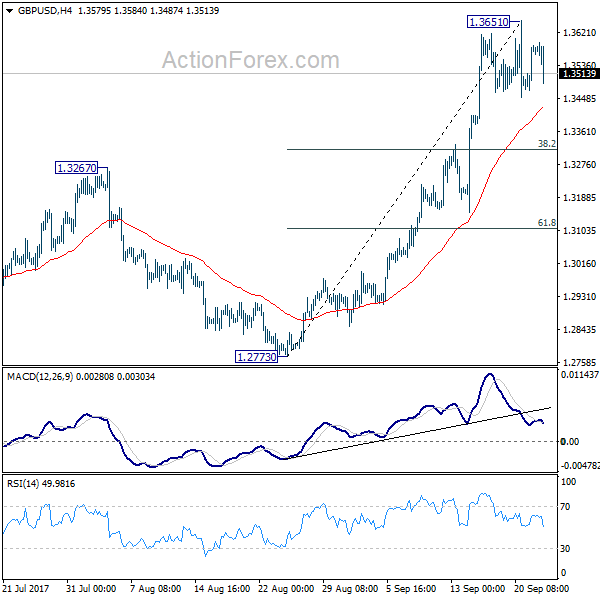

Daily Pivots: (S1) 1.3011; (P) 1.3037; (R1) 1.3074; More…

Intraday bias in GBP/UISD remains neutral first as correction fro m1.3514 is still unfolding. With 1.3209 resistance intact, another fall is mildly in favor through 1.2872 at a later stage. Nevertheless, firm break of 1.3209 will turn bias to the upside for retesting 1.3514 instead.

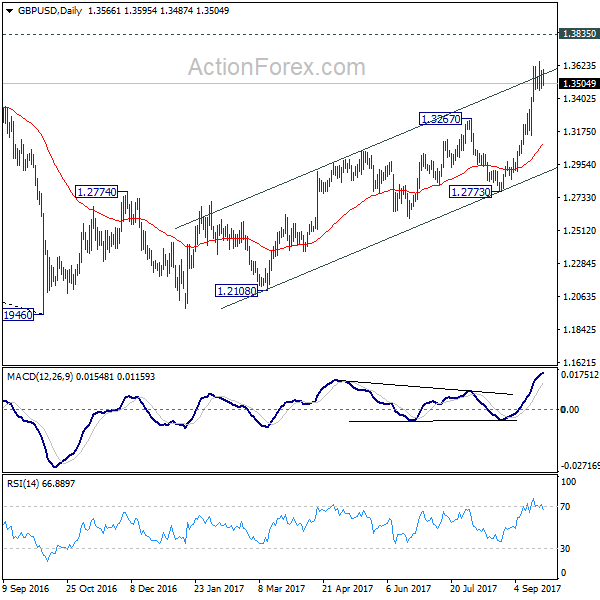

In the bigger picture, rise from 1.1958 medium term bottom is not completed yet despite current pull back form 1.3514. Such rally is expected to resume later to 1.4376 key resistance. Reactions from there would decide whether it’s in consolidation from 1.1946 (2016 low). Or, firm break of 1.4376 will indicate long term bullish reversal. In any case, for now, outlook will stay bullish as long as 1.2582 resistance turned support holds.