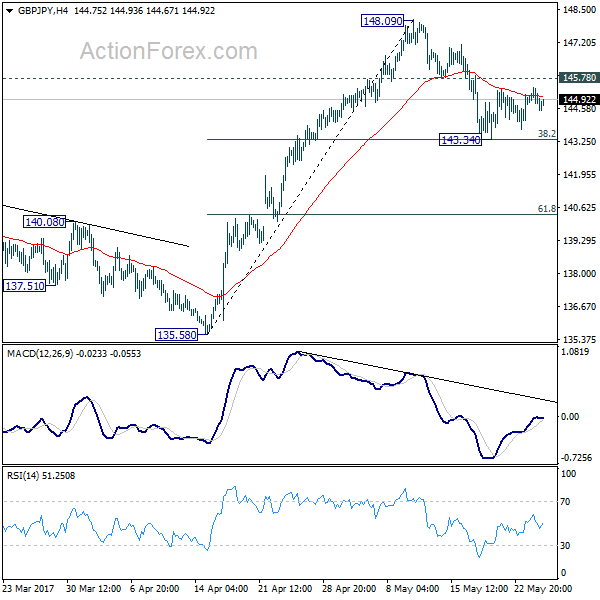

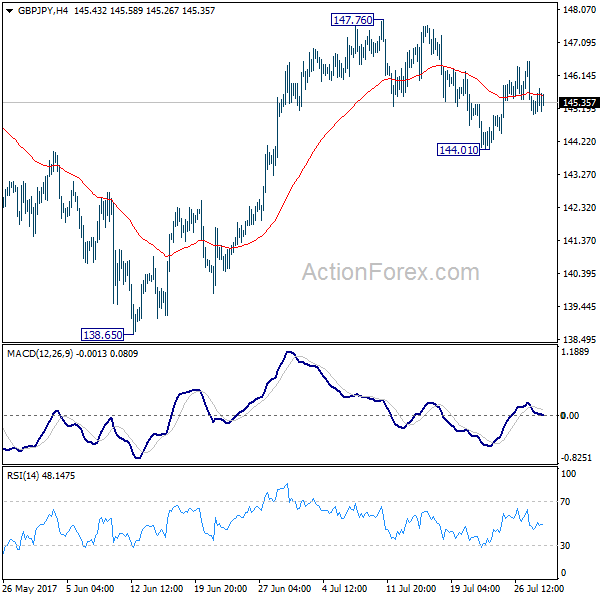

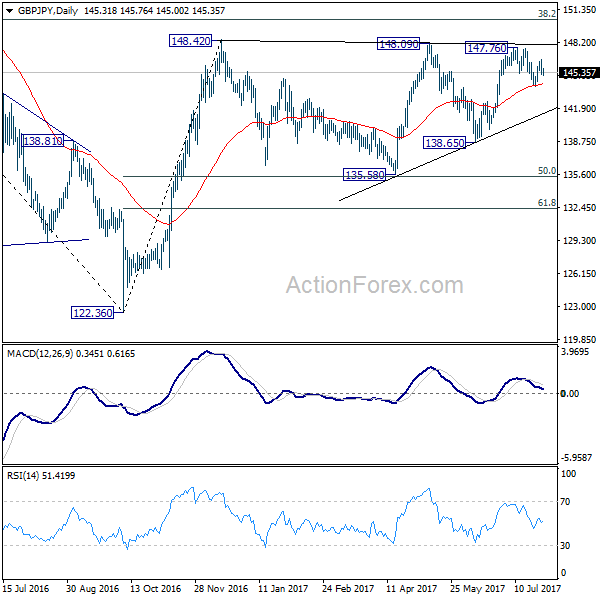

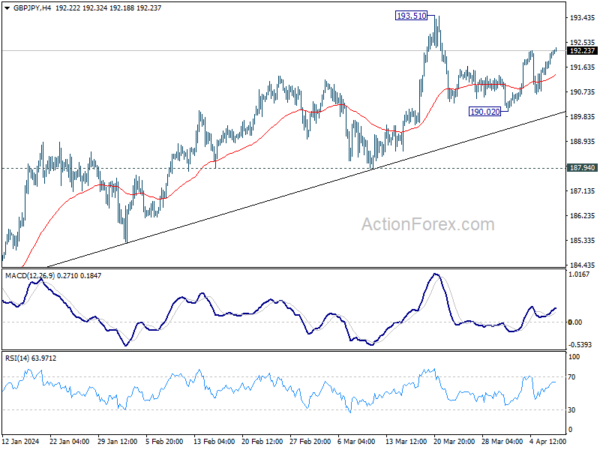

Daily Pivots: (S1) 144.29; (P) 144.85; (R1) 145.21; More….

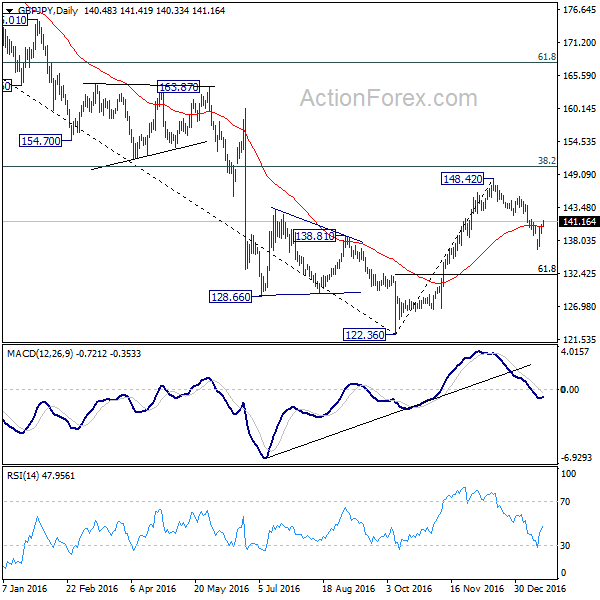

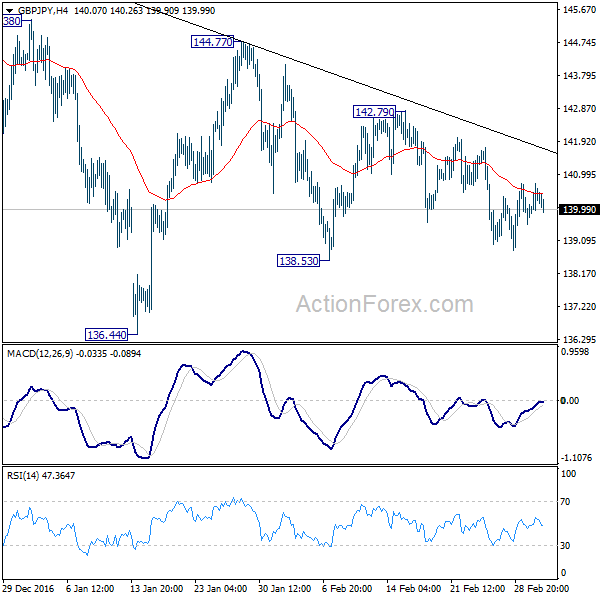

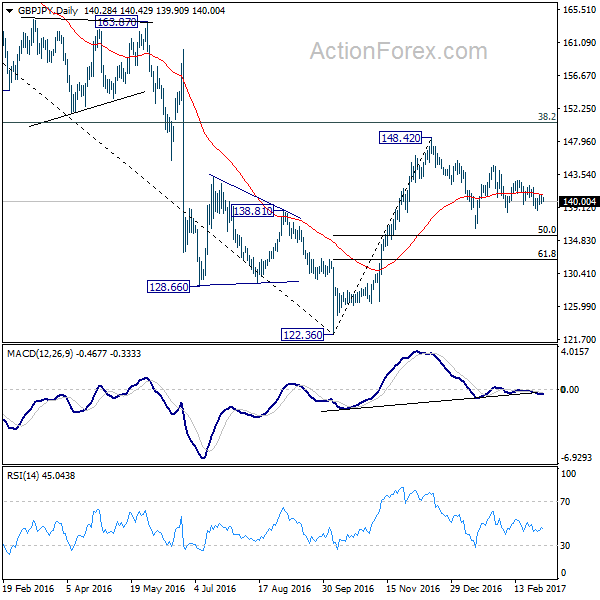

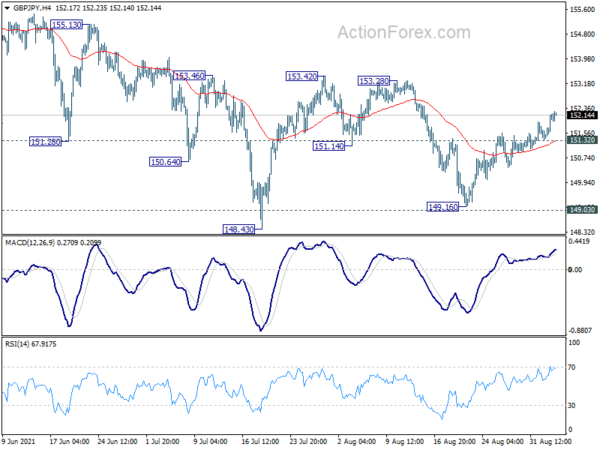

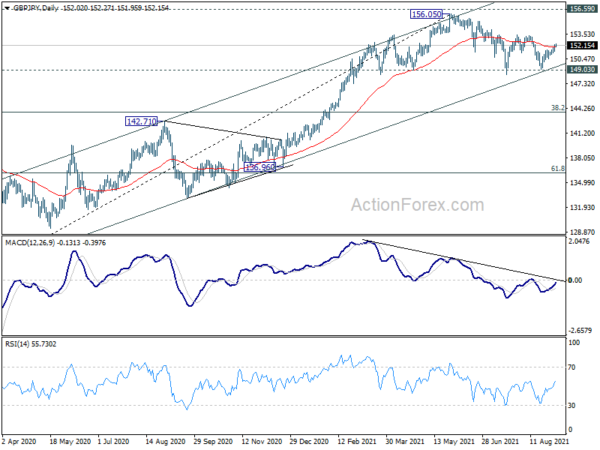

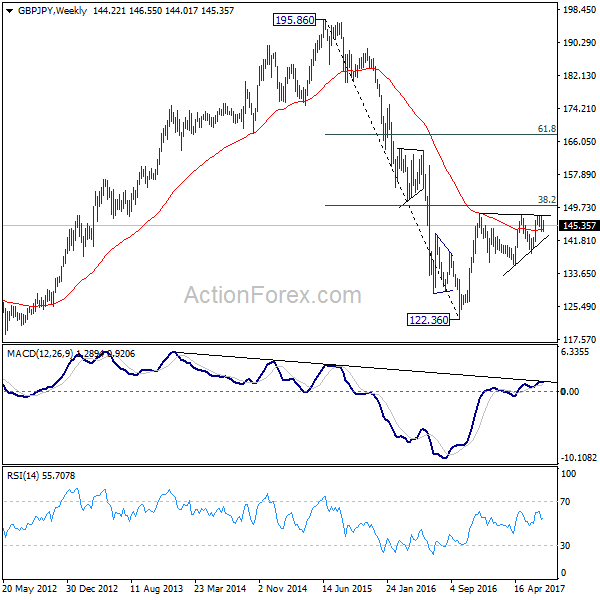

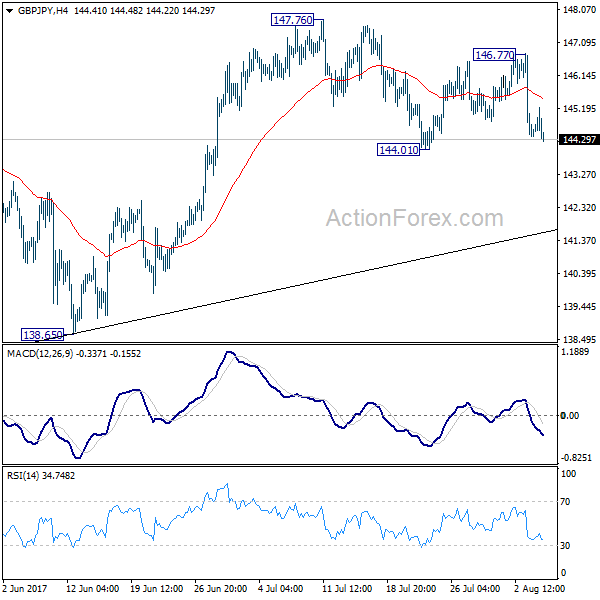

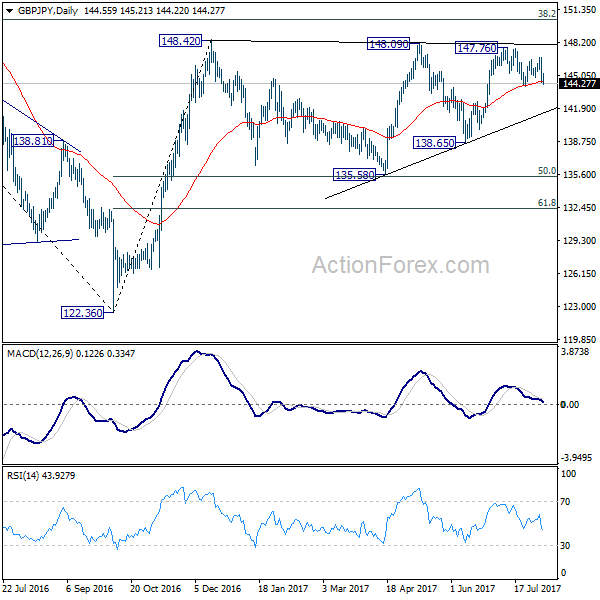

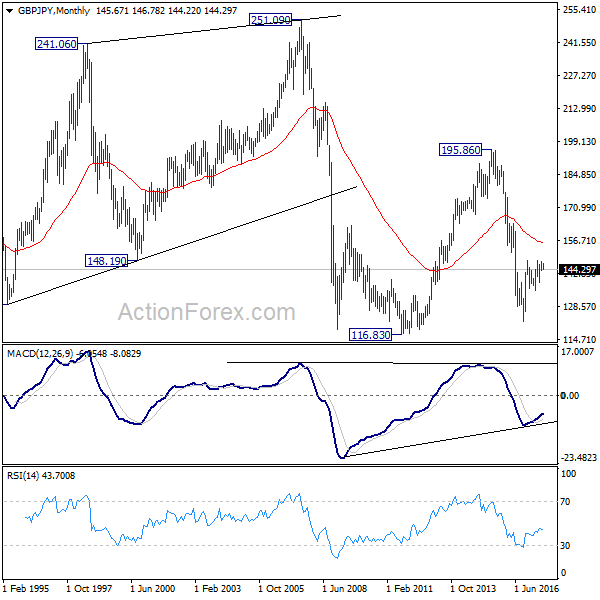

Intraday bias in GBP/JPY remains neutral as it’s staying in tight range of 143.34/145/78. The corrective pattern from 148.09 short term top could extend. On the upside, above 145.78 will turn bias back to the upside for retesting 148.09 first. Meanwhile, break of 143.34 will extend the pull back from 148.09 to 61.8% retracement at 140.35. Overall, we’d still expect the rise from 122.36 to resume after pull back from 148.09 completes. Break of 148.09 will target 150.42 long term fibonacci level first.

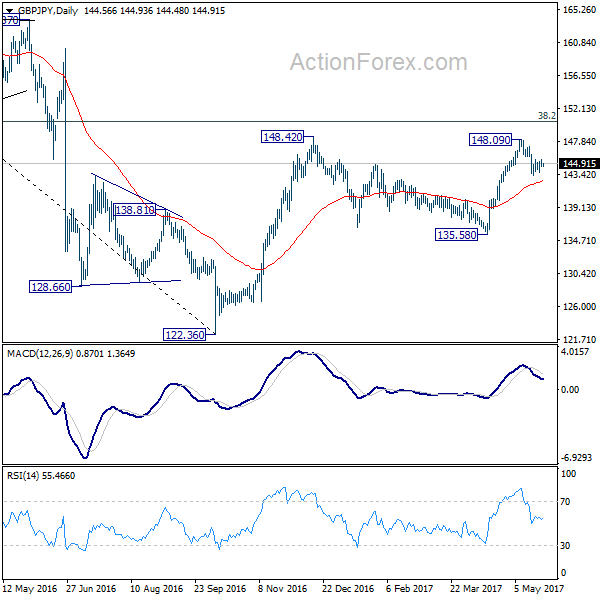

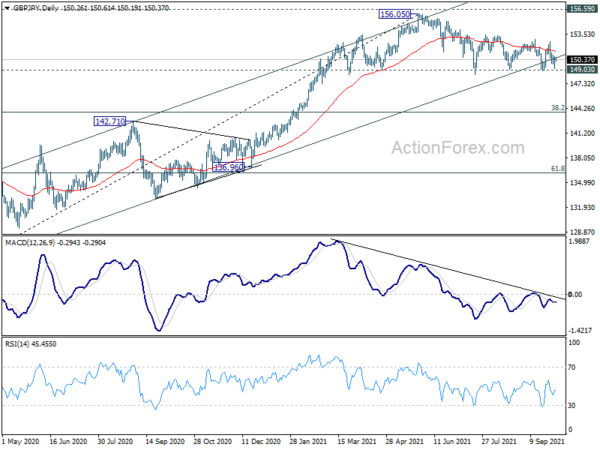

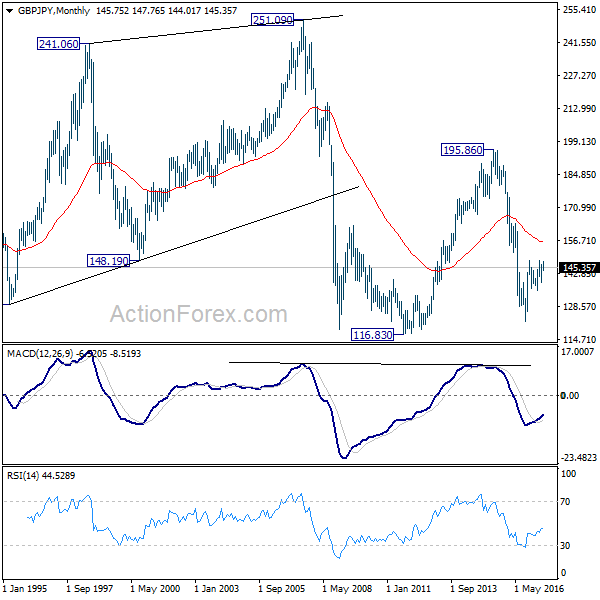

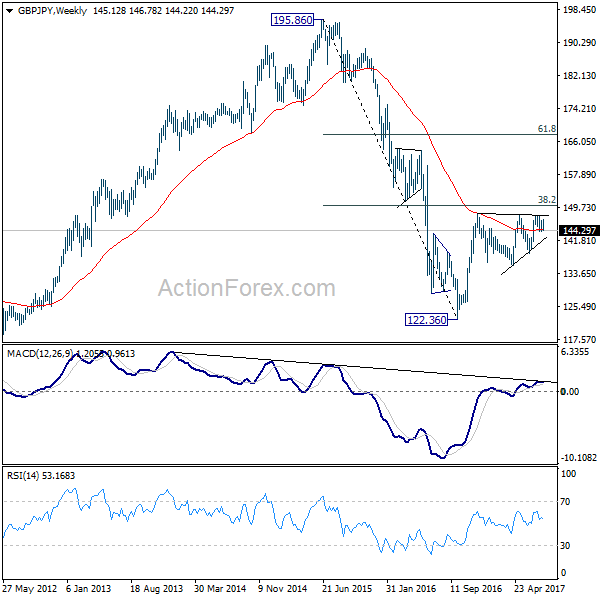

In the bigger picture, based on current momentum, rise from 122.36 bottom should be developing into a medium term move. Break of 38.2% retracement of 195.86 to 122.36 at 150.42 should pave the way to 61.8% retracement at 167.78. This will now be the favored case as long as 135.58 support holds.