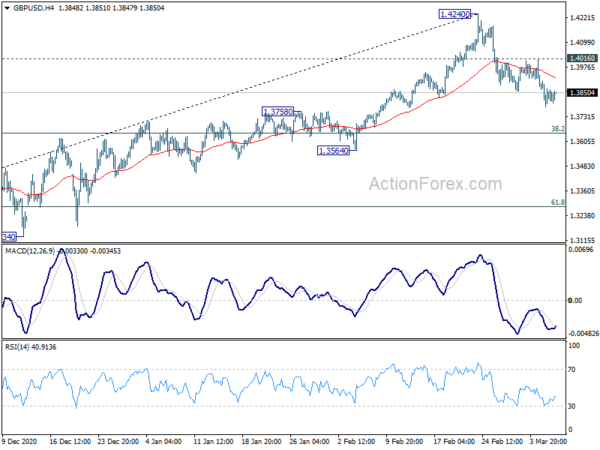

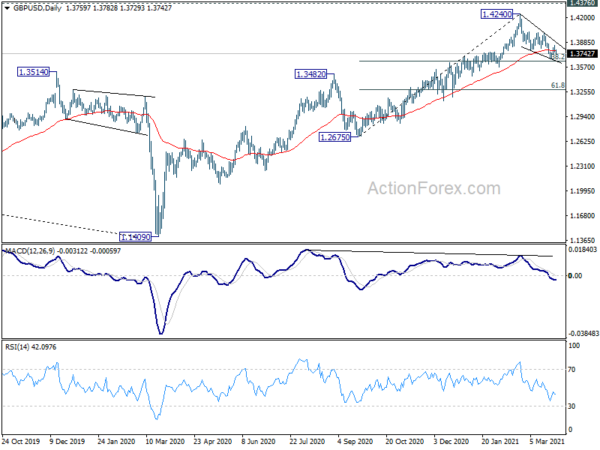

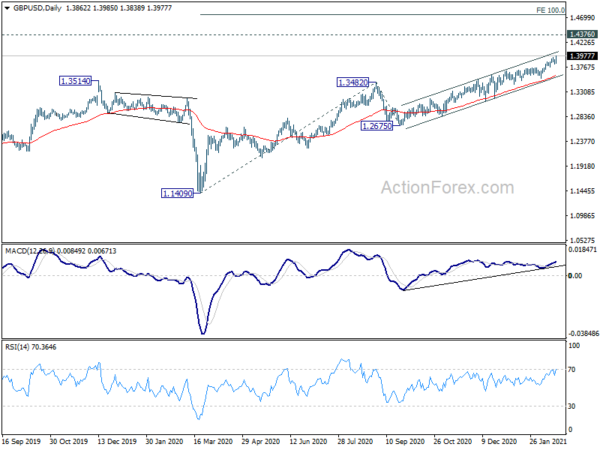

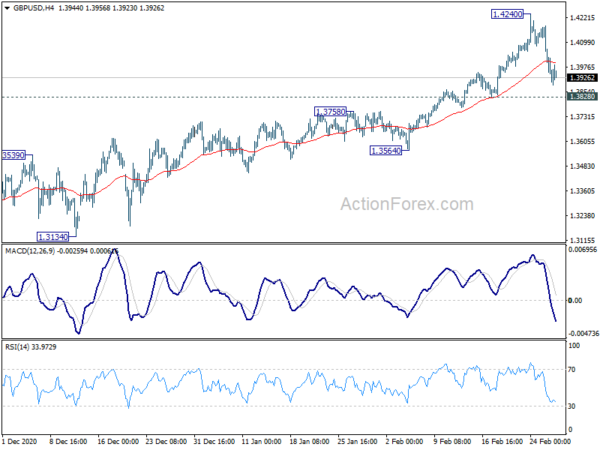

Daily Pivots: (S1) 1.3770; (P) 1.3839; (R1) 1.3898 More….

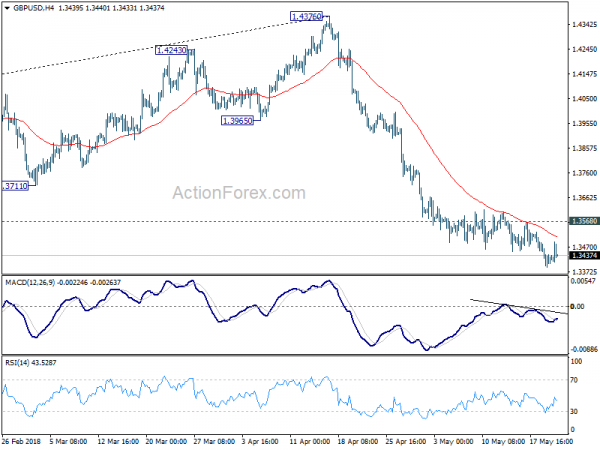

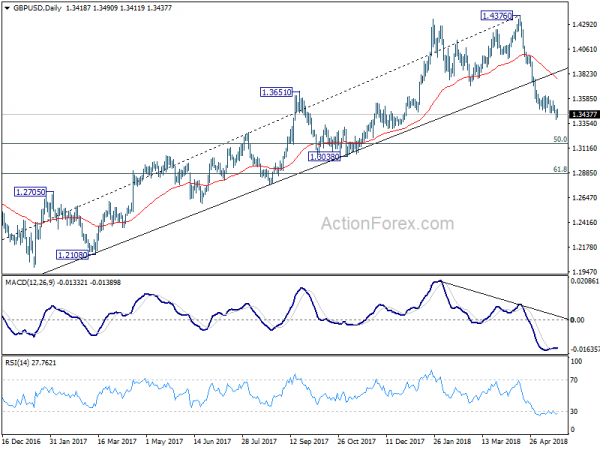

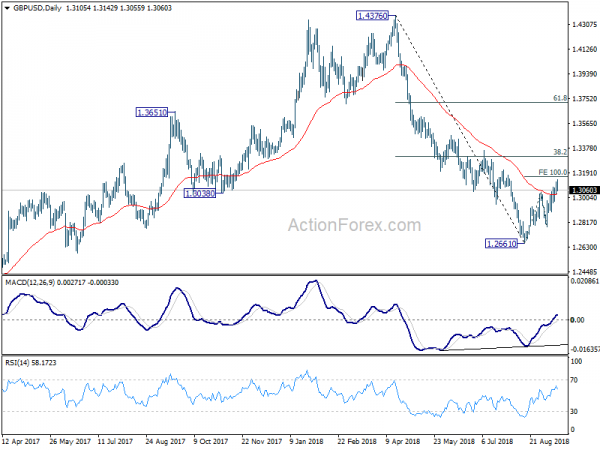

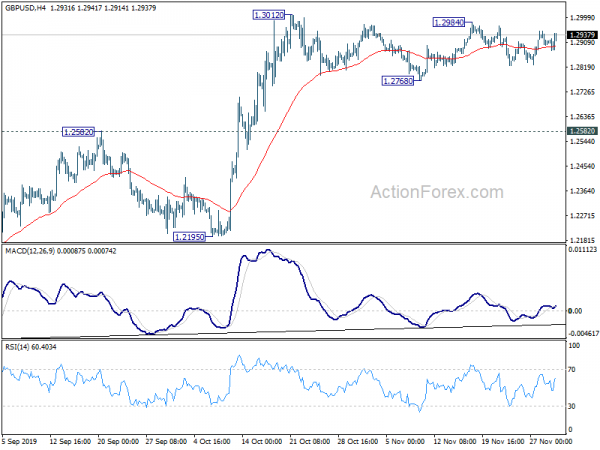

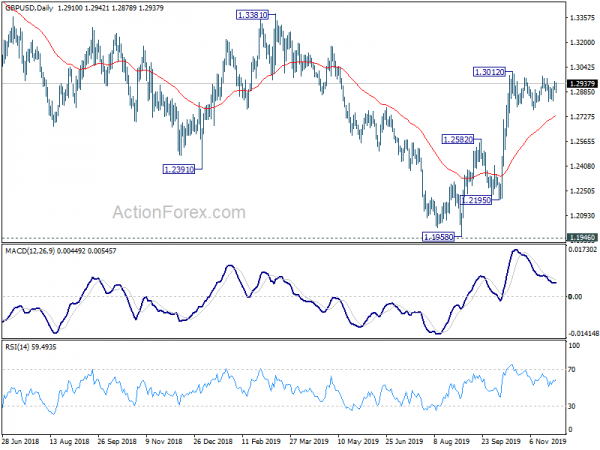

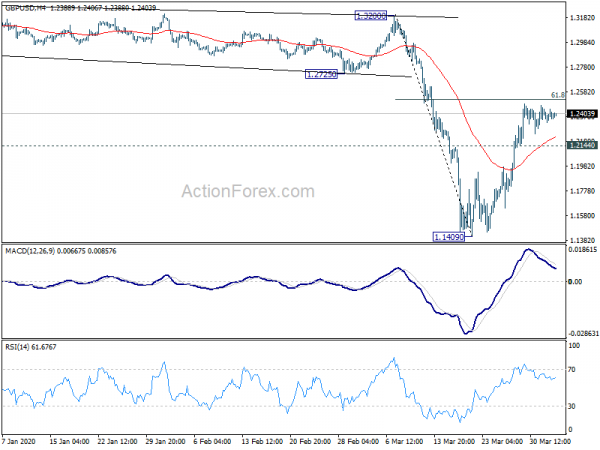

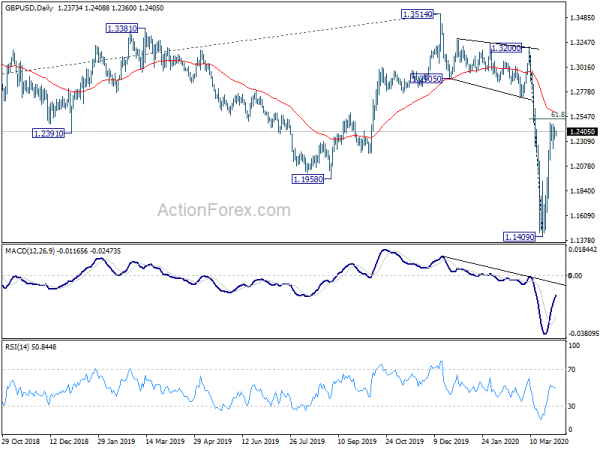

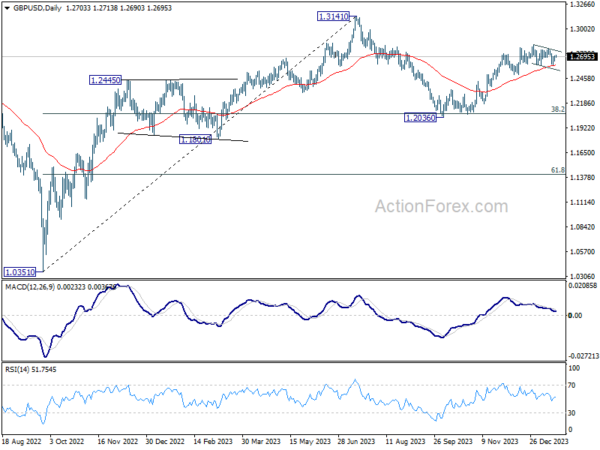

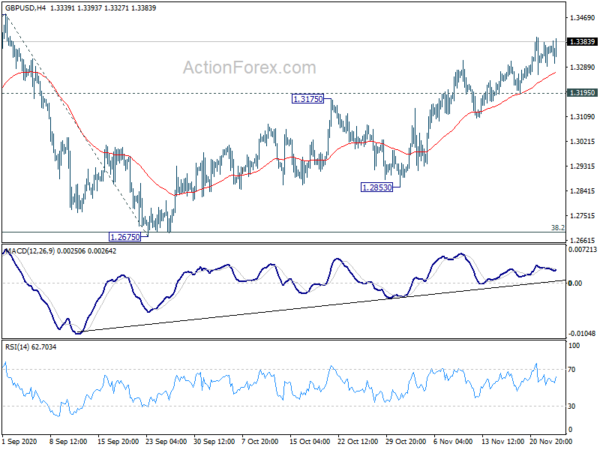

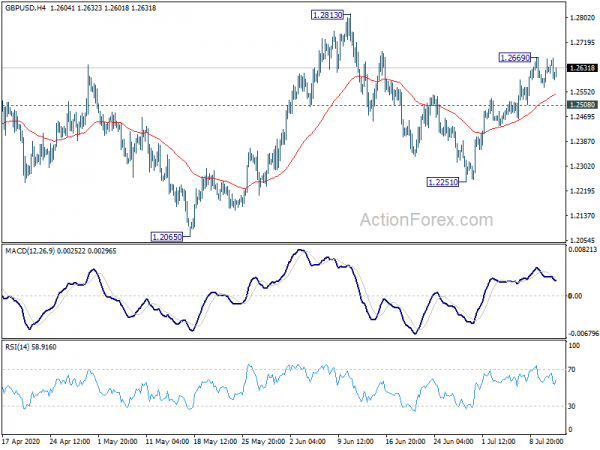

Intraday bias in GBP/USD stays mildly on the downside for the moment. Correction from 1.4240 could extend further towards 38.2% retracement of 1.2675 to 1.4240 at 1.3642. We’d look for some support from there to bring rebound. On the upside, break of 1.4016 minor resistance will argue that the correction has completed, and bring retest of 1.4240 high.

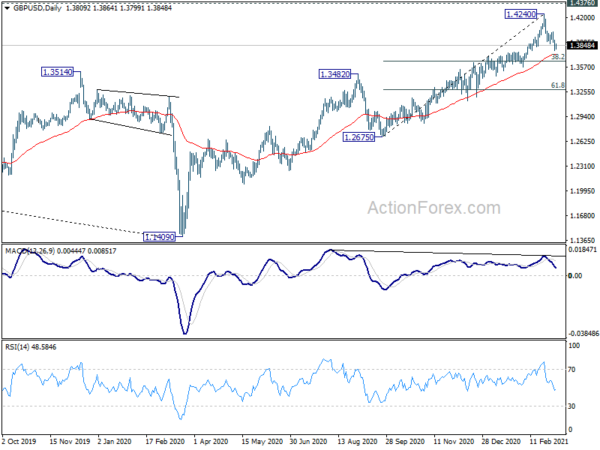

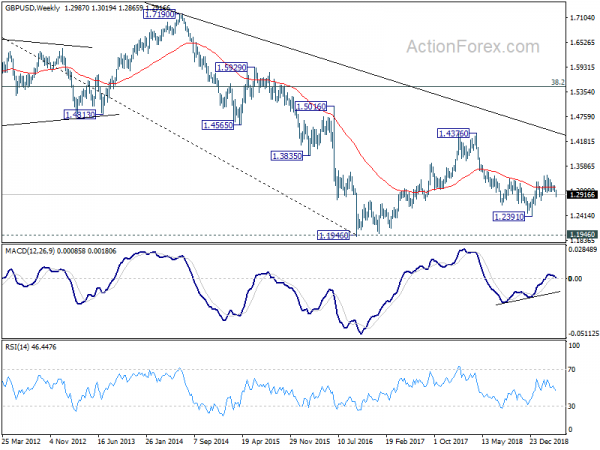

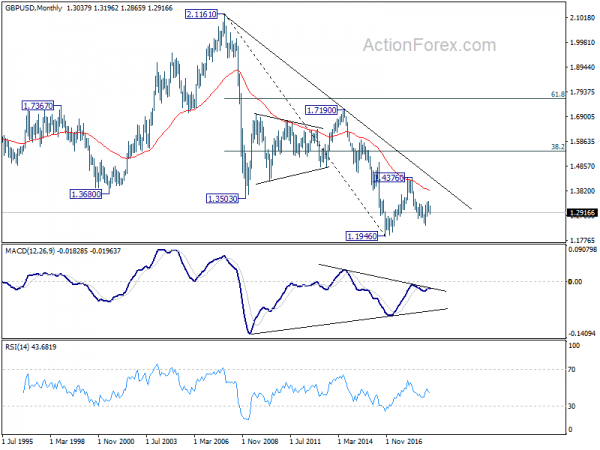

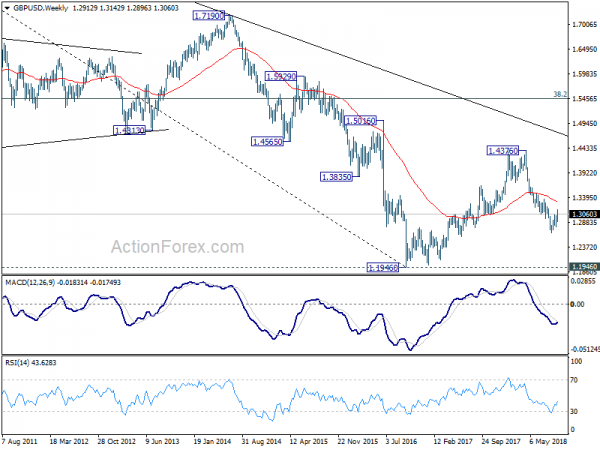

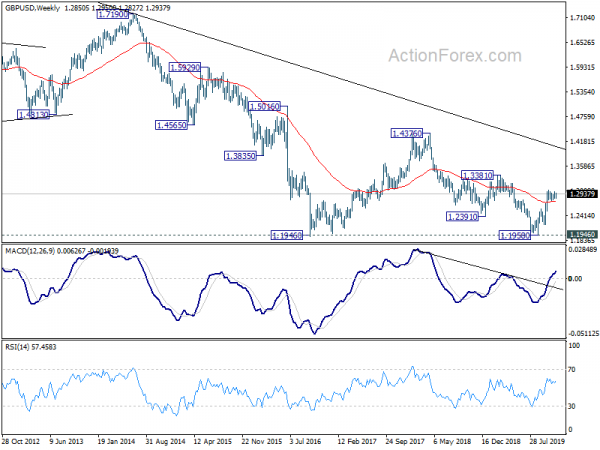

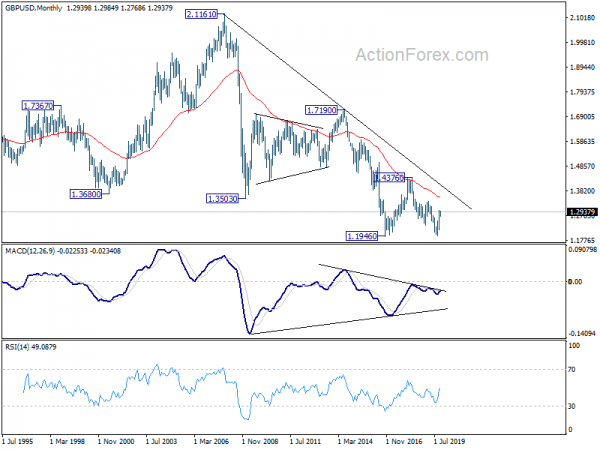

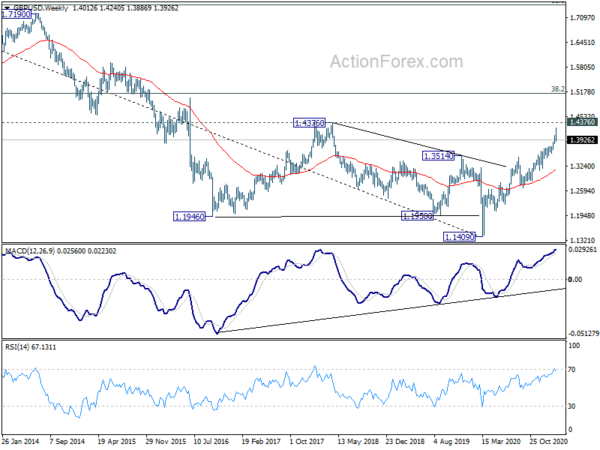

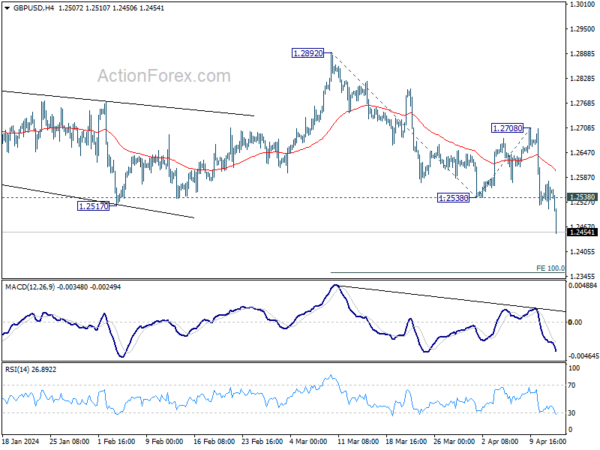

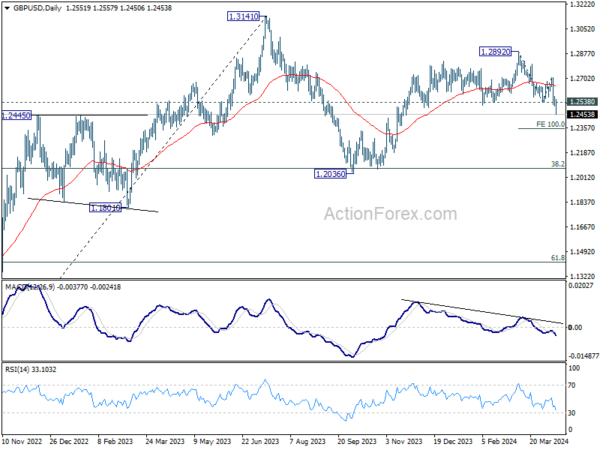

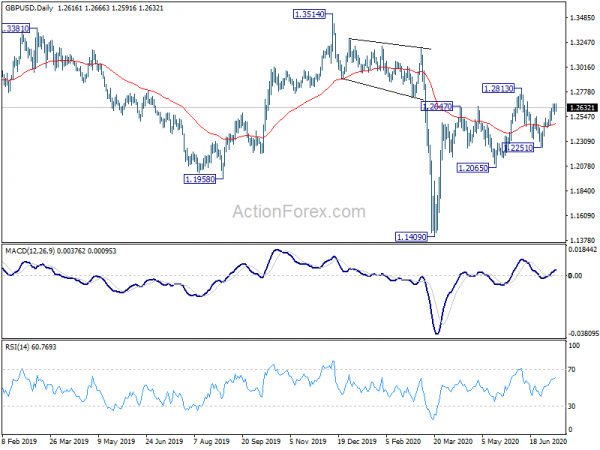

In the bigger picture, rise from 1.1409 medium term bottom is in progress. Further rally would be seen to 1.4376 resistance and above. Decisive break there will carry larger bullish implications and target 38.2% retracement of 2.1161 (2007 high) to 1.1409 (2020 low) at 1.5134. On the downside, break of 1.3482 resistance turned support is needed to be first indication of completion of the rise. Otherwise, outlook will stay cautiously bullish even in case of deep pullback.