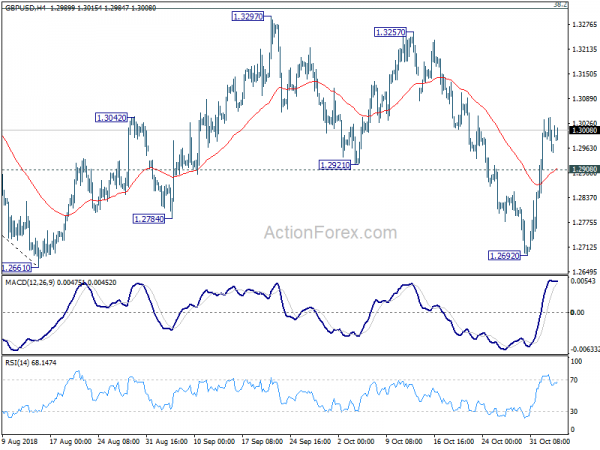

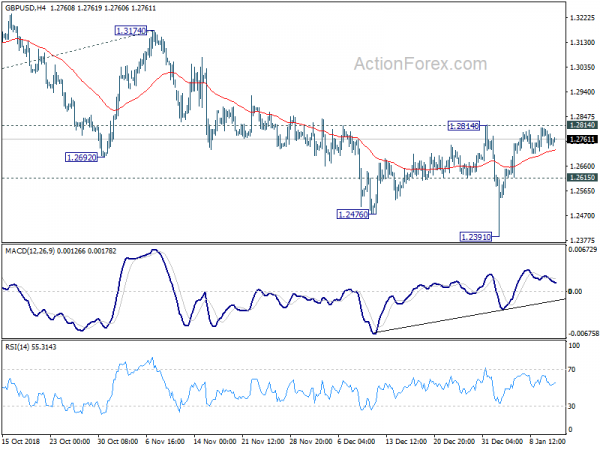

Daily Pivots: (S1) 1.2932; (P) 1.2986; (R1) 1.3022; More…

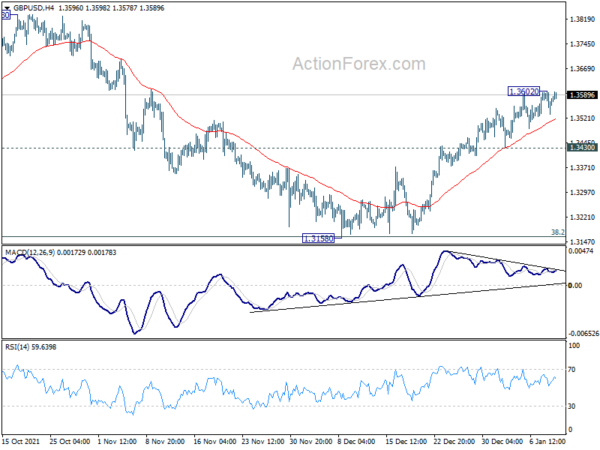

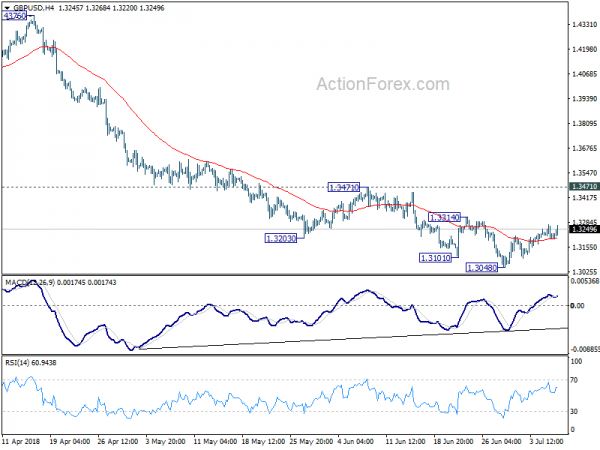

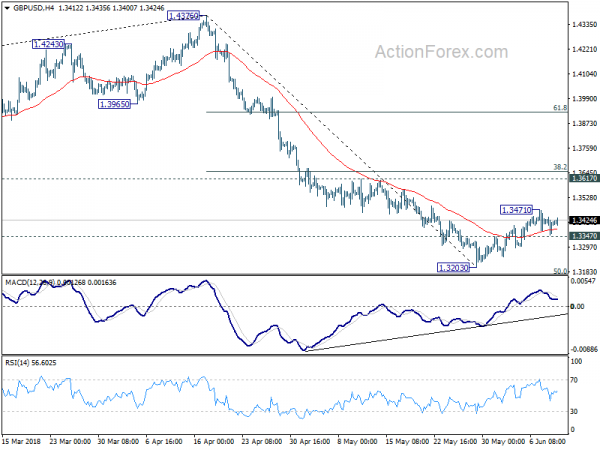

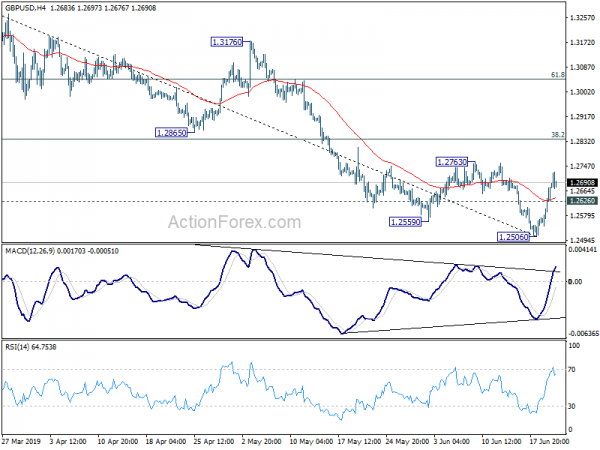

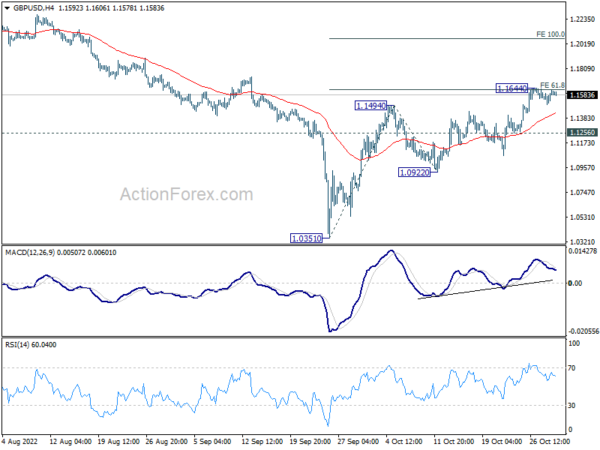

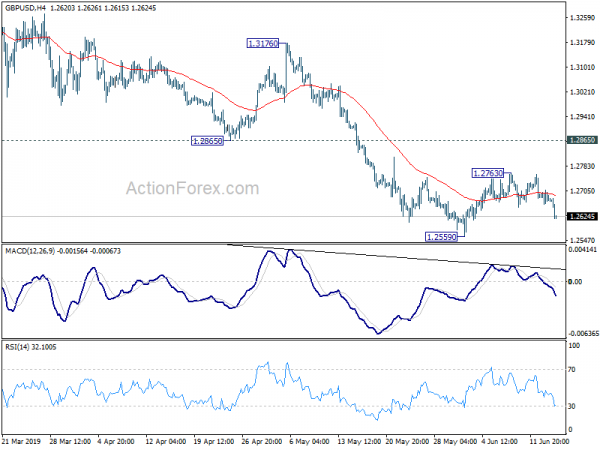

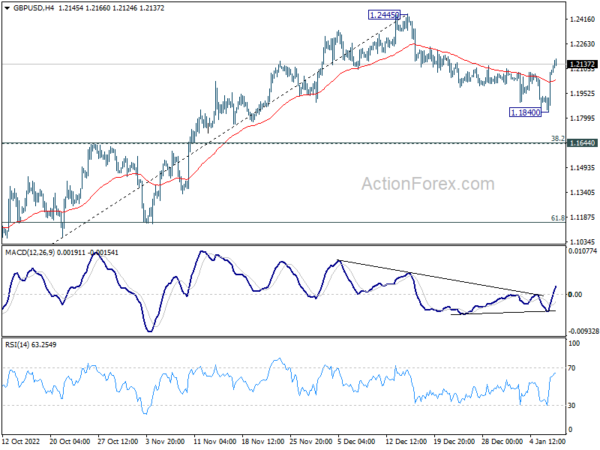

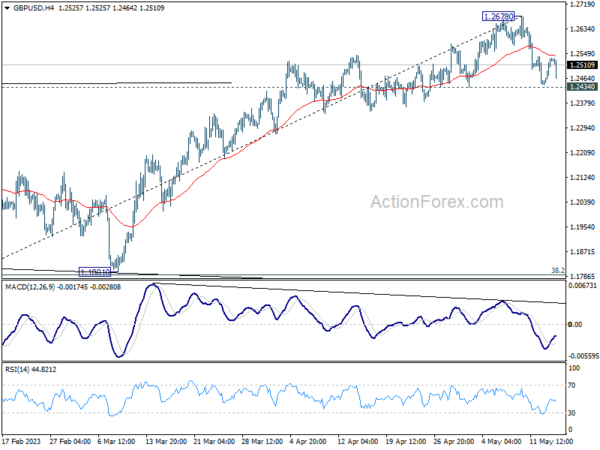

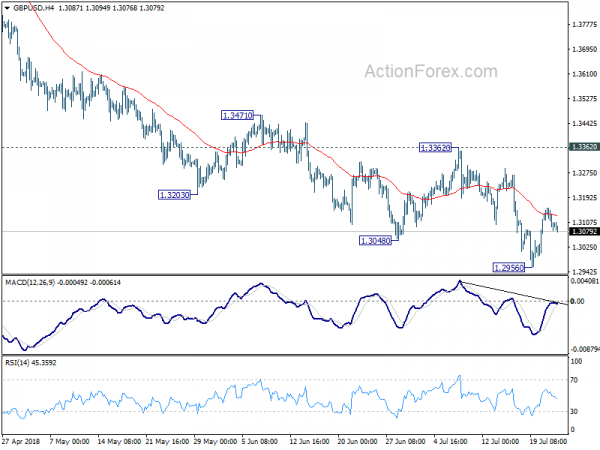

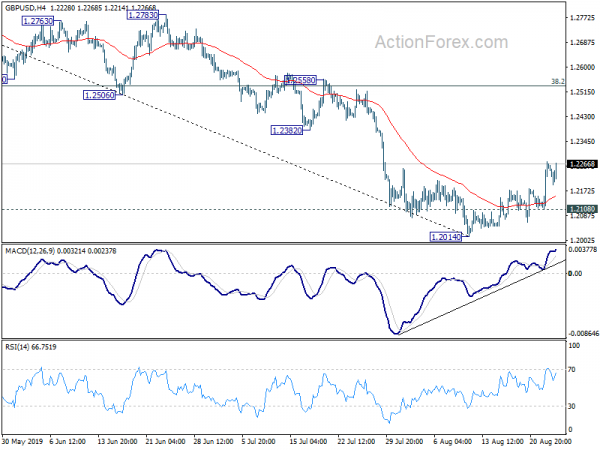

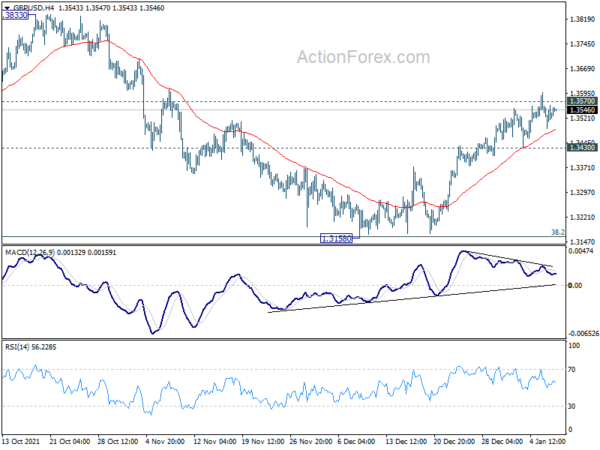

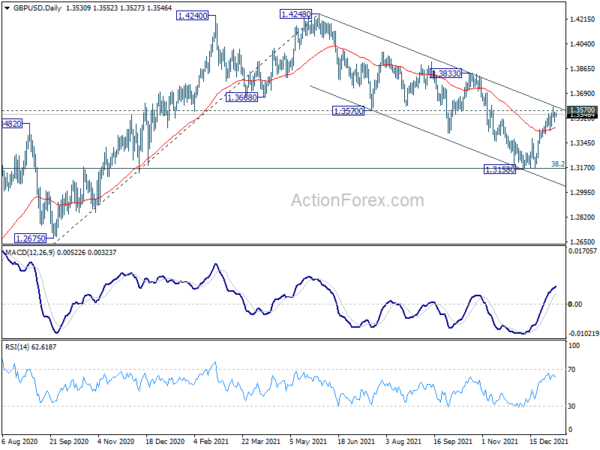

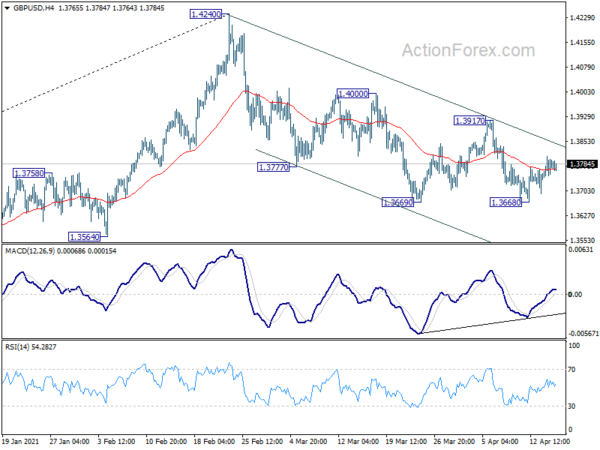

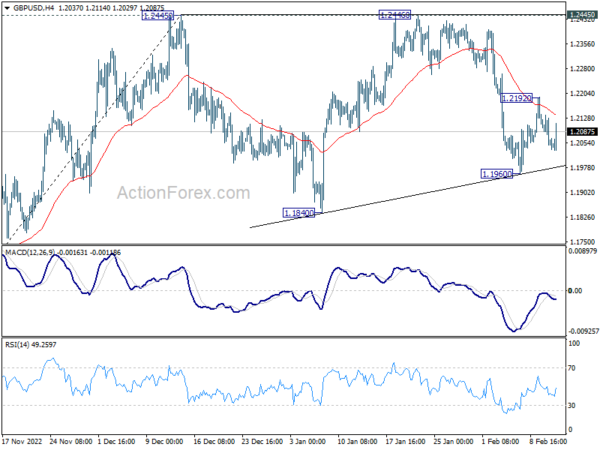

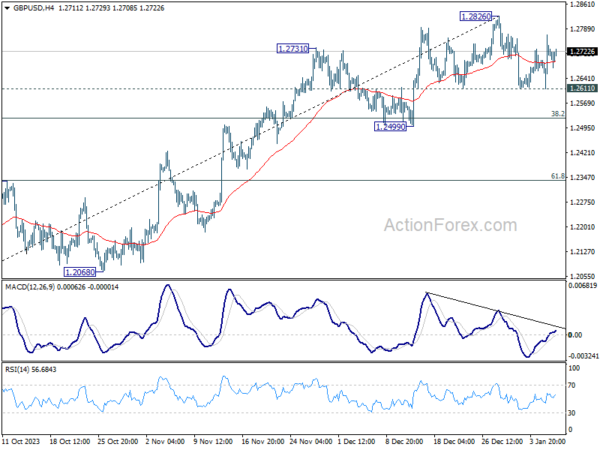

Intraday bias in GBP/USD remains on the upside for the moment. Rebound from 1.2692 could target 1.3297 resistance zone. But as such rise is seen as the third leg of consolidation pattern from 1.2661, we’d expect strong resistance from 1.3316 fibonacci level to limit upside to bring down trend resumption eventually. On the downside, below 1.2908 minor support will turn bias back to the downside for 1.2692 instead.

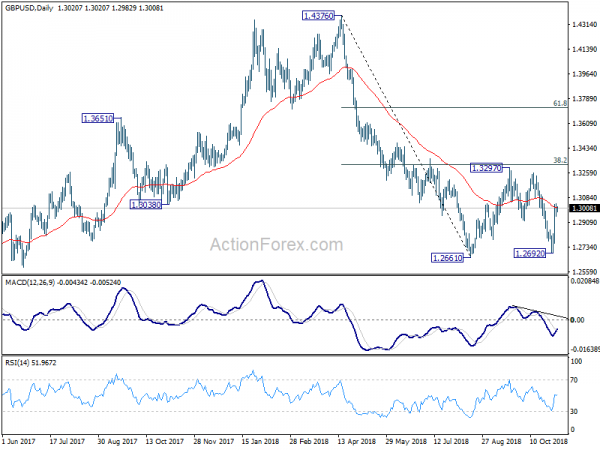

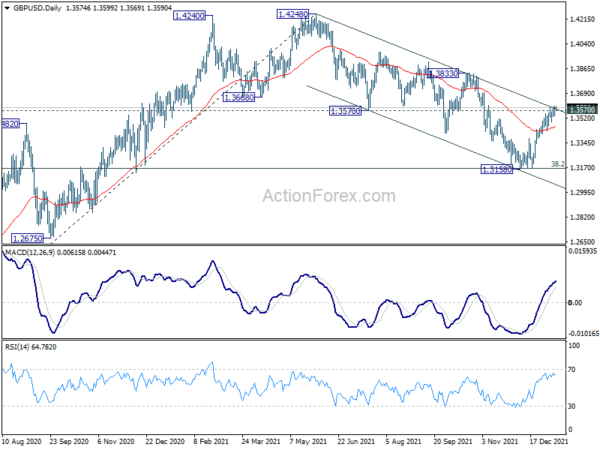

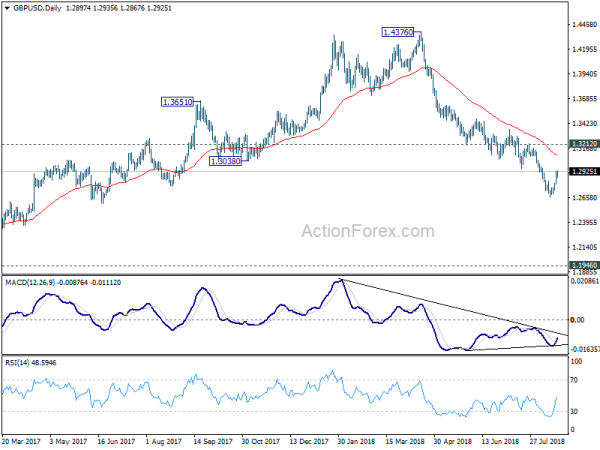

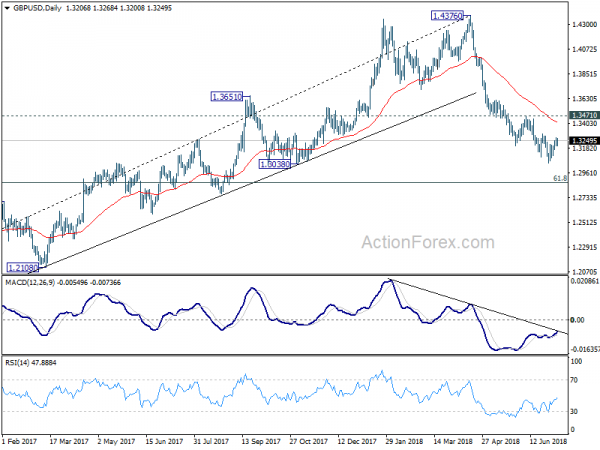

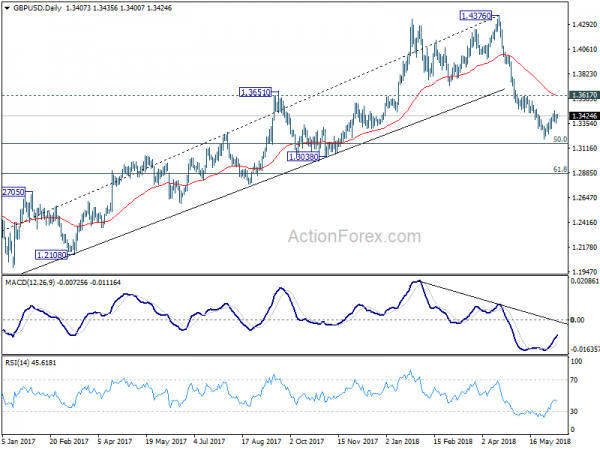

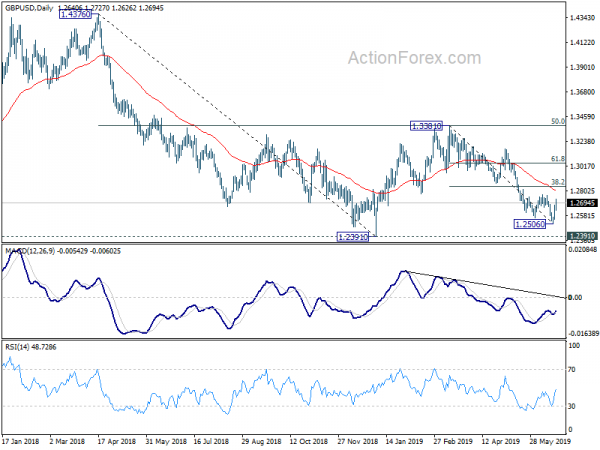

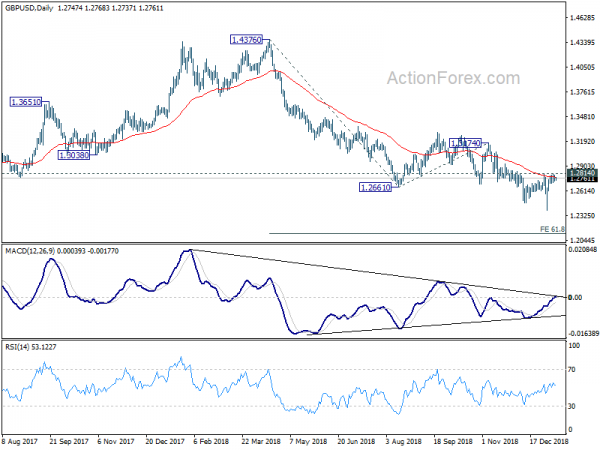

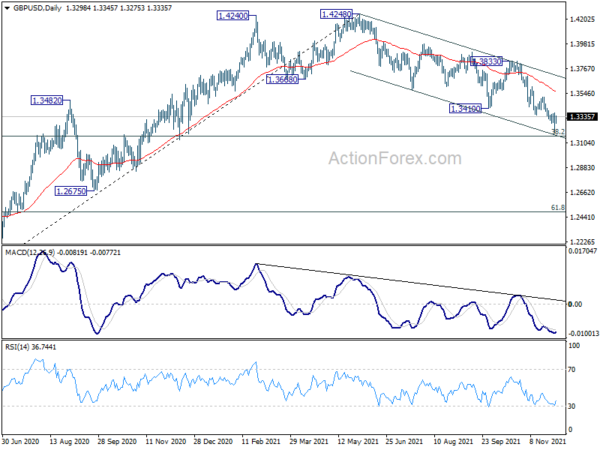

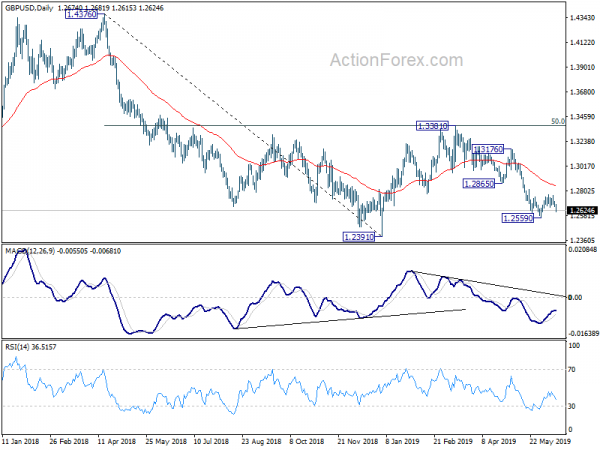

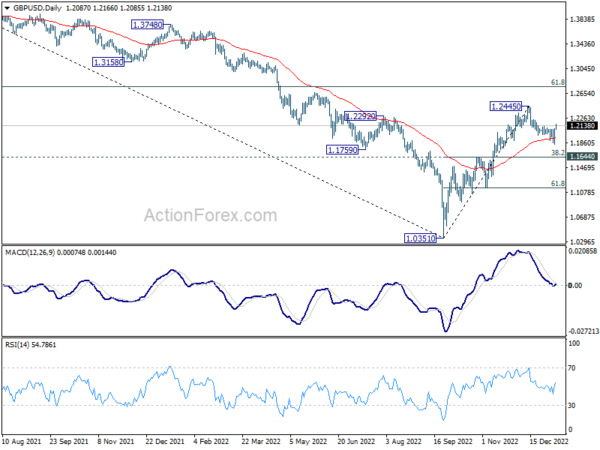

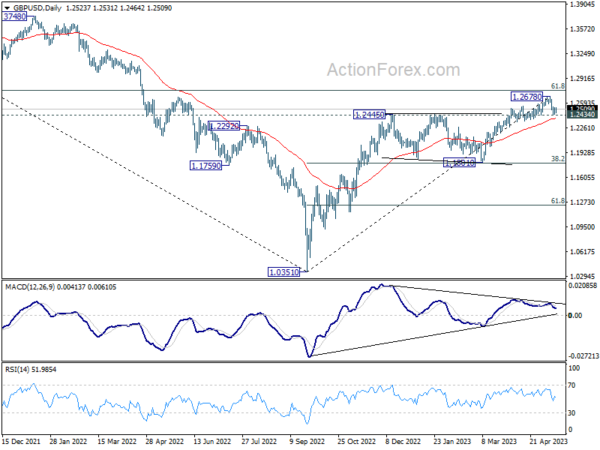

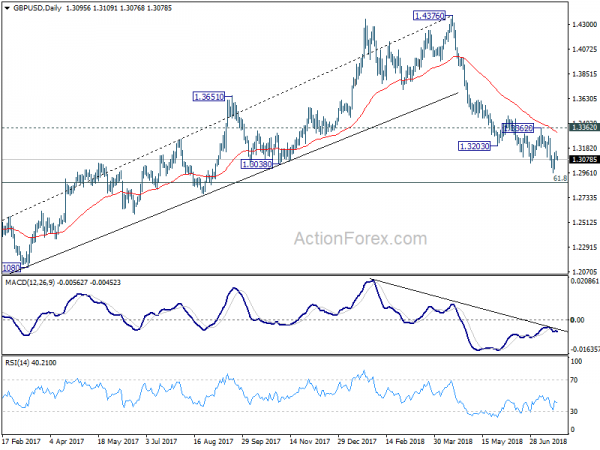

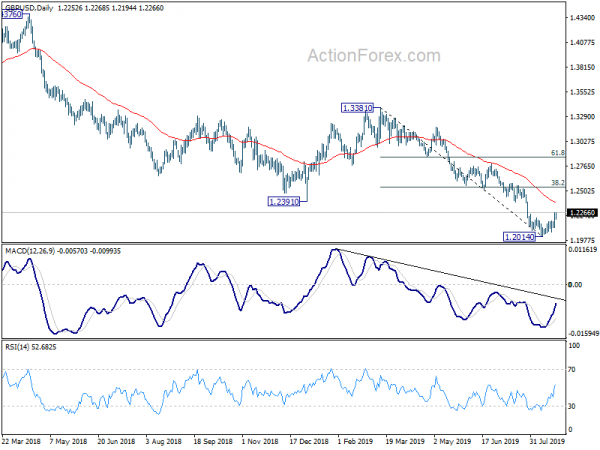

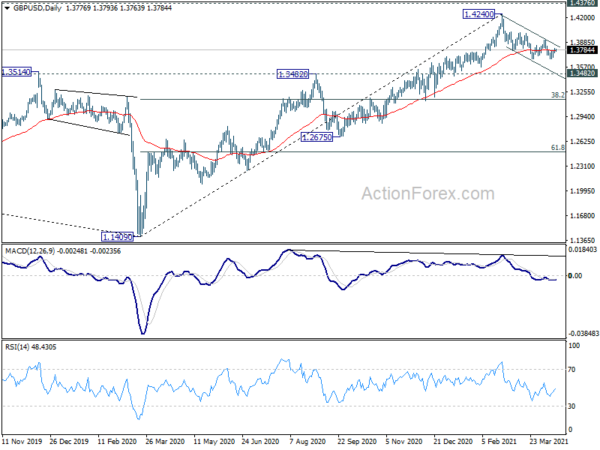

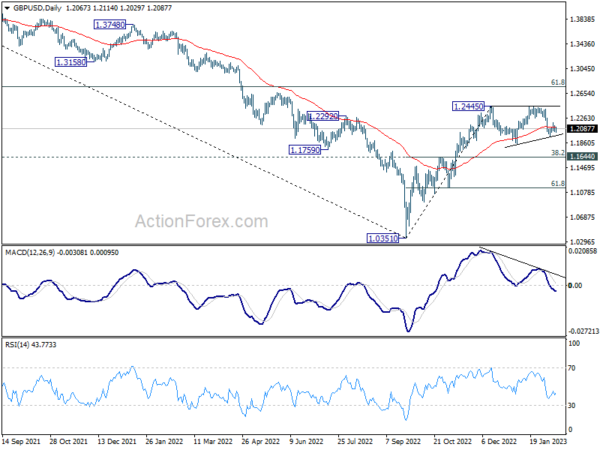

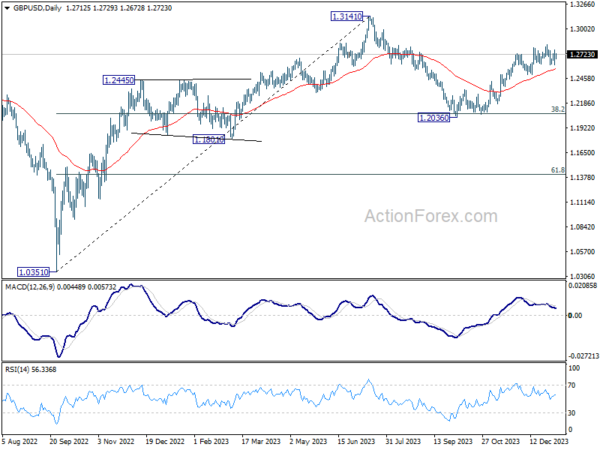

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.