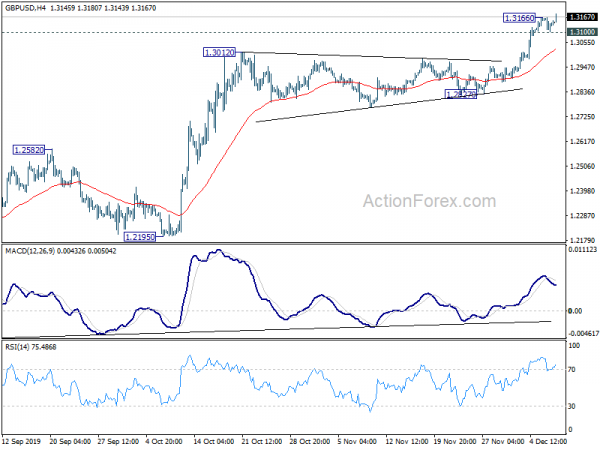

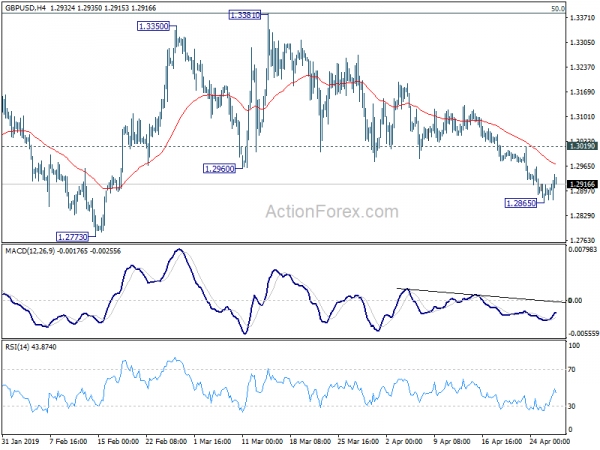

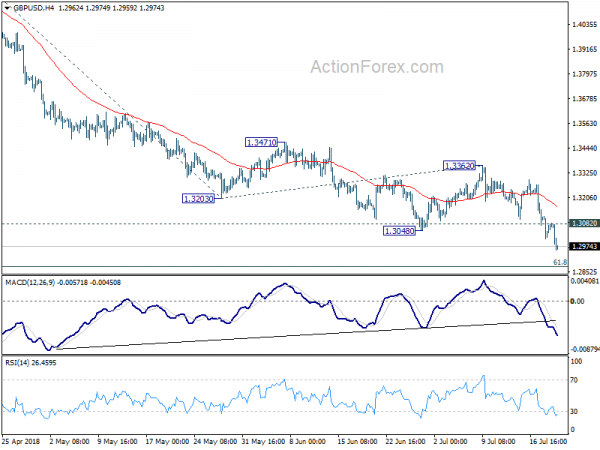

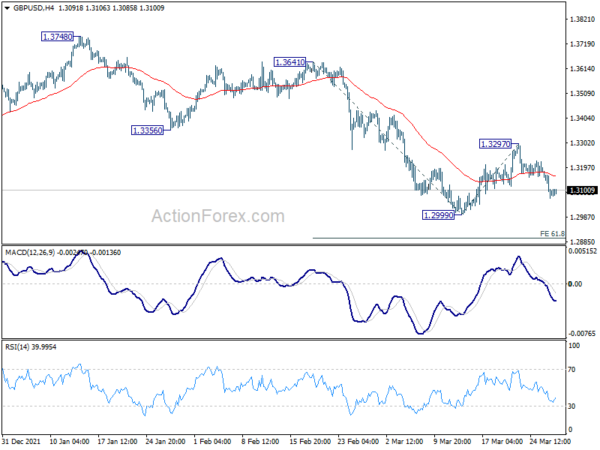

Daily Pivots: (S1) 1.3103; (P) 1.3135; (R1) 1.3168; More….

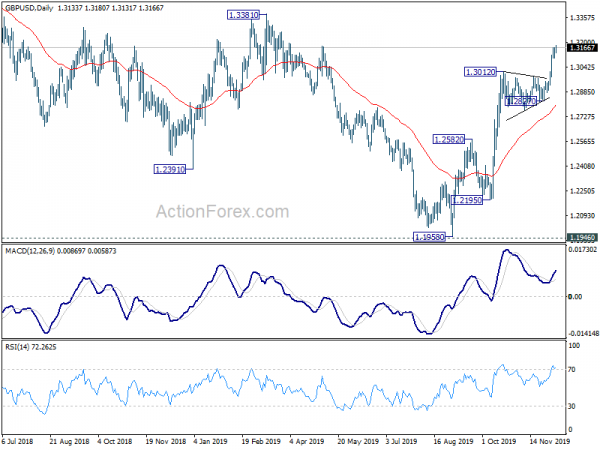

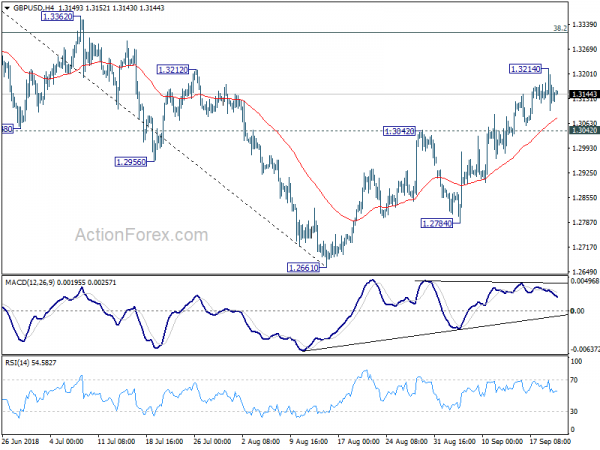

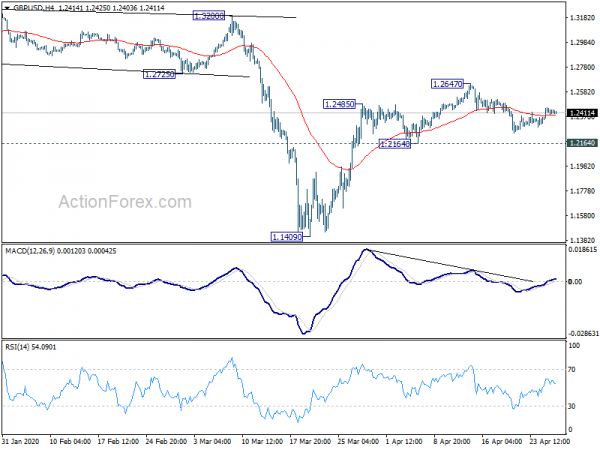

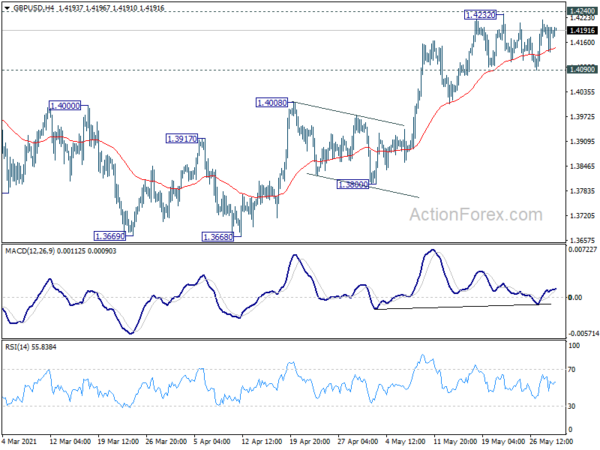

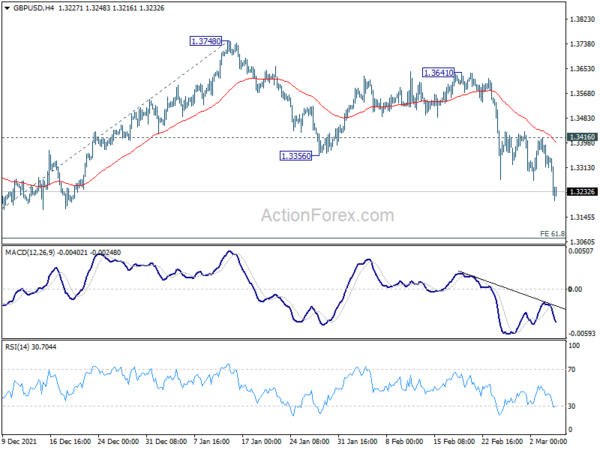

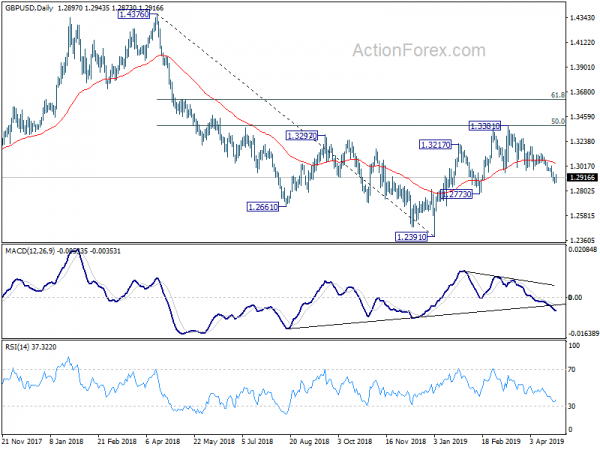

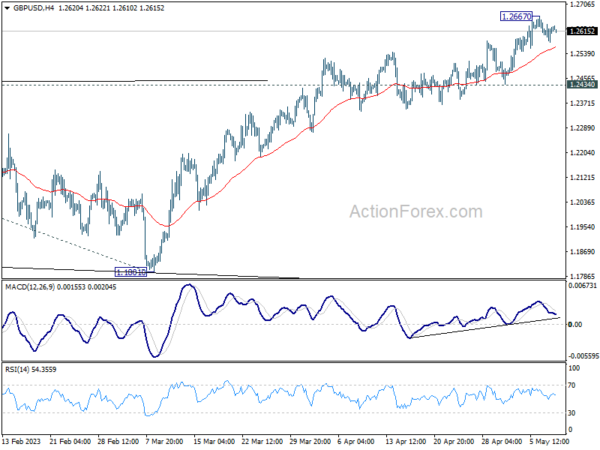

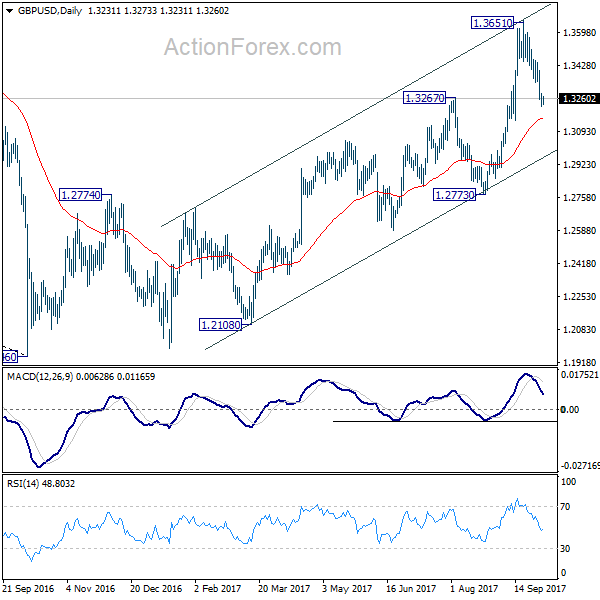

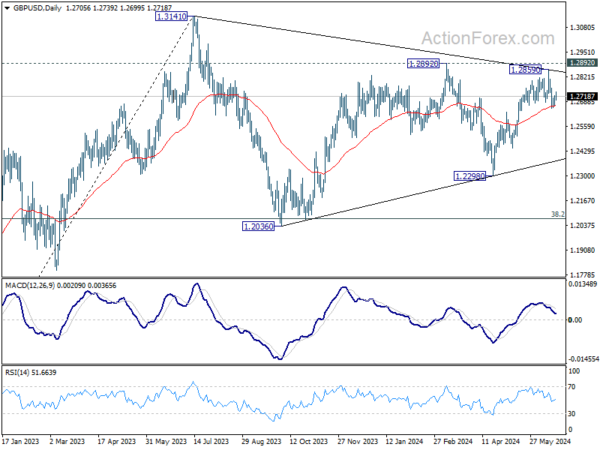

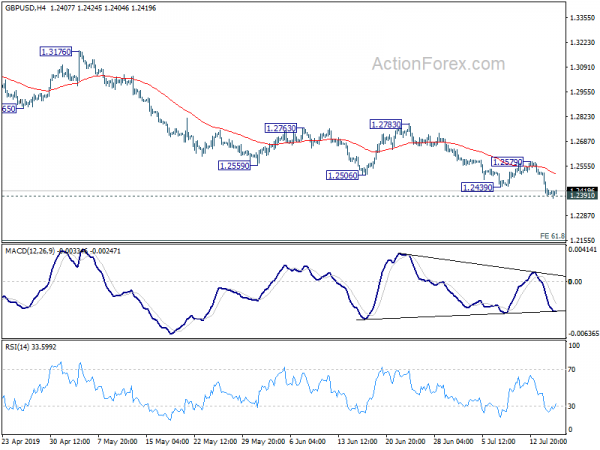

GBP/USD’s rally resumed after brief consolidations and intraday bias back on the upside. Current rise from 1.1958 is in progress for 1.3381 resistance next. On the downside, below 1.3100 minor support will turn intraday bias neutral again first. But downside of retreat should be contained well above 1.2827 support to bring rise resumption.

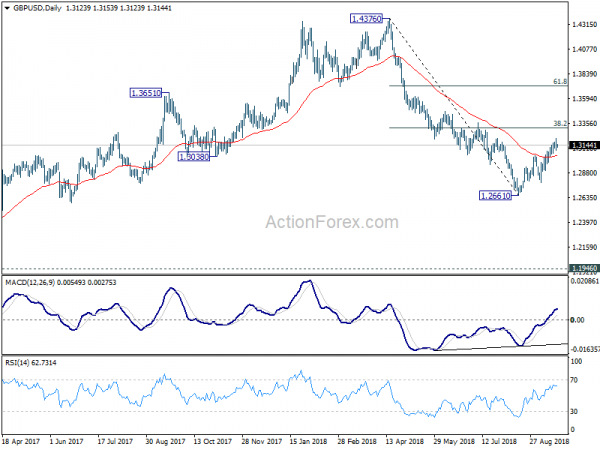

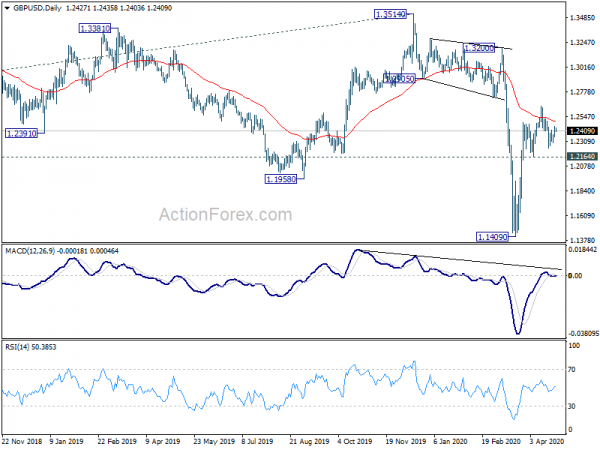

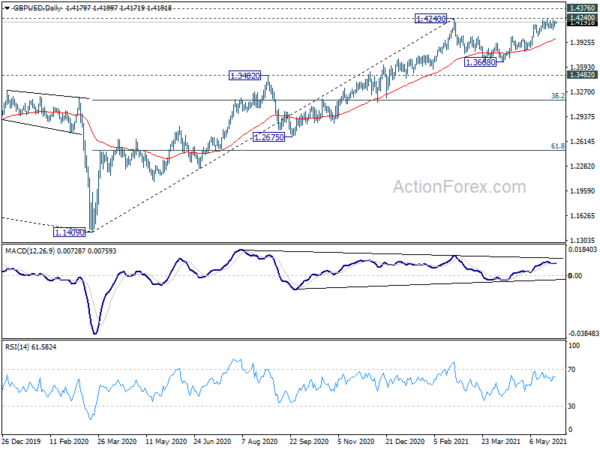

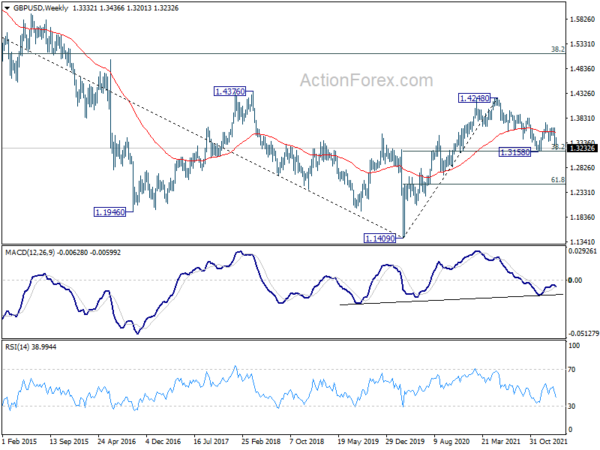

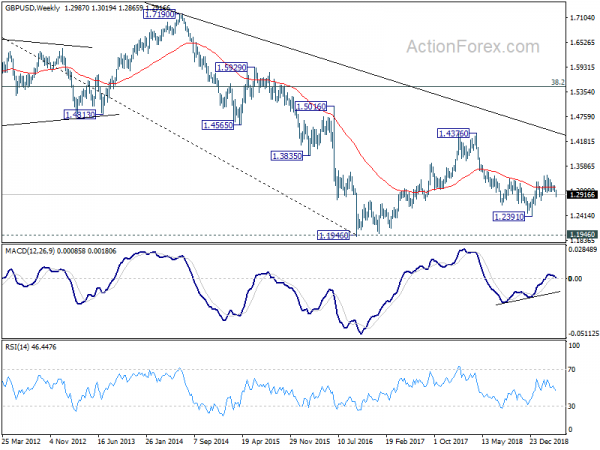

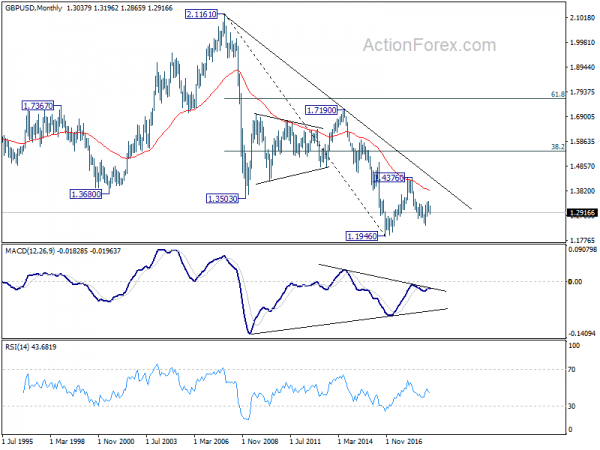

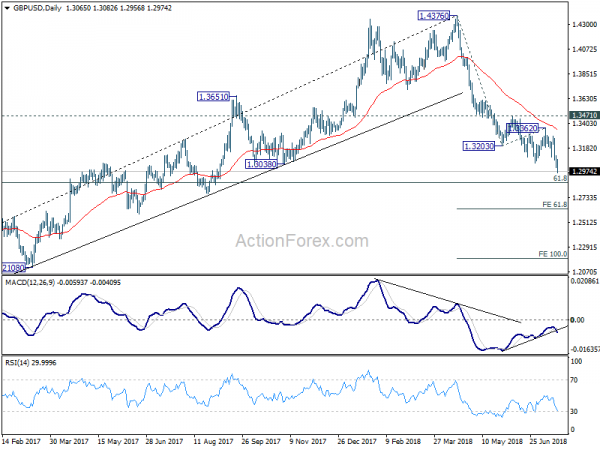

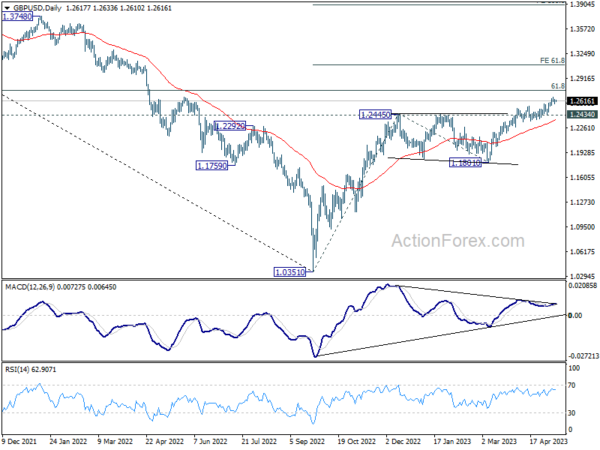

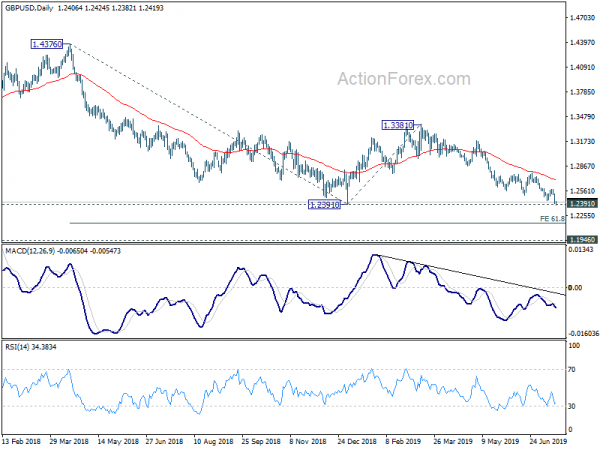

In the bigger picture, rise from 1.1958 medium term bottom is seen as the third leg of consolidation from 1.1946. Further rise would be seen back towards 1.4376 resistance. For now, this will remain the favored case as long as 1.2582 resistance turned support holds. However, firm break of 1.2582 will turn focus back to 1.1946 low.