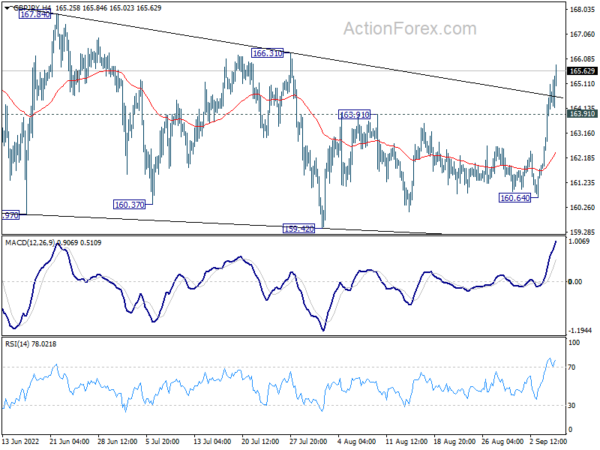

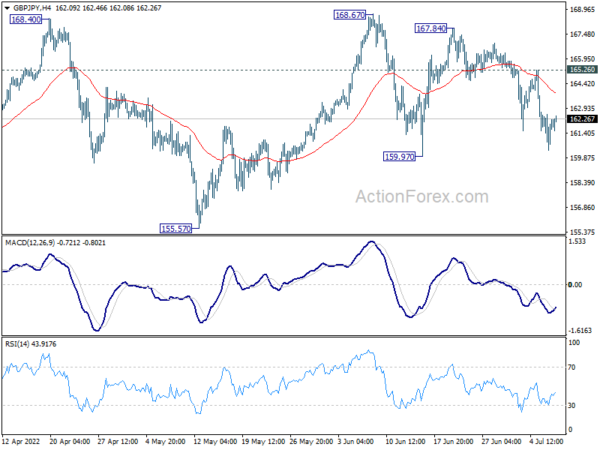

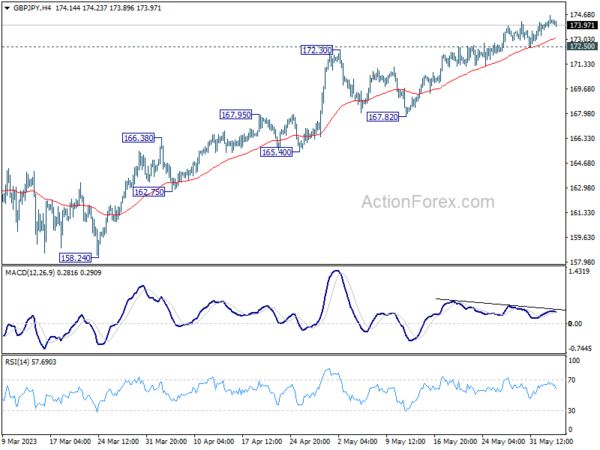

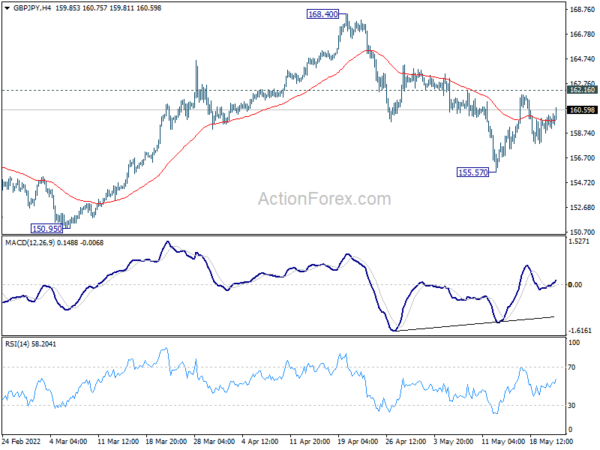

Daily Pivots: (S1) 162.57; (P) 163.84; (R1) 165.75; More…

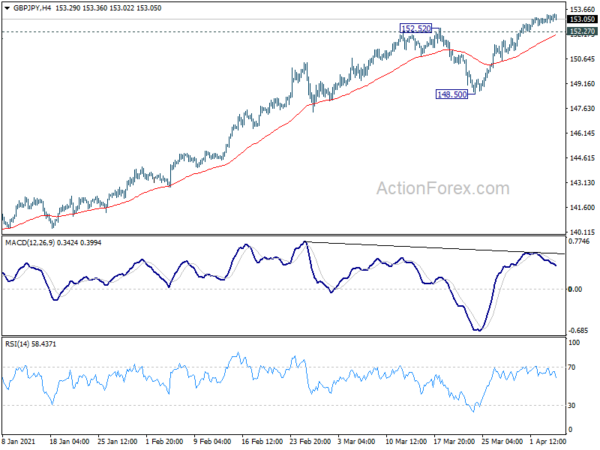

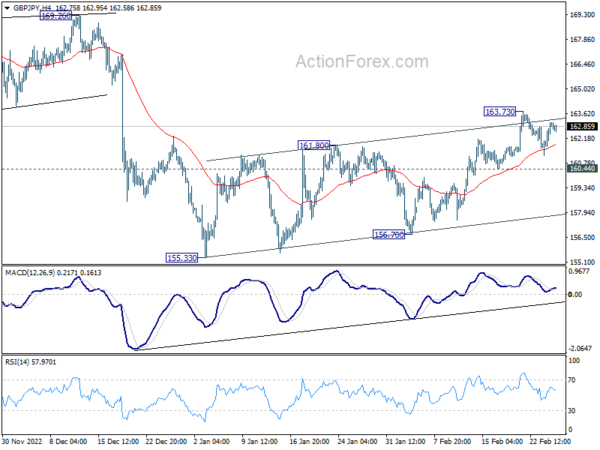

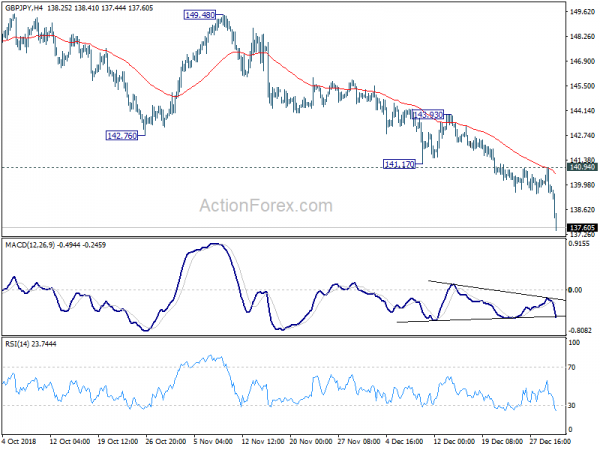

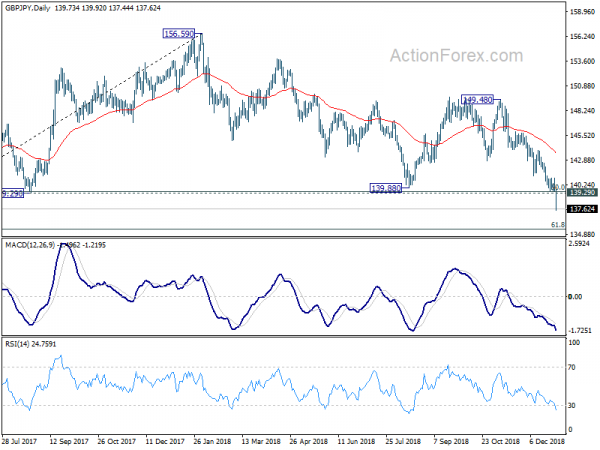

GBP/JPY’s rally continues today and intraday bias stays on the upside. Firm break of 166.31 resistance will argue that larger up trend is ready to resume through 168.67 high. On the downside, below 163.91 minor support will turn intraday bias neutral first, and would probably extend the corrective pattern from 168.67 with more sideway trading.

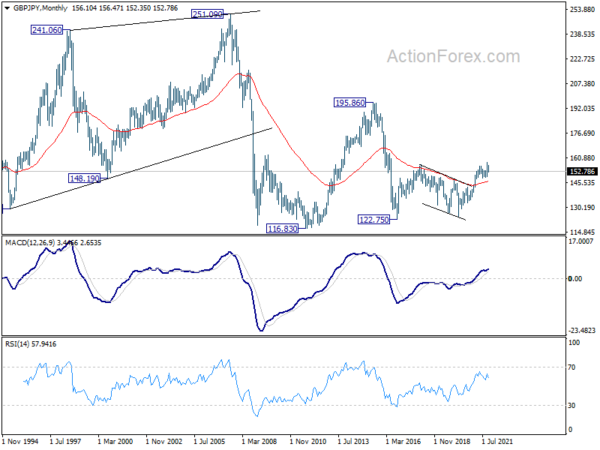

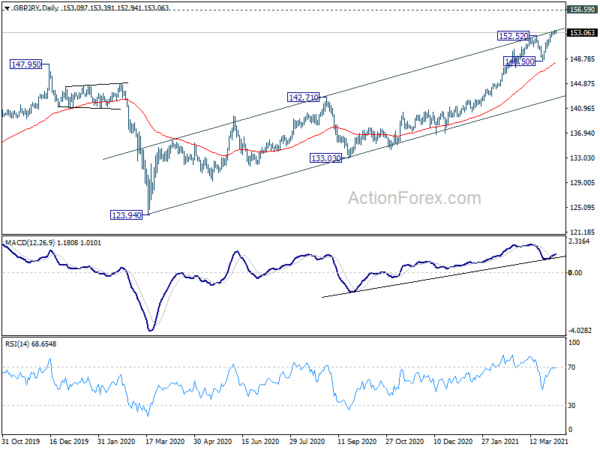

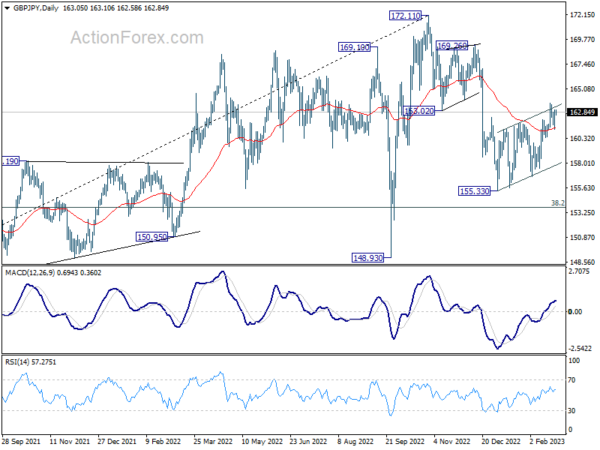

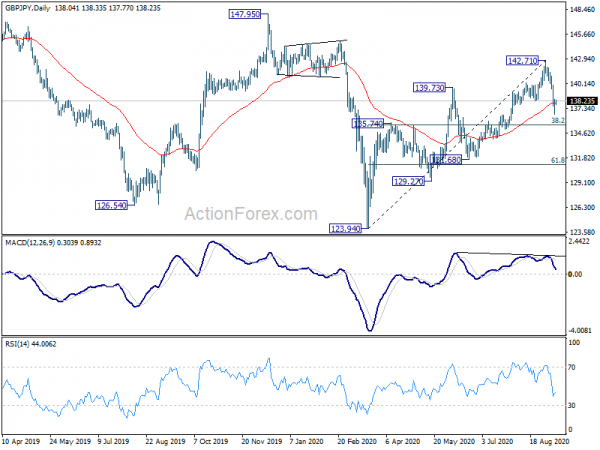

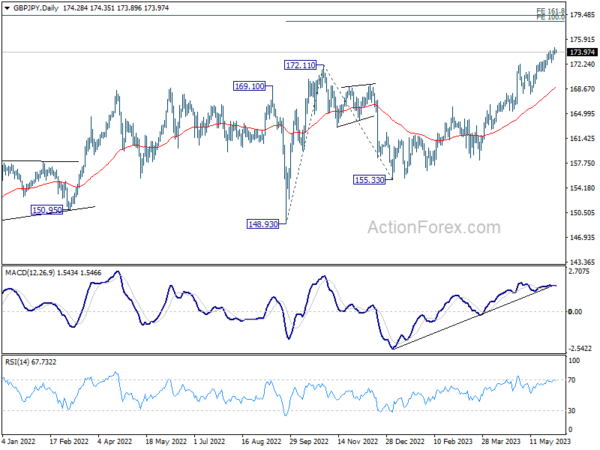

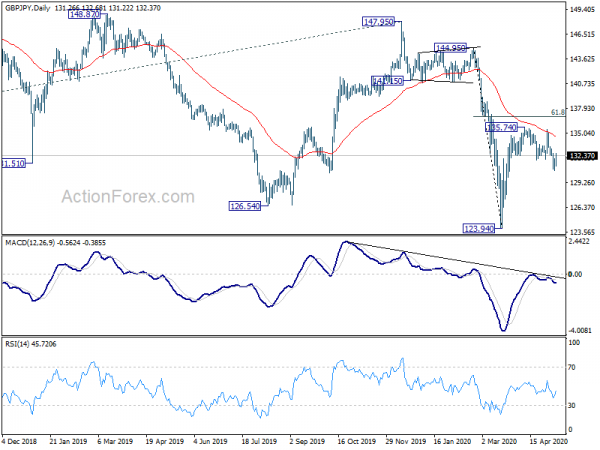

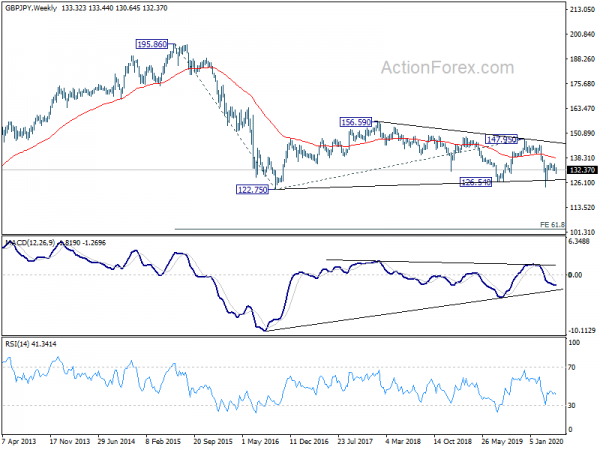

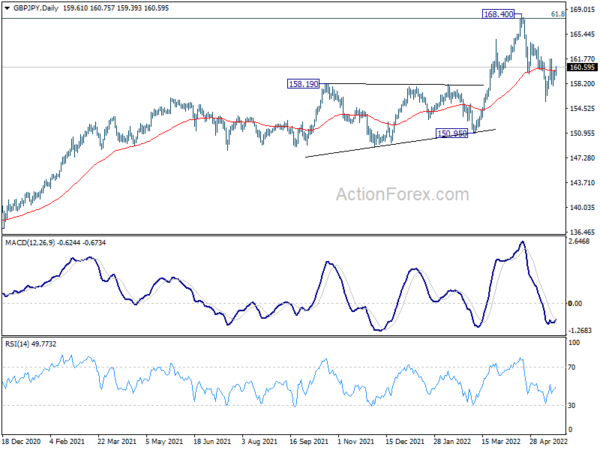

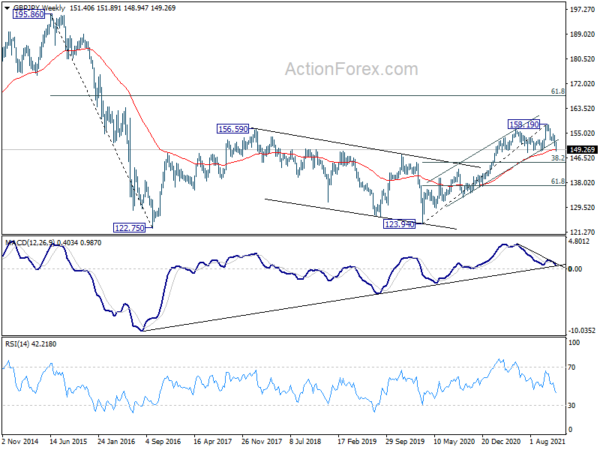

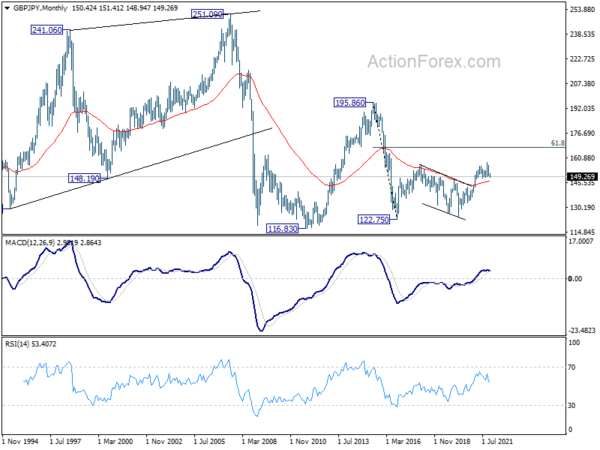

In the bigger picture, up trend from 123.94 (2020 low) is still in progress. Sustained break of 61.8% retracement of 195.86 (2015 high) to 122.75 (2016 low) at 167.93 will be a long term bullish signal, and could pave the way back to 195.86 high. This will remain the favored case as long as 155.57 support holds, even in case of deep pull back.