Daily Pivots: (S1) 163.09; (P) 164.28; (R1) 164.93; More…

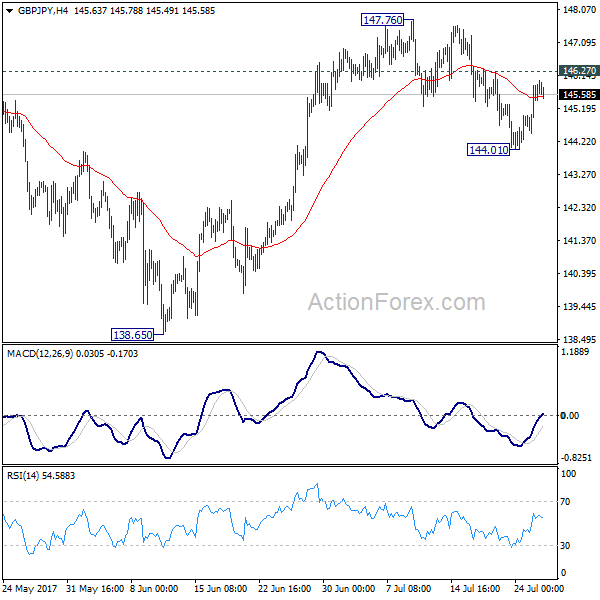

Intraday bias in GBP/JPY remains neutral for the moment. On the upside, break of 165.99 resume the whole rebound from 155.33 to 169.26 resistance next. On the downside, however, break of 162.95 minor support will mix up the outlook and turn intraday bias to the downside for 158.24 support instead.

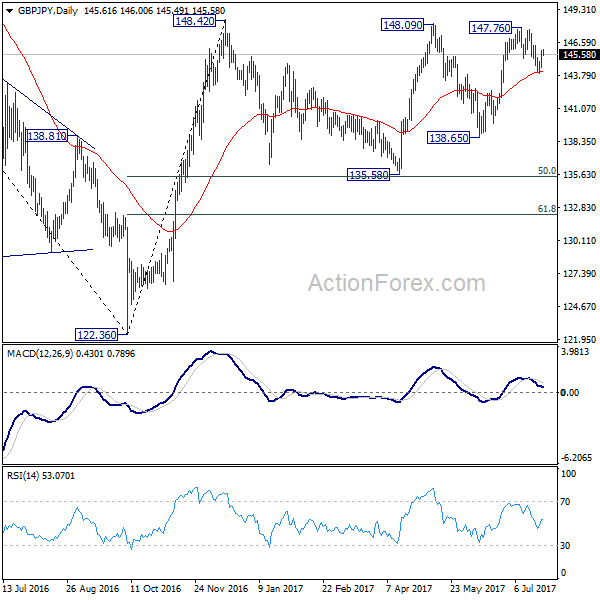

In the bigger picture, as long as 38.2% retracement of 123.94 (2020 low) to 172.11 (2022 high) at 153.70 holds, medium term bullishness is retained. That is, larger up trend from 123.94 (2020 low) is still in progress. Break of 172.11 high to resume such up trend is expected at a later stage.