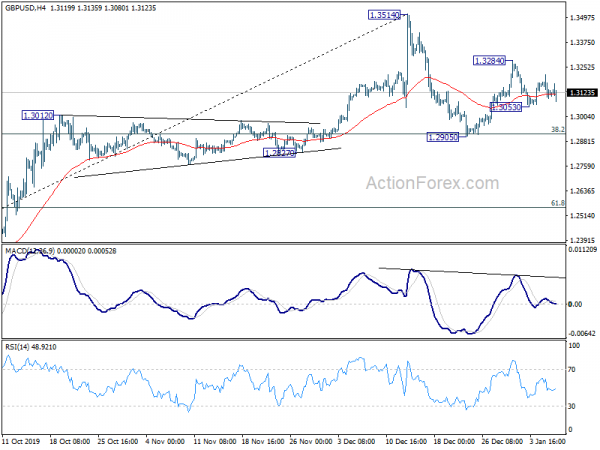

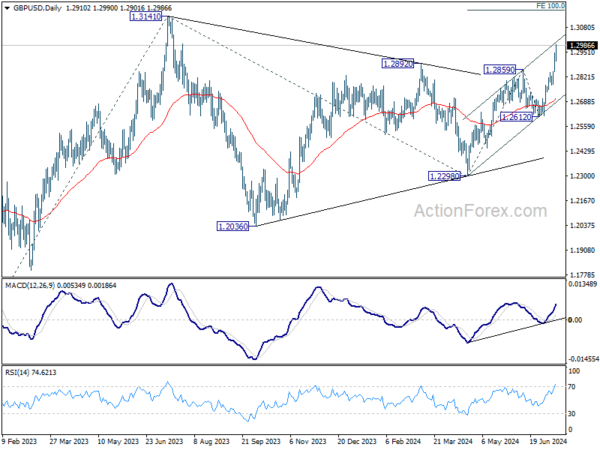

Daily Pivots: (S1) 1.3072; (P) 1.3142; (R1) 1.3189; More….

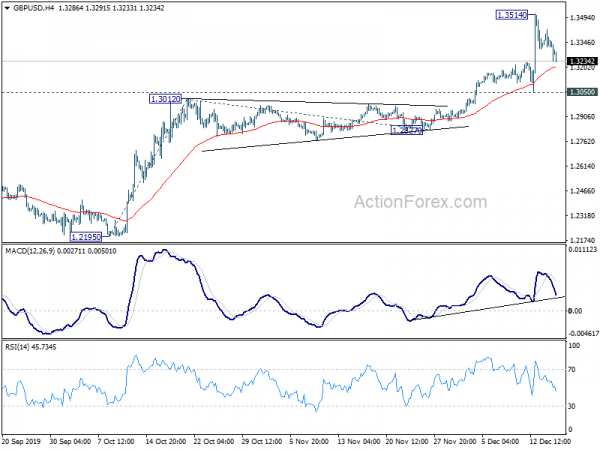

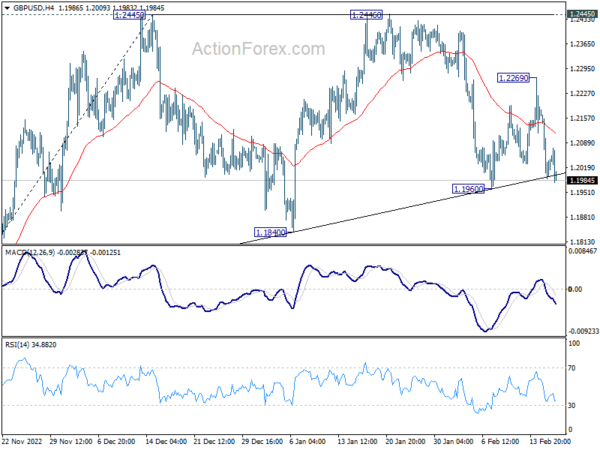

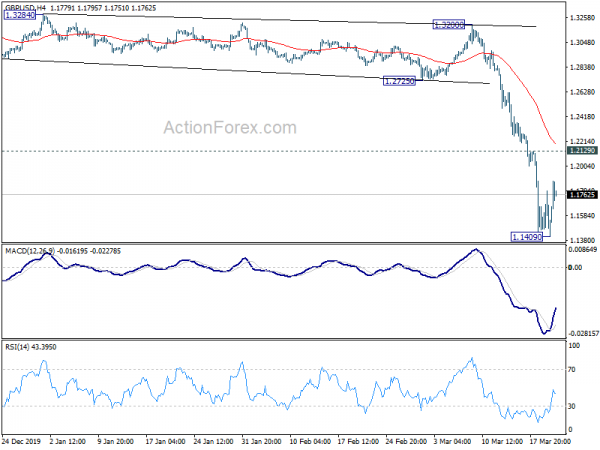

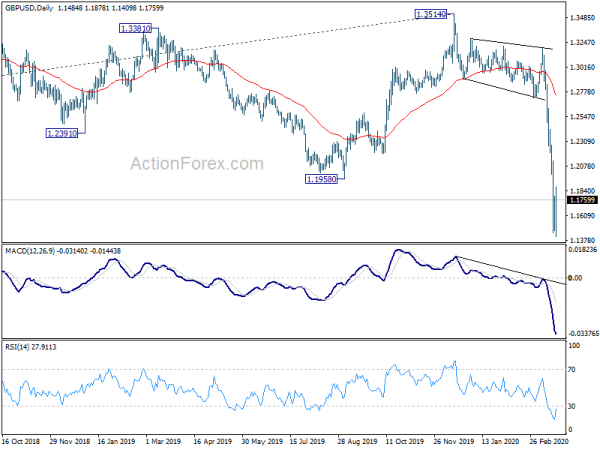

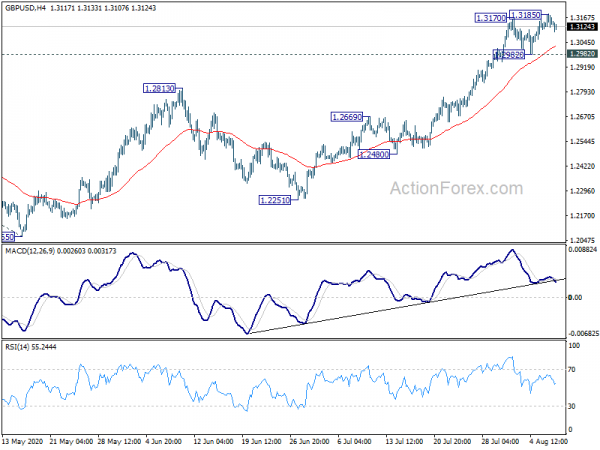

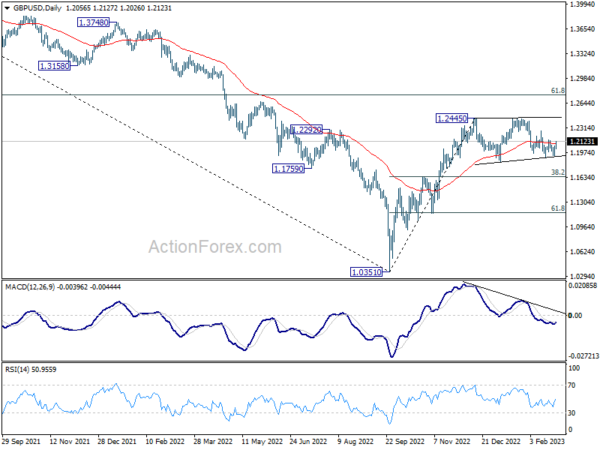

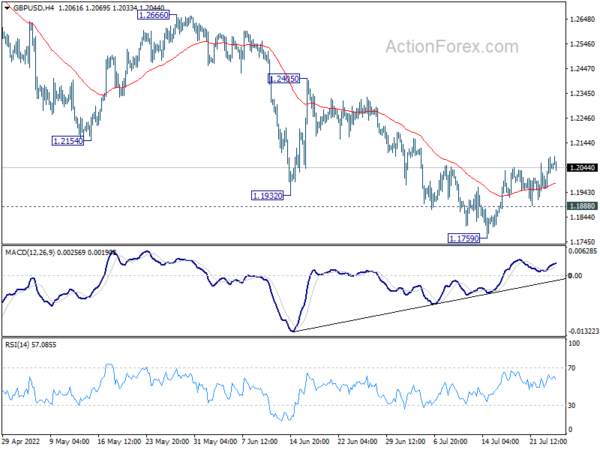

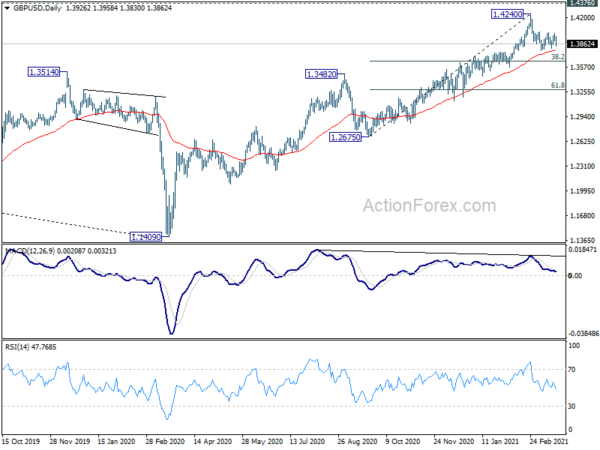

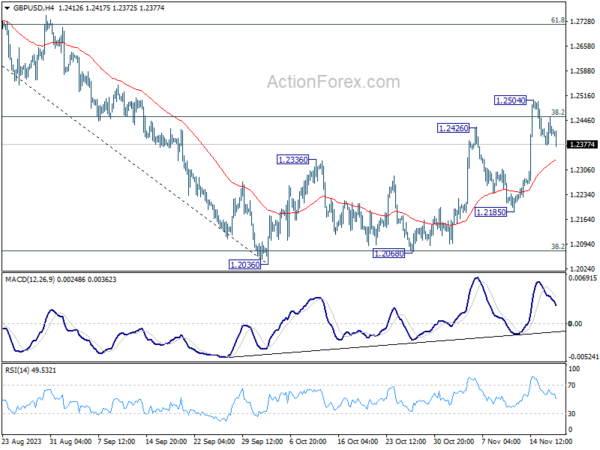

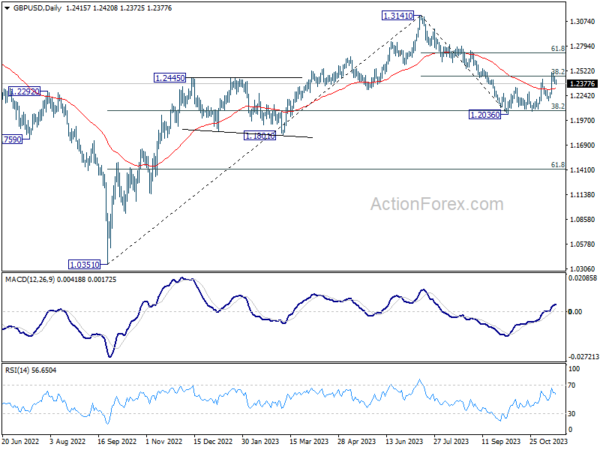

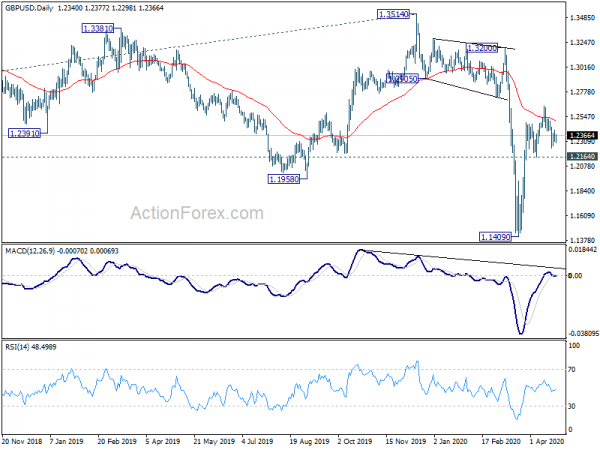

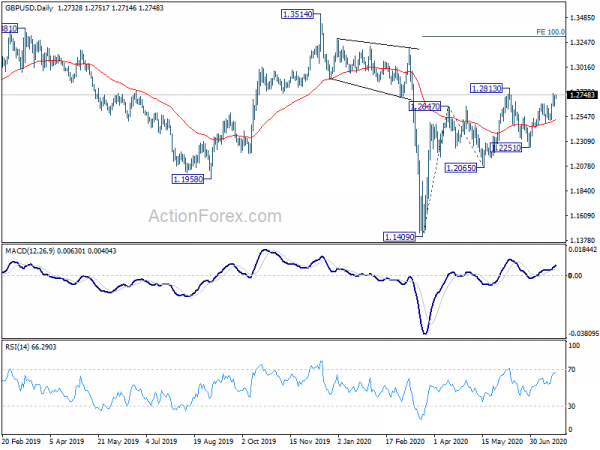

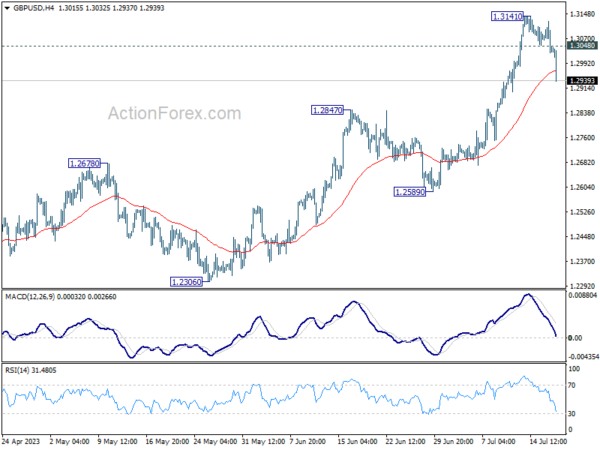

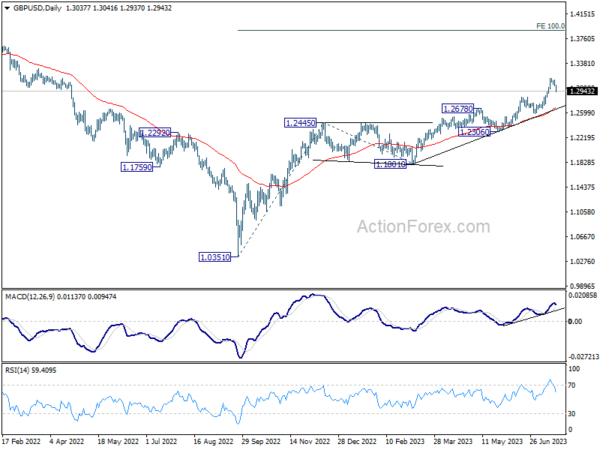

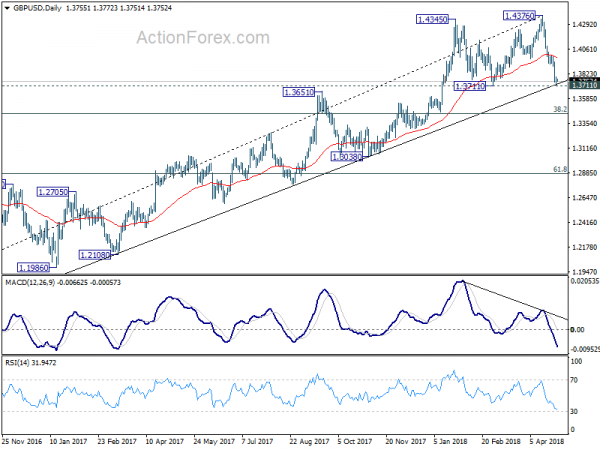

GBP/USD is staying in range of 1.3053/3284 and intraday bias remains neutral for the moment. On the downside, below 1.3053 will target 1.2905 support. Sustained break of 38.2% retracement of 1.1958 to 1.3514 at 1.2920 will target 61.8% retracement at 1.2552. On the upside, break of 1.3284 will bring retest of 1.3514 high.

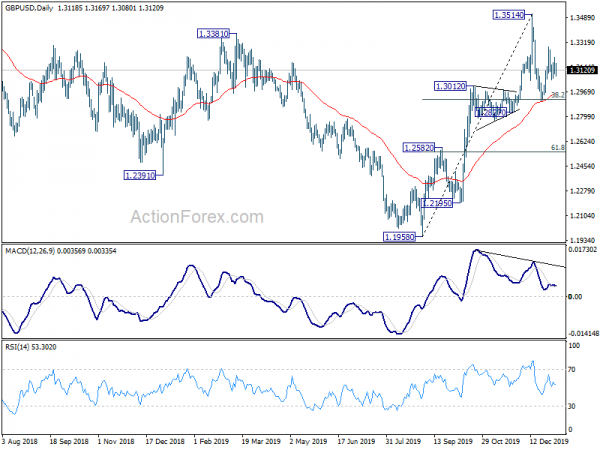

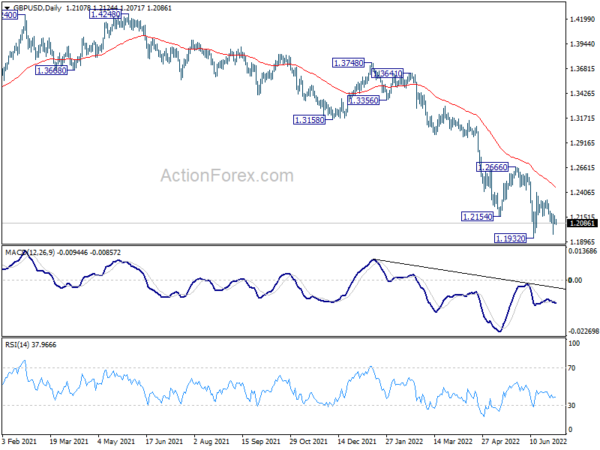

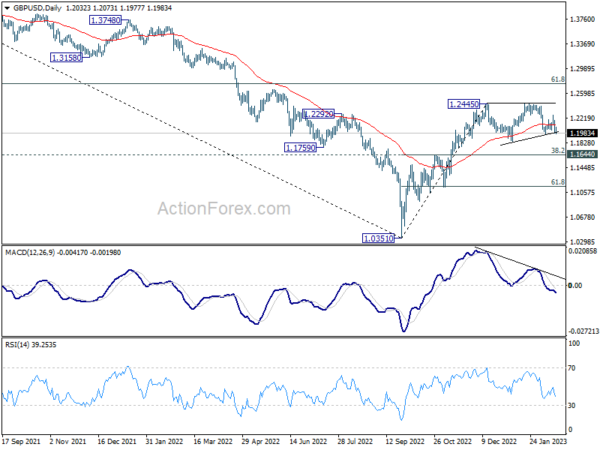

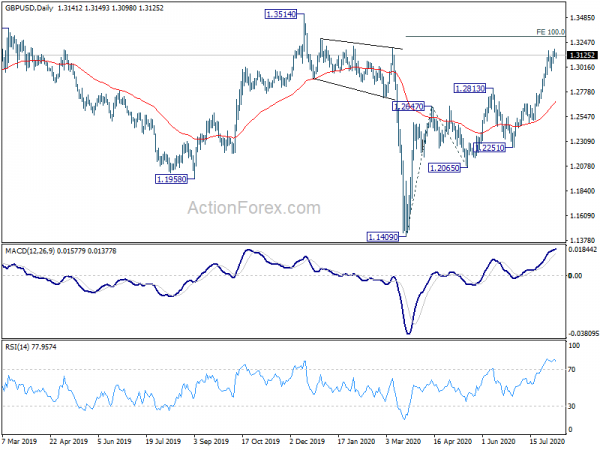

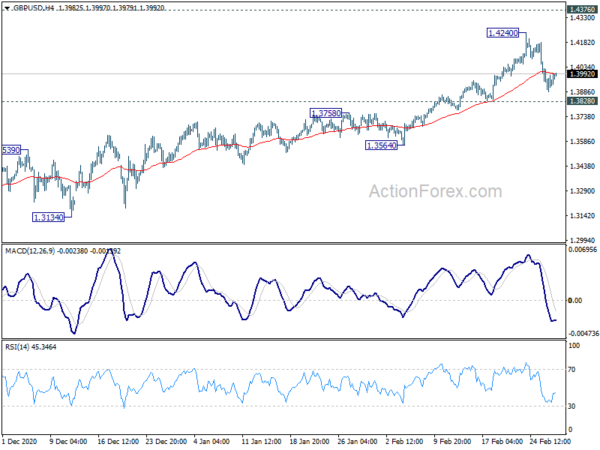

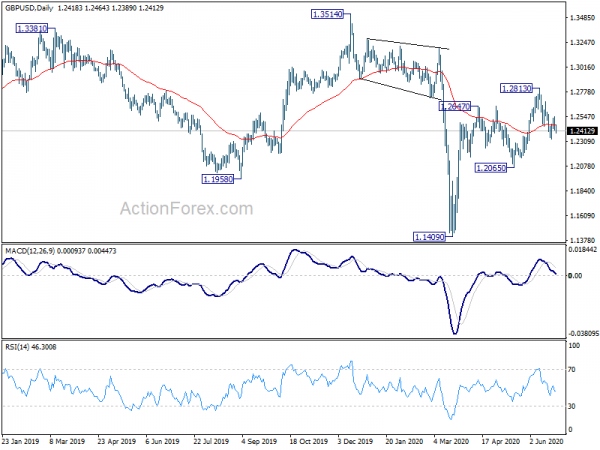

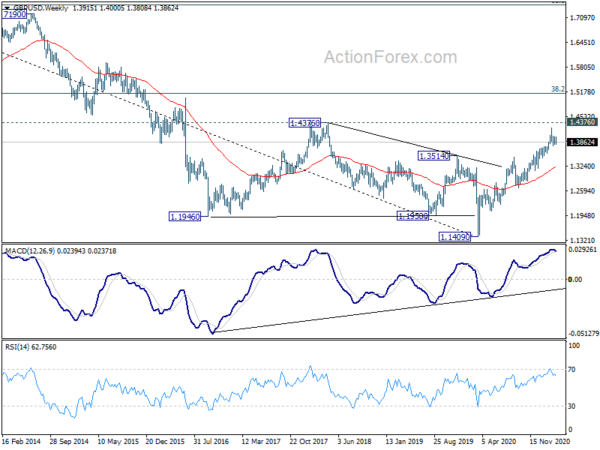

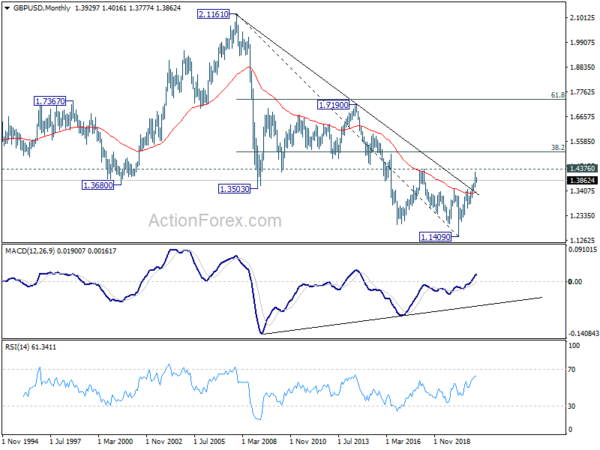

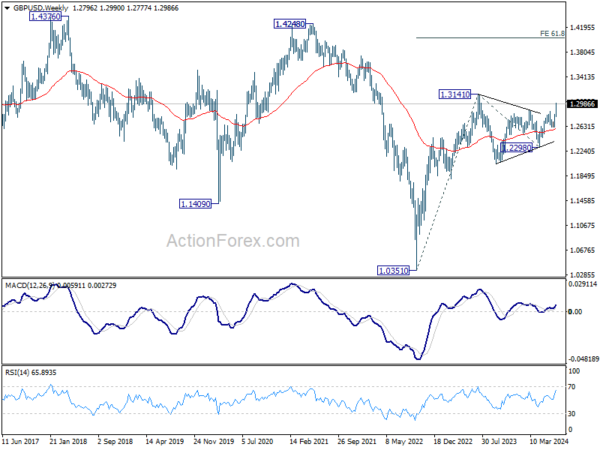

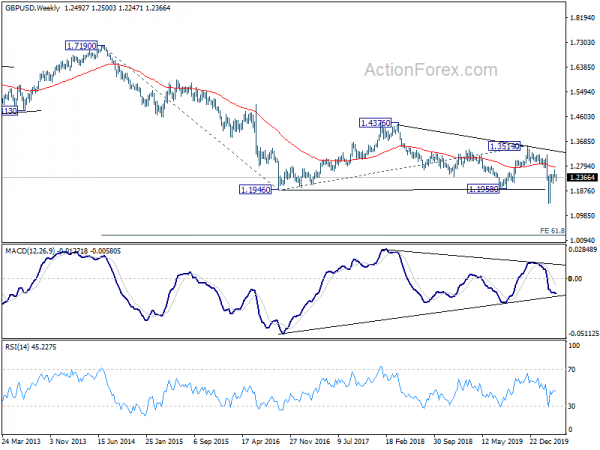

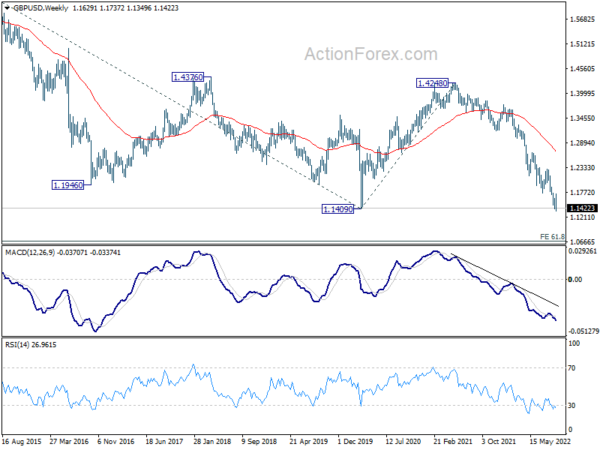

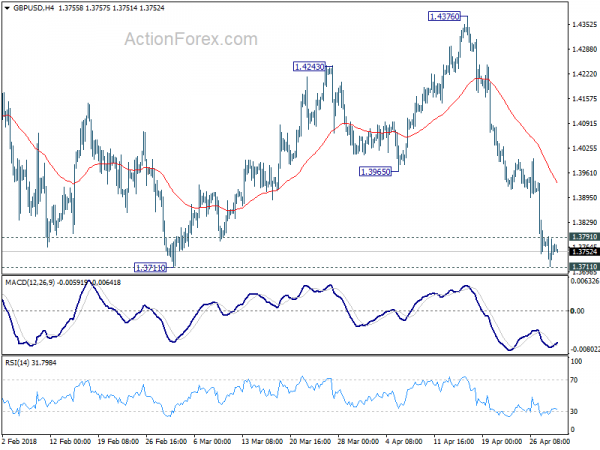

In the bigger picture, rise from 1.1958 medium term bottom is expected to extend higher to retest 1.4376 key resistance. Reactions from there would decide whether it’s in consolidation from 1.1946 (2016 low). Or, firm break of 1.4376 will indicate long term bullish reversal. In any case, for now, outlook will stay bullish as long as 1.2582 resistance turned support holds.