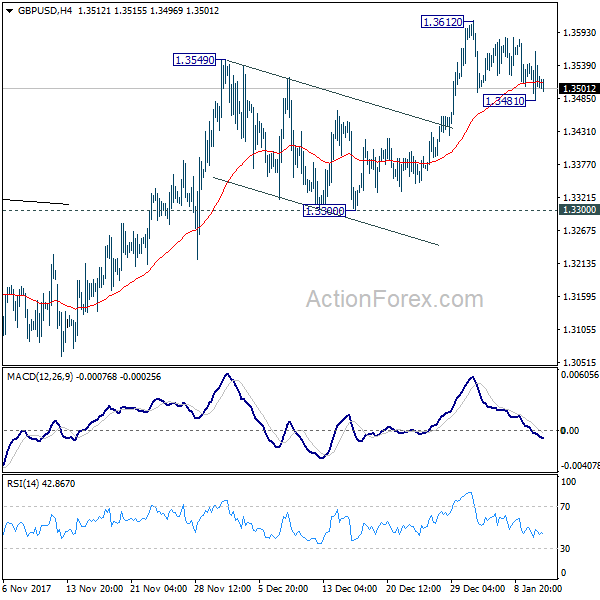

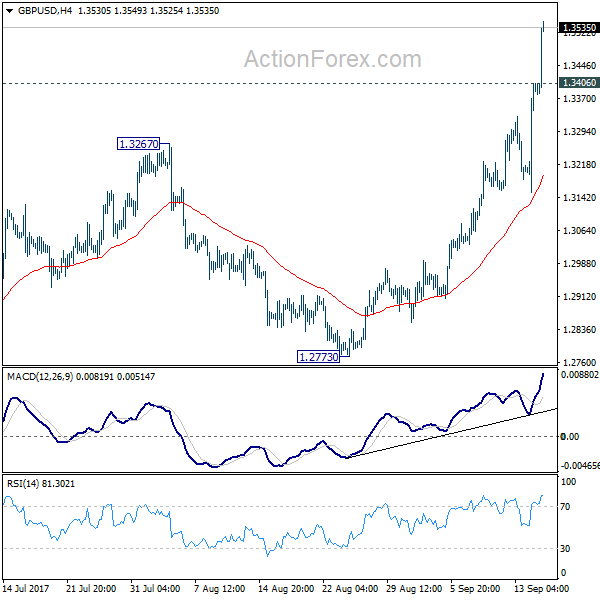

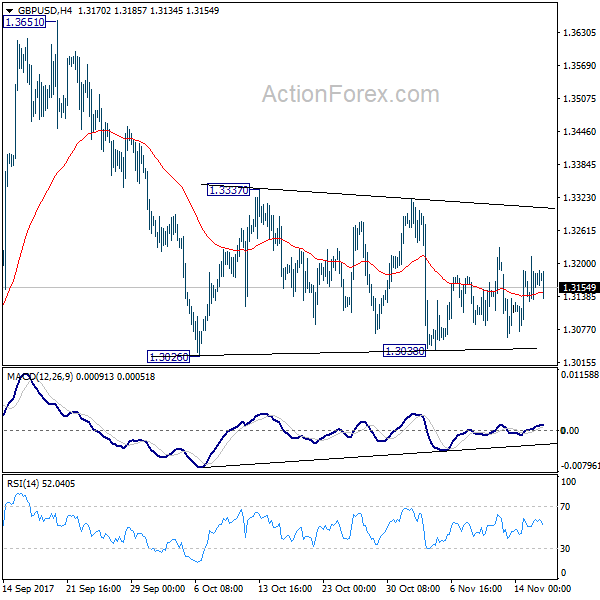

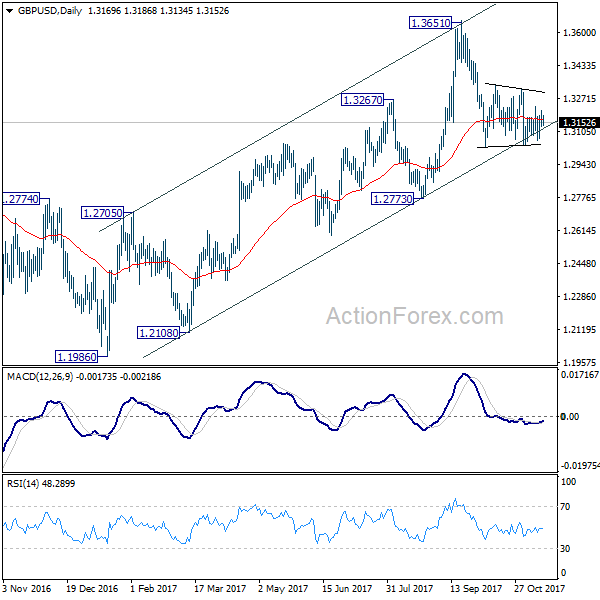

Daily Pivots: (S1) 1.3471; (P) 1.3516; (R1) 1.3551; More…..

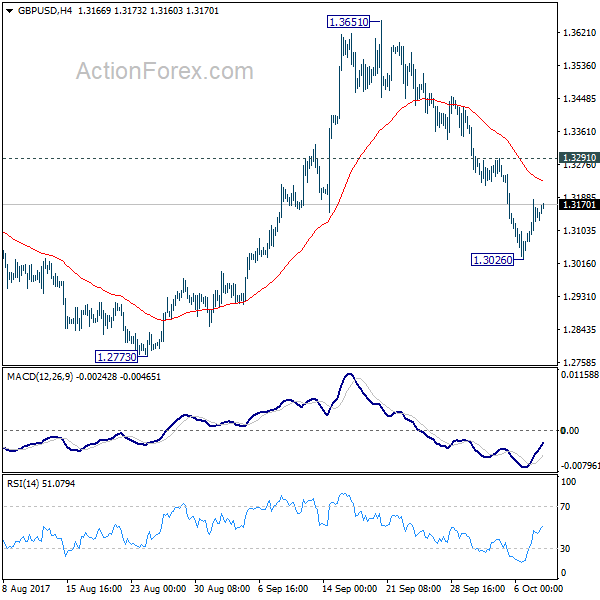

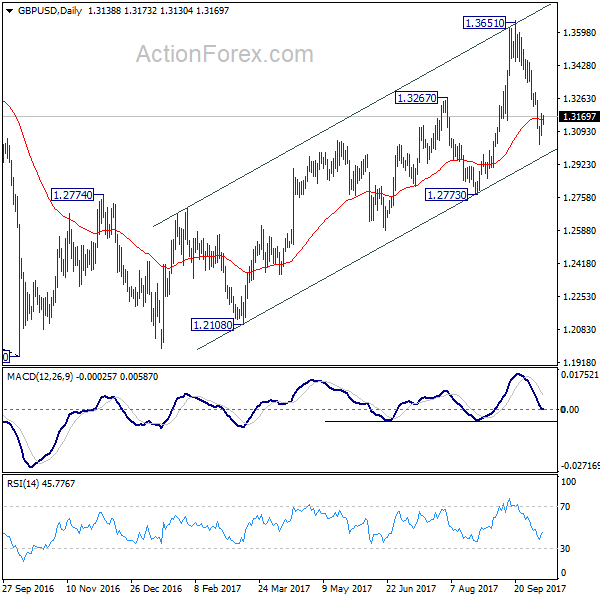

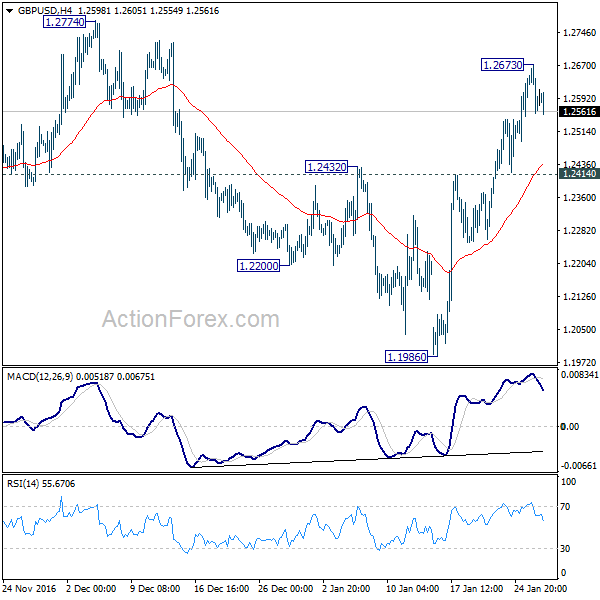

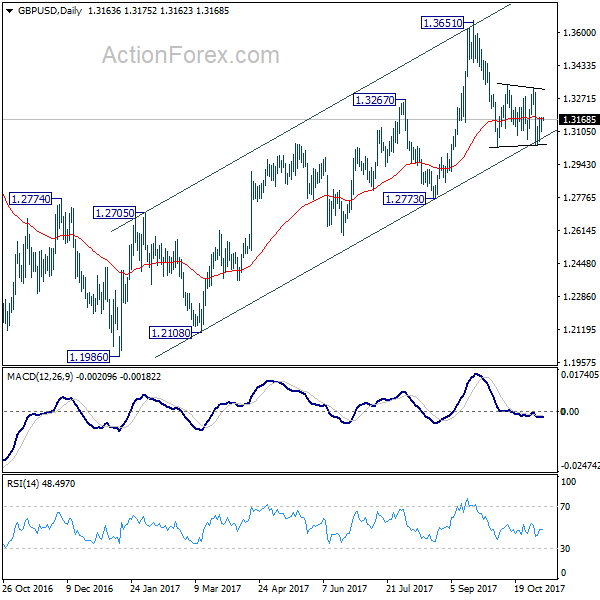

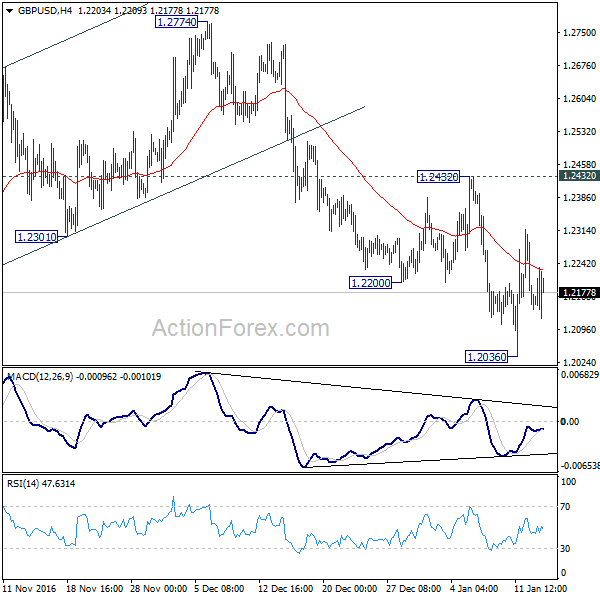

Intraday bias in GBP/USD remains neutral first. At this point, another rise is still in favor. Above 1.3612 will target 1.3651 key resistance first. Break will resume medium term rise from 1.1946 and target key resistance level at 1.3835. However, another decline and break of 1.3481 will raise the chance of near term reversal and turn focus back to 1.3300 support.

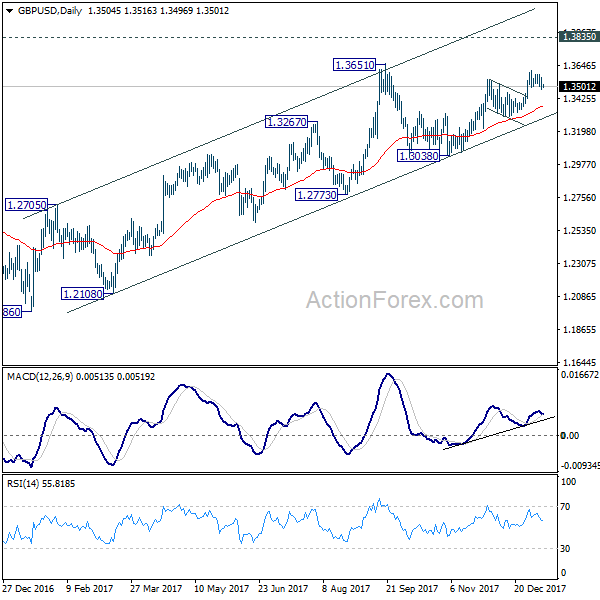

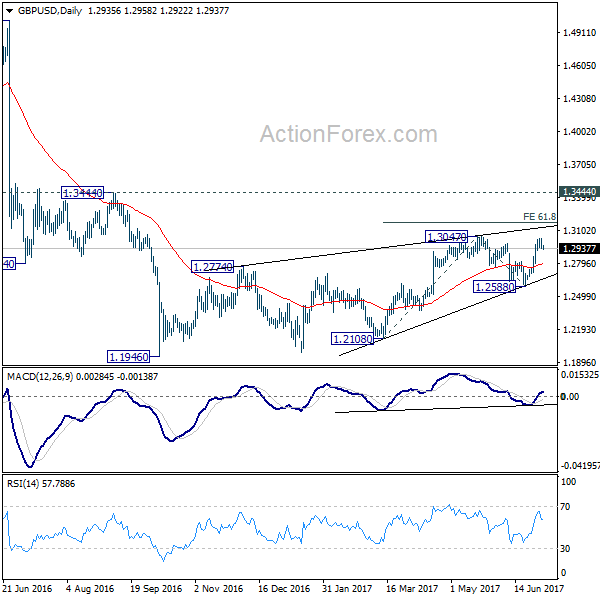

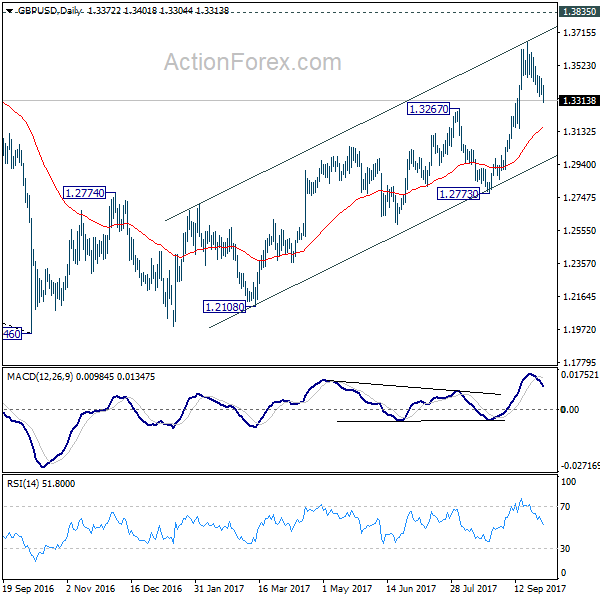

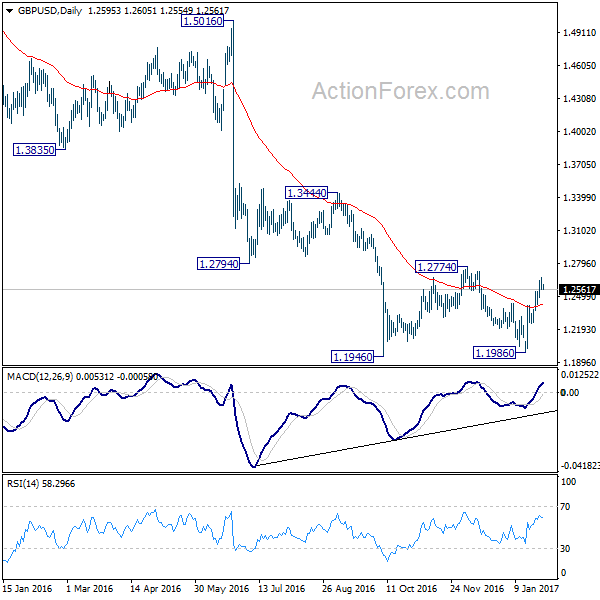

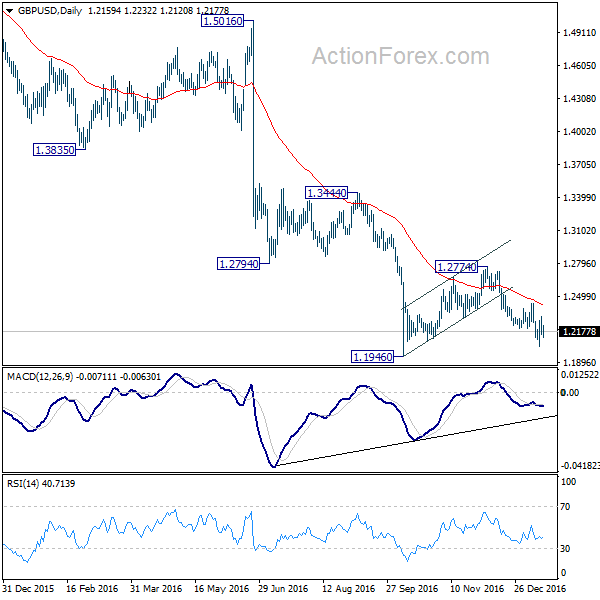

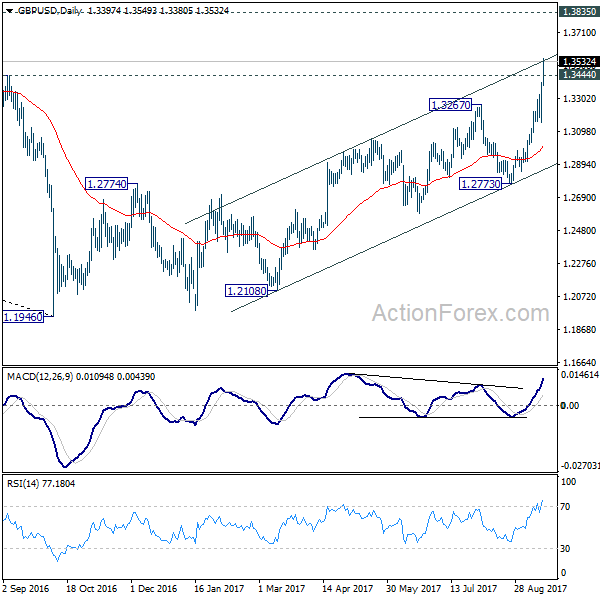

In the bigger picture, the break of long term trend line resistance from 1.7190 (2014 high) is seen as a sign of long term reversal. However, rise from 1.1946 (2016 low) is not impulsive looking. And the pair is limited below 1.3835 key resistance. Hence, we won’t turn bullish yet and would continue to monitor the development. On the downside, break of 1.3038 support will now indicate that rebound from 1.1946 has completed and turn outlook bearish. Meanwhile, sustained break of 1.3835 should at least send GBP/USD to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466.