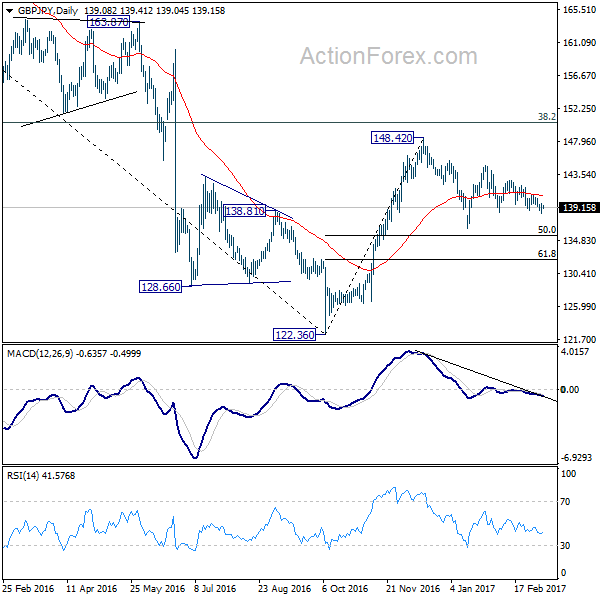

GBP/JPY dipped through 138.53 support last week to 137.75. But the cross quickly recovered since then. The development suggests that choppy decline from 144.77 is in progress and should head lower. But there is no change in the view that price actions from 148.42 are forming a consolidation pattern. And, larger rise from 122.36 would resume later.

Initial bias in GBP/JPY remains neutral this week first. Further fall is mildly in favor as long as 140.60 resistance holds. Below 137.75 will target 136.44 support and below. But we’d expect support from 50% retracement of 122.36 to 148.42 at 135.39 to contain downside and bring rebound. On the upside, break of 140.60 resistance will turn bias to the upside and send GBP/JPY through 144.77 resistance.

In the bigger picture, price actions from 122.36 medium term bottom are still seen as a corrective pattern. Main focus is on 38.2% retracement of 195.86 to 122.36 at 150.42. Rejection from there will turn the cross into medium term sideway pattern. Or, sustained break of 50% retracement of 122.36 to 148.42 at 135.39 will turn outlook bearish for a test on 122.36 low. Though, sustained break of 150.42 will extend the rebound towards 61.8% retracement of 195.86 to 122.36 at 167.78.

In the longer term picture, while price actions from 122.36 would develop into a medium term correction, fall from 195.86 is still seen as resuming the down trend from 251.09 (2007 high). Hence, after the correction from 122.36 completes we’d expect another fall through 116.83 low.