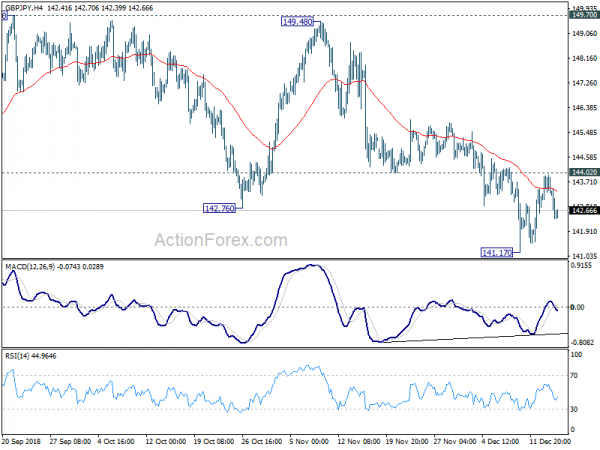

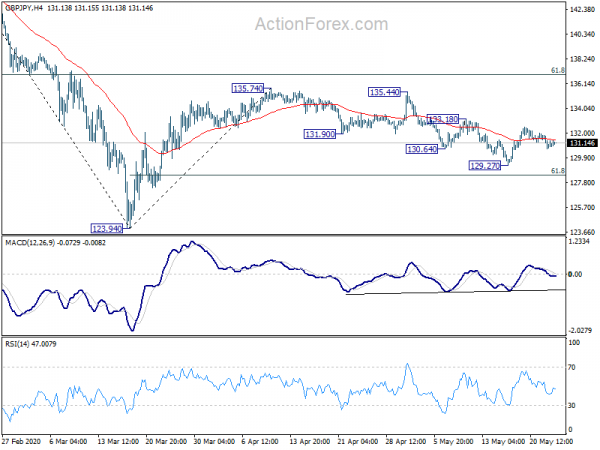

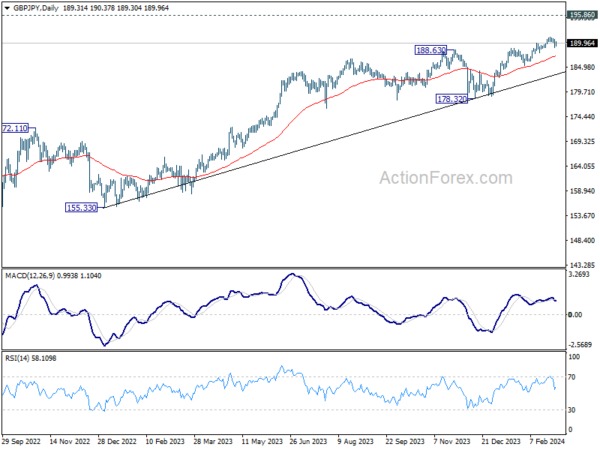

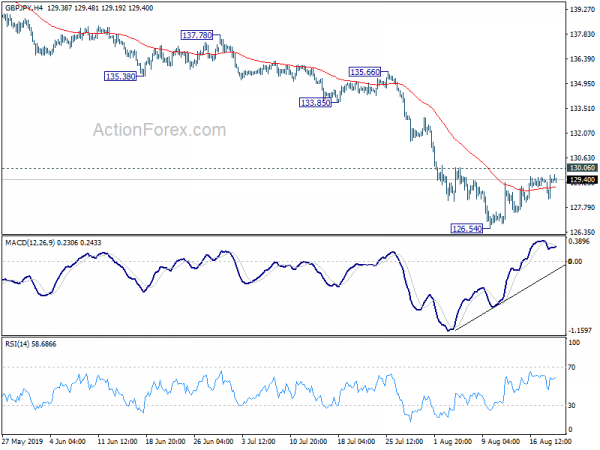

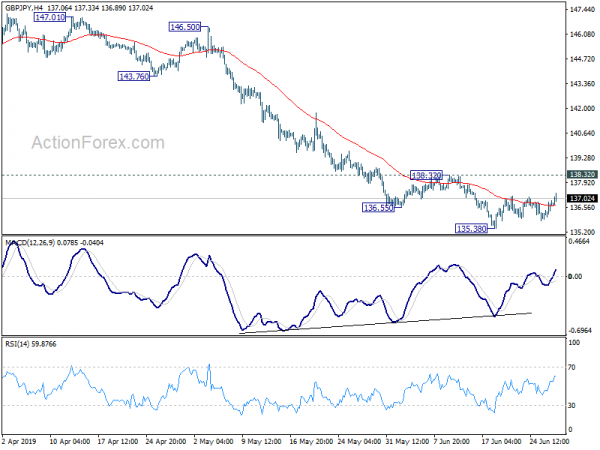

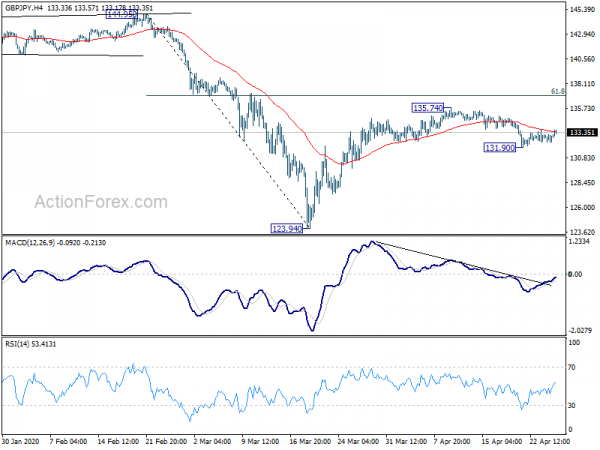

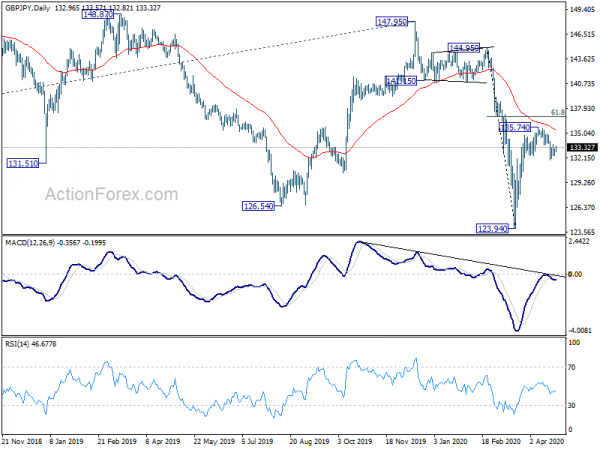

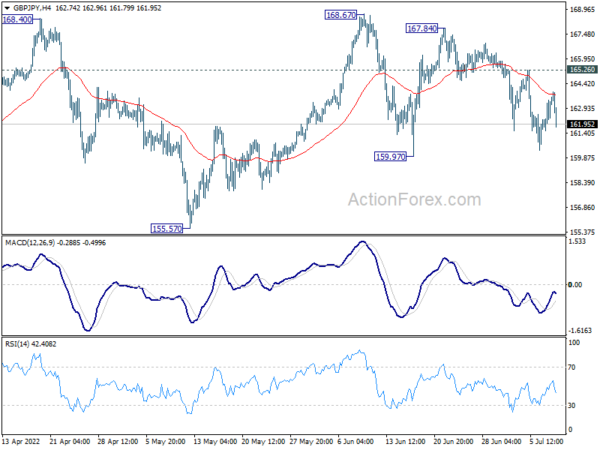

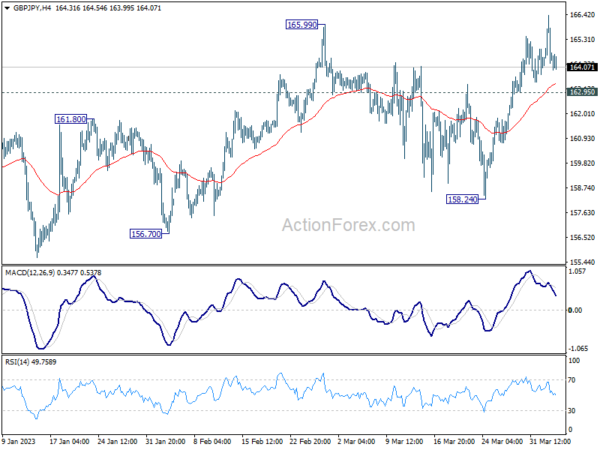

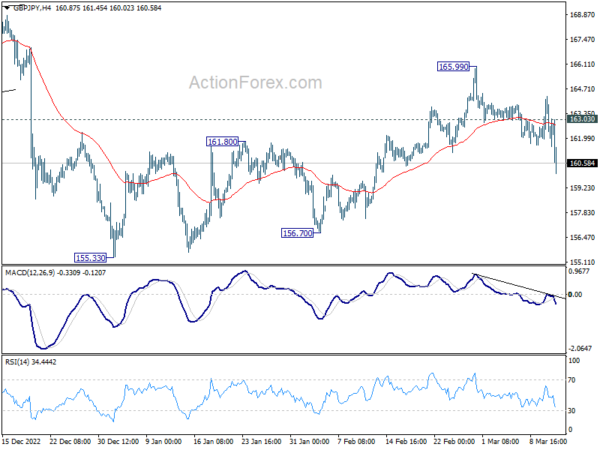

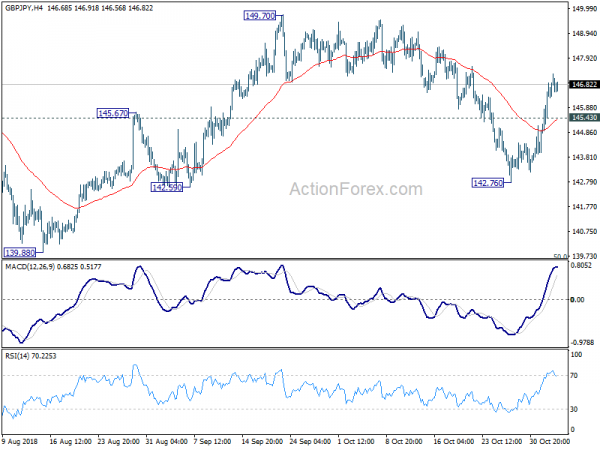

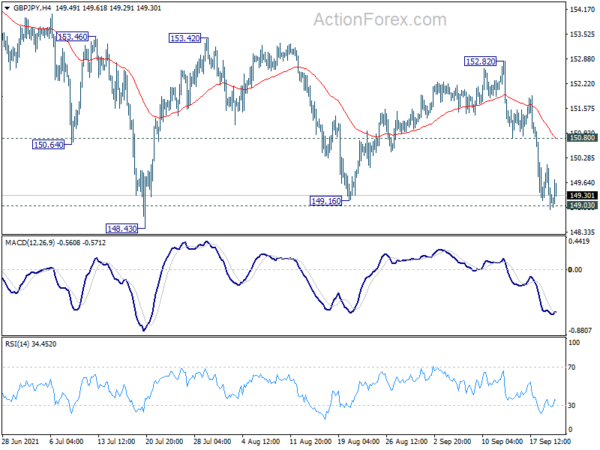

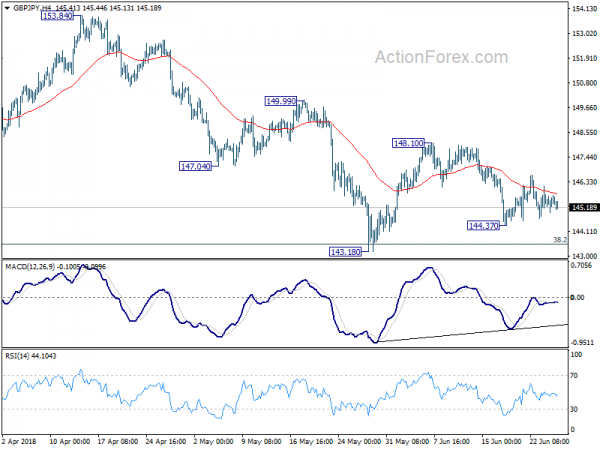

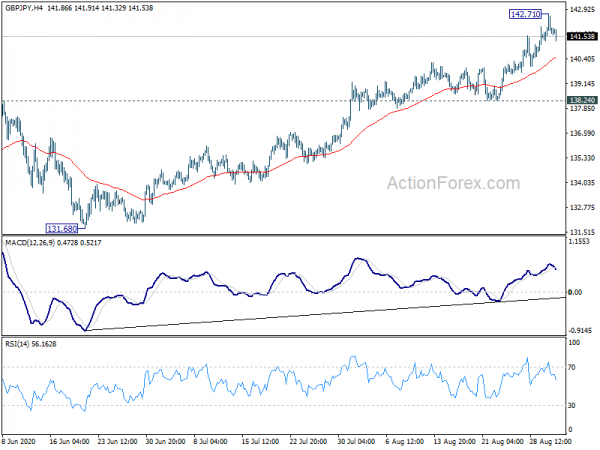

GBP/JPY dropped to as low as 141.17 last week but recovered since then. Initial bias stays neutral this week for consolidation. And near term outlook remain bearish with 144.02 support turned resistance holds. On the downside, below 141.17 will resume the fall from 149.70 and target 139.29/47 key support zone. However, considering bullish convergence condition in 4 hour MACD, decisive break of 144.02 will suggest near term reversal. Stronger rally should then be seen to 55 day EMA (now at 145.16) and above.

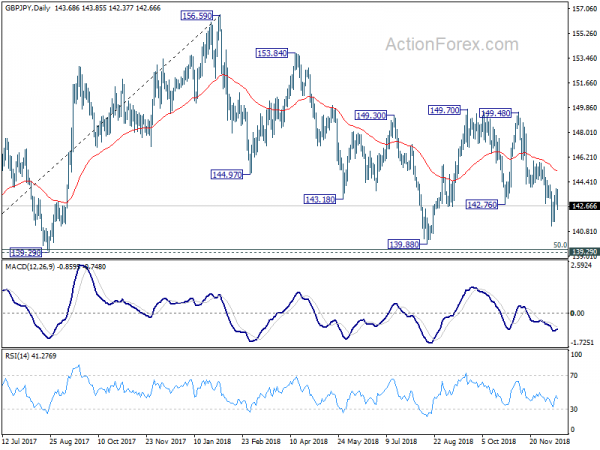

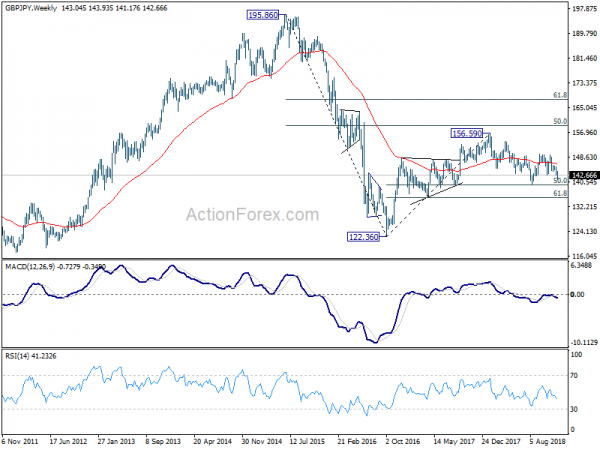

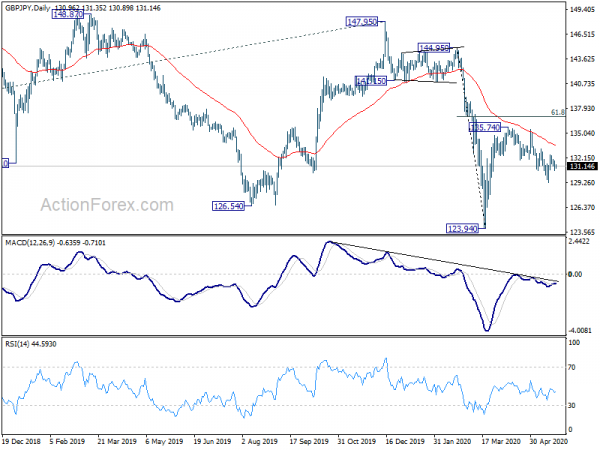

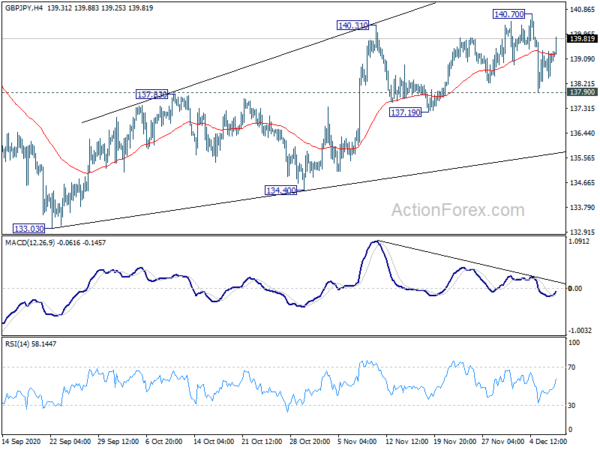

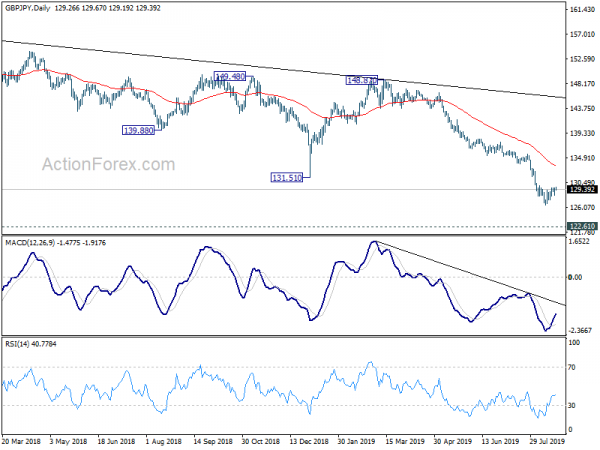

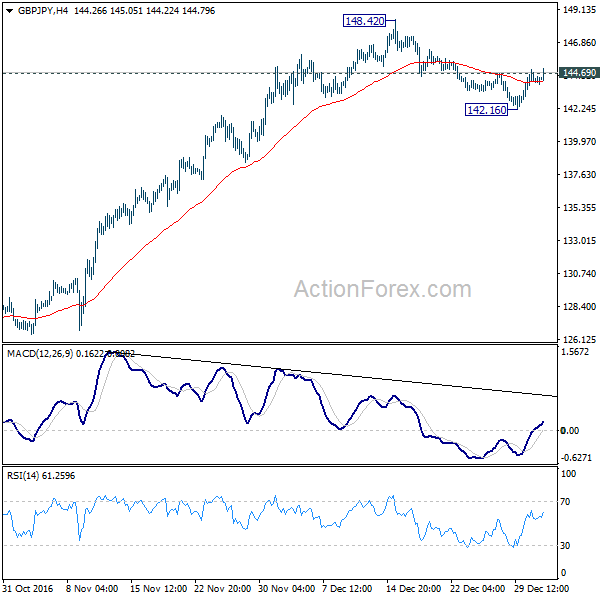

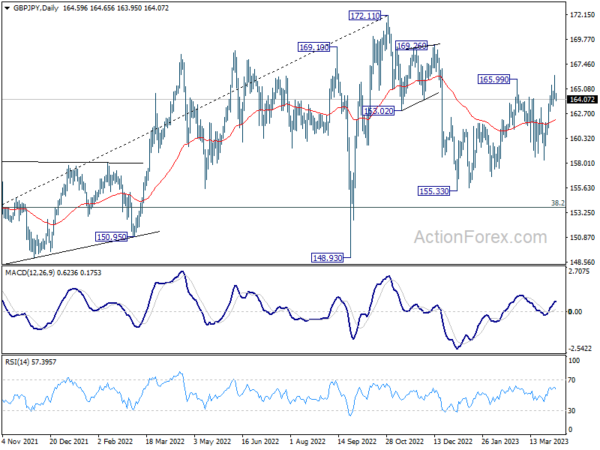

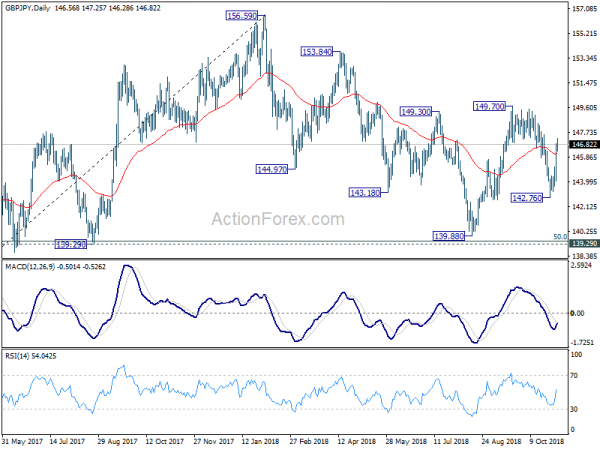

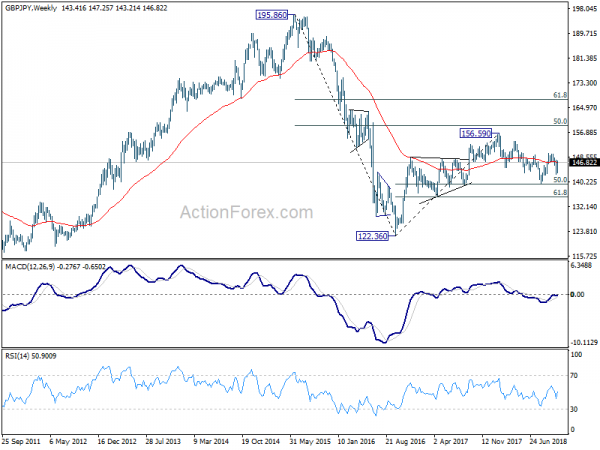

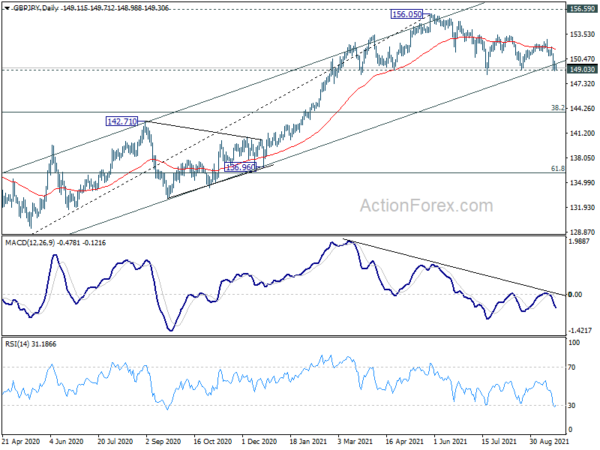

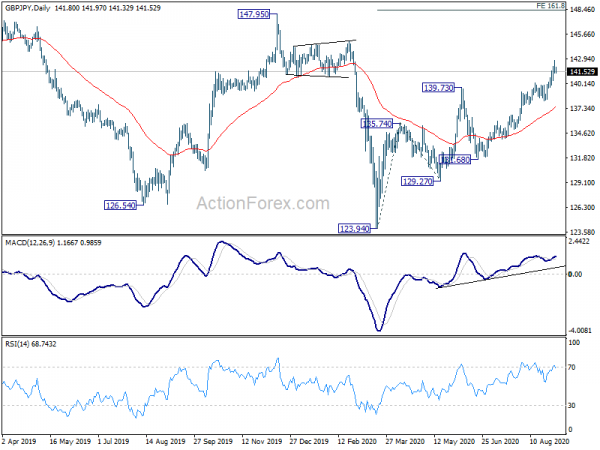

In the bigger picture, as long as 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) holds, up trend from 122.36 (2016 low) could still extend beyond 156.69 high. However, decisive break of 139.29/47 will suggest that such up trend is completed and turn outlook bearish. In that case, next target is 61.8% retracement at 135.43.

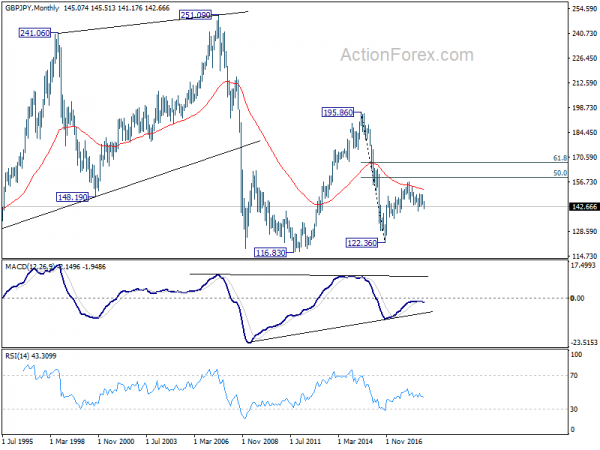

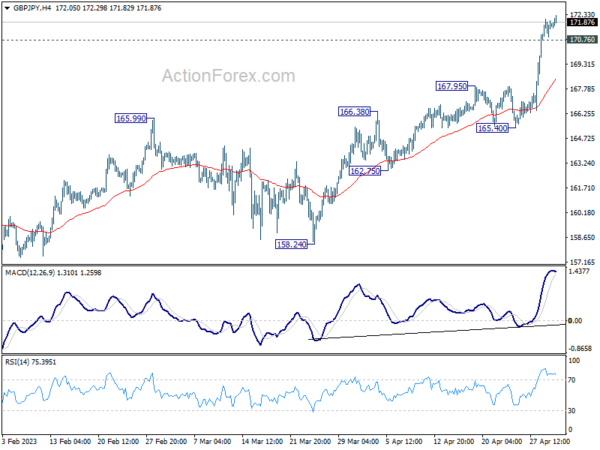

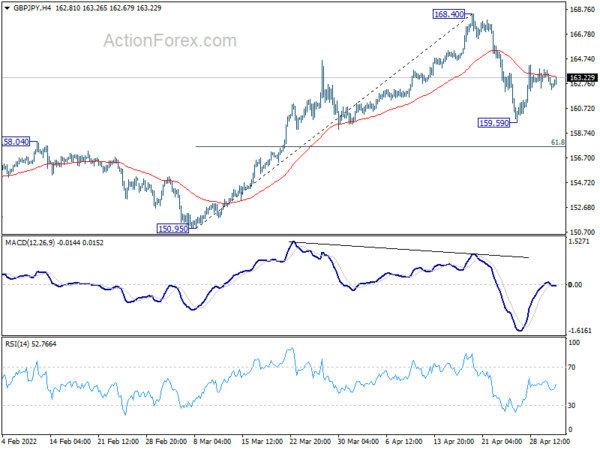

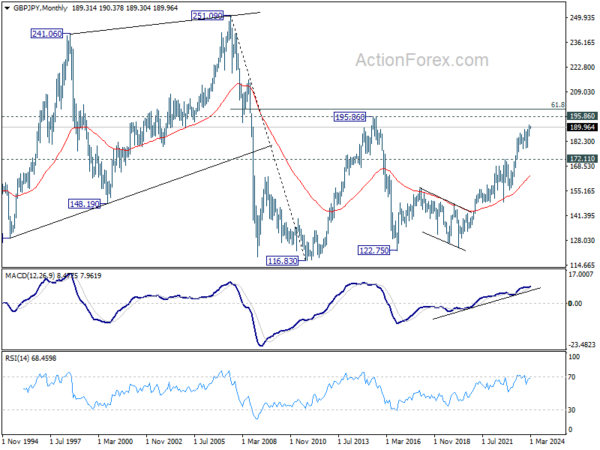

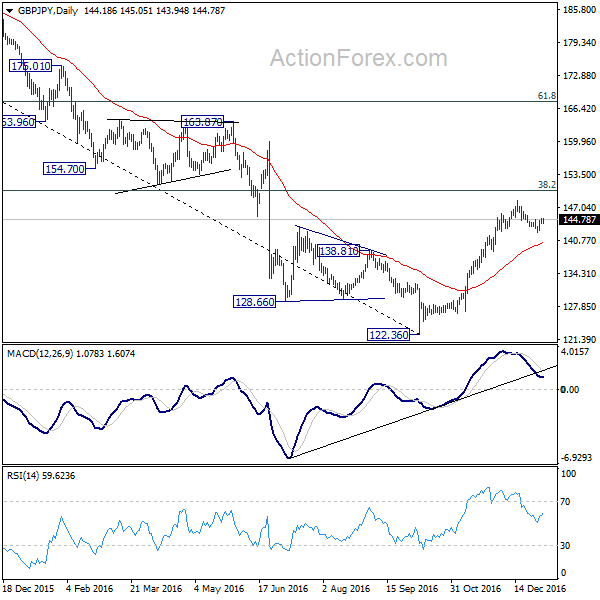

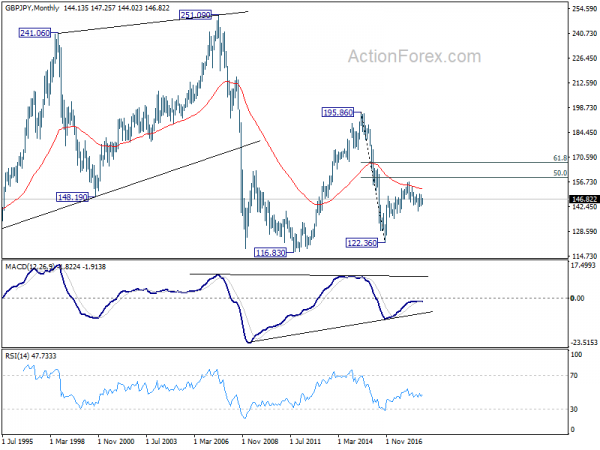

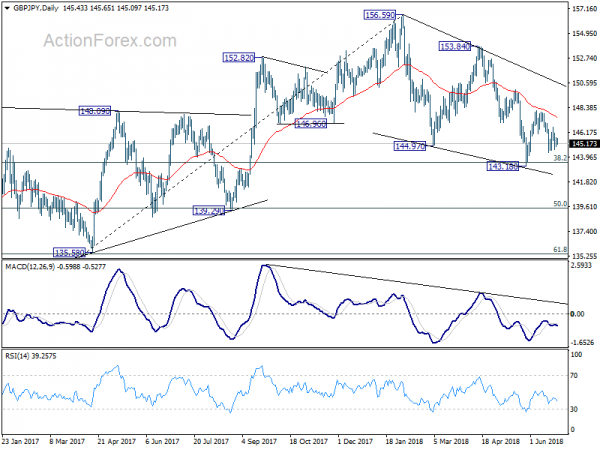

In the longer term picture, as long as 139.29 holds, rise from 122.36 is in favor to extend to 50% retracement of 195.86 (2015 high) to 122.36 (2016 low) at 159.11, and possibly further to 61.8% retracement at 167.78 before completion. However, firm break of 139.29 will turn focus back to 116.83/122.36 support zone instead (116.83 as 2011 low).