Daily Pivots: (S1) 135.43; (P) 135.85; (R1) 136.27; More…

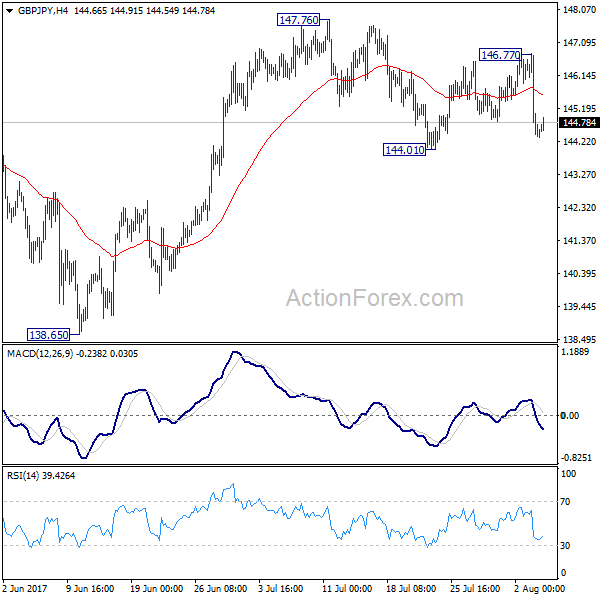

GBP/JPY’s rebound from 133.03 is still in progress but fails to take out 136.46 resistance so far. Intraday bias remains neutral and further decline is in favor. On the downside, break of 133.03 will resume the fall from 142.71 and target 61.8% retracement of 123.94 to 142.71 at 131.11 next. However, firm break of 136.46 will indicate short term bottoming and turn bias back to the upside for stronger rebound.

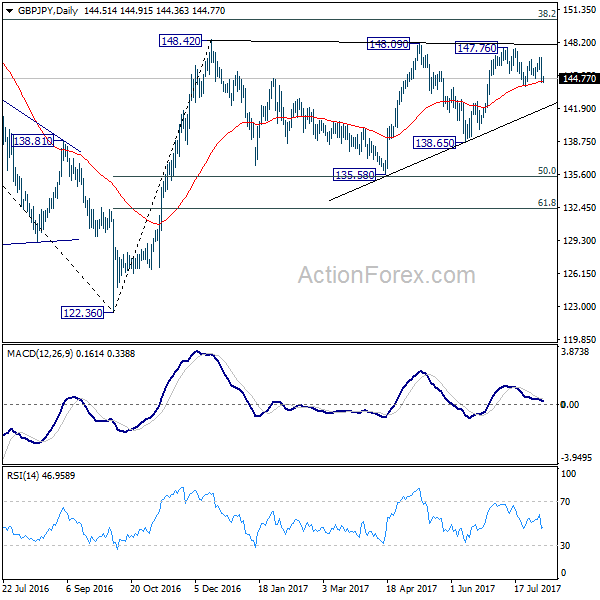

In the bigger picture, rise from 123.94 is seen only as a rising leg of the sideway consolidation pattern from 122.75 (2016 low). As long as 147.95 resistance holds, an eventual downside breakout remains in favor. However, firm break of 147.95 will raise the chance of long term bullish reversal. Focus will then be turned to 156.59 resistance for confirmation.