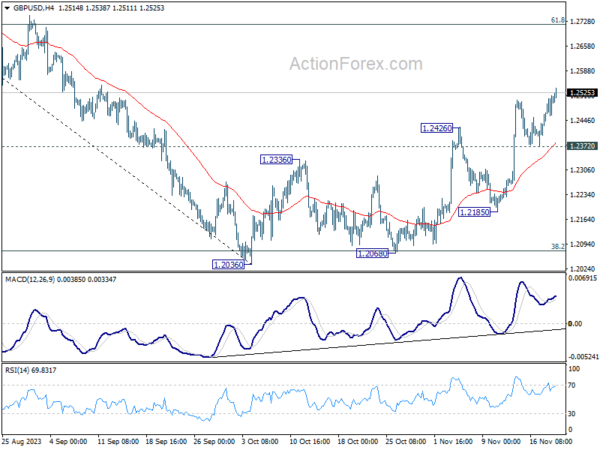

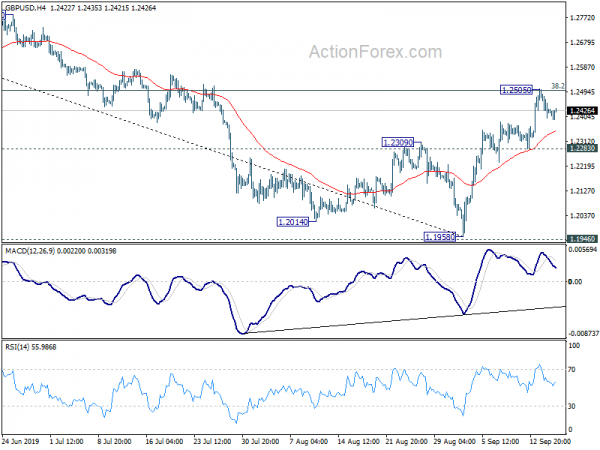

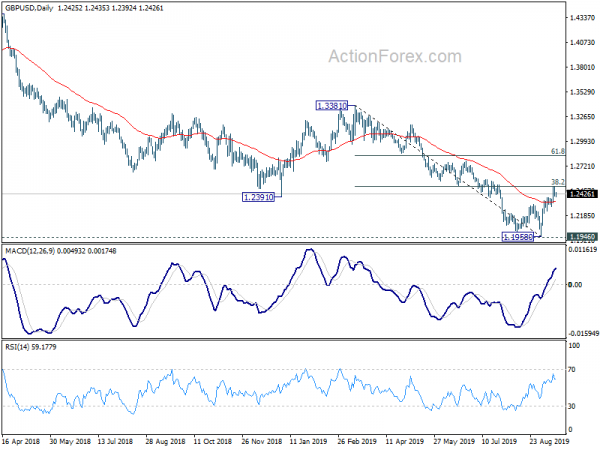

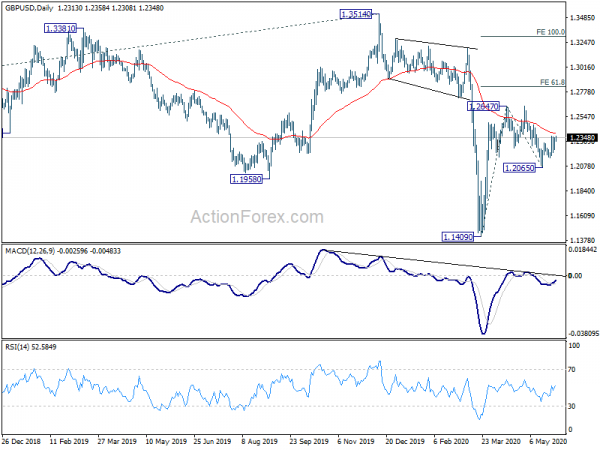

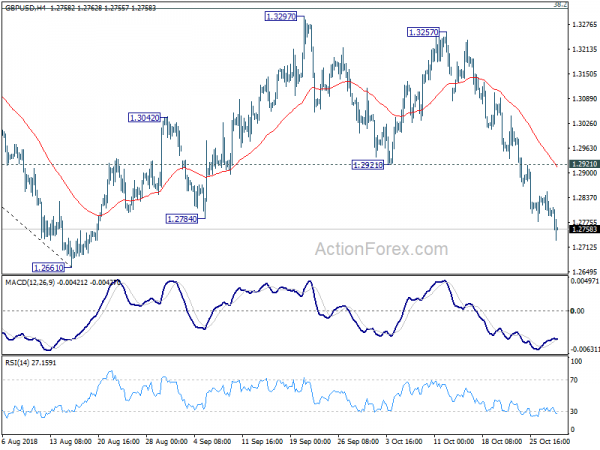

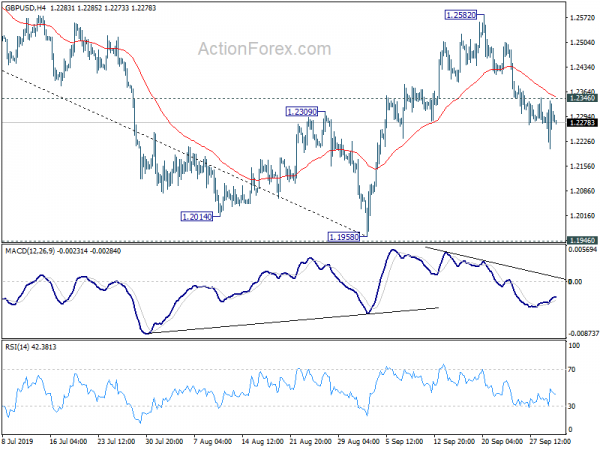

Daily Pivots: (S1) 1.2461; (P) 1.2490; (R1) 1.2533; More…

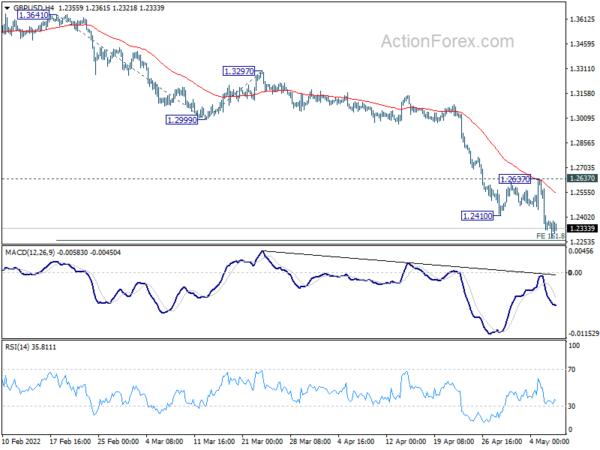

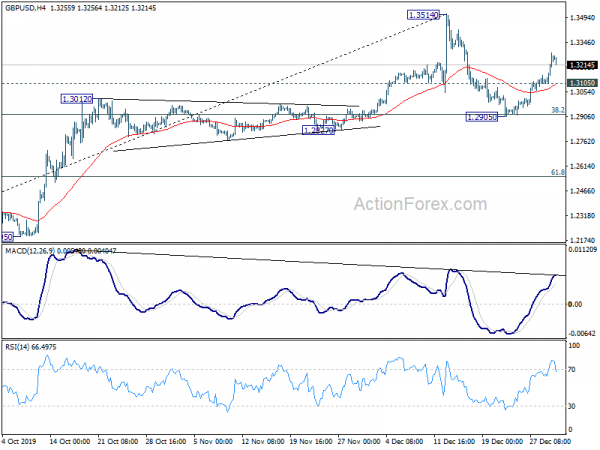

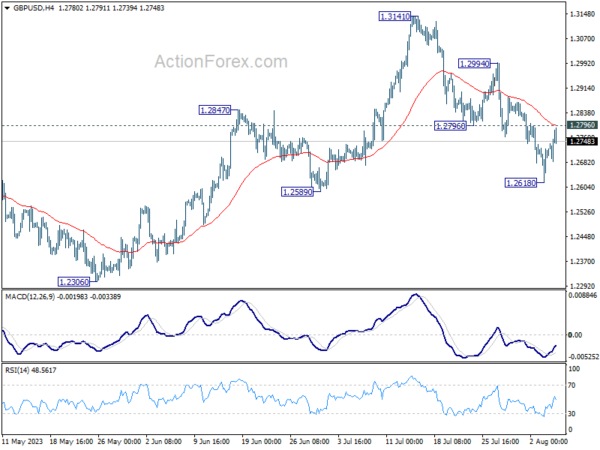

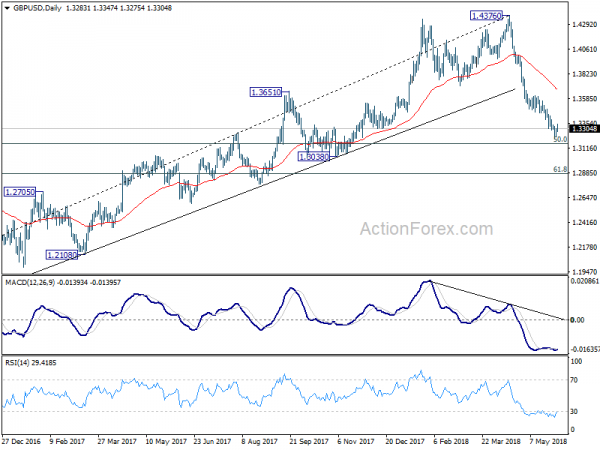

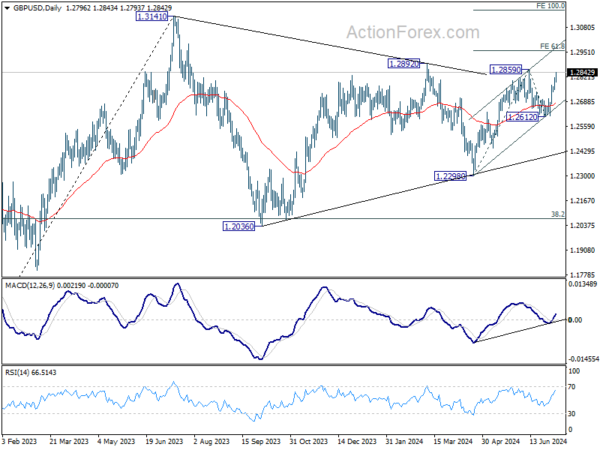

Intraday bias in GBP/USD stays on the upside as rise from 1.2036 is in progress. Current rally should target 61.8% retracement of 1.3141 to 1.2036 at 1.2716 next. On the downside, break of 1.2372 support is needed to indicate short term topping. Otherwise, further rally will remain in favor in case of retreat.

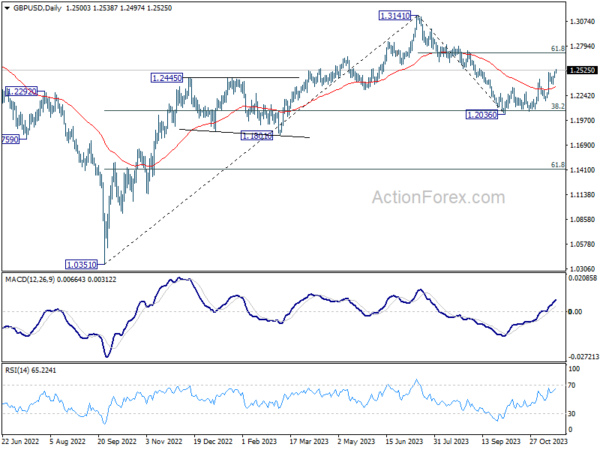

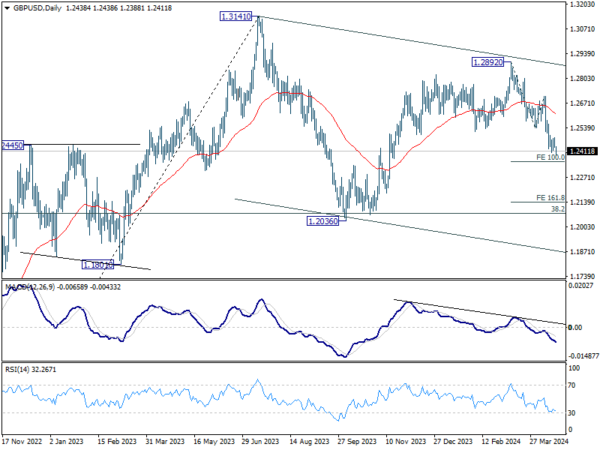

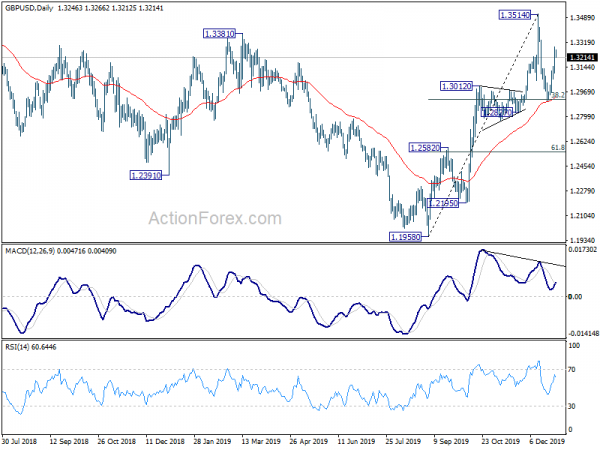

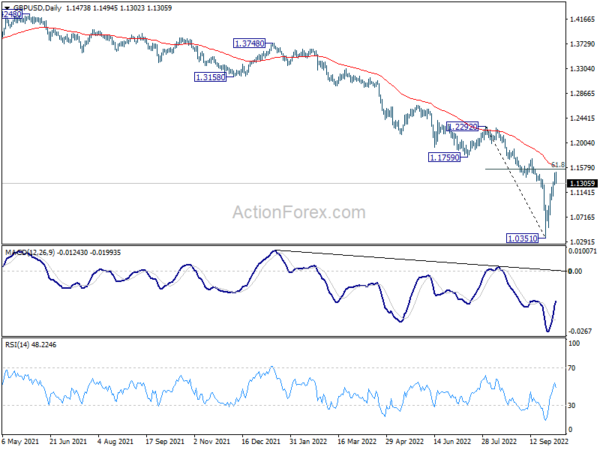

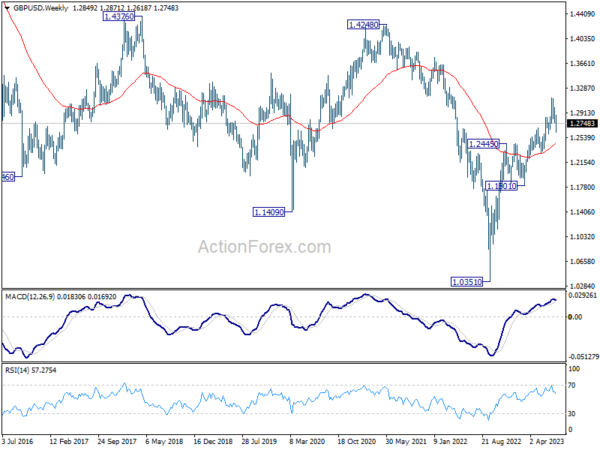

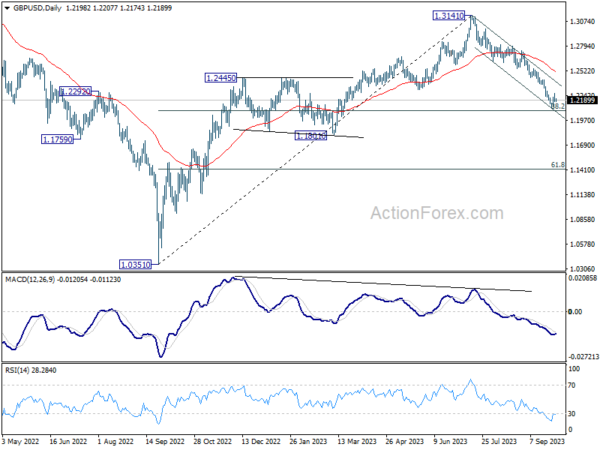

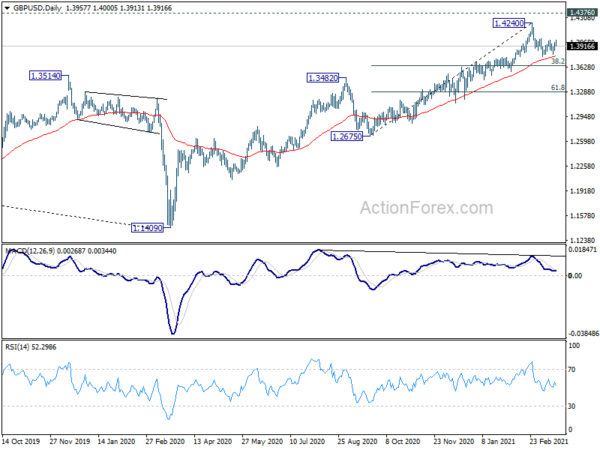

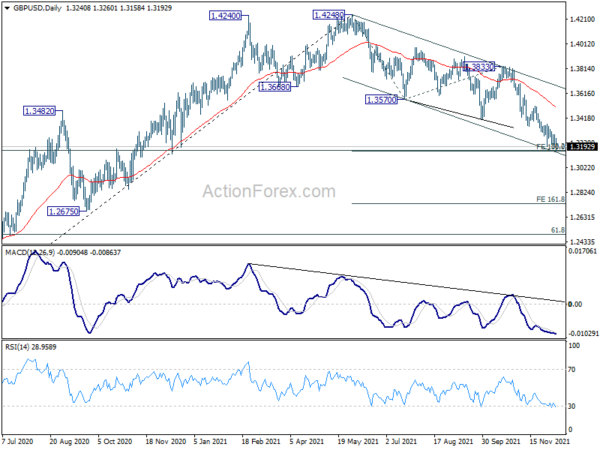

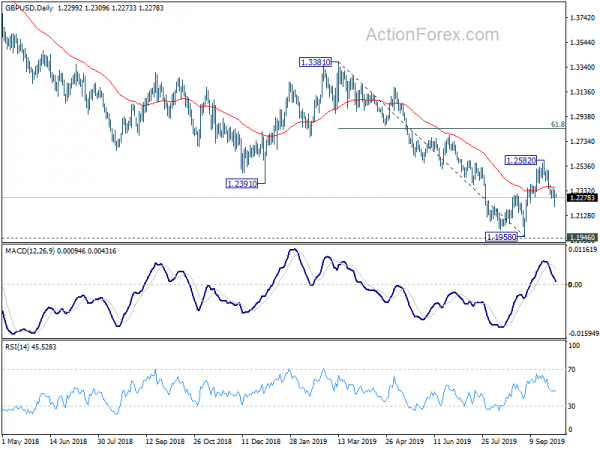

In the bigger picture, price actions from 1.3141 are seen as a corrective pattern to rise from 1.0351 (2022 low). Strong rebound from 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 argues that current rise from 1.2036 is the second leg. However, while further rally could be seen, upside should be limited by 1.3141 to bring the third leg of the pattern.