Daily Pivots: (S1) 144.68; (P) 145.52; (R1) 146.04; More…

Break of 144.80 minor support suggests that rebound from 143.76 has completed at 146.50 already. Intraday bias in GBP/JPY is turned back to the downside for 143.72 key support level. Decisive break there will be a strong sign of bearish reversal. That is, whole rebound from 131.51 has completed. Deeper fall should then be seen to 141.00 key support for confirmation.

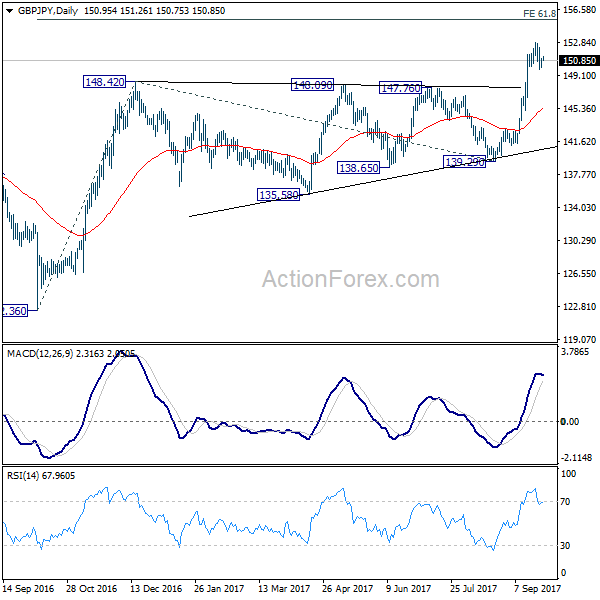

In the bigger picture, focus is staying on 149.98 key resistance. Decisive break there should confirm that medium term fall from 156.59 (2018 high) has completed at 131.51 already. Rise from 131.51 is then seen as the third leg of the corrective pattern from 122.36 (2016 low). GBP/JPY should then target 156.59 and above. However, rejection by 149.98 will retain medium term bearishness and could extend the fall from 156.59 through 131.51 to 122.36.