Daily Pivots: (S1) 1.2735; (P) 1.2762; (R1) 1.2811; More…

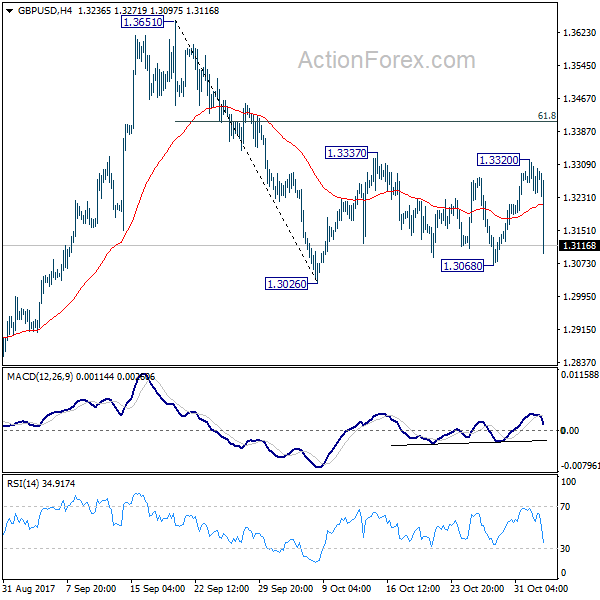

Intraday bias in GBP/USD is staying neutral for the moment. On the downside, below 1.2618, and sustained trading below 1.2678 resistance turned support will argue that it’s already in a larger correction. Deeper decline would then be seen to 1.2306 support next. Nevertheless, firm break of 1.2796 will indicate that the pull back has completed, and turn bias back to the upside for stronger rebound.

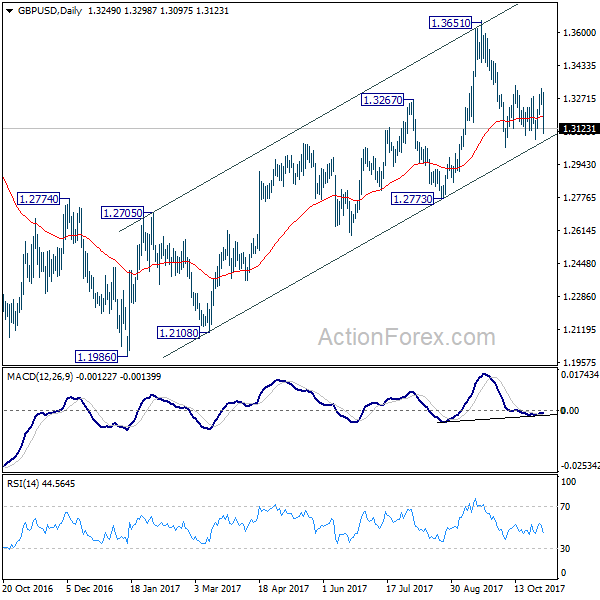

In the bigger picture, a medium term top could be in place at 1.3141 already, on bearish divergence condition in D MACD. Sustained trading below 55 D EMA (now at 1.2726) should confirm this case, and bring deeper fall to 38.2% retracement of 1.0351 to 1.3141 at 1.2075, as a correction to up trend from 1.0351 (2022 low). For now, rise will stay mildly on the downside as long as 1.3141 resistance holds, in case of strong rebound.