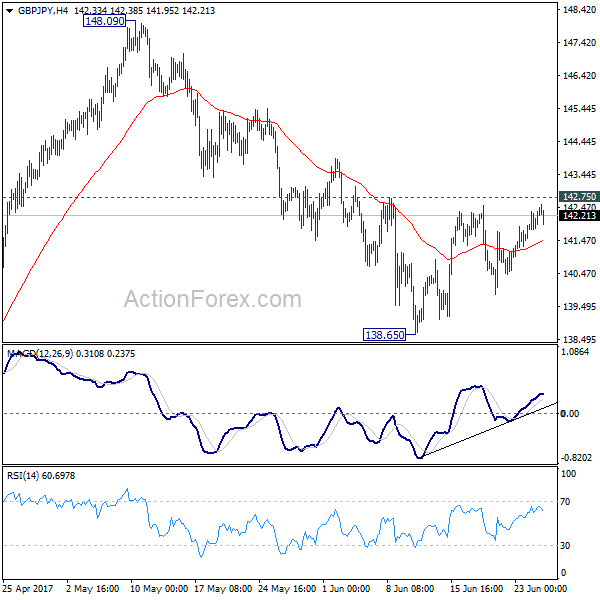

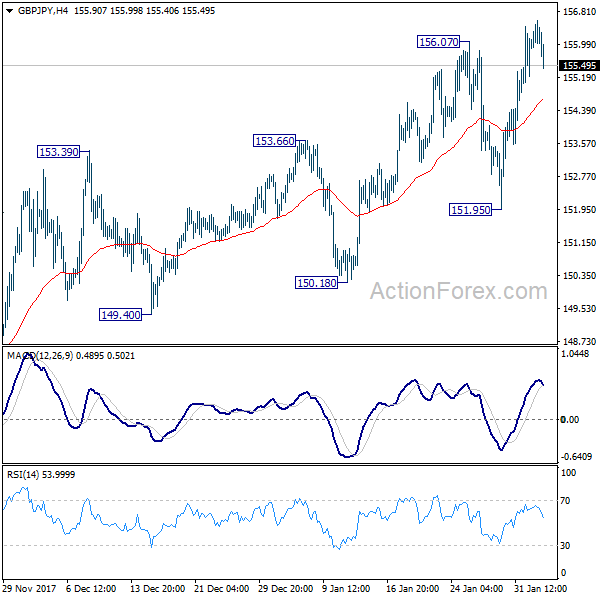

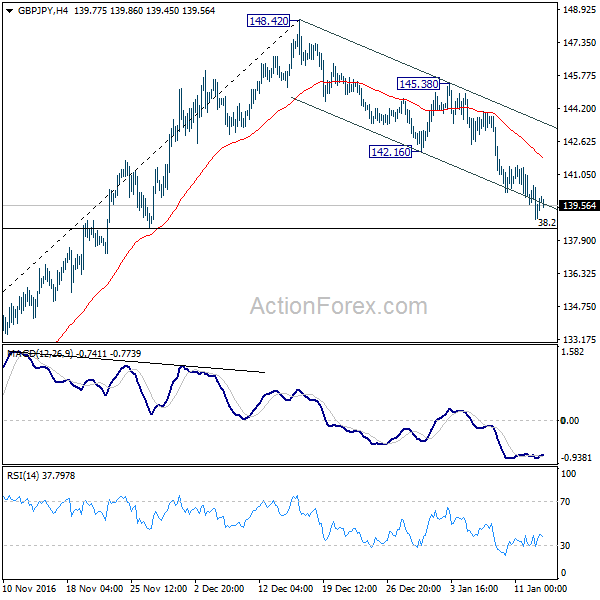

GBP/JPY dived to 148.43 last week but rebound strongly, after drawing support from 149.03 support. Corrective fall from 156.05 might have completed already. Initial bias stays mildly on the upside for 153.46 resistance first. Firm break there will pave the way to retest 156.05 high. On the downside, however, break of 150.71 minor support will turn bias back to the downside for 148.43 again.

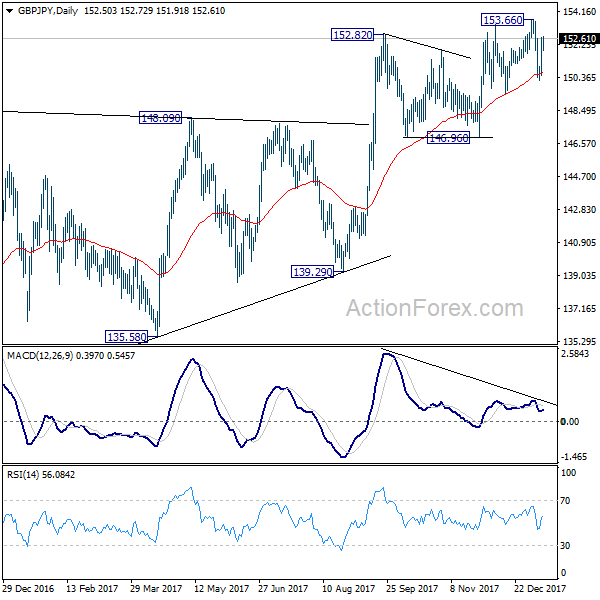

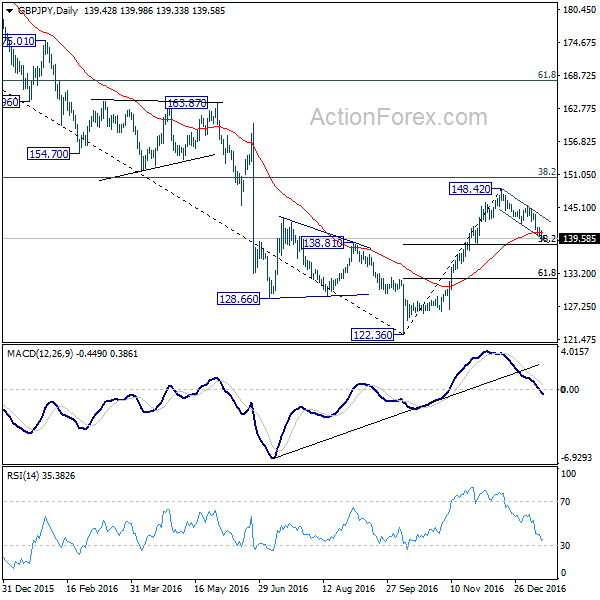

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). Focus remains on 156.59 resistance (2018 high). Sustained break there should confirm long term bullish trend reversal. Next target is 61.8% retracement of 195.86 (2015 high) to 122.75 at 167.93. On the downside, sustained break of 149.03 support, however, will argue that rise from 123.94 has completed. Further break of 142.71 would open up the bearish case for retesting 122.75 low.

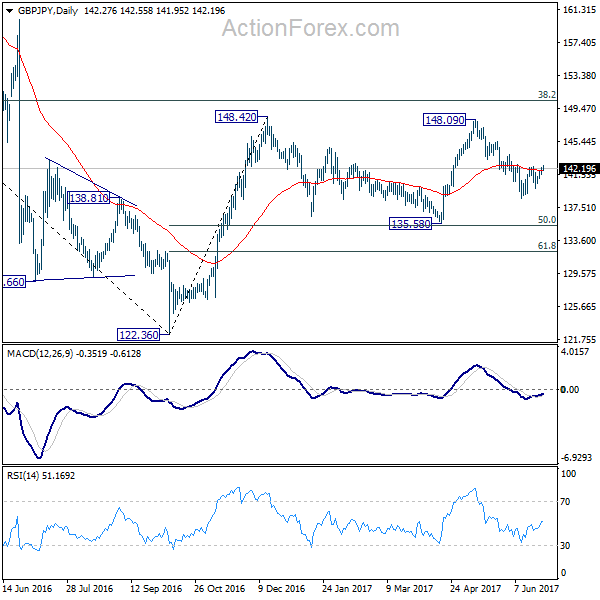

In the longer term picture, the strong break of 55 months EMA was an early sign of long term bullish reversal. Firm break of 156.69 resistance should now confirm the start of an up trend for 195.86 (2015 high).