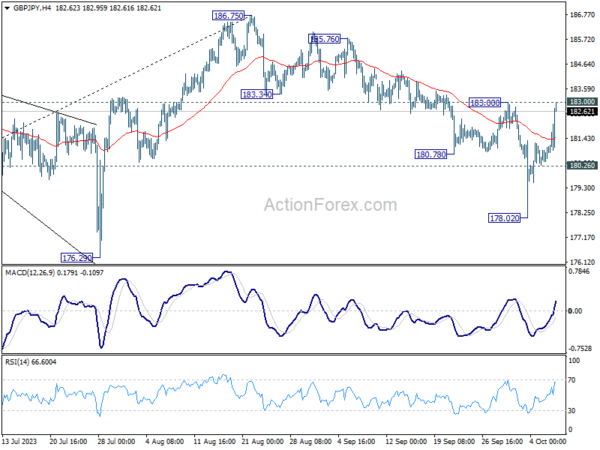

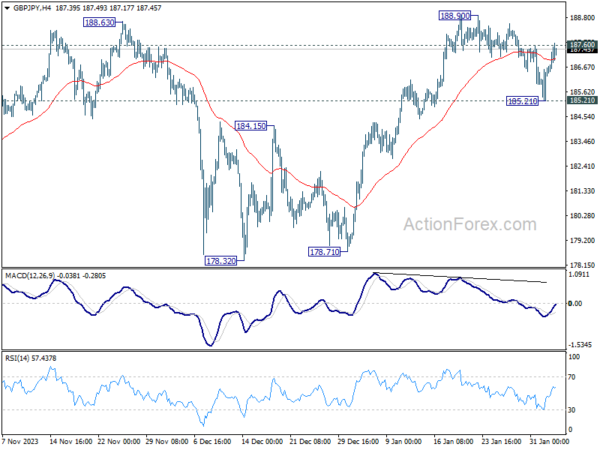

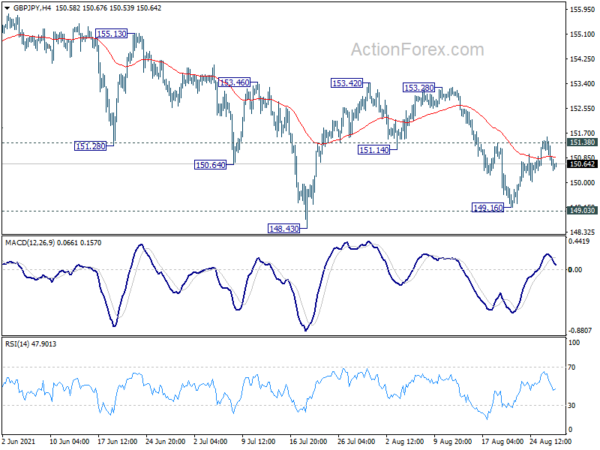

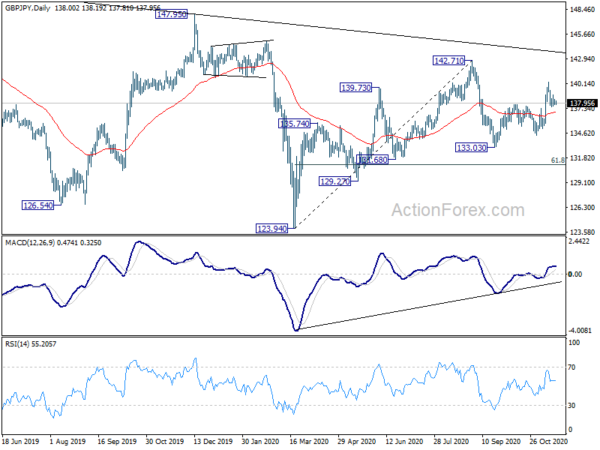

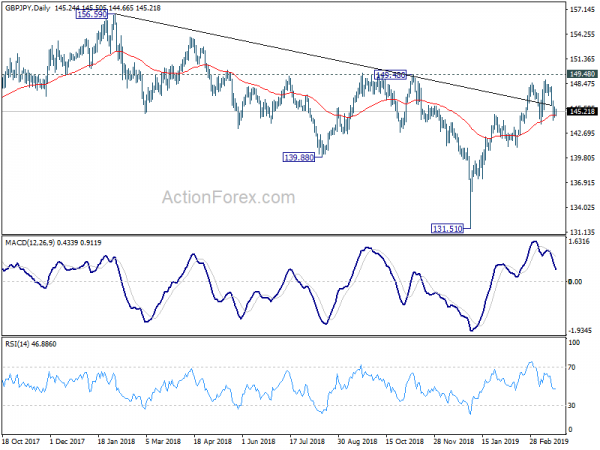

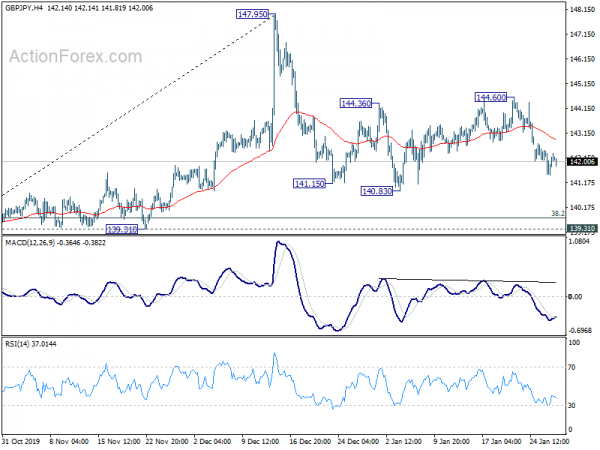

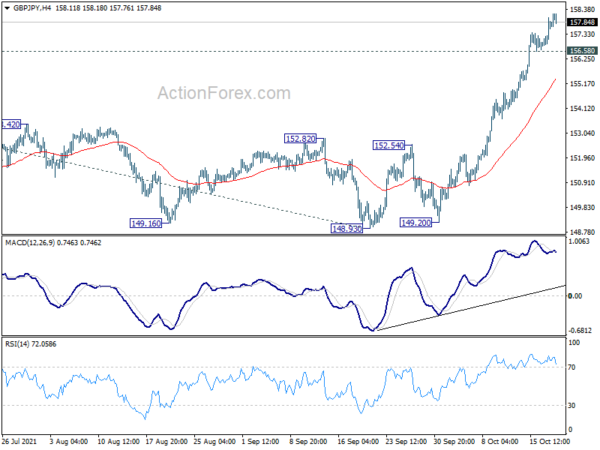

GBP/JPY rebounded strongly after initial fall to 178.02, but upside is limited by 183.00 resistance. Initial bias stays neutral this week first. On the upside, firm break of 183.00 will argue that the pull back from 187.65 has completed, and turn bias back to the upside for retesting this high. On the downside, below 180.26 minor support will turn bias back to the downside for 178.02 again.

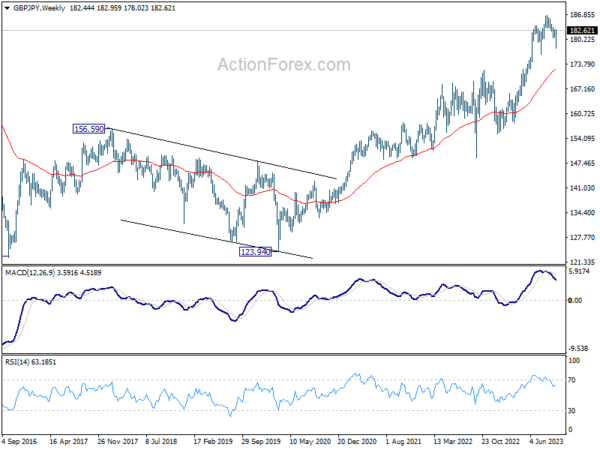

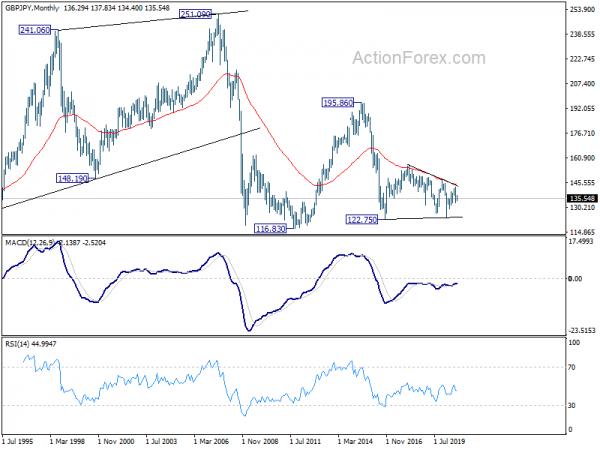

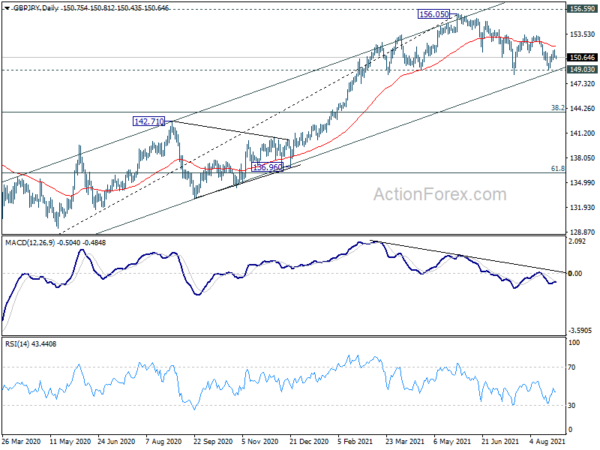

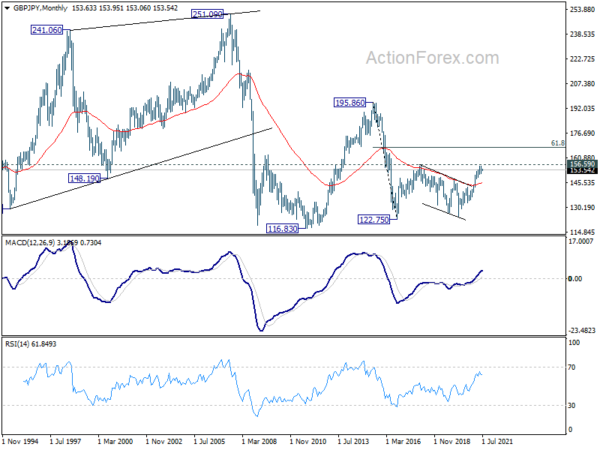

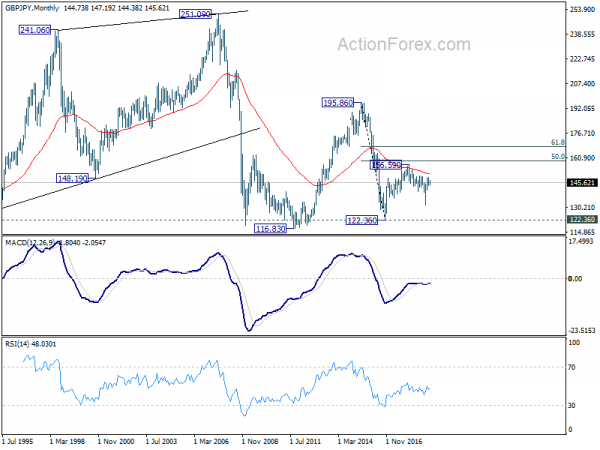

In the bigger picture, fall from 186.75 is currently seen as a corrective move only. As long as 176.29 support holds, larger up trend from 123.94 (202 low) should still be in progress. Break of 186.75 will target 195.86 (2015 high). Nevertheless, firm break of 176.29 will confirm medium term topping, and bring lengthier and deeper consolidations.

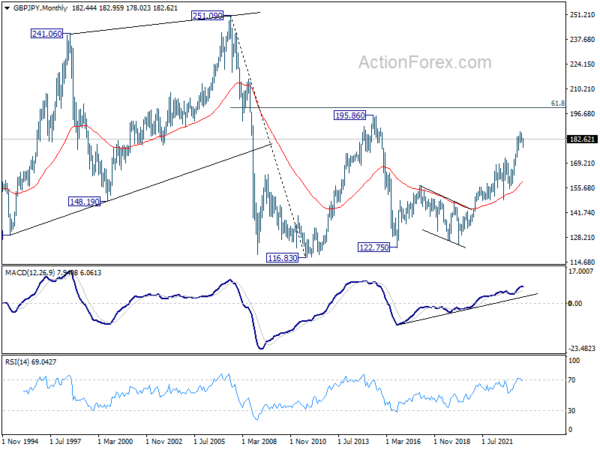

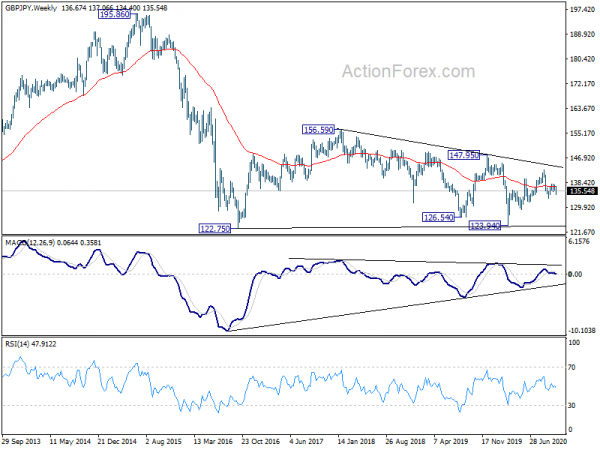

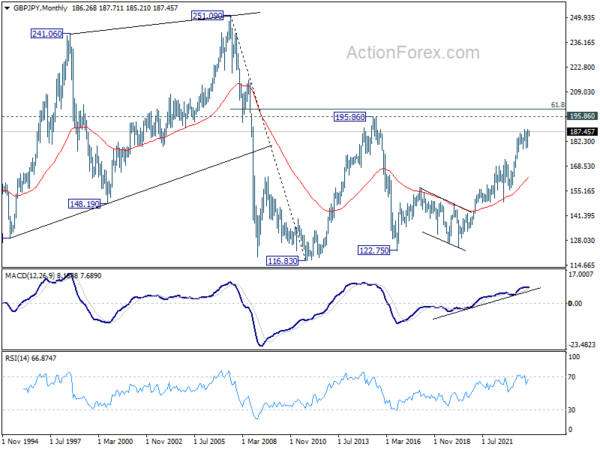

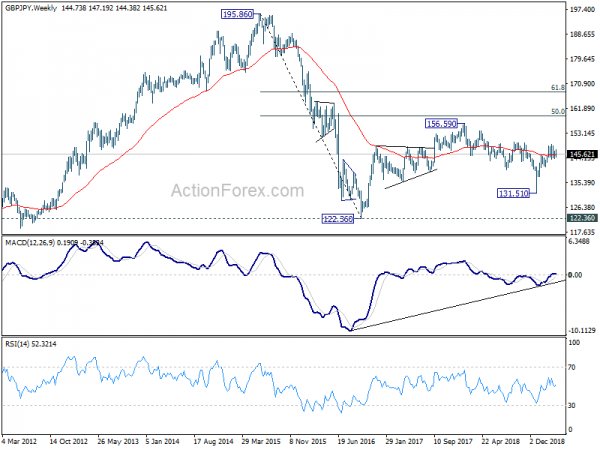

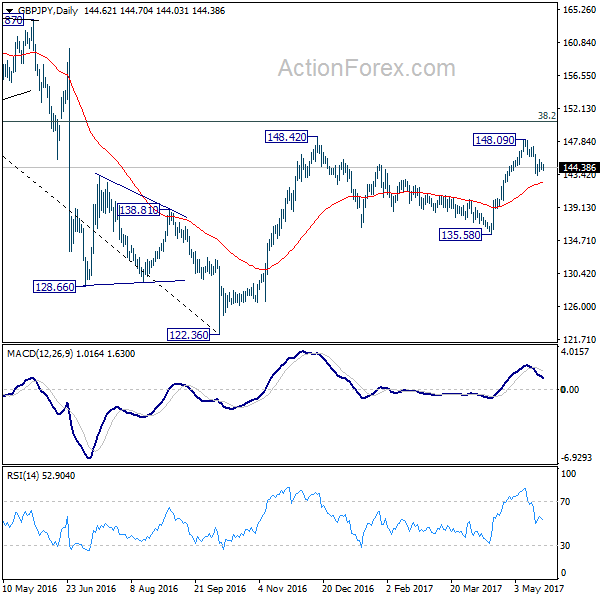

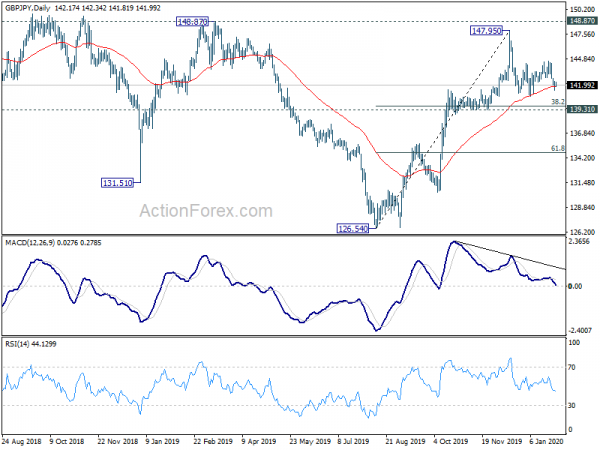

In the longer term picture, rise from 122.75 (2016 low) in still in progress but started losing upside momentum as seen in W MACD. Further rise will remain in favor, though, as long as 176.29 support holds, to retest 195.86 (2015 high).