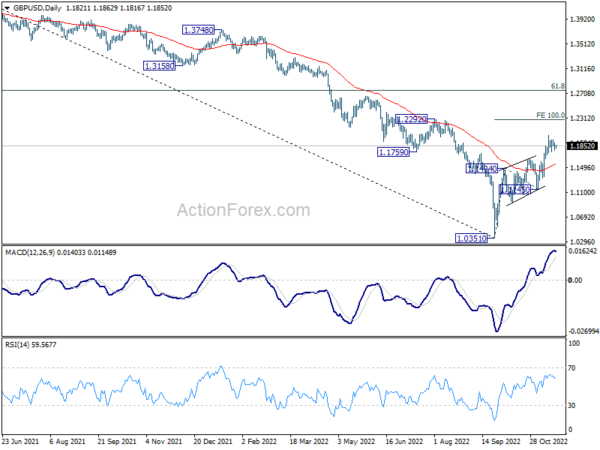

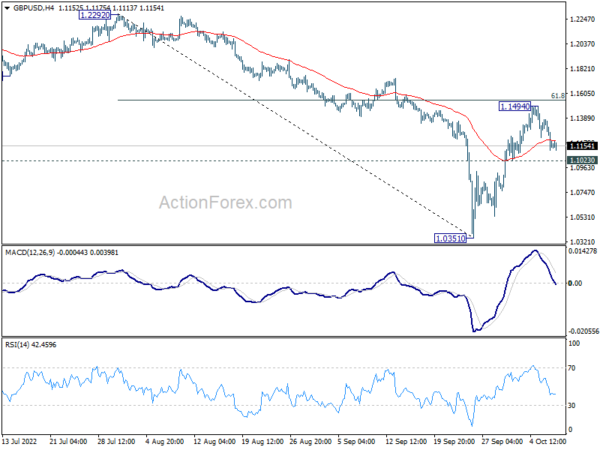

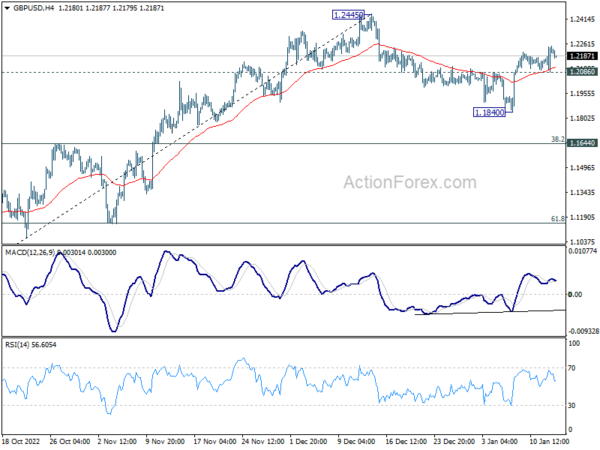

Daily Pivots: (S1) 1.1766; (P) 1.1837; (R1) 1.1895; More…

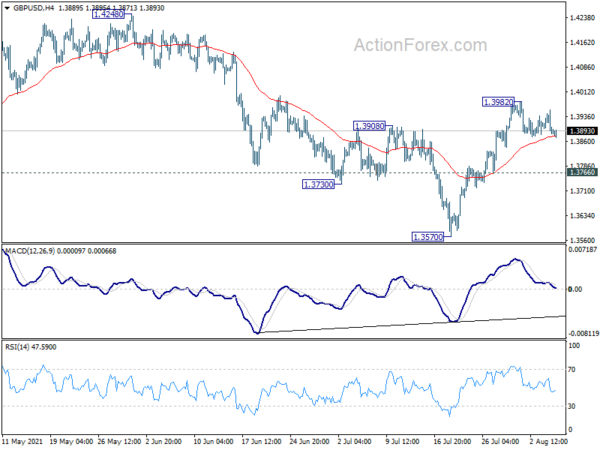

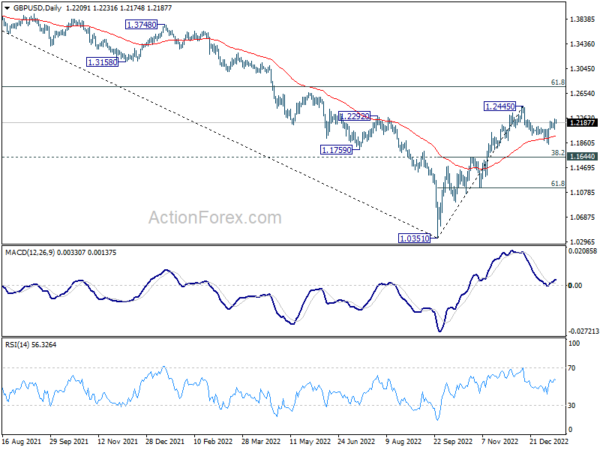

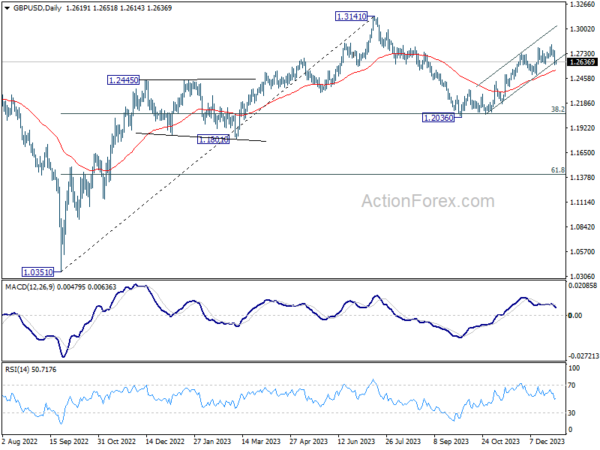

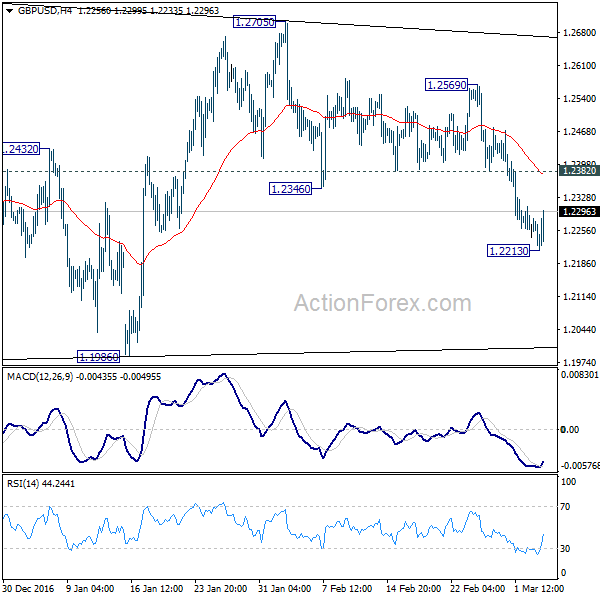

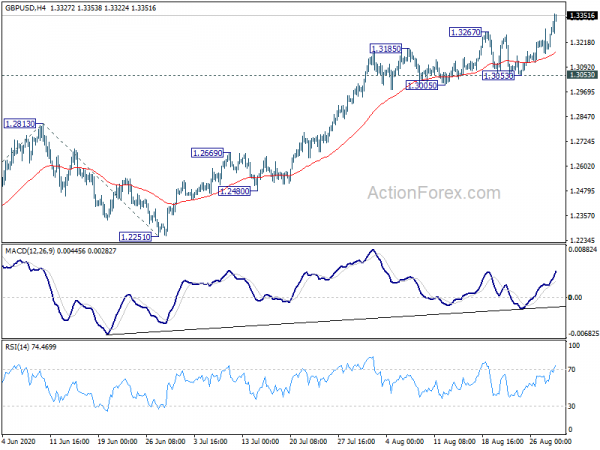

GBP/USD is staying inside tight range below 1.2028 as sideway consolidation continues. Intraday bias remains neutral first, and further rally is expected as long as 1.1644 resistance turned support holds. On the upside, break of 1.2028 will resume whole rise from 1.0351 to 100% projection of 1.0351 to 1.1494 from 1.1145 at 1.2288. However, sustained break of 1.1644 will bring deeper fall to 1.1145 support instead.

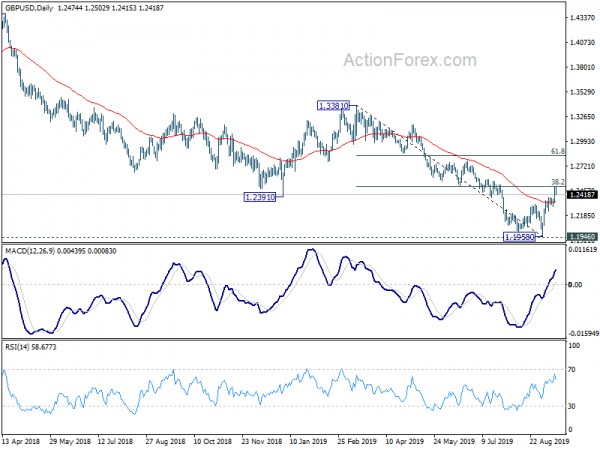

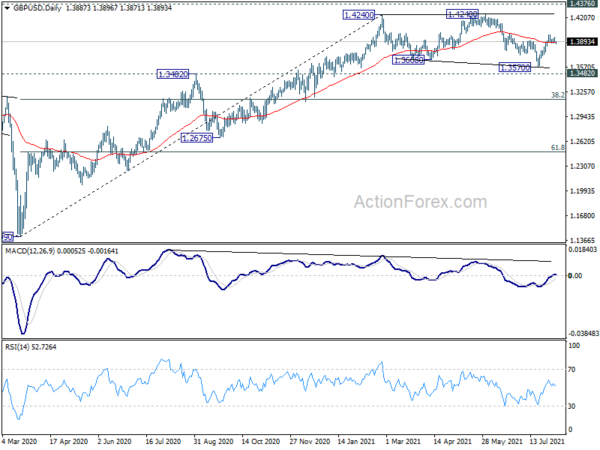

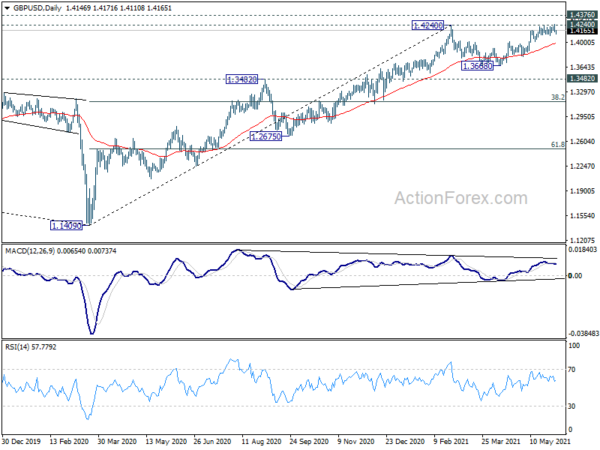

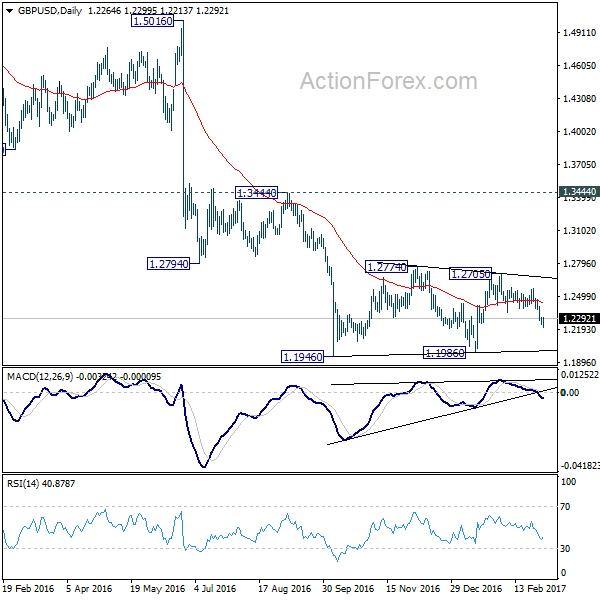

In the bigger picture, rise from 1.0351 medium term bottom is at least correcting whole down trend from 1.4248 (2021 high). Further rise is expected as long as 1.1145 support holds. Next target is 61.8% retracement of 1.4248 to 1.0351 at 1.2759.