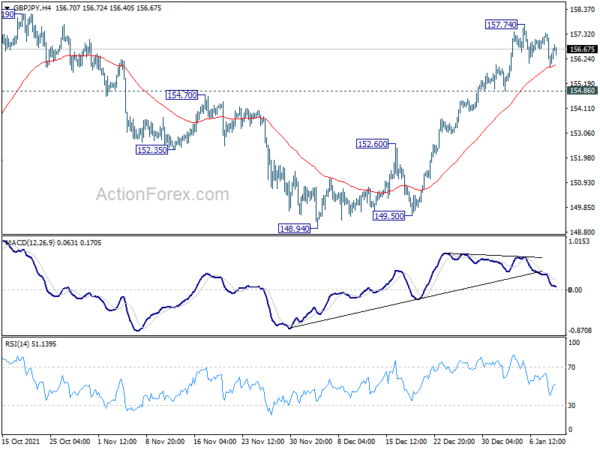

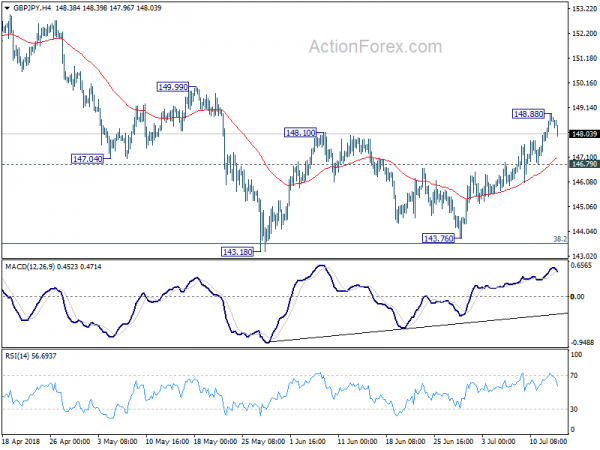

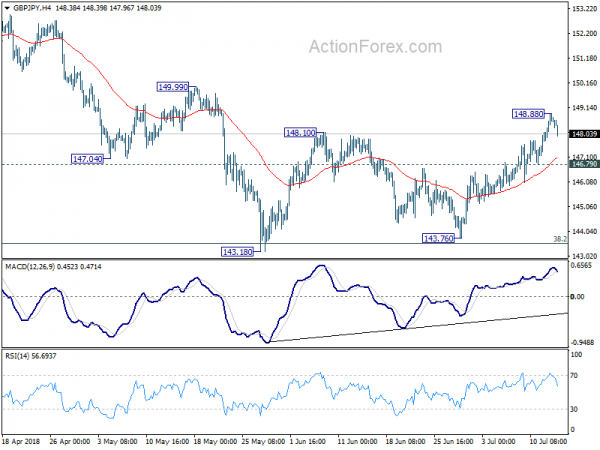

Daily Pivots: (S1) 153.97; (P) 154.27; (R1) 154.54; More…

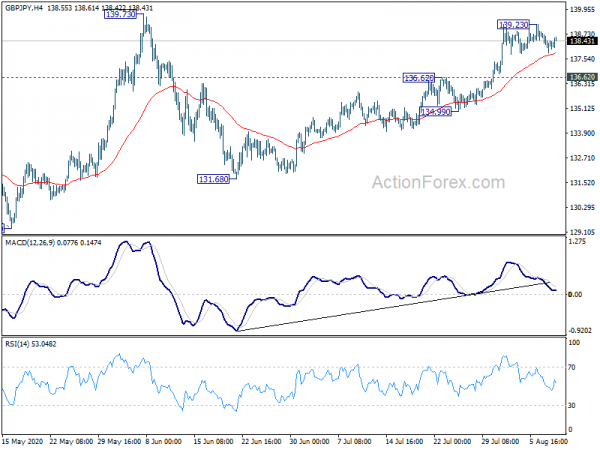

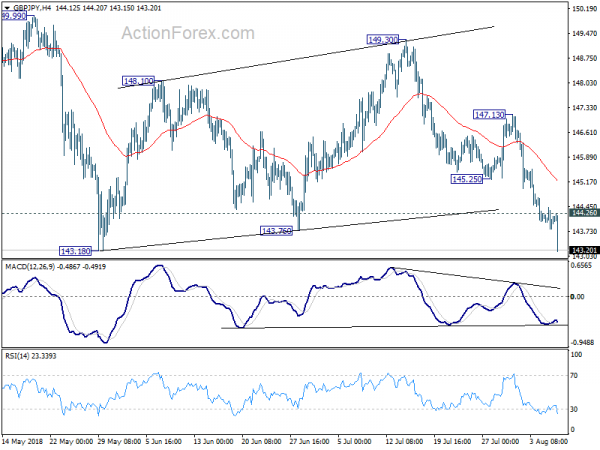

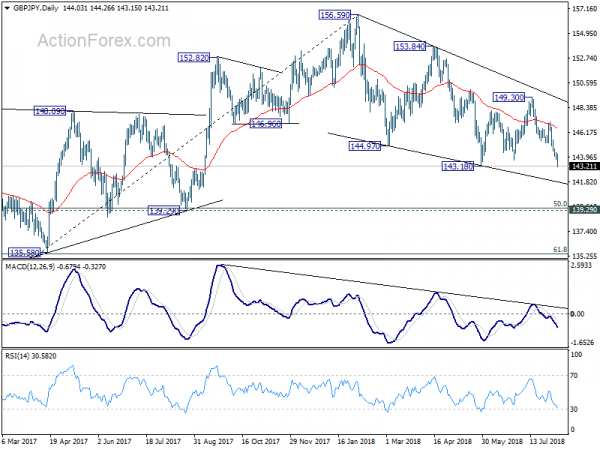

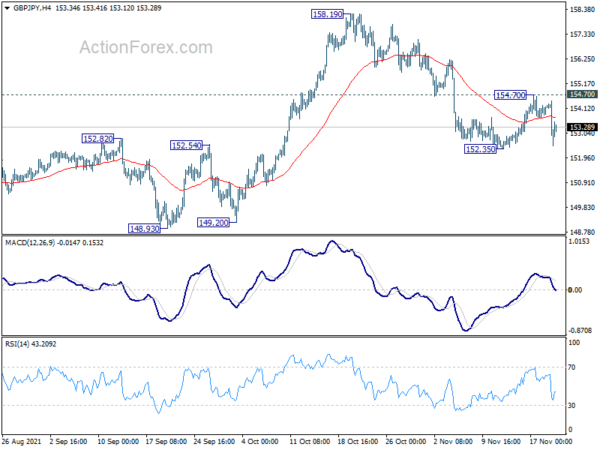

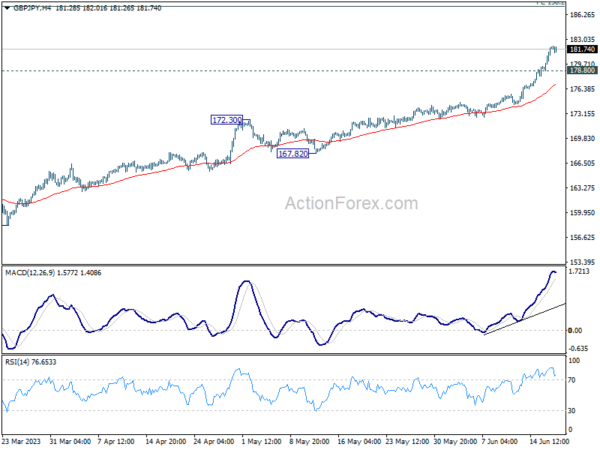

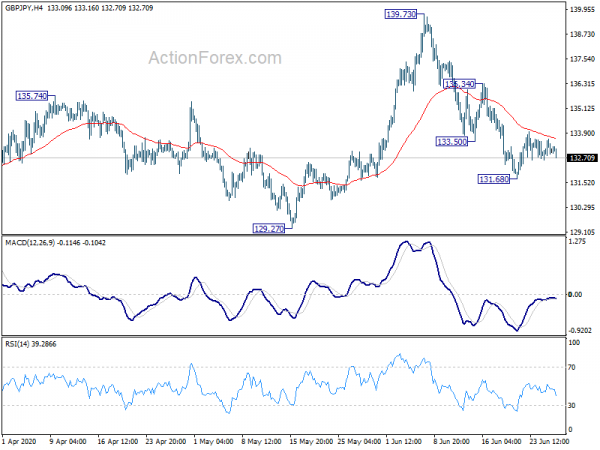

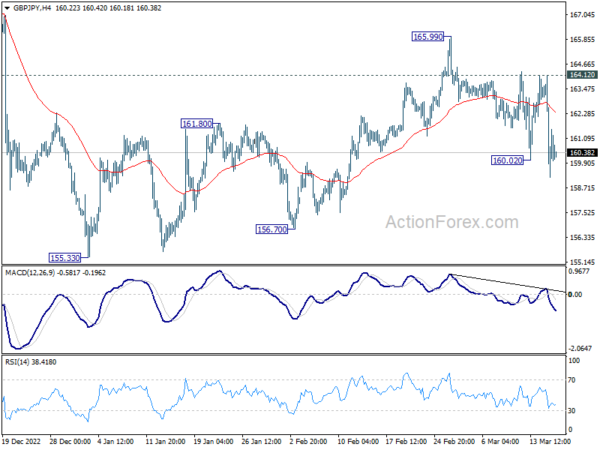

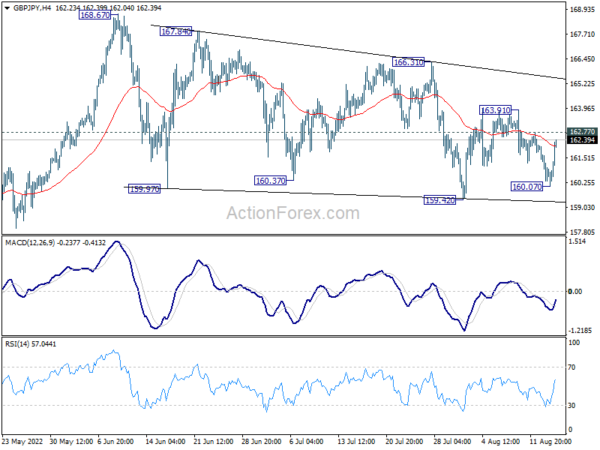

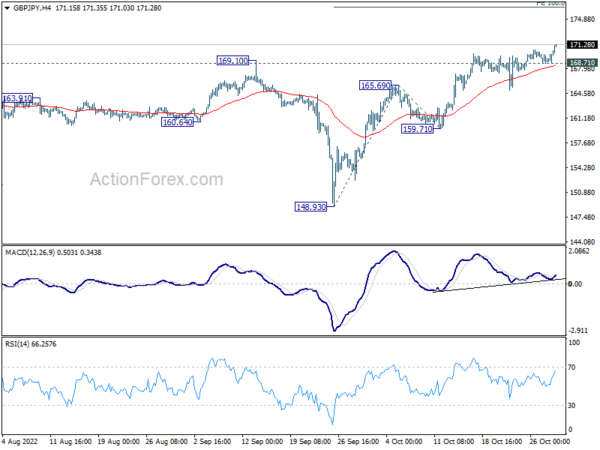

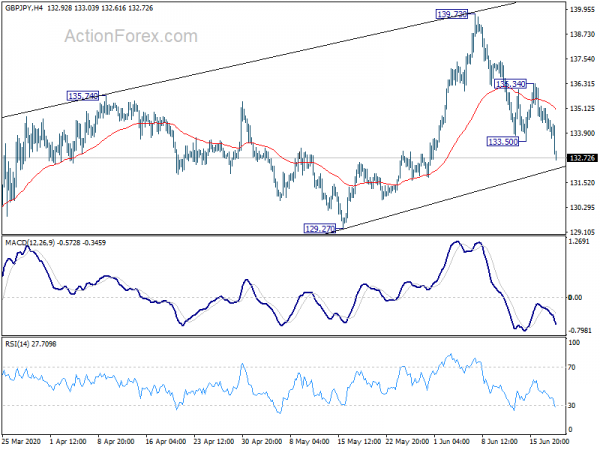

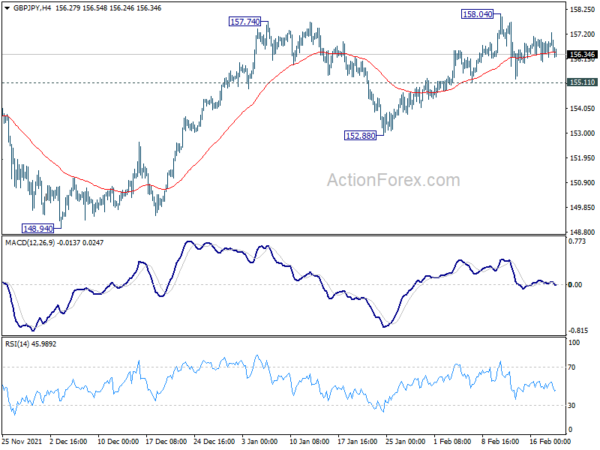

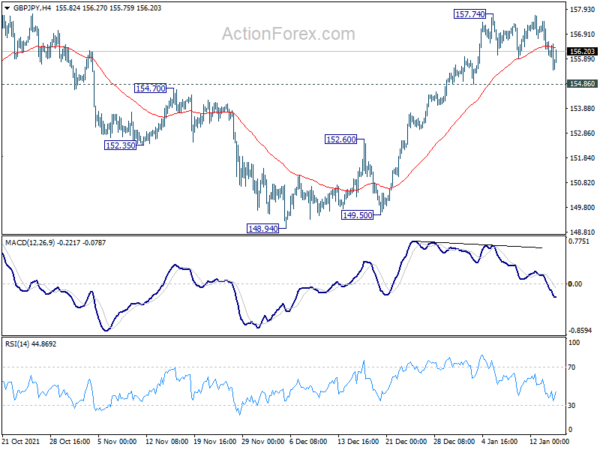

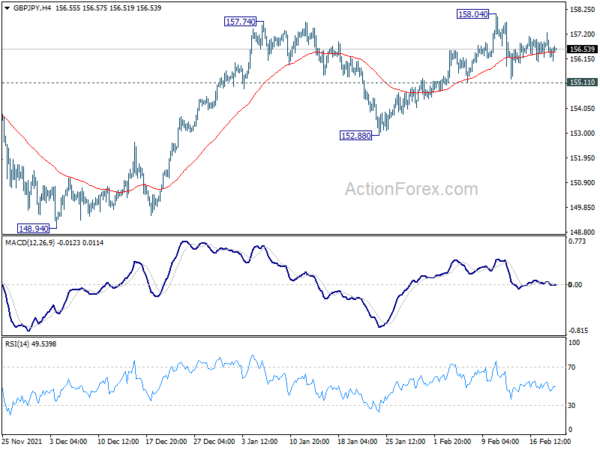

GBP/JPY is losing some upside momentum as seen in 4 hour MACD. But further rise is expected with 153.02 minor support intact. Firm break of 154.70 should confirm the bullish case that correction from 158.19 has completed at 148.94, after defending 148.93 key support. Further rally should then be seen to retest 158.19 next. On the downside, however, break of 153.02 minor support will mix up the near term outlook and turn intraday bias neutral again first.

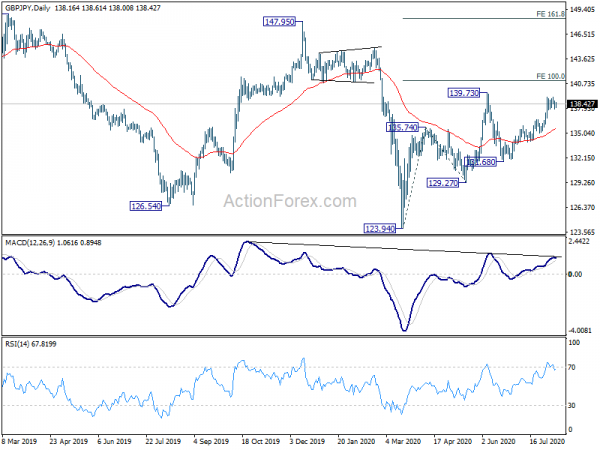

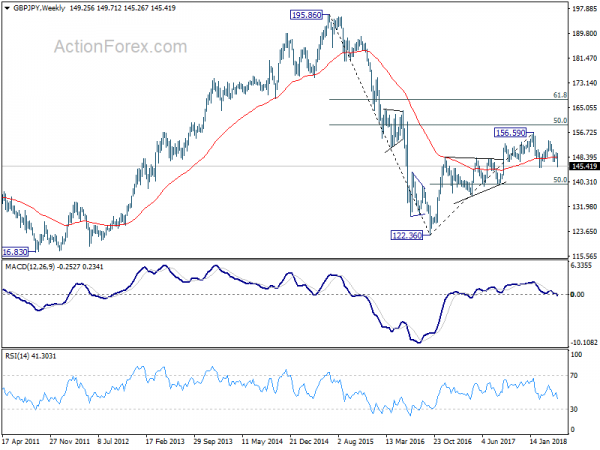

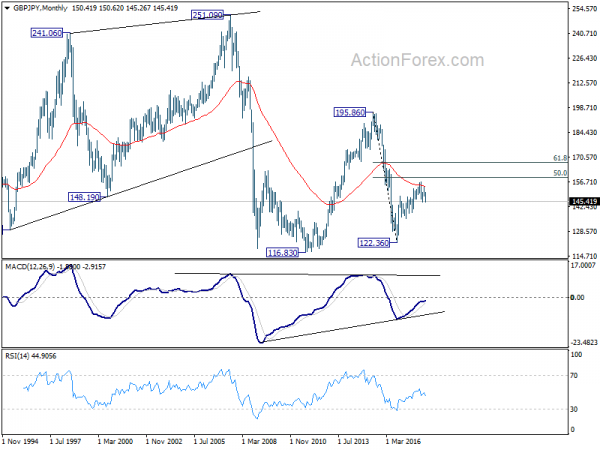

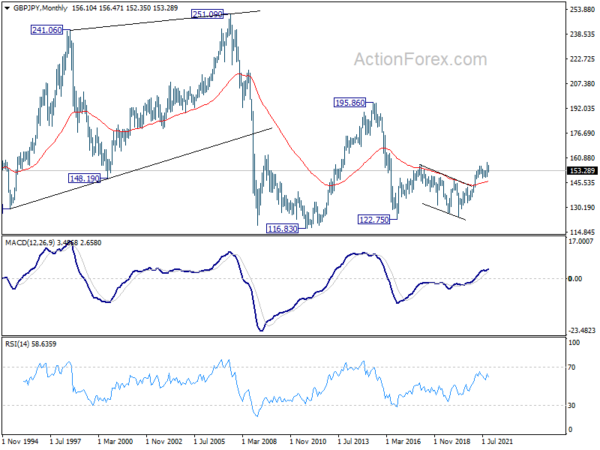

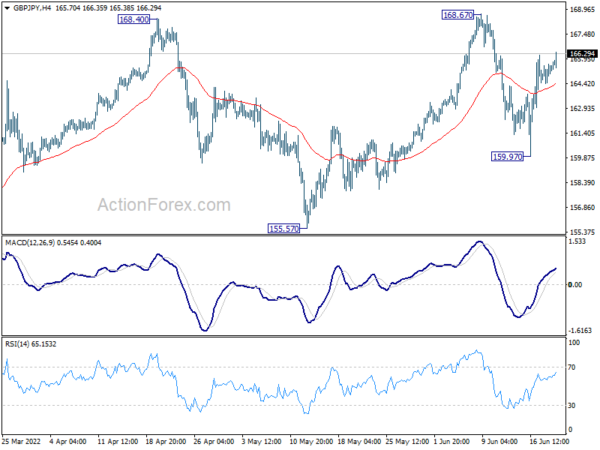

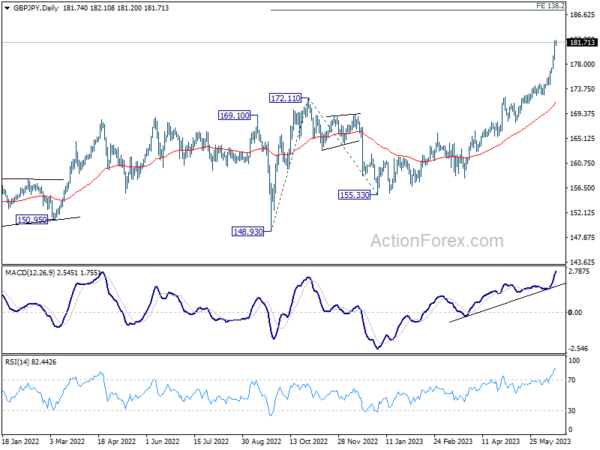

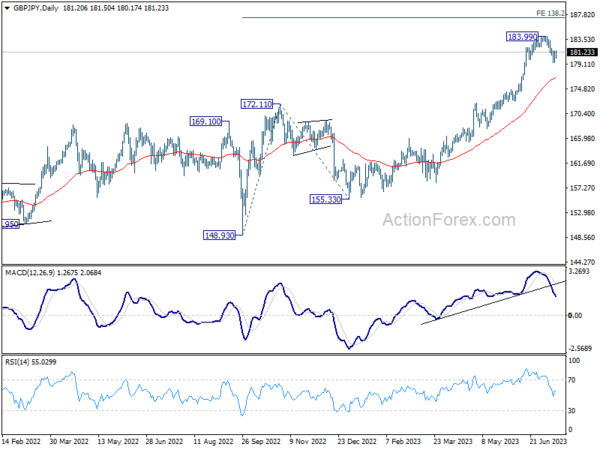

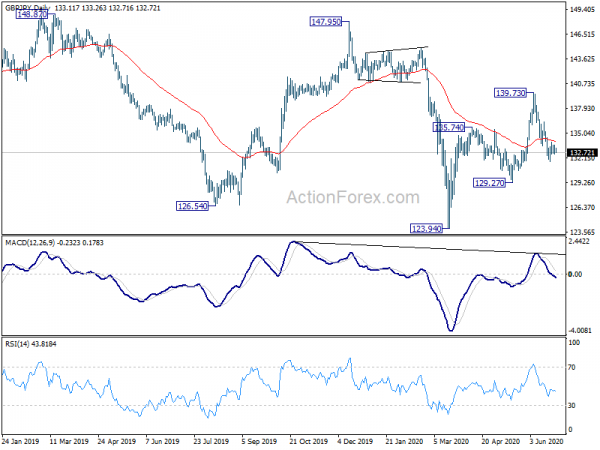

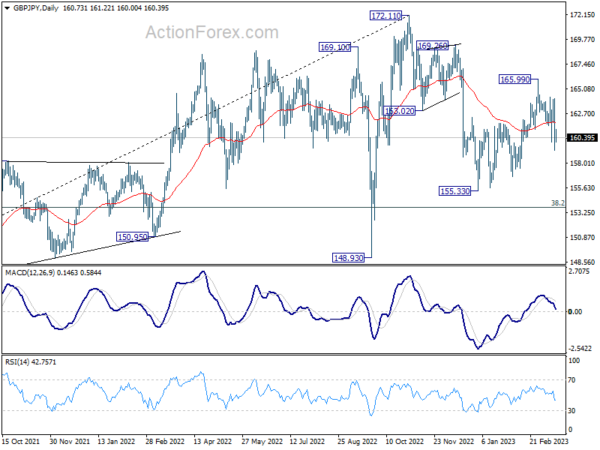

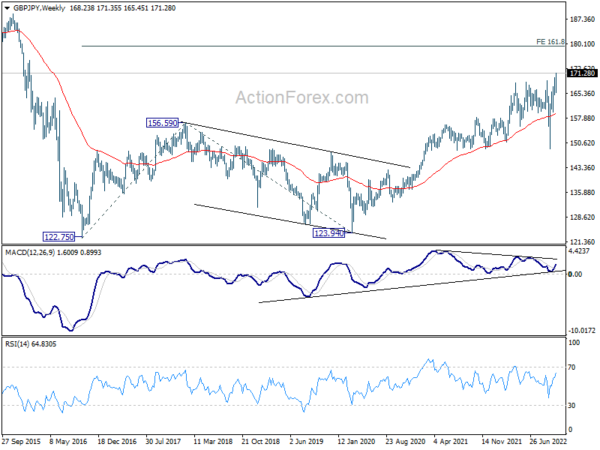

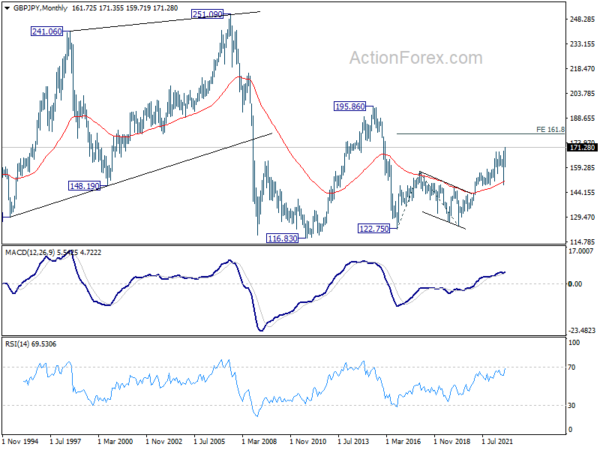

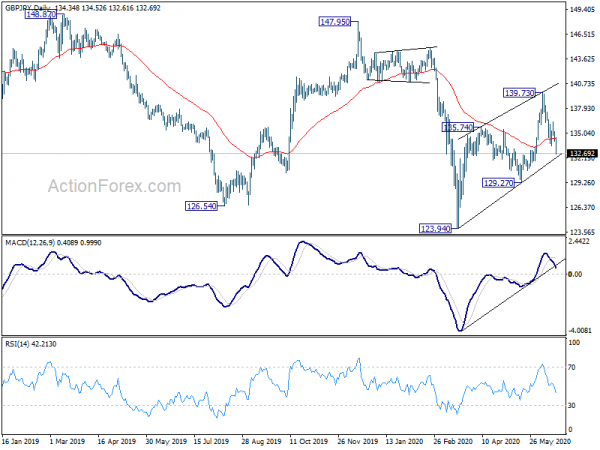

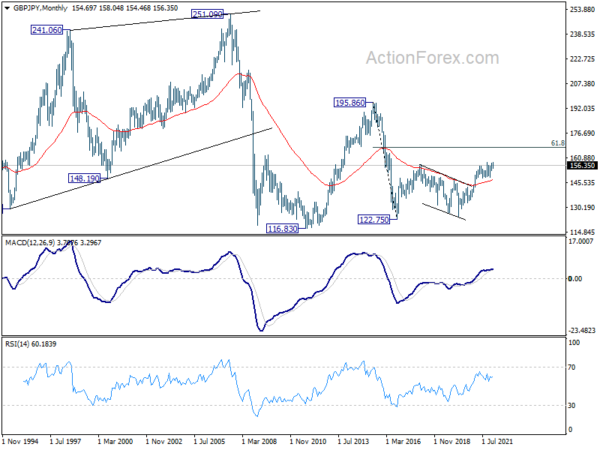

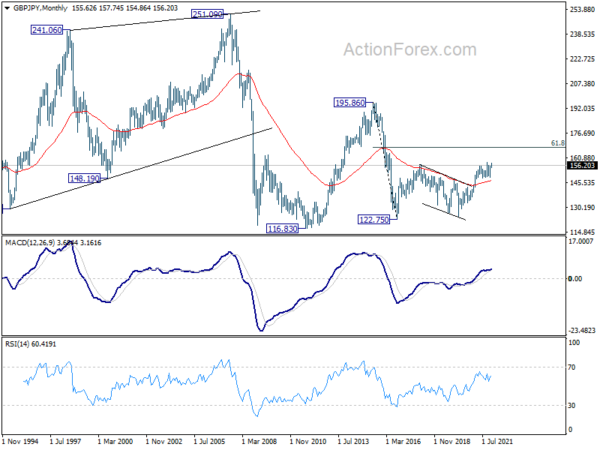

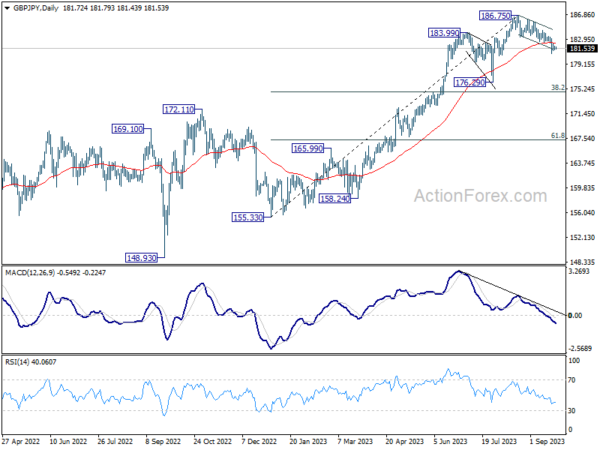

In the bigger picture, strong rebound from 148.93 key structural support will retain medium term bullishness. Firm break of 158.19 high will resume whole up trend from 123.94 (2020 low), to 61.8% retracement of 195.86 to 122.75 at 167.93. Nevertheless, firm break of 148.93 will bring deeper correction to 38.2% retracement of 123.94 to 158.19 at 145.10, and possibly further lower, as a correction to up trend from 123.94 at least