Daily Pivots: (S1) 137.58; (P) 137.90; (R1) 138.06; More…

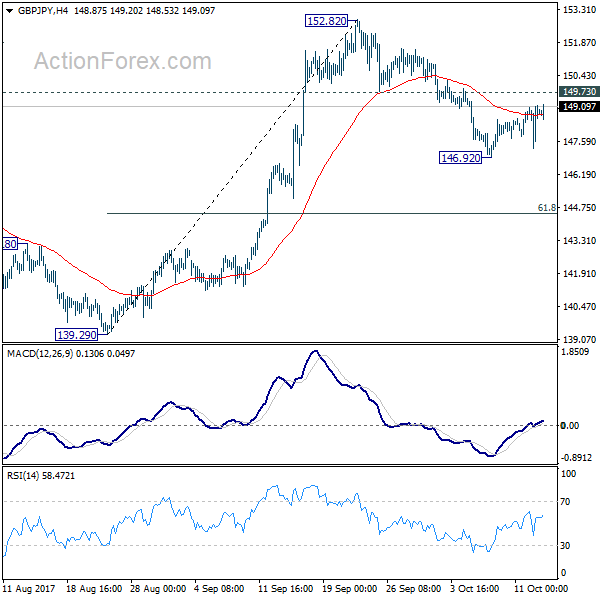

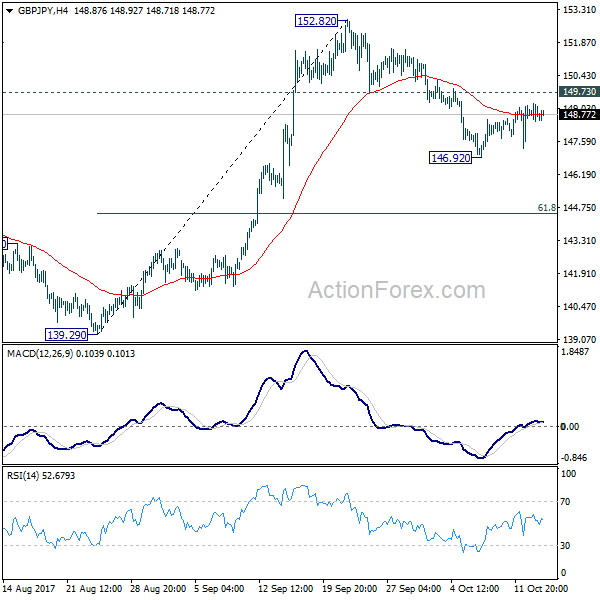

GBP/JPY’s fall from 140.31 resumes by breaking 137.83 support and 4 hour 55 EMA firmly. The development suggests that corrective rebound from 133.03 has completed with three waves up to 140.31. Large fall from 142.71 might be resuming. Intraday bias is back on the downside for 133.03/134.40 support zone first. On the upside, through, break of 138.86 minor resistance will turn bias back to the upside for 140.31 instead.

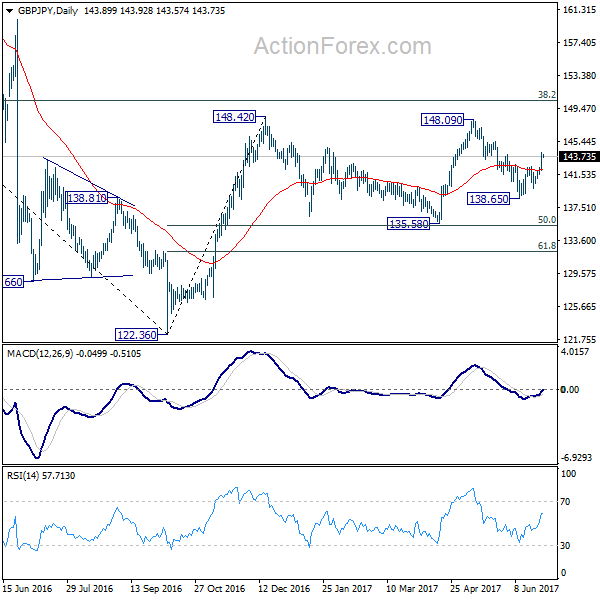

In the bigger picture, rise from 123.94 is seen only as a rising leg of the sideway consolidation pattern from 122.75 (2016 low). As long as 147.95 resistance holds, an eventual downside breakout remains in favor. However, firm break of 147.95 will raise the chance of long term bullish reversal. Focus will then be turned to 156.59 resistance for confirmation.