Daily Pivots: (S1) 1.2305; (P) 1.2354; (R1) 1.2449; More….

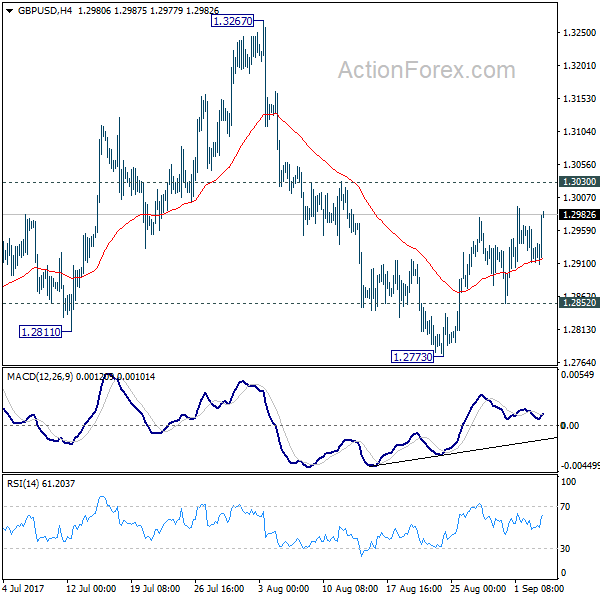

Intraday bias in GBP/USD remains neutral for consolidation above 1.2251 temporary first. Further fall is expected as long as 1.2542 resistance holds. On the downside, break of 1.2251 will resume the fall from 1.2814 to 1.2065 support. Nevertheless, break of 1.2542 will suggest completion of the decline and turn bias back to the upside.

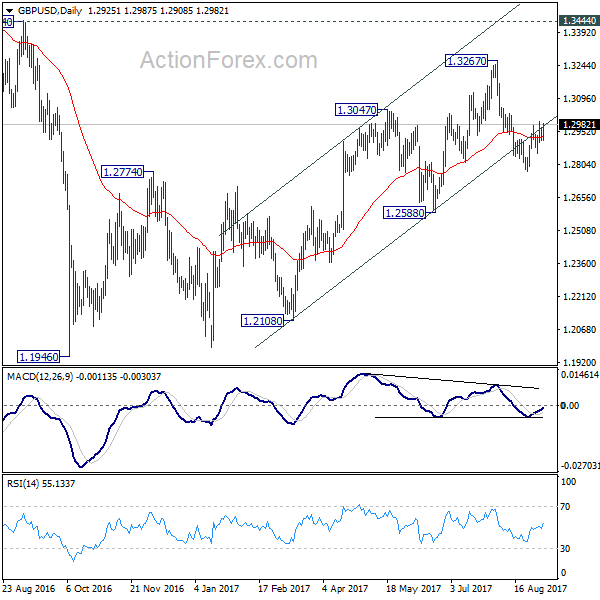

In the bigger picture, while the rebound from 1.1409 is strong, there is not enough evidence for trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. However, decisive break of 1.3514 should at least confirm medium term bottoming and turn outlook bullish for 1.4376 resistance first.