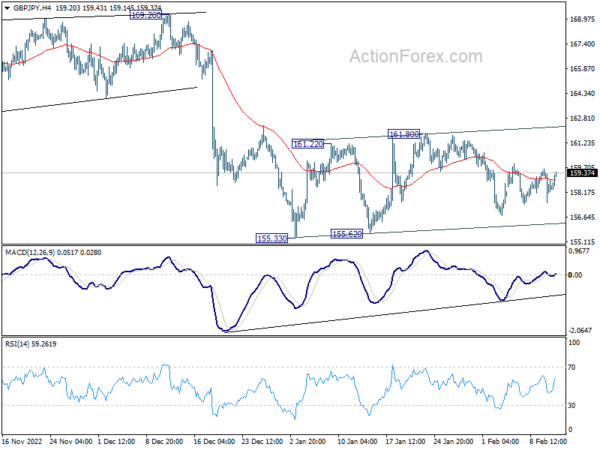

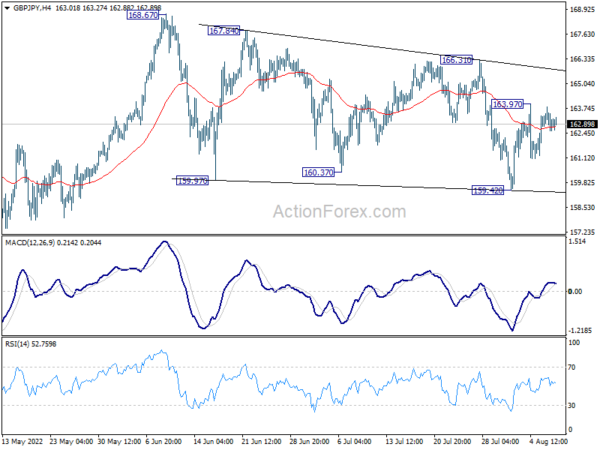

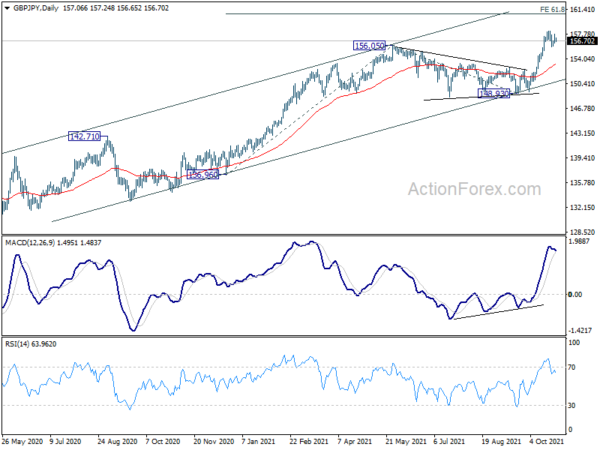

Daily Pivots: (S1) 157.47; (P) 158.55; (R1) 159.56; More…

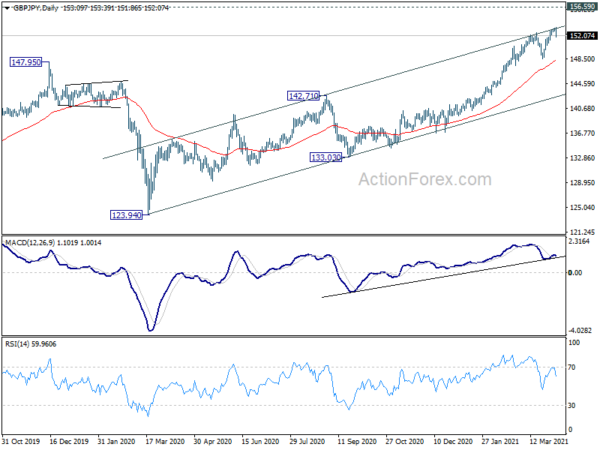

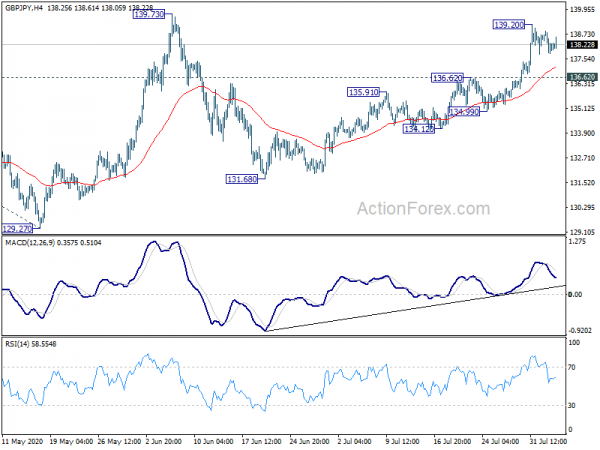

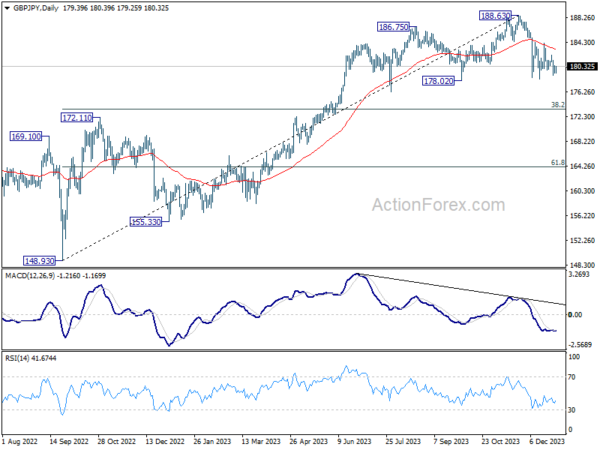

Range trading continues in GBP/JPY and intraday bias remains neutral. Further decline is mildly in favor. On the downside, break of 155.33 low will resume the fall from 172.11 to 153.70 fibonacci level next. On the upside, sustained trading above 55 day EMA (now at 160.99) will turn bias to the upside, for stronger rise back to 169.26/172.11 resistance zone.

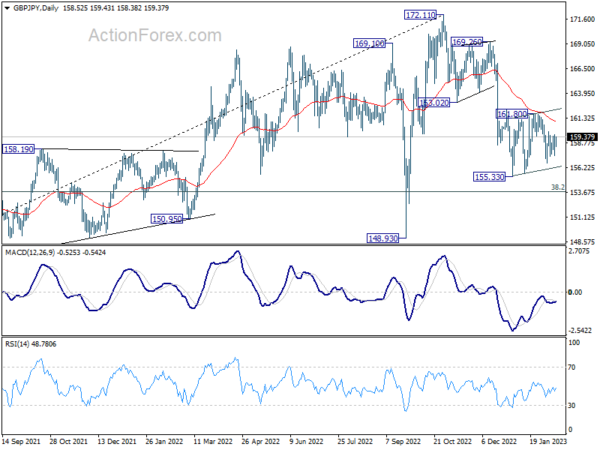

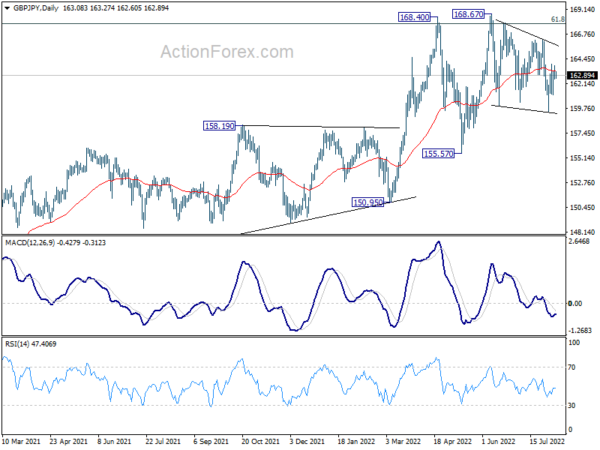

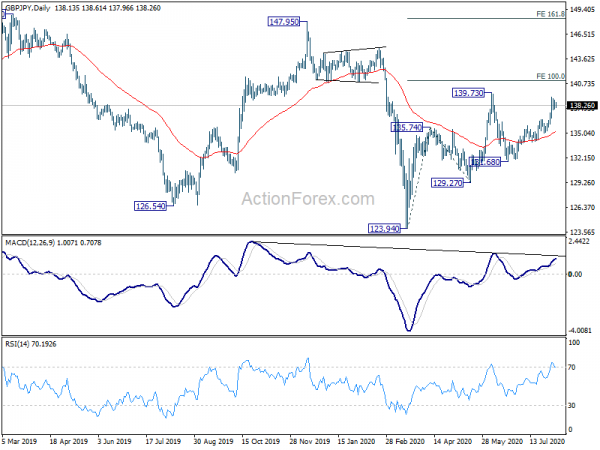

In the bigger picture, as long as 163.02 support turned resistance holds, decline from 172.11 medium term top is expected to continue to 38.2% retracement of 123.94 to 172.11 at 153.70. Sustained break there will raise the change of trend reversal and target 61.8% retracement at 142.34. Nevertheless, break of 163.02 support turned resistance will argue that the decline has completed, and retain medium term bullishness.