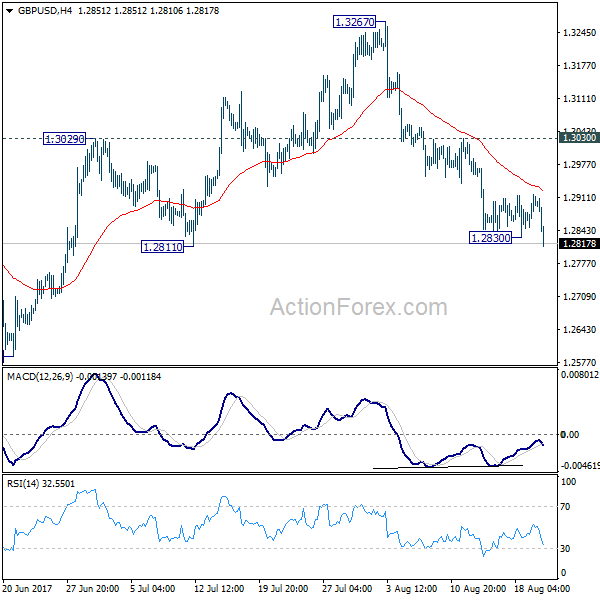

Daily Pivots: (S1) 1.2437; (P) 1.2474; (R1) 1.2509; More….

No change in GBP/USD’s outlook and intraday bias remains neutral. On the upside, sustained break of 38.2% retracement of 1.3381 to 1.1958 at 1.2502 will pave the way to 61.8% retracement at 1.2837. On the downside, however, break of 1.2283 minor support will suggest that the rebound is completed. Intraday bias will be turned back to the downside for retesting 1.1958 low.

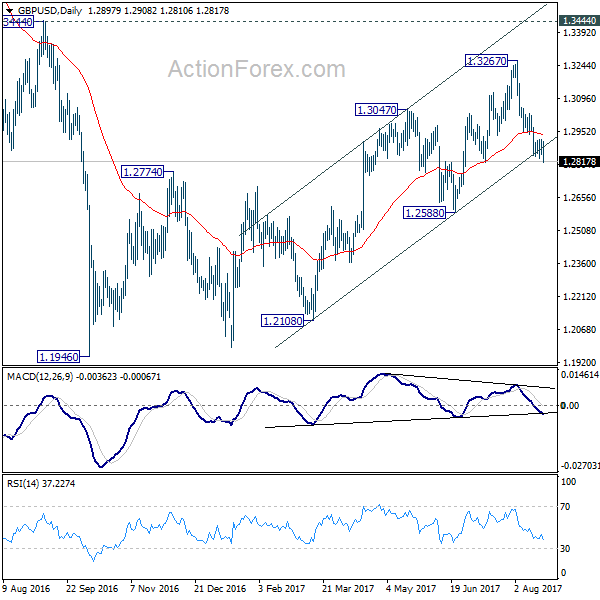

In the bigger picture, we’d remain cautious on medium term bottoming around 1.1946 (2016 low). Sustained trading above 55 week EMA (now at 1.2769) will extend the consolidation pattern from 1.1946 with another rise to 1.4376 resistance. Nevertheless, decisive break of 1.1946 will resume down trend from 2.1161 (2007 high) to 61.8% projection of 1.7190 to 1.1946 from 1.4376 at 1.1135.