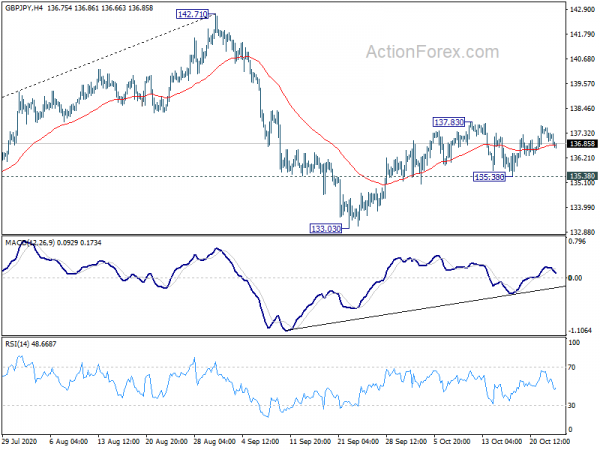

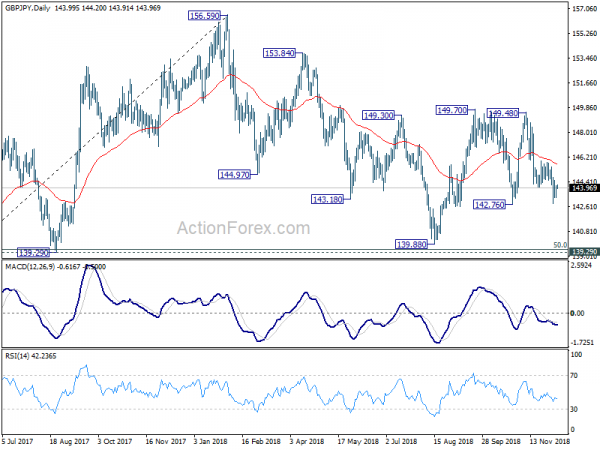

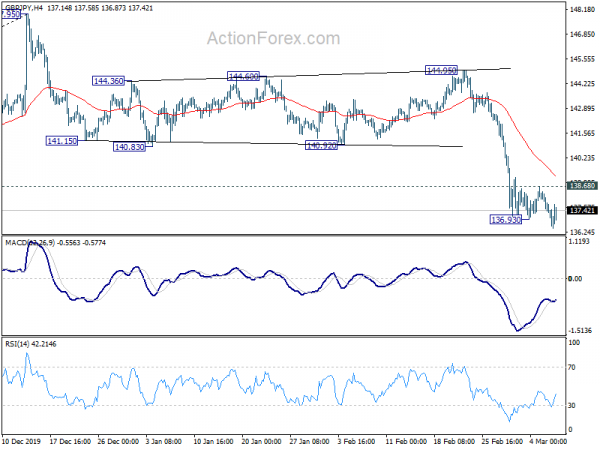

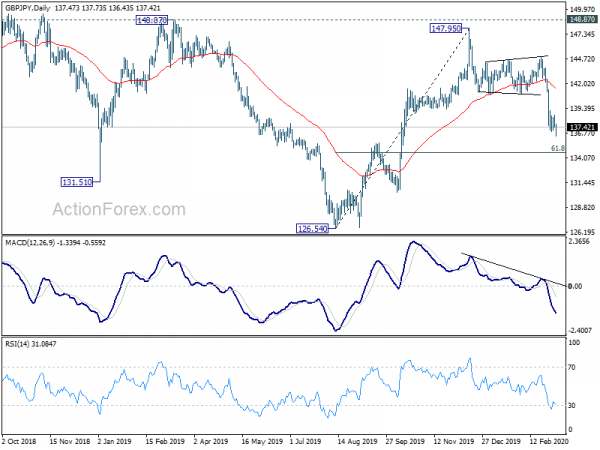

Daily Pivots: (S1) 136.95; (P) 137.27; (R1) 137.57; More…

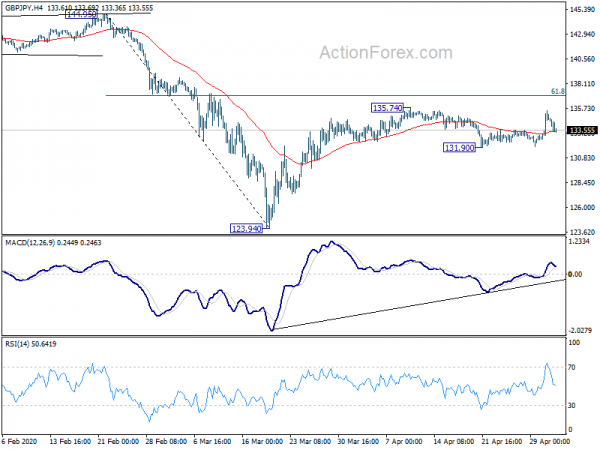

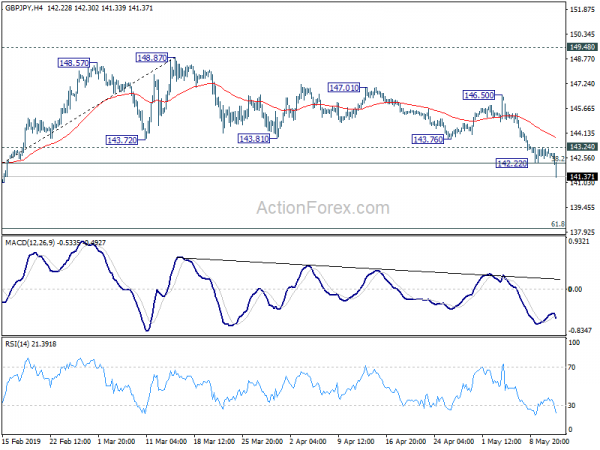

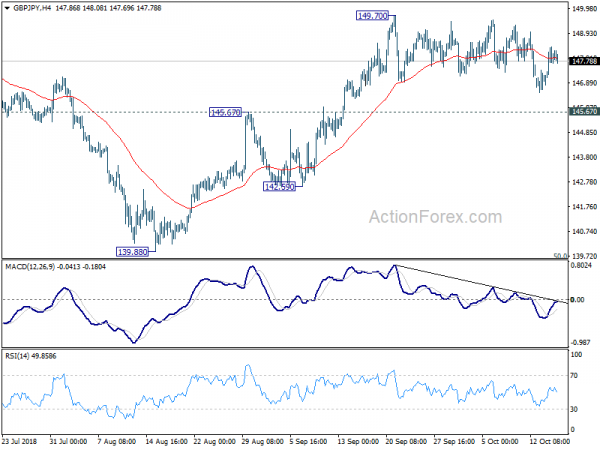

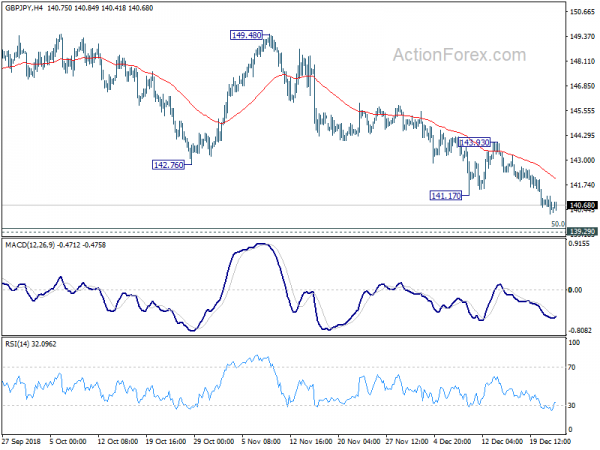

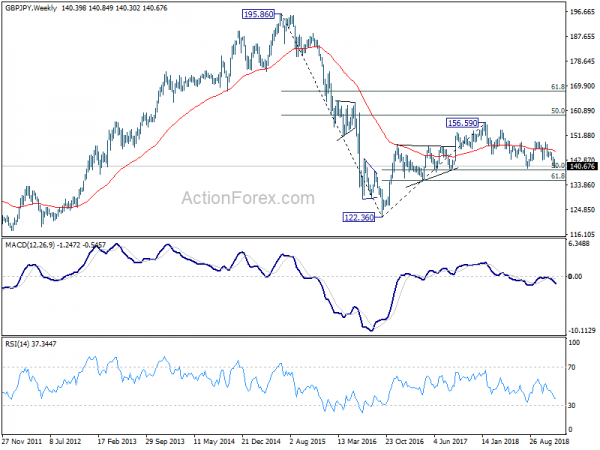

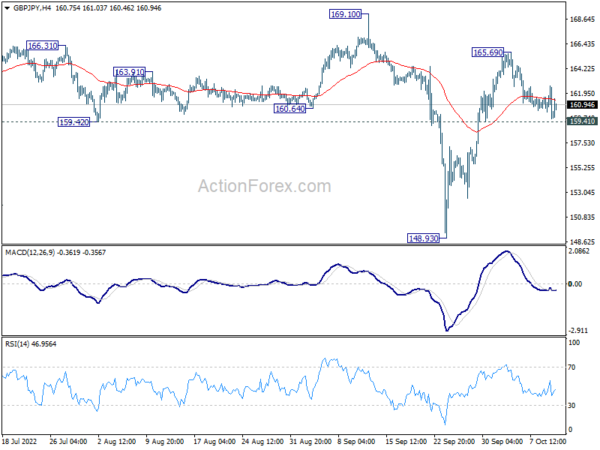

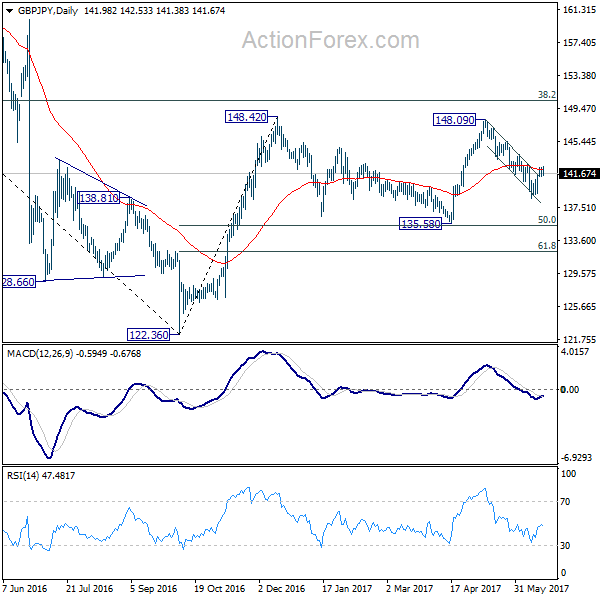

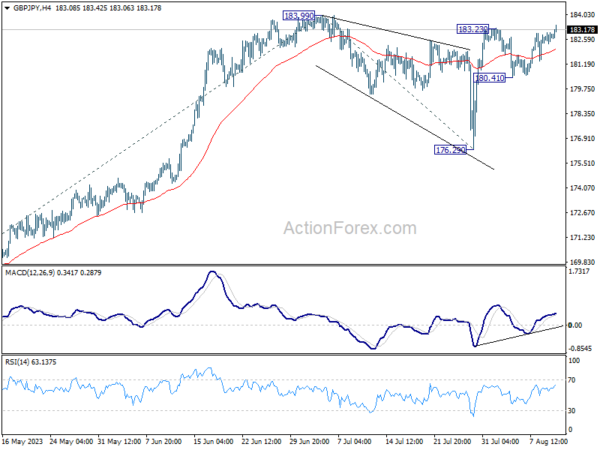

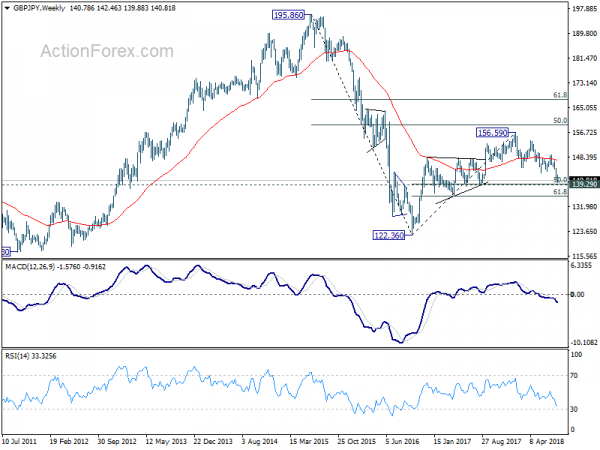

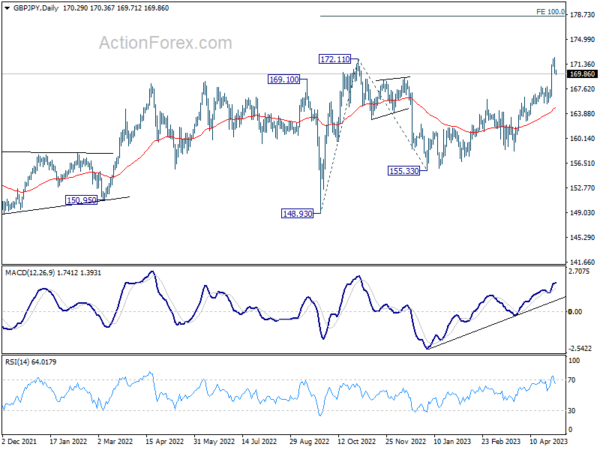

GBP/JPY is staying in range of 135.38/137.83 and intraday bias remains neutral. On the upside, above 137.83 will resume the rebound from 133.03 to retest 142.71 high. On the downside, firm break of 135.36 support will suggest that rebound from 133.03 has completed. Also, in this case fall from 142.71 is resuming. Intraday bias will be turned back to the downside for 133.03, and then 61.8% retracement of 123.94 to 142.71 at 131.11.

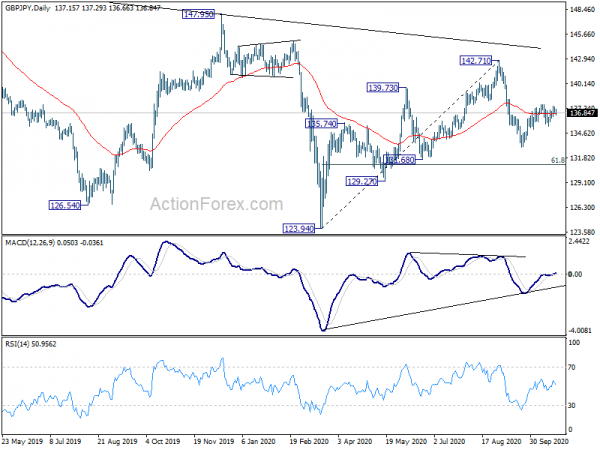

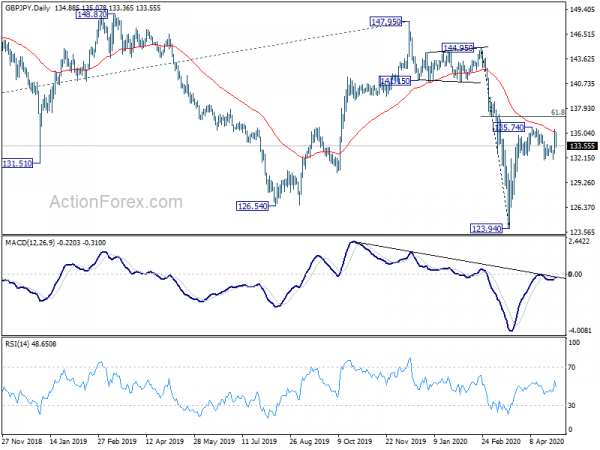

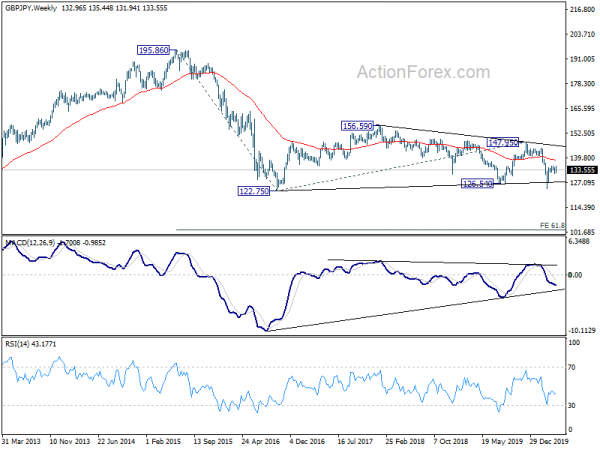

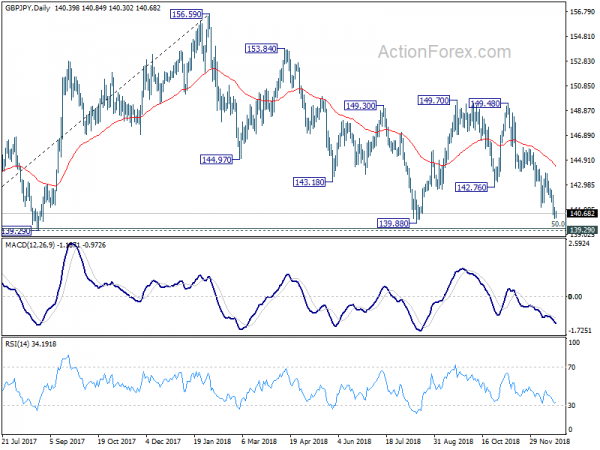

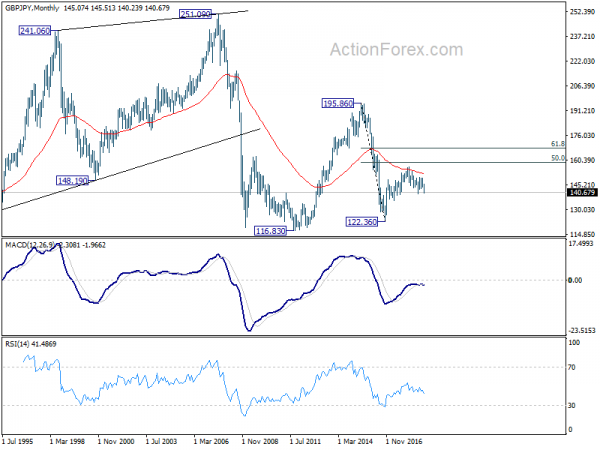

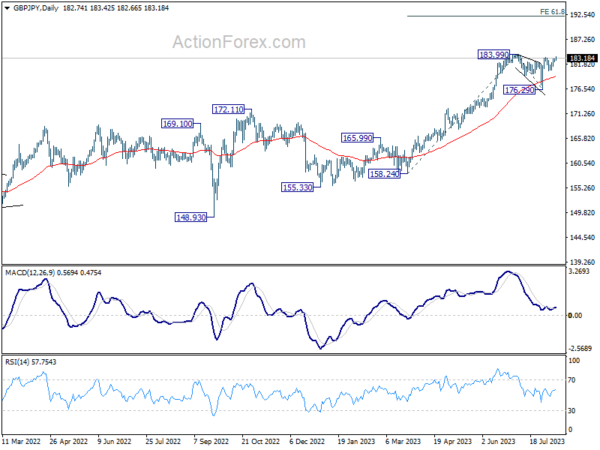

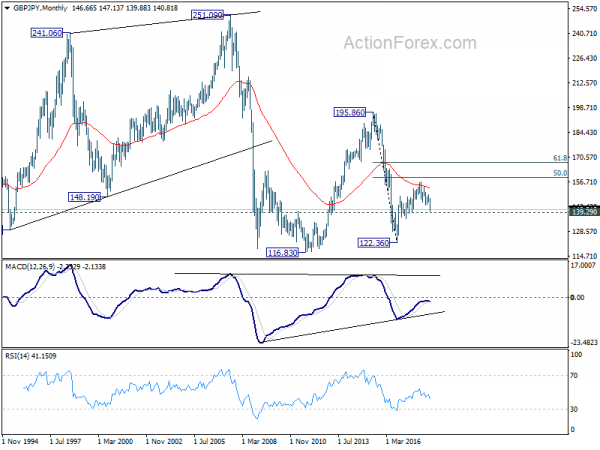

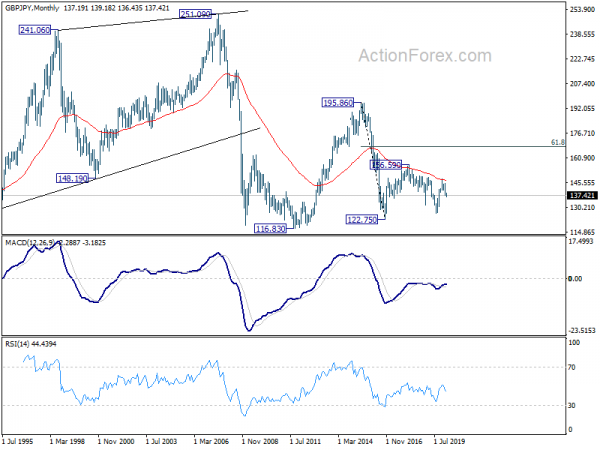

In the bigger picture, rise from 123.94 is seen only as a rising leg of the sideway consolidation pattern from 122.75 (2016 low). As long as 147.95 resistance holds, an eventual downside breakout remains in favor. However, firm break of 147.95 will raise the chance of long term bullish reversal. Focus will then be turned to 156.59 resistance for confirmation.