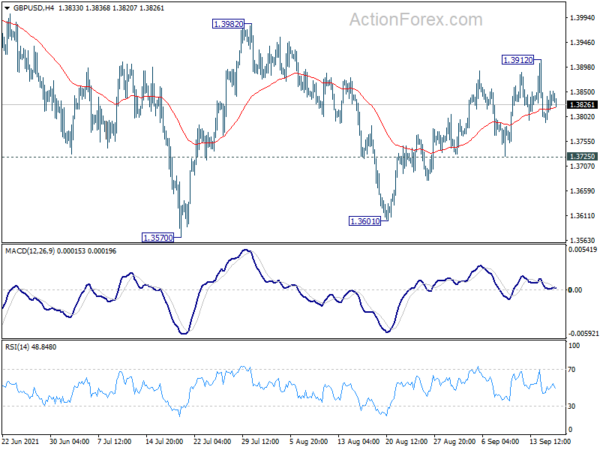

Daily Pivots: (S1) 1.3341; (P) 1.3372; (R1) 1.3414; More…..

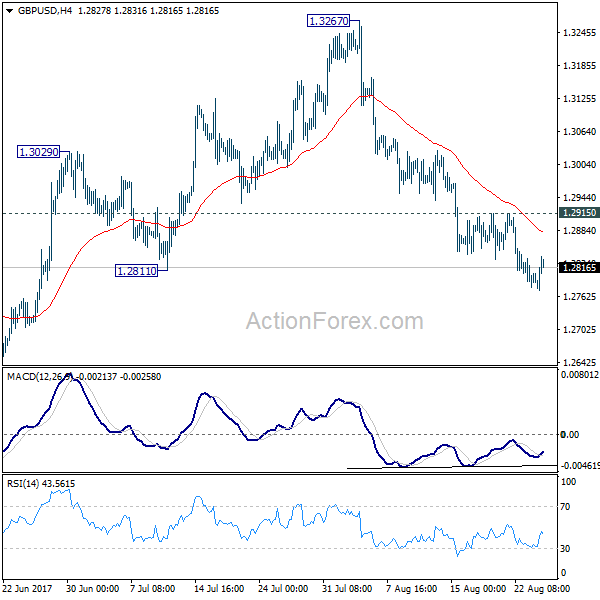

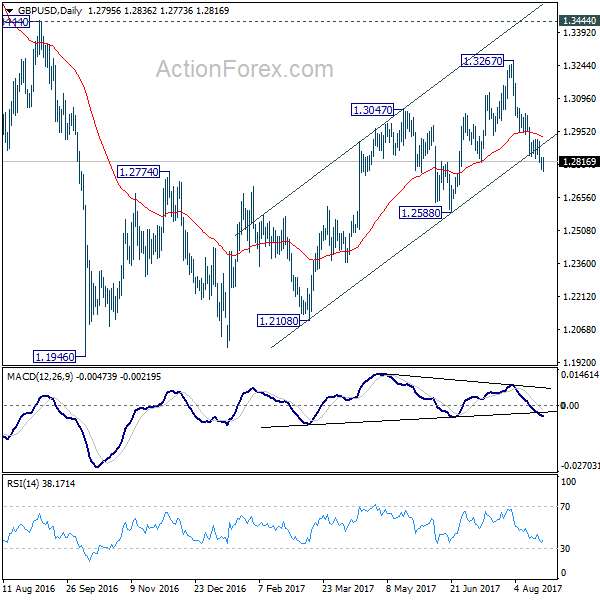

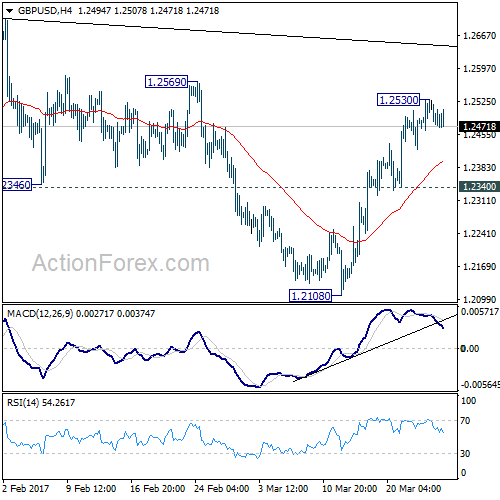

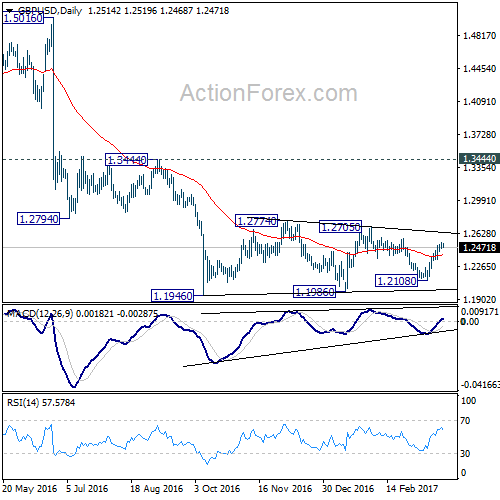

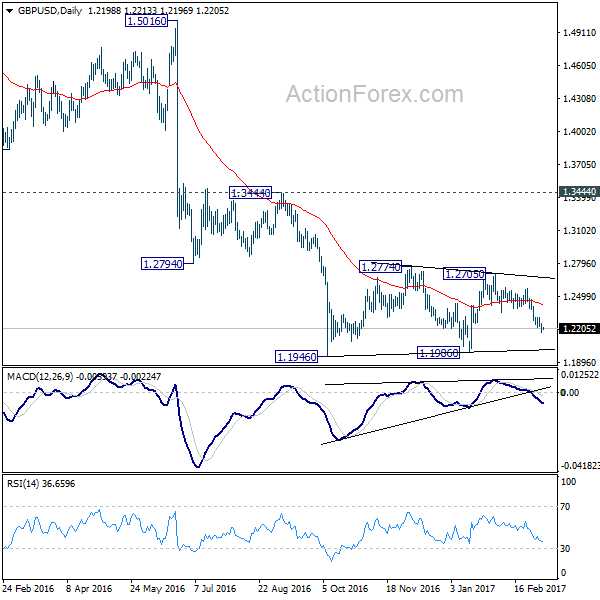

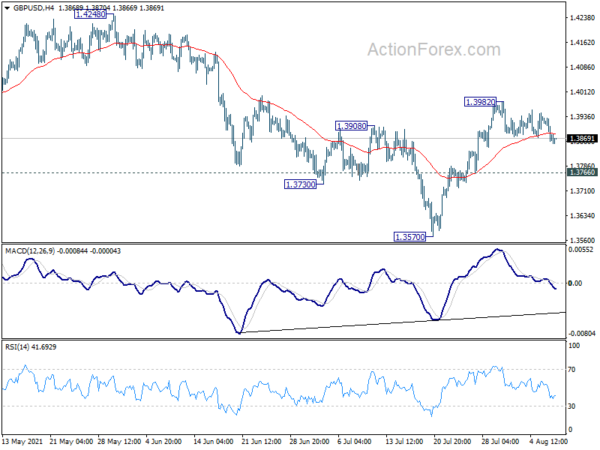

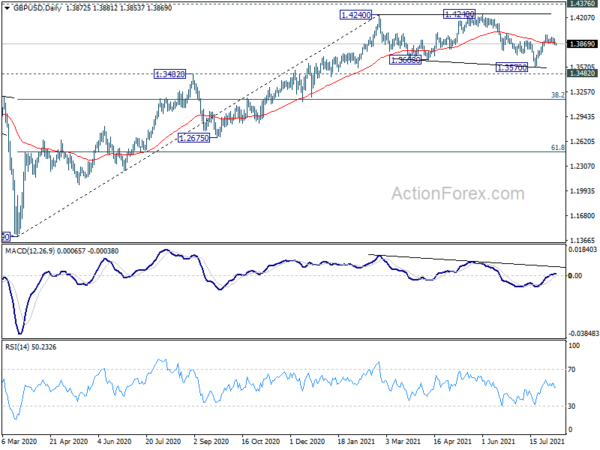

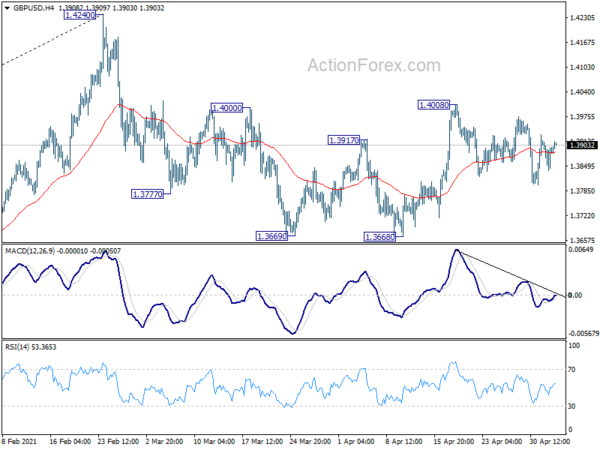

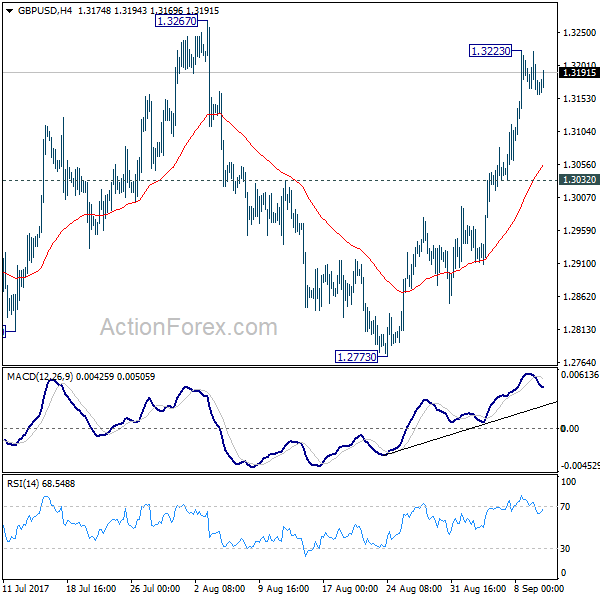

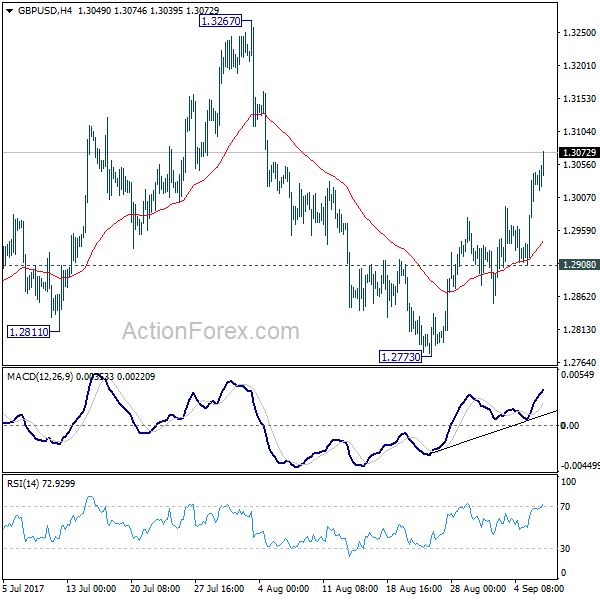

GBP/USD is staying in the correction from 1.3549 and intraday bias stays neutral for the moment. As long as 1.3220 support holds, we’d favor another rise. Break of 1.3549 will target 1.3651 high next. Break there will resume medium term rally from 1.1946. However, firm break of 1.3220 will turn near term outlook bearish for 1.3038 key support level.

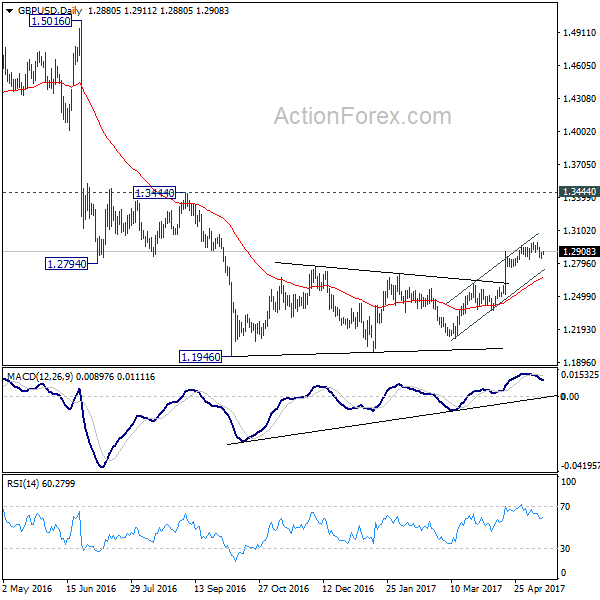

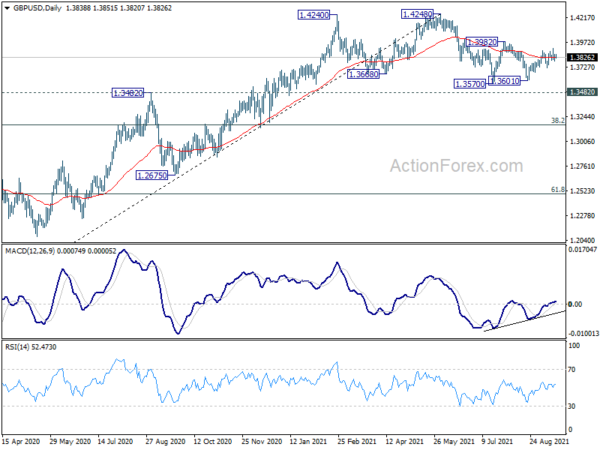

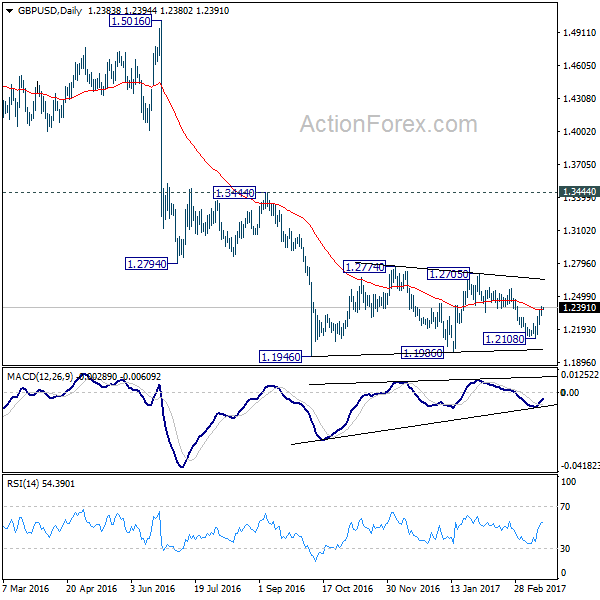

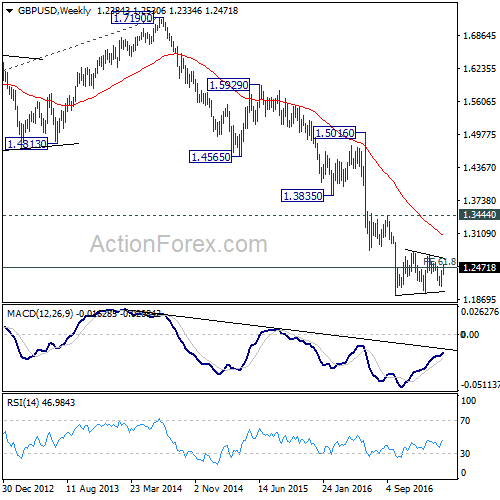

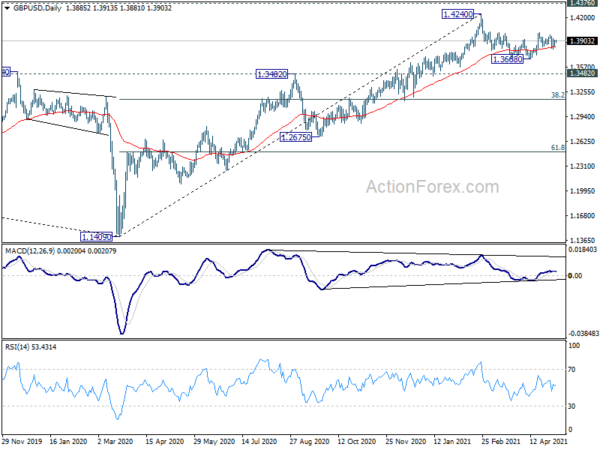

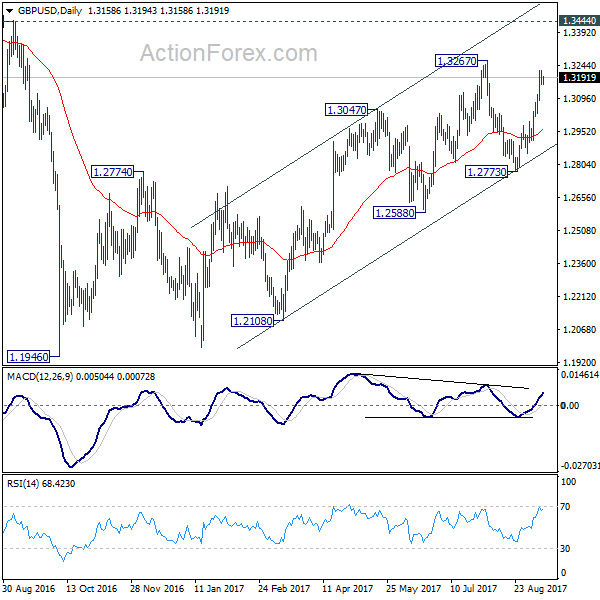

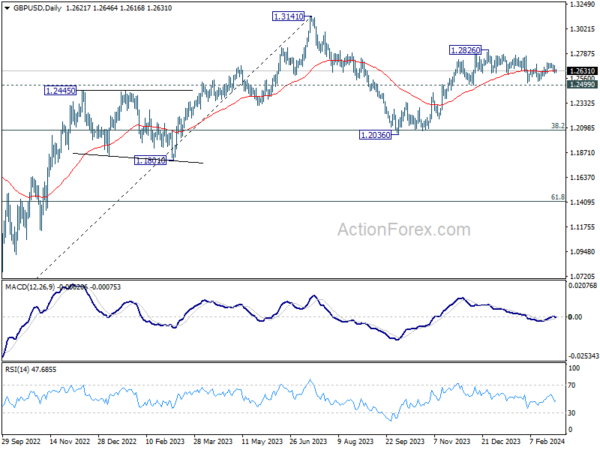

In the bigger picture, while the medium term rebound from 1.1946 low was strong, it’s limited below 1.3835 key support turned resistance. As long as 1.3835 holds, we’d view such rebound as a correction. That is, we’d expect another leg in the long term down trend through 1.1946 low. However, sustained break of 1.3835 should at least send GBP/USD to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466.