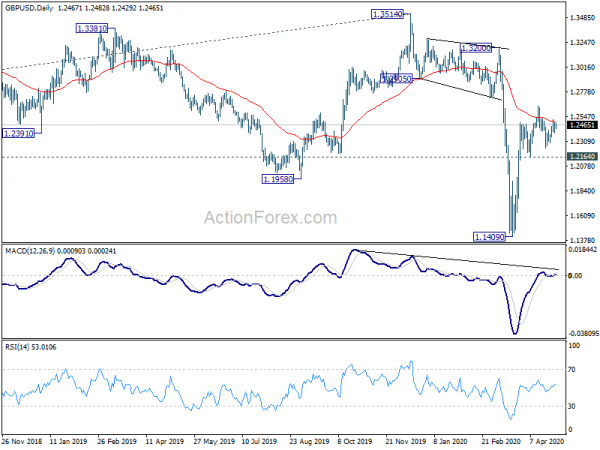

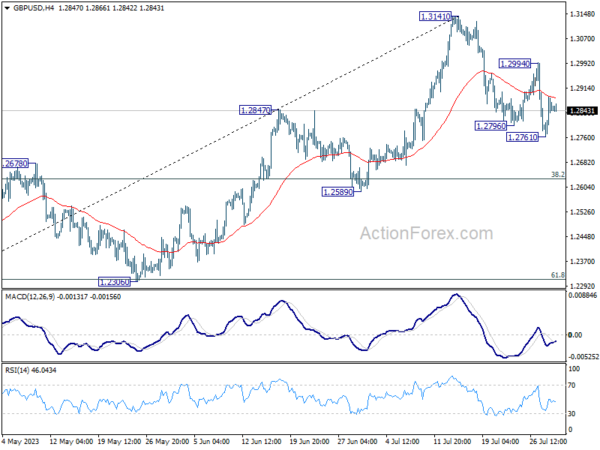

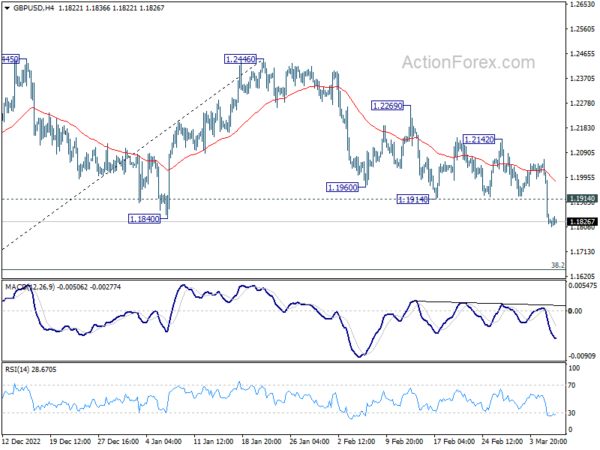

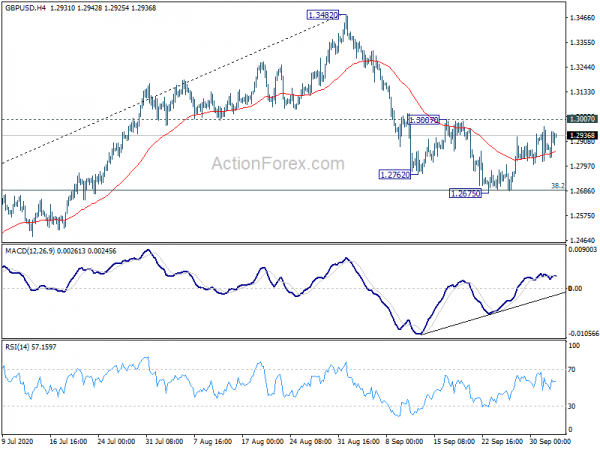

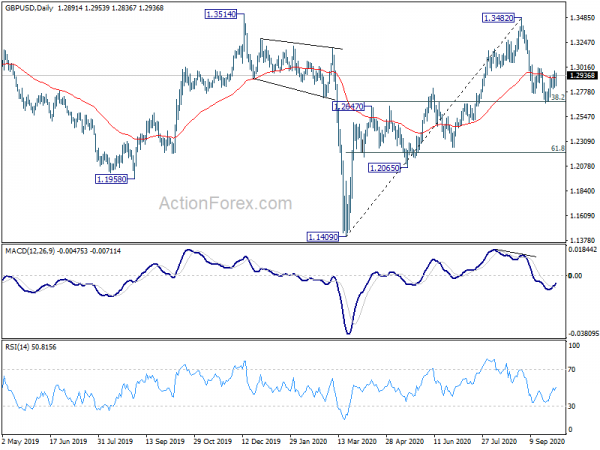

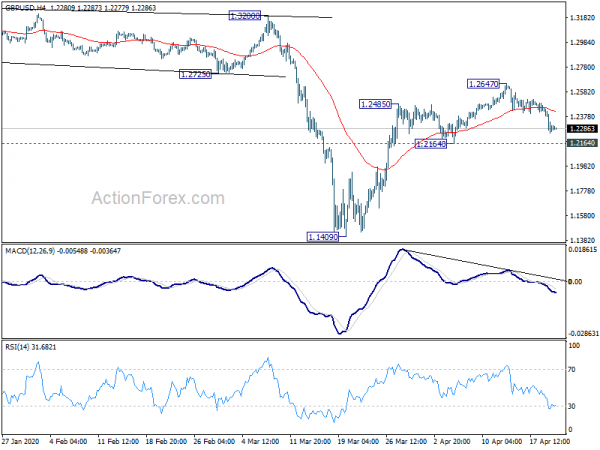

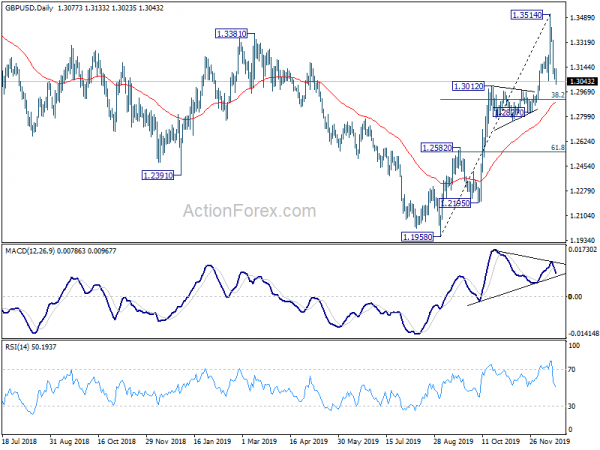

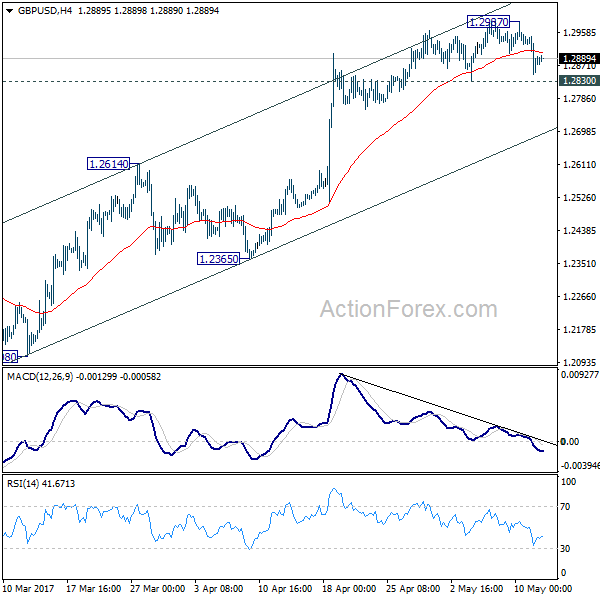

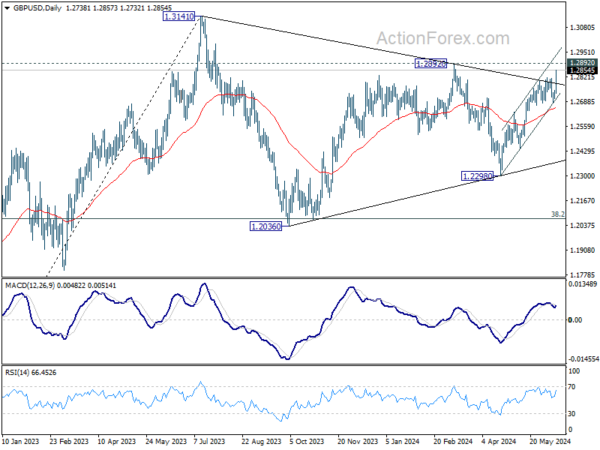

No change in GBP/USD’s outlook as range trading continues inside 1.2164/2647. Intraday bias stays neutral for the moment. With 1.2164 support intact, further rise is mildly in favor. On the upside, break of will extend the rebound from 1.1409 towards 1.3200 resistance. On the downside, break of 1.2164 will indicate completion of rebound from 1.1409. Intraday bias will be turned back to the downside for retesting 1.1409 low.

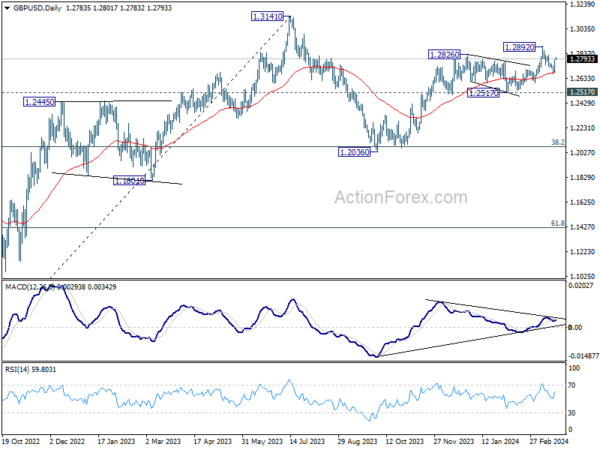

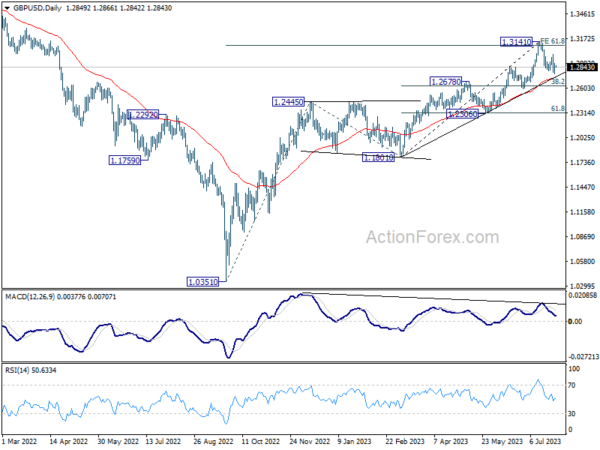

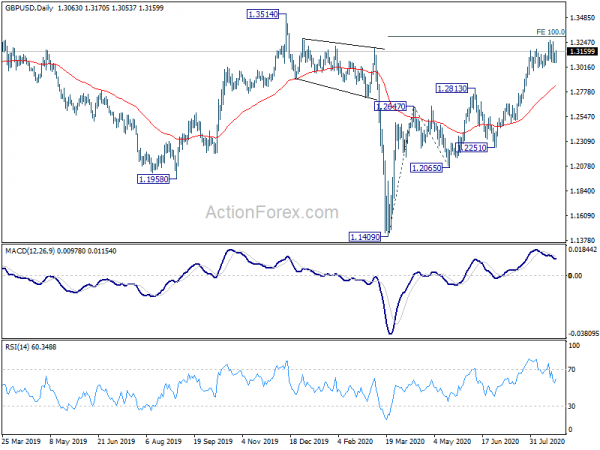

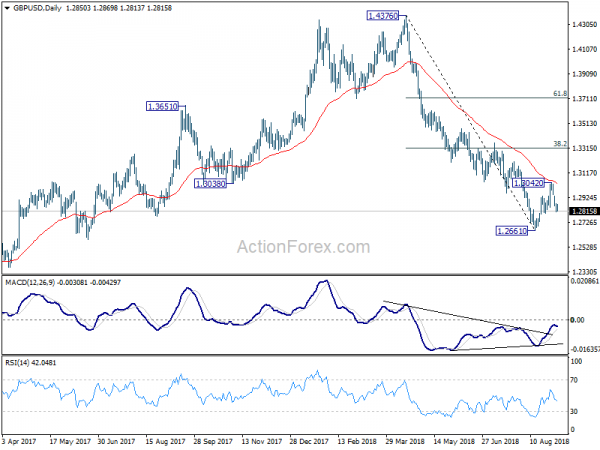

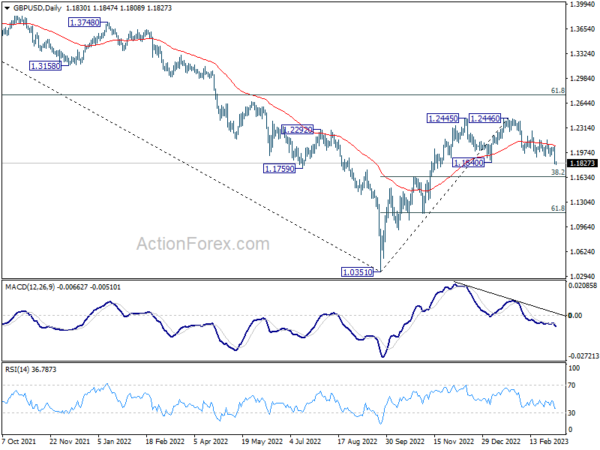

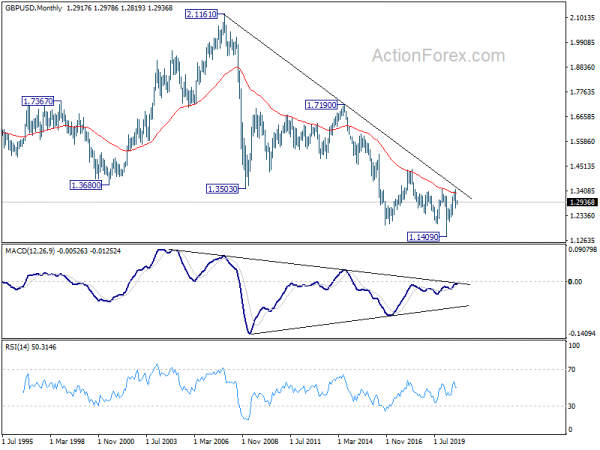

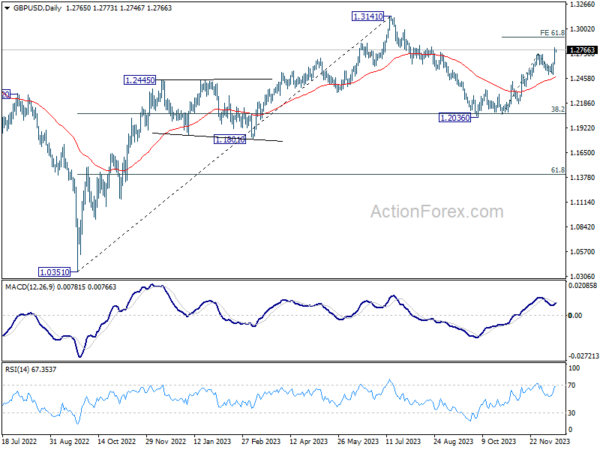

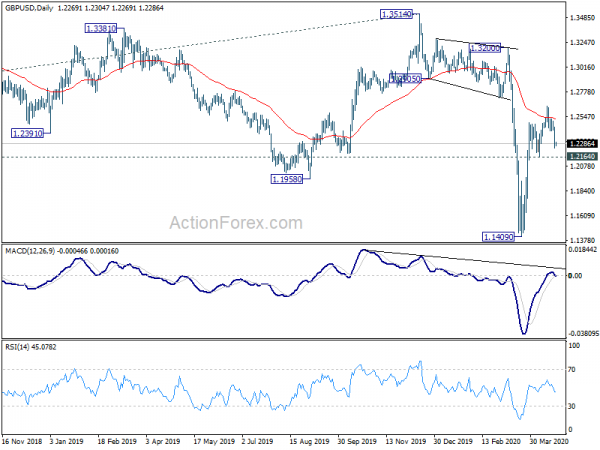

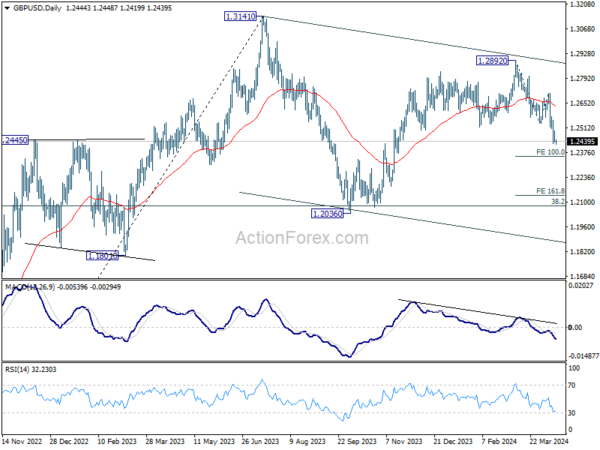

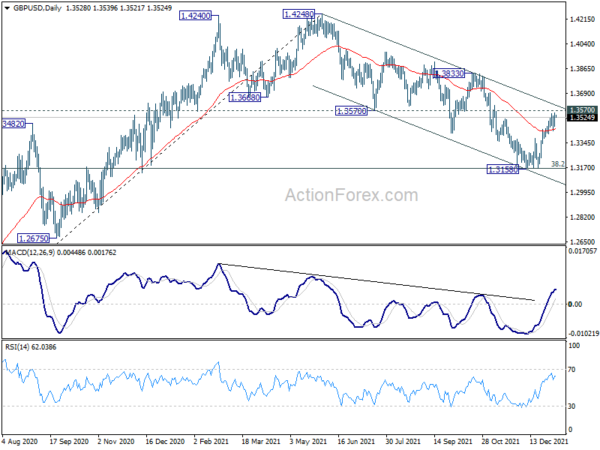

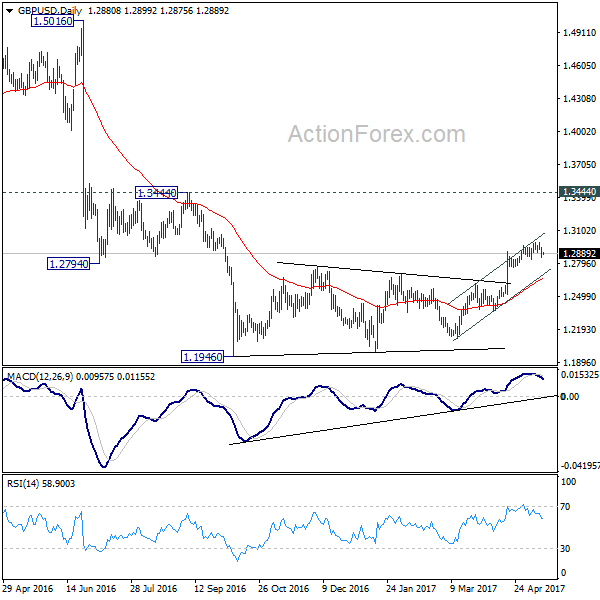

In the bigger picture, while the rebound from 1.1409 is strong, there is no indication of trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. Next medium term target will be 61.8% projection of 1.7190 to 1.1946 from 1.3514 at 1.0273. In any case, outlook will remain bearish as long as 1.3514 resistance holds, in case of strong rebound.