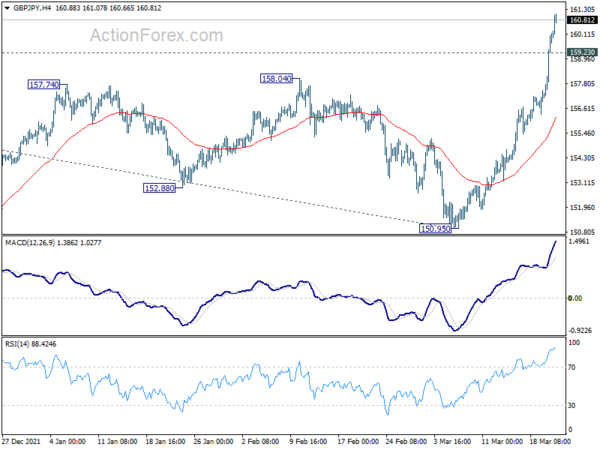

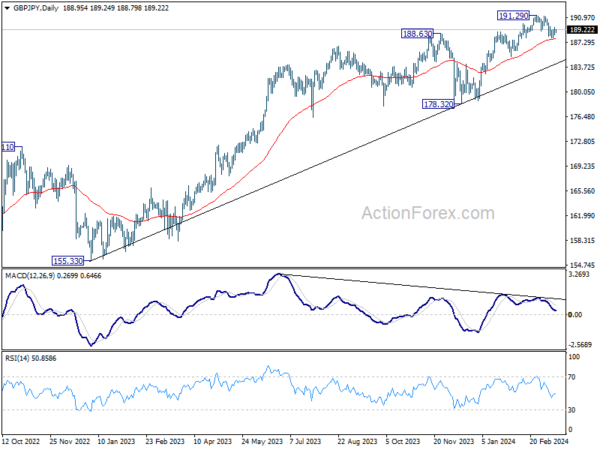

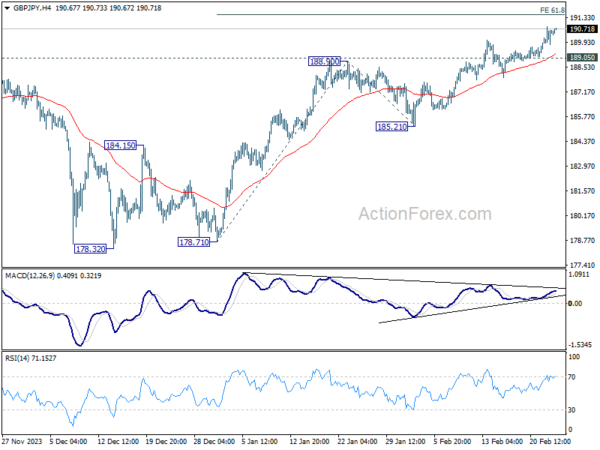

Daily Pivots: (S1) 158.25; (P) 159.24; (R1) 161.22; More…

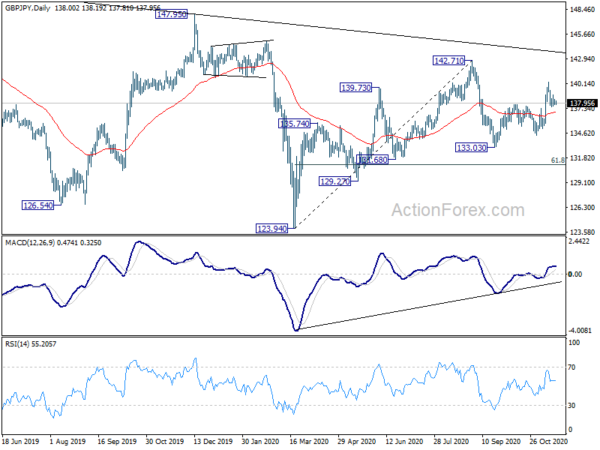

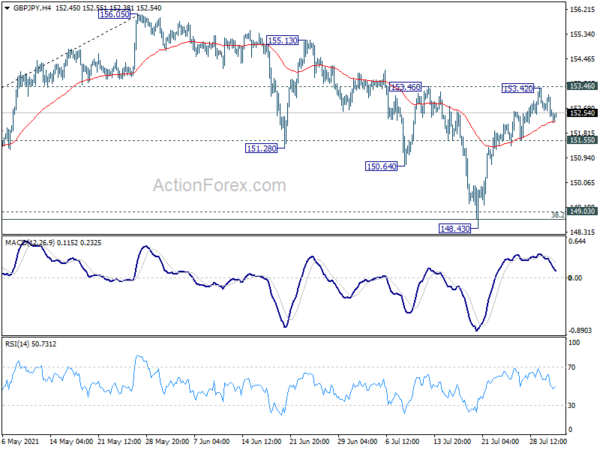

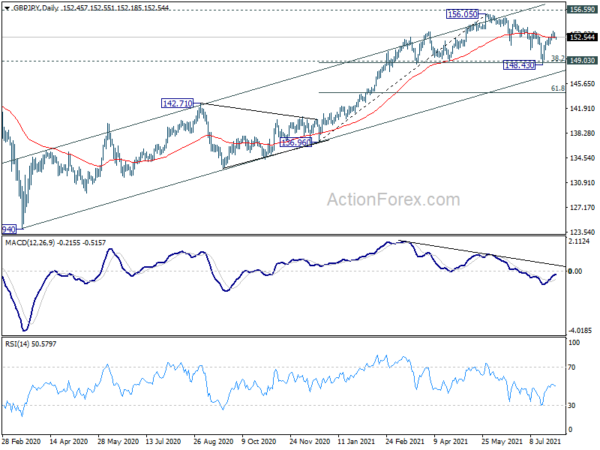

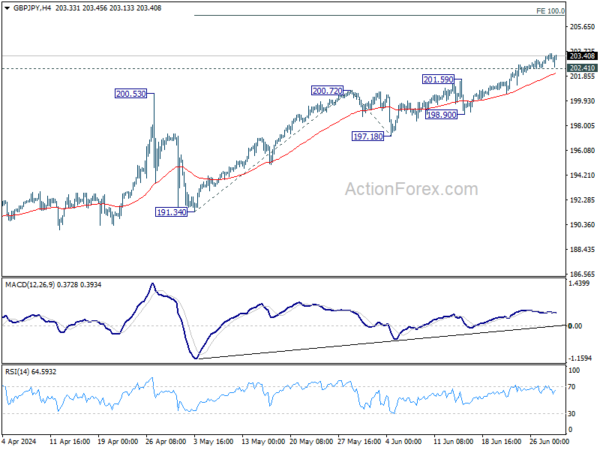

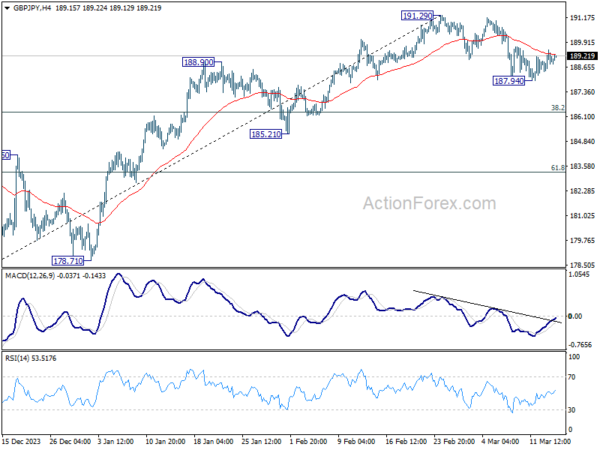

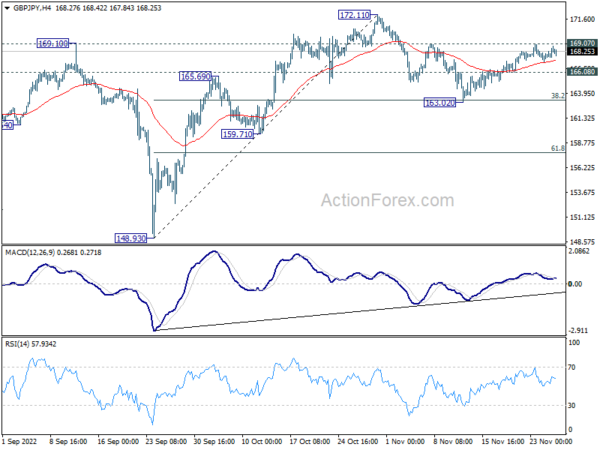

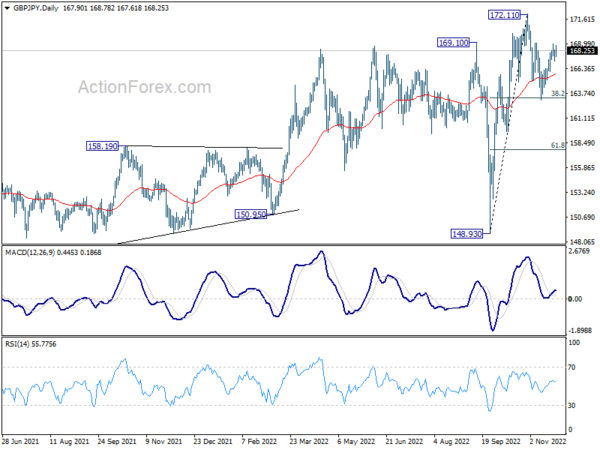

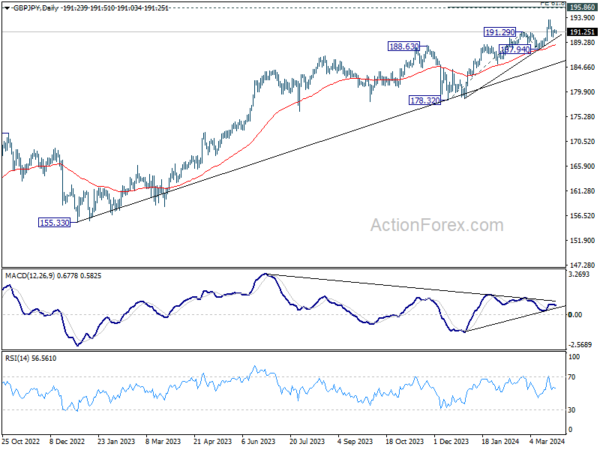

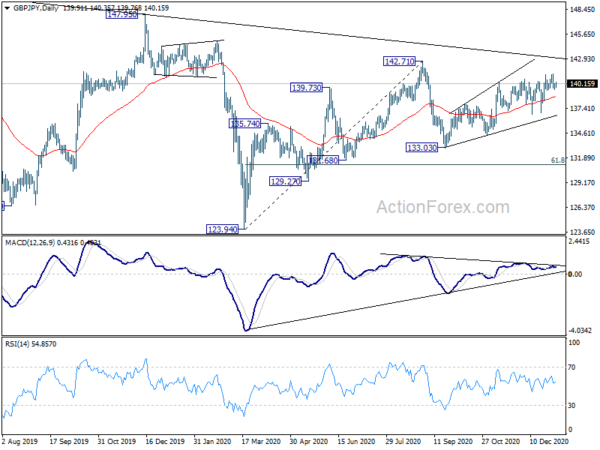

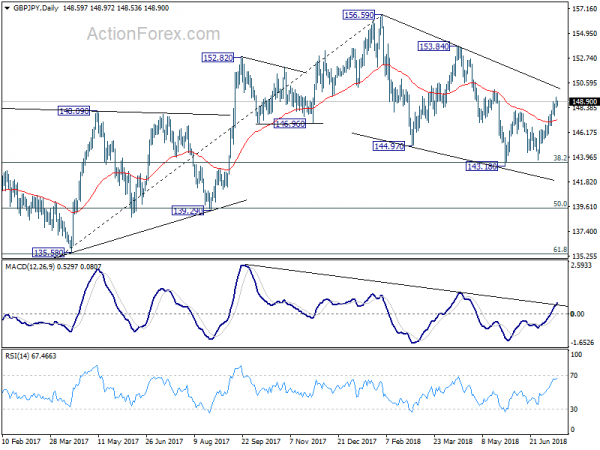

Intraday bias in GBP/JPY remains on the upside at this point. Up trend form 123.94 has just resumed. Next target is 61.8% projection of 136.96 to 158.19 from 150.95 at 164.07. On the downside, below 159.25 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

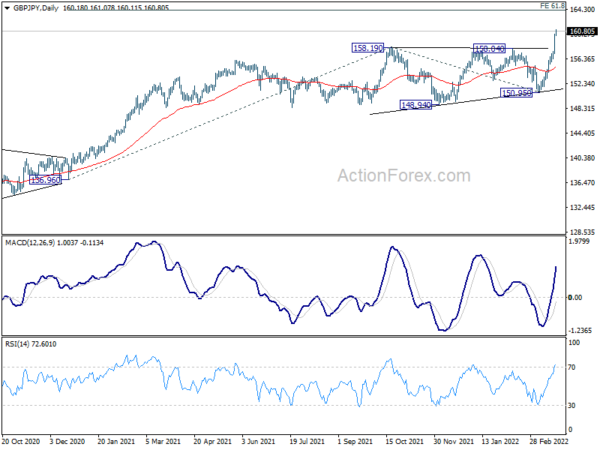

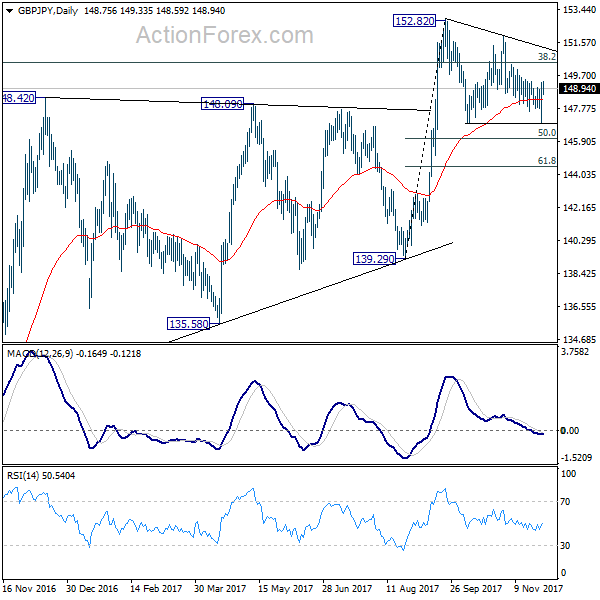

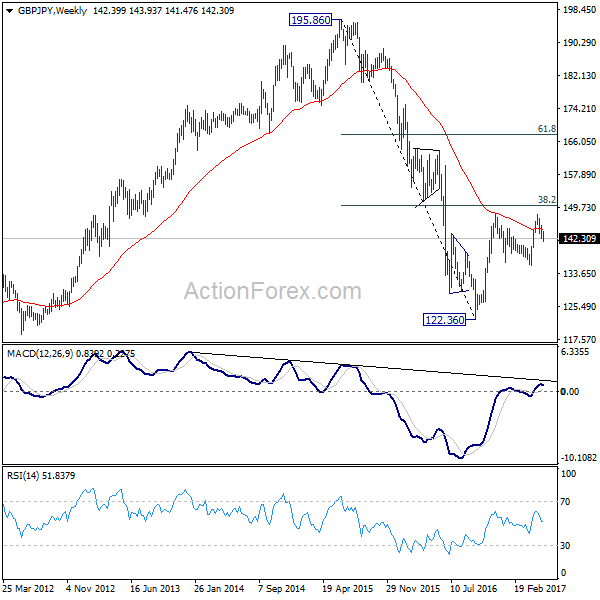

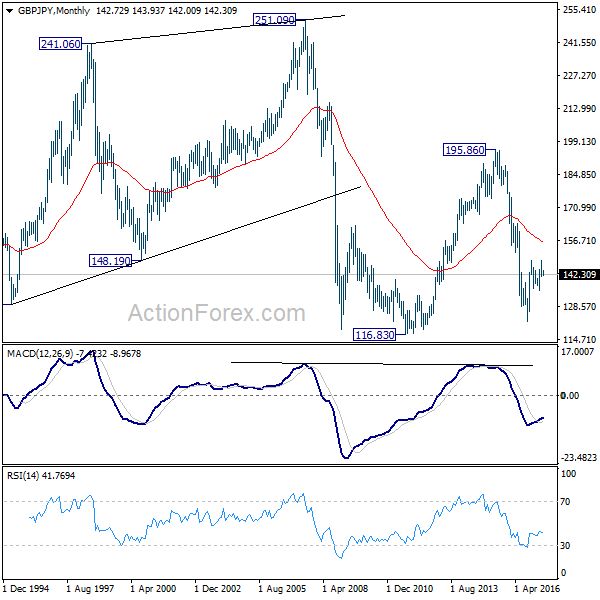

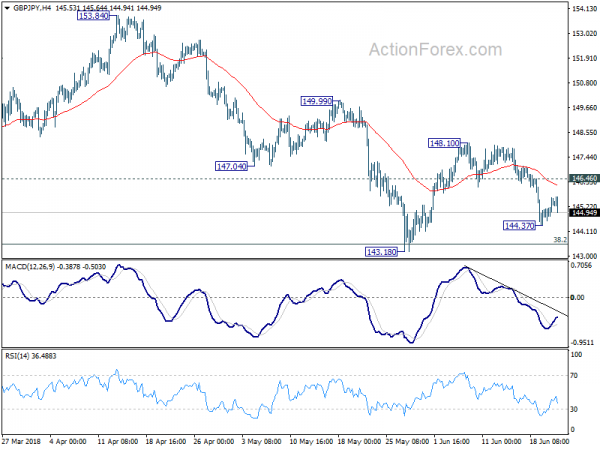

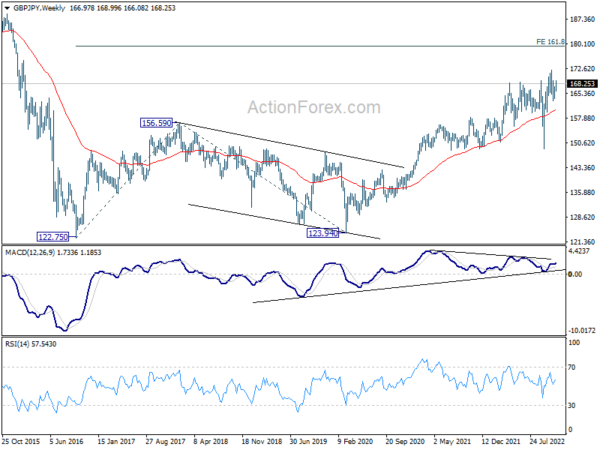

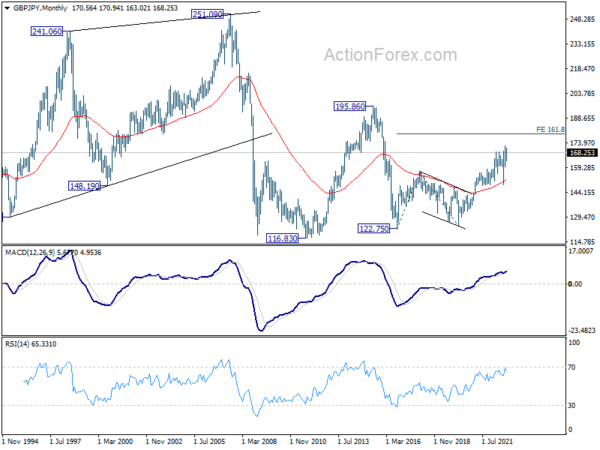

In the bigger picture, up trend from 123.94 (2020 low) should still be in progress, and notable support from 55 week EMA affirms medium term bullishness. Next target is 61.8% retracement of 195.86 (2015 high) to 122.75 (2016 low) at 167.93. Sustained break there will be a long term bullish signal. This will now remain the favored case as long as 148.94 support holds.