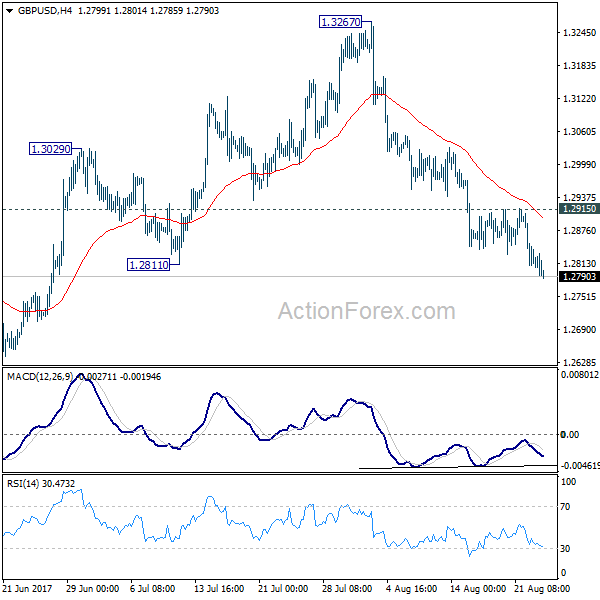

Daily Pivots: (S1) 1.2255; (P) 1.2345; (R1) 1.2436; More…

Intraday bias in GBP/USD remains on the upside for the moment. Decisive break of 1.2445 resistance will confirm resumption of whole rise from 1.0351. Next target will be 1.2759 fibonacci level. On the downside, break of 1.2252 minor support will turn bias to the downside, the extend the corrective pattern from 1.2445 with another falling leg.

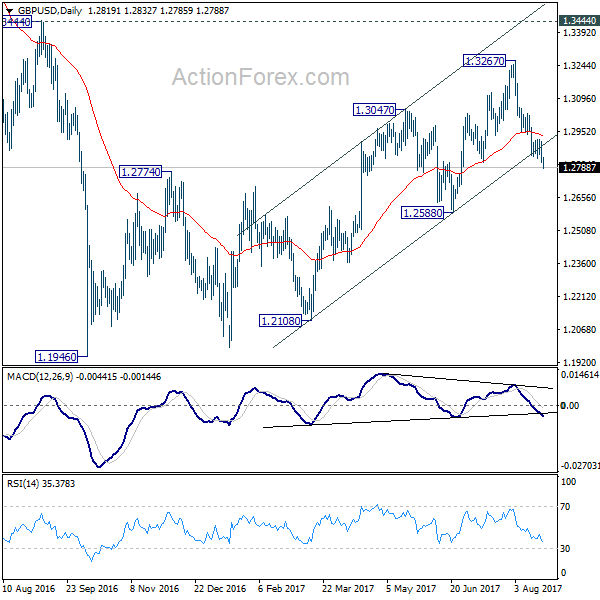

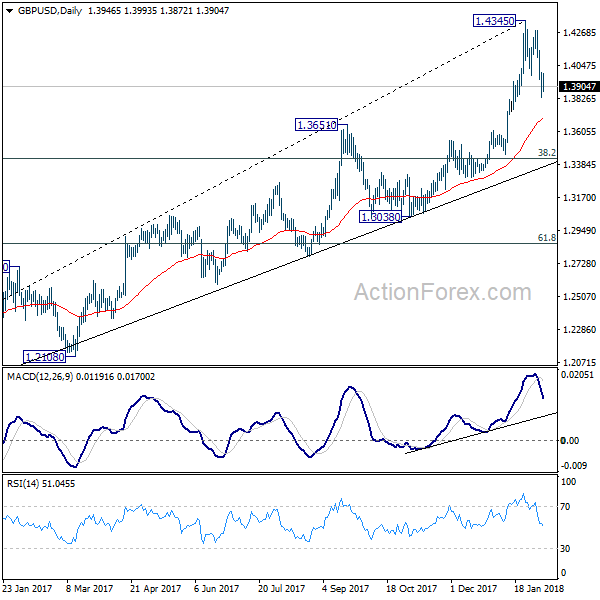

In the bigger picture, rise from 1.0351 medium term bottom is at least correcting whole down trend from 1.4248 (2021 high). Further rise is expected as long as 1.1644 resistance turned support holds. Next target is 61.8% retracement of 1.4248 to 1.0351 at 1.2759. Sustained break there will pave the way back to 1.4248.