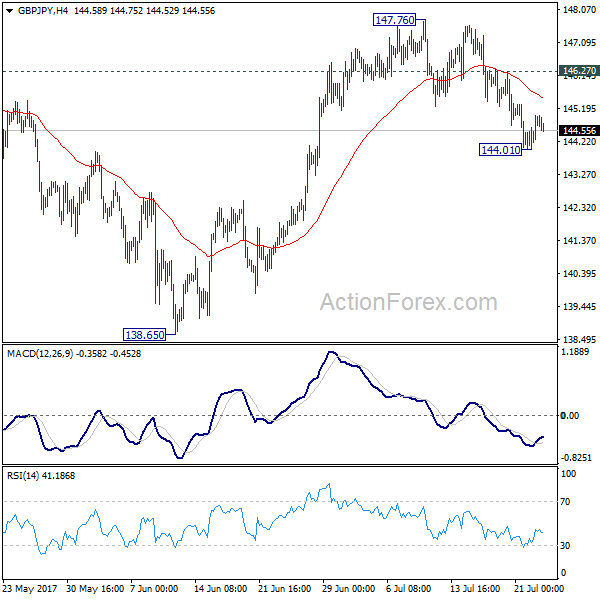

Daily Pivots: (S1) 144.17; (P) 144.58; (R1) 145.16; More

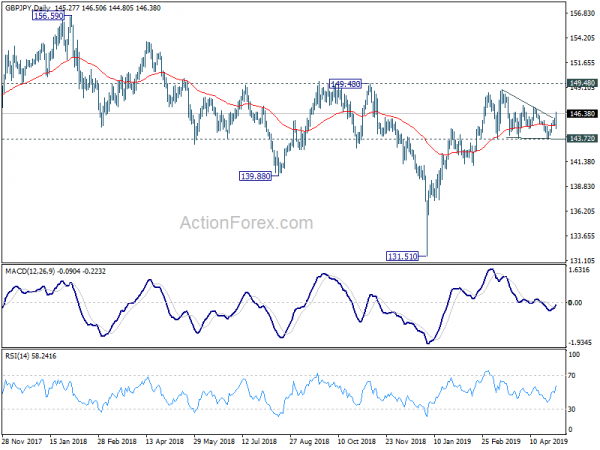

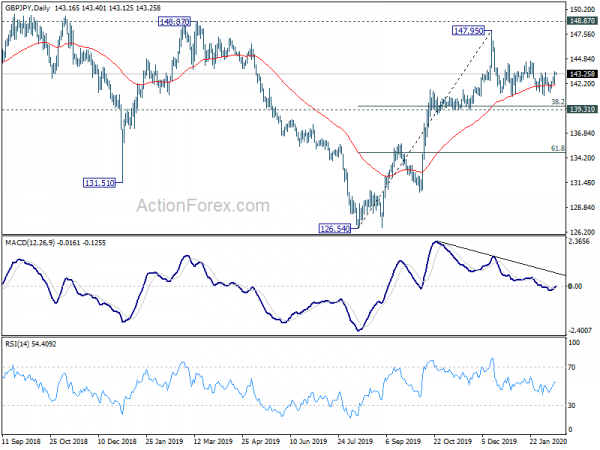

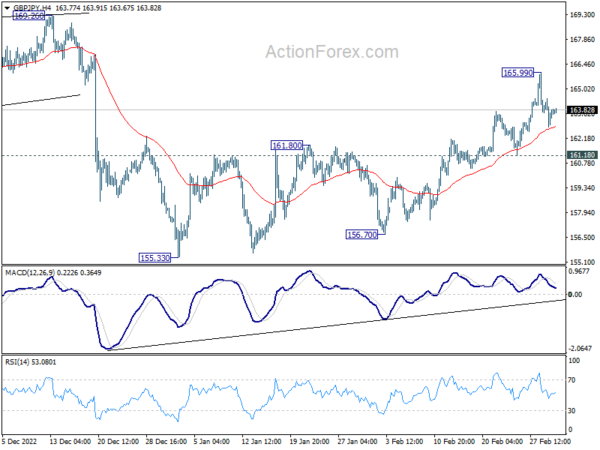

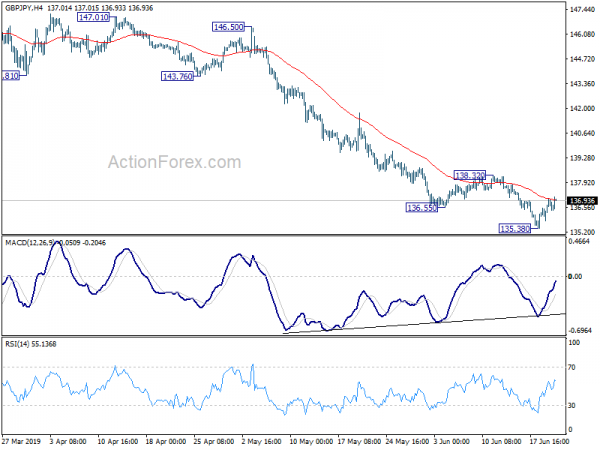

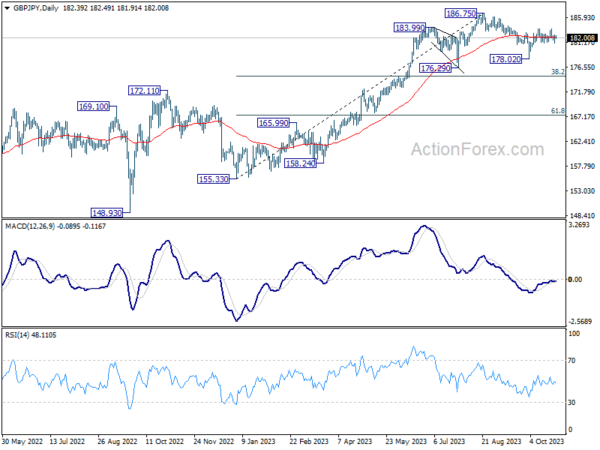

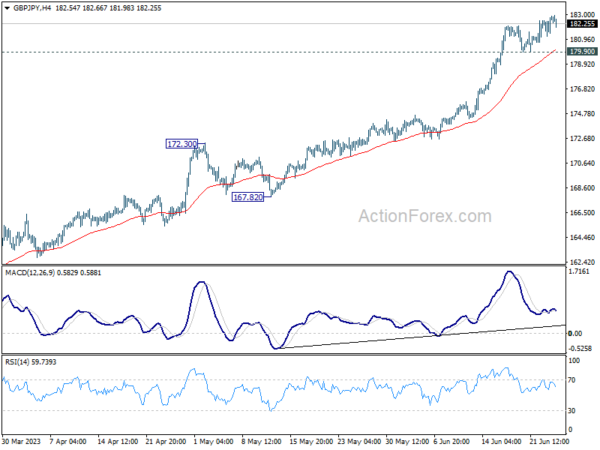

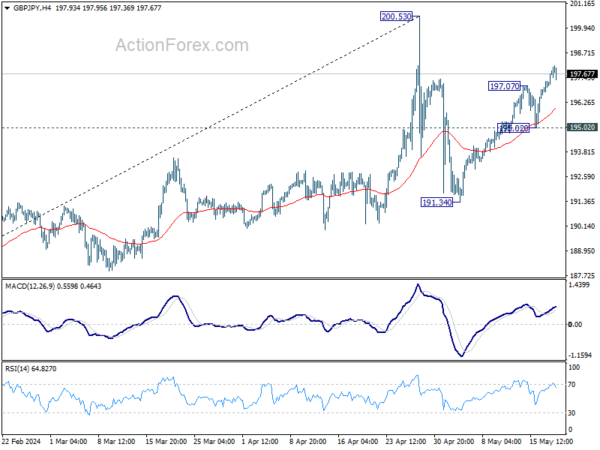

A temporary low is in place in GBP/JPY at 144.01 and intraday bias is turned neutral first. On the downside below 144.01 will extend the decline from 147.76 and target 138.65 support and below. But we’d expect strong support from 135.58 to contain downside and bring rebound. On the upside, above 146.27 minor resistance will turn bias back to the upside for 147.76 instead.

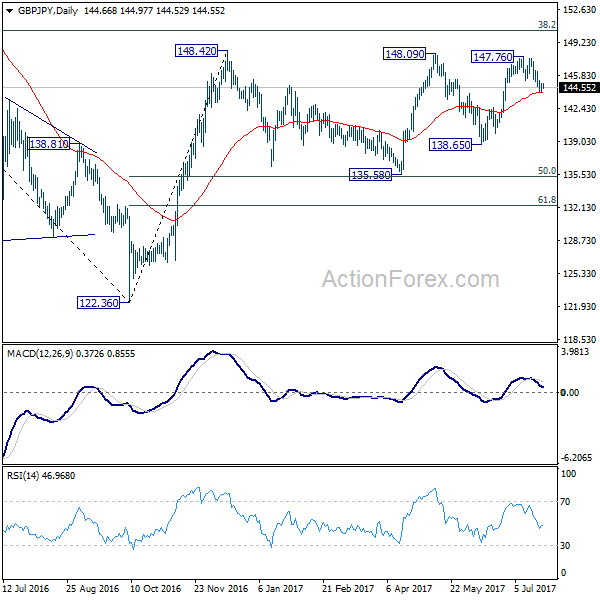

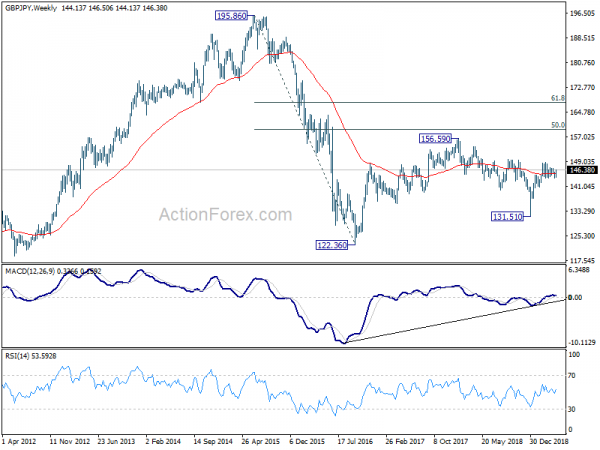

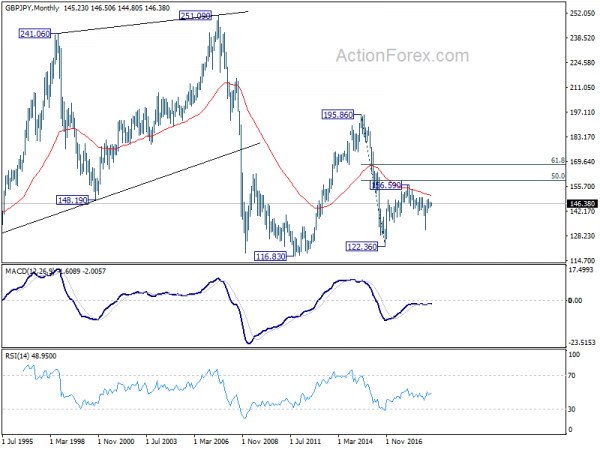

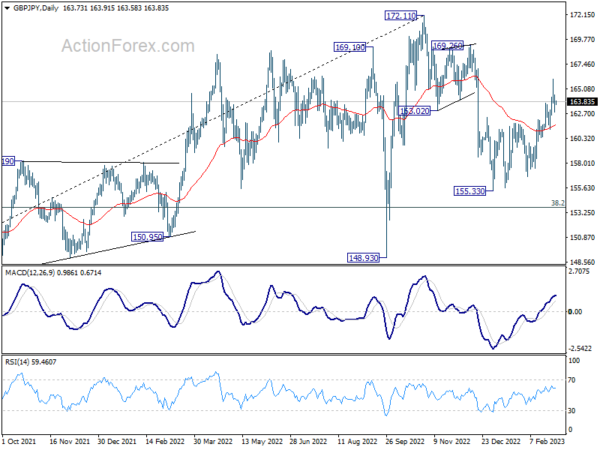

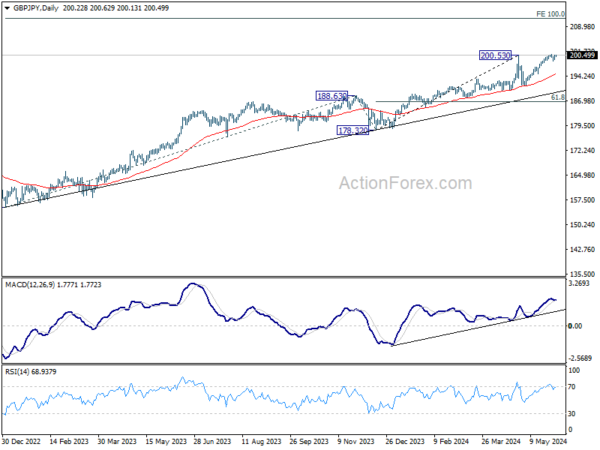

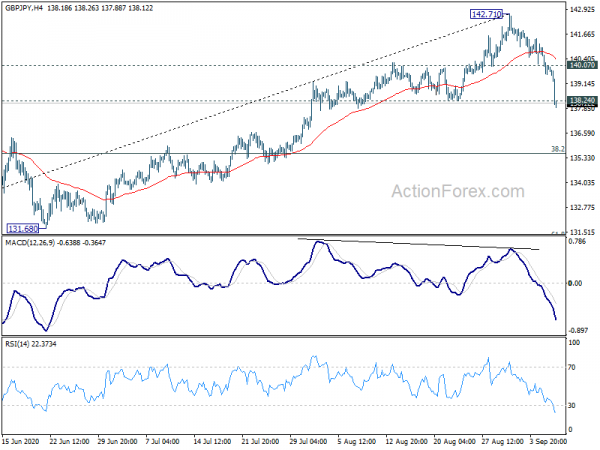

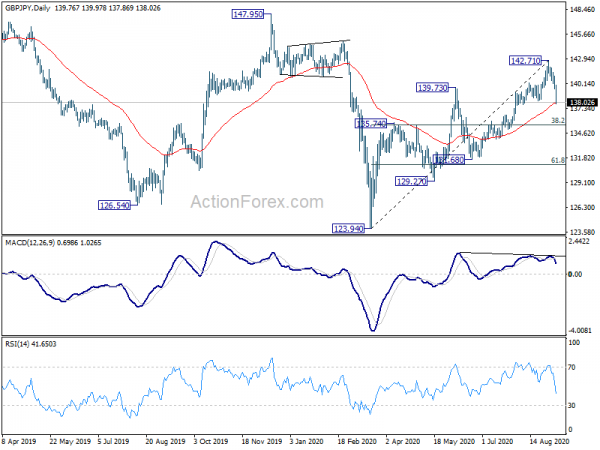

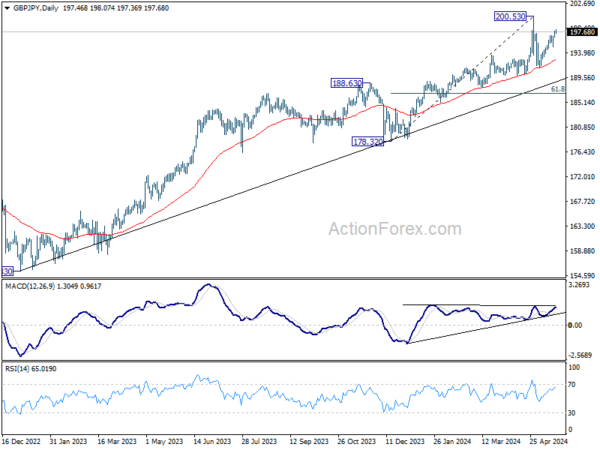

In the bigger picture, rise from medium term bottom at 122.36 is expected to continue to 38.2% retracement of 196.85 to 122.36 at 150.43. Decisive break there will carry long term bullish implications and pave the way to 61.8% retracement at 167.78. In case the sideway pattern from 148.42 extends, we’d be looking for strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside.