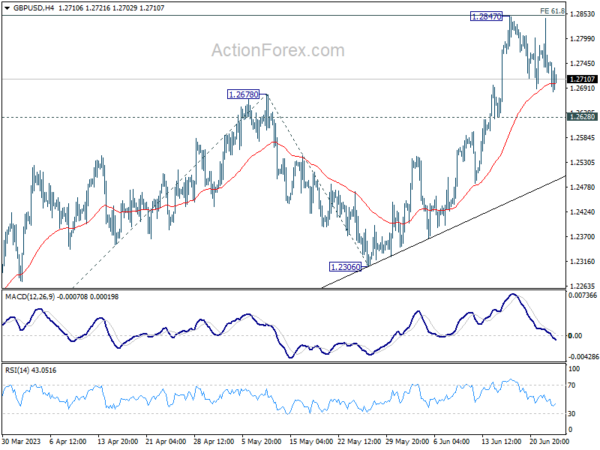

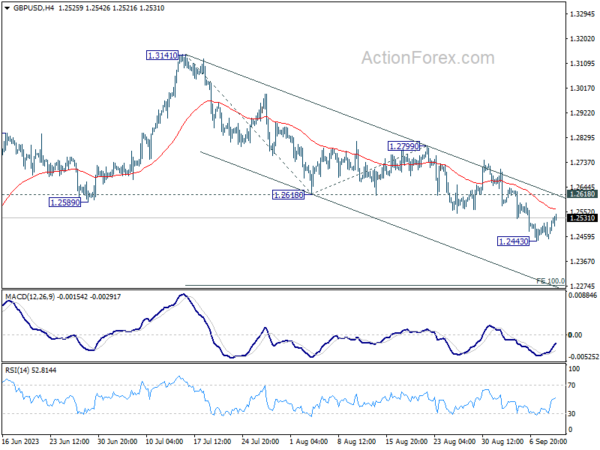

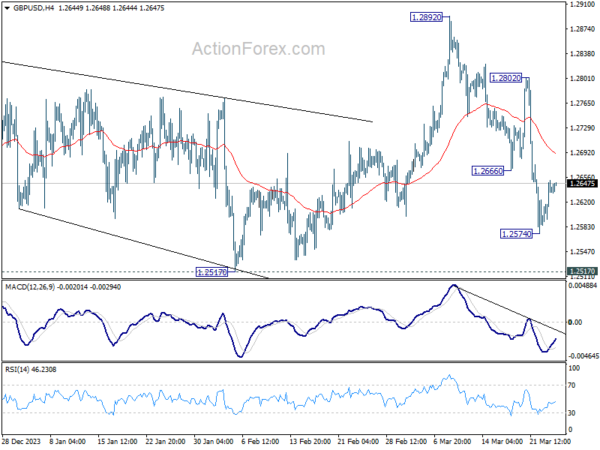

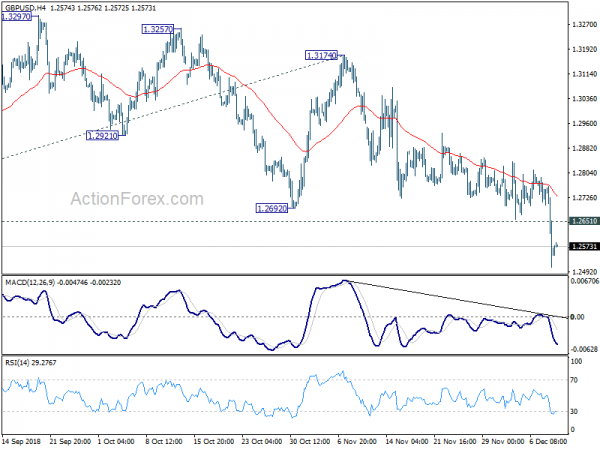

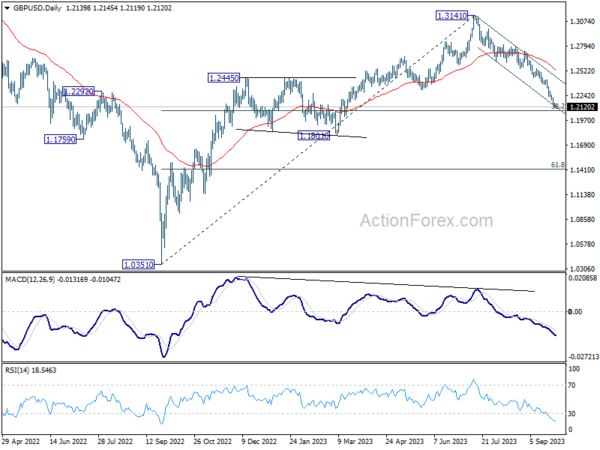

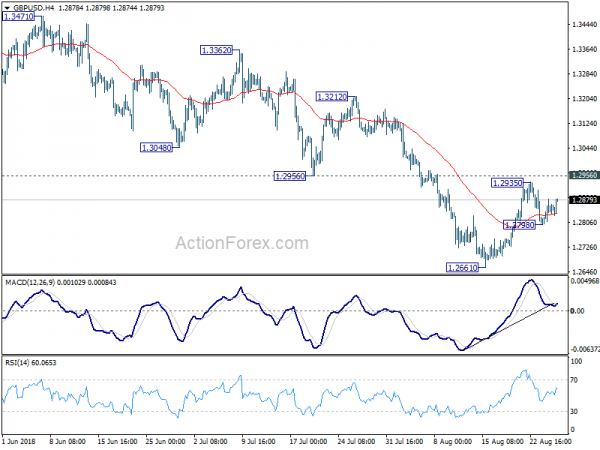

Daily Pivots: (S1) 1.2707; (P) 1.2767; (R1) 1.2809; More…

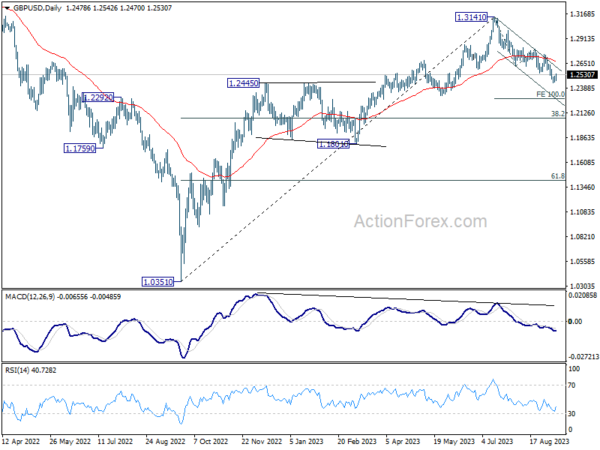

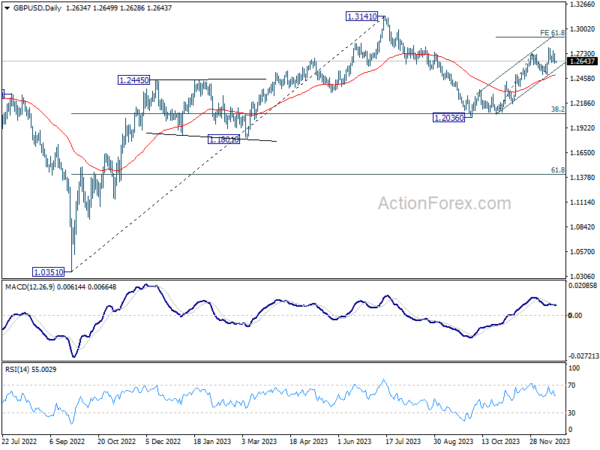

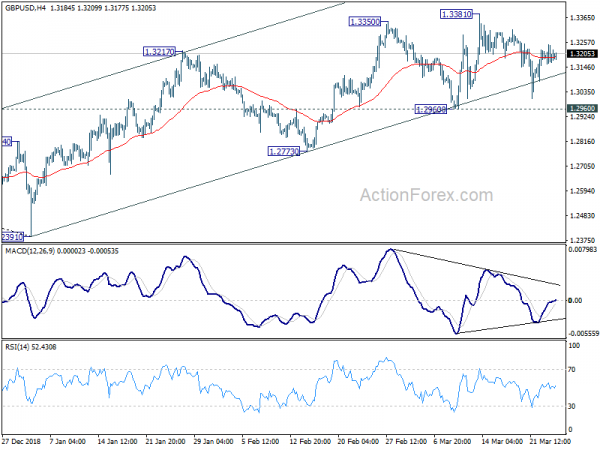

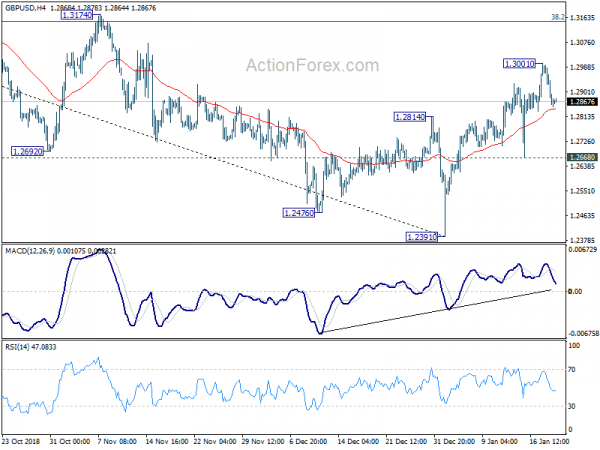

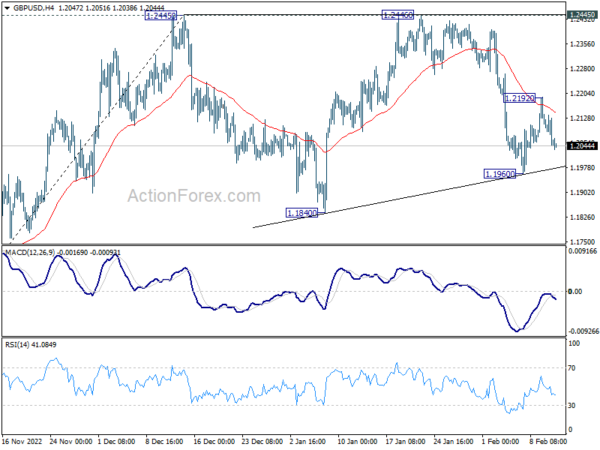

GBP/USD is still bounded in consolidation from 1.2847 and intraday bias stays neutral. On the upside, firm break of 1.2847 will resume larger up trend and target 100% projection of 1.1801 to 1.2678 from 1.2306 at 1.3183 next. However, firm break of 1.2628 will turn bias to the downside, for deeper fall to 1.2306 support instead.

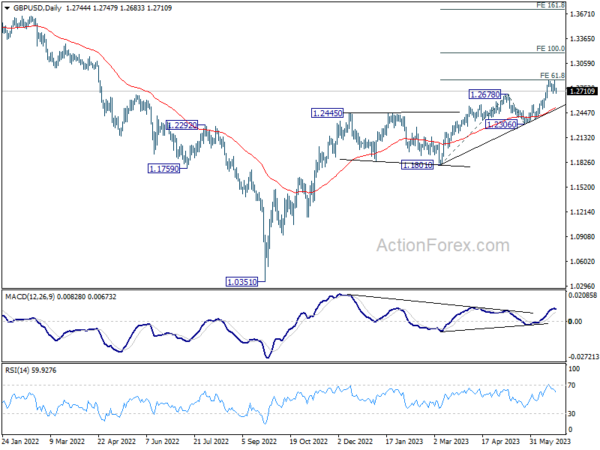

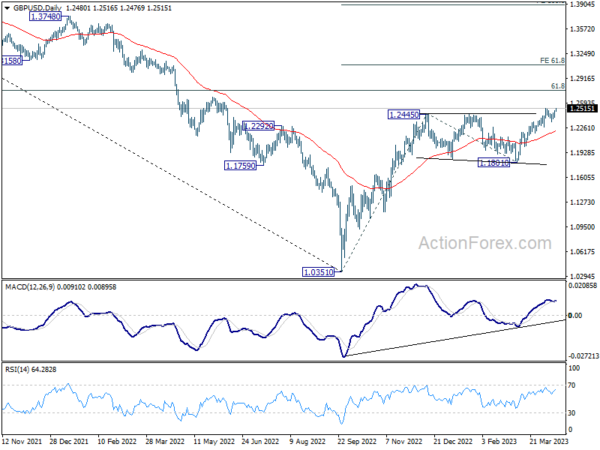

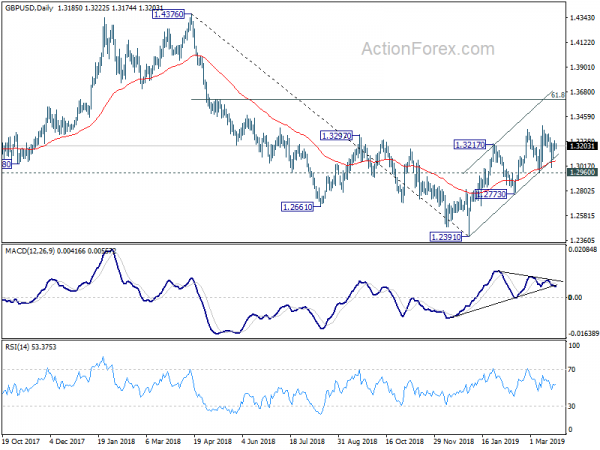

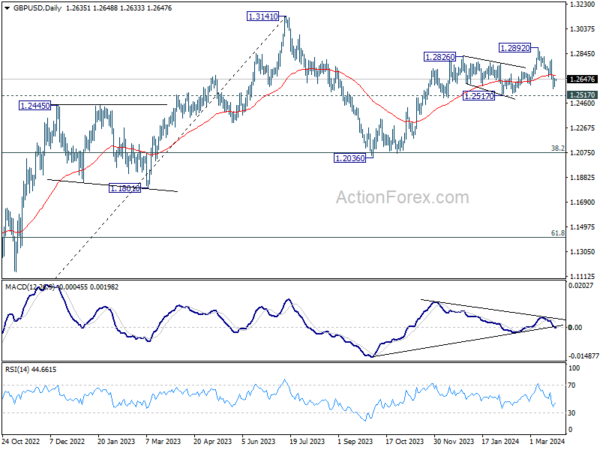

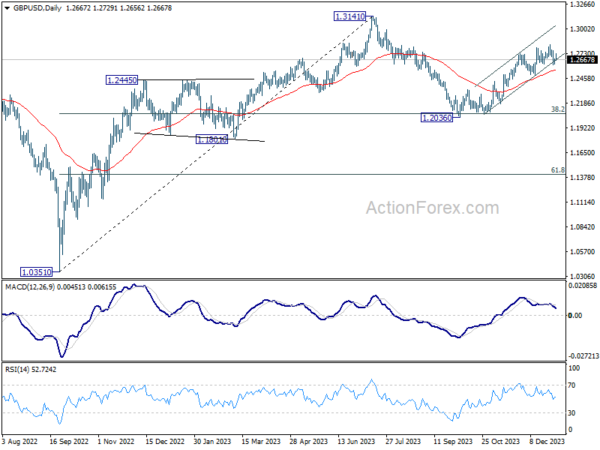

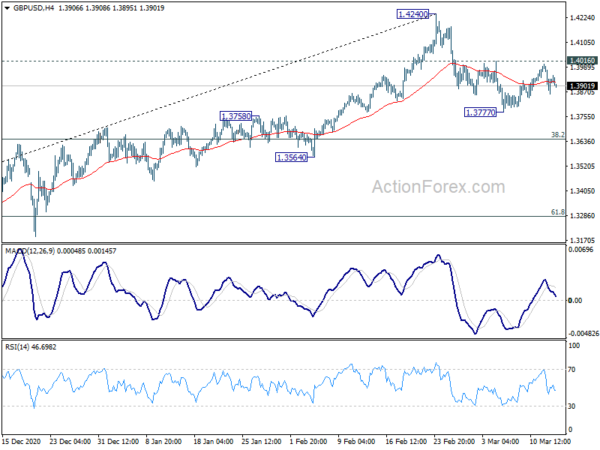

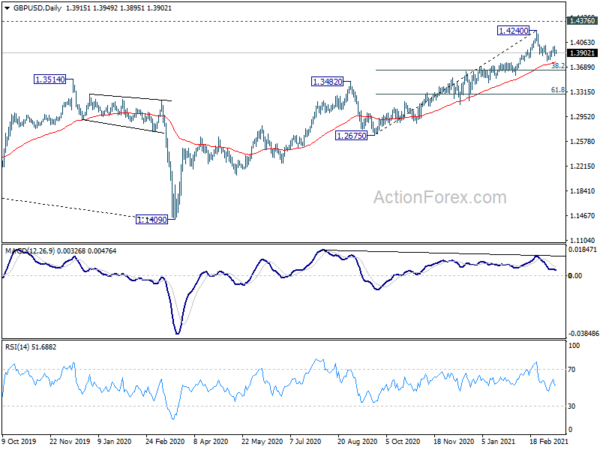

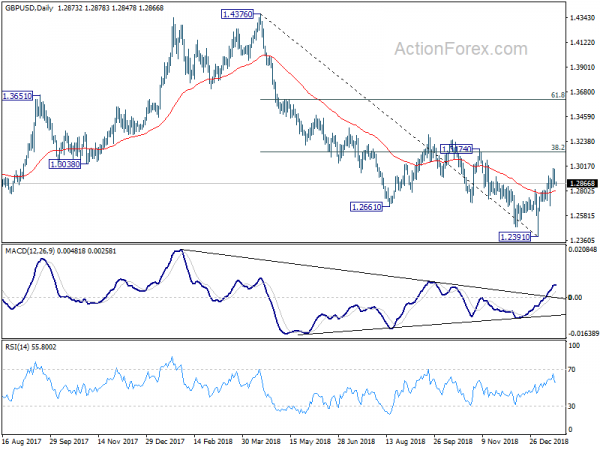

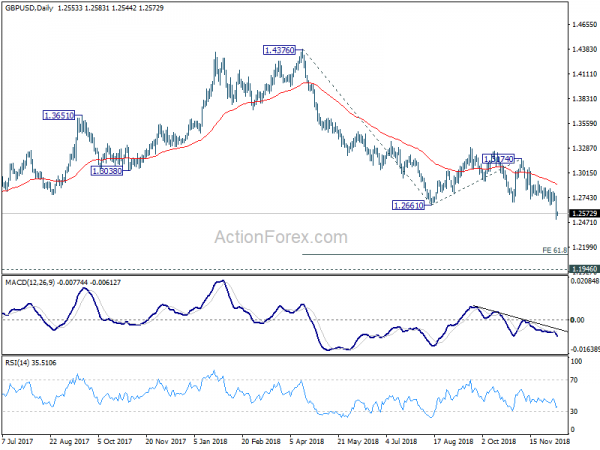

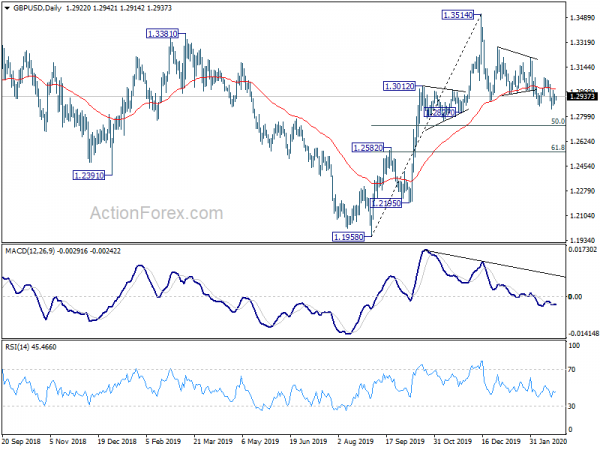

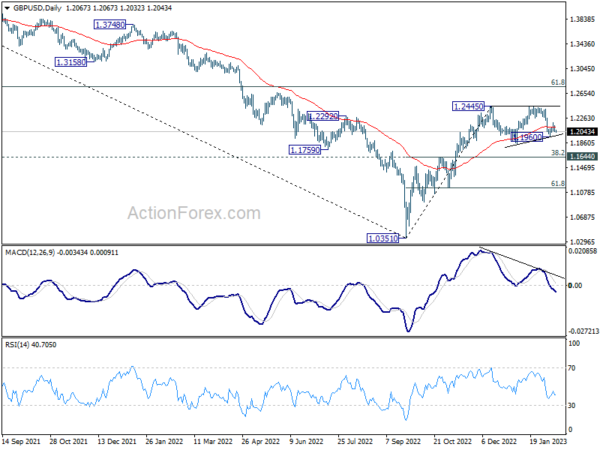

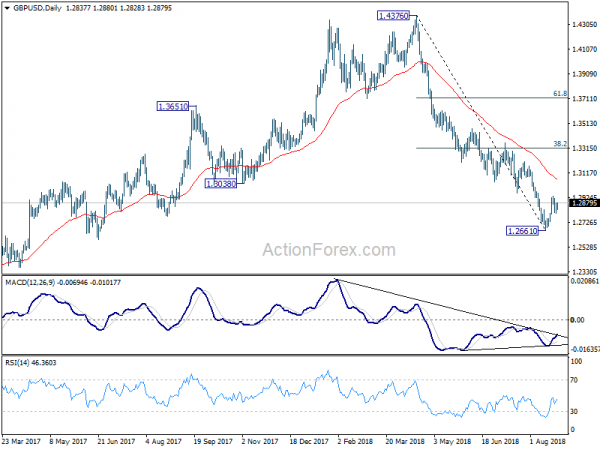

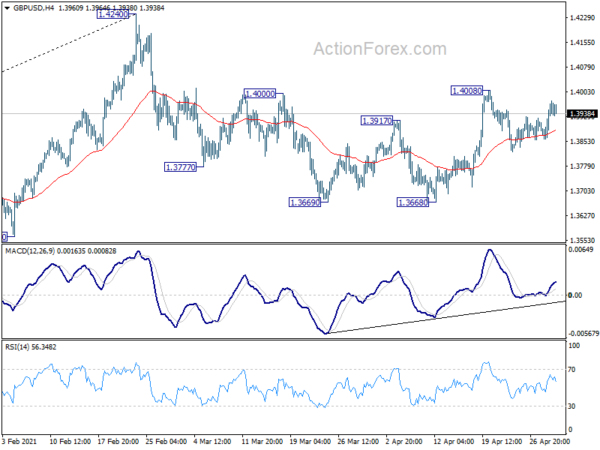

In the bigger picture, the strong support from 55 W EMA (now at 1.2345) is a medium term bullish sign. Outlook will stay bullish as long as 1.2306 support holds. Rise from 1.0351 medium term bottom (2022 low) is expected to extend further to retest 1.4248 key resistance (2021 high).