Daily Pivots: (S1) 139.08; (P) 140.10; (R1) 140.68; More…

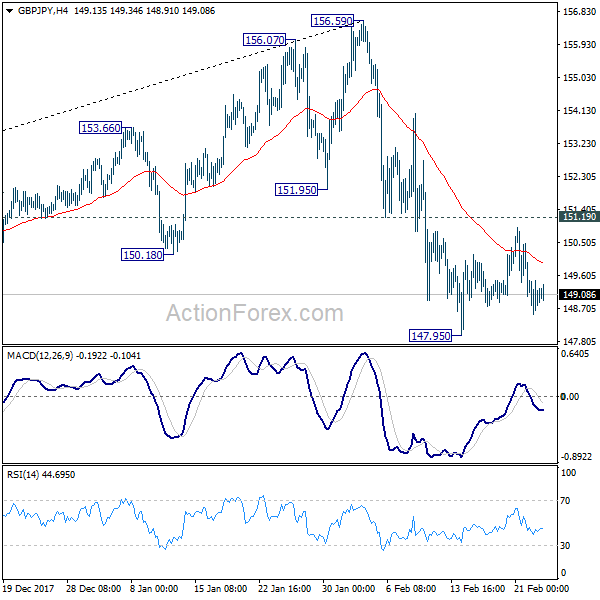

Intraday bias in GBP/JPY turned neutral for consolidation below 141.50 temporary top. Deeper retreat could be seen but downside should be contained by 135.74 resistance turned support. On the upside, above 141.50 will resume the rise from 126.54 for 148.87 key resistance.

In the bigger picture, consolidation pattern from 122.75 (2016 low) is still in progress with rise from 126.54 as the third leg. Further rise should be seen back to 148.87/156.59 resistance zone. For now, we’d expect strong resistance from there to limit upside. And, this will remain the favored case as long as 130.42 support holds.