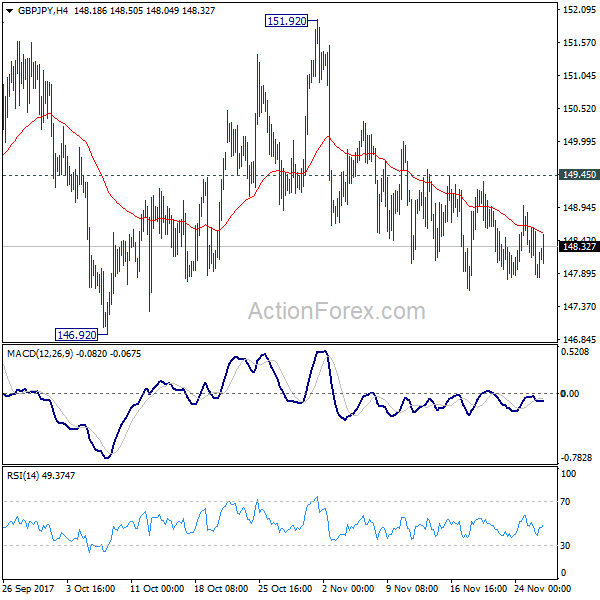

Daily Pivots: (S1) 141.52; (P) 142.03; (R1) 142.73; More

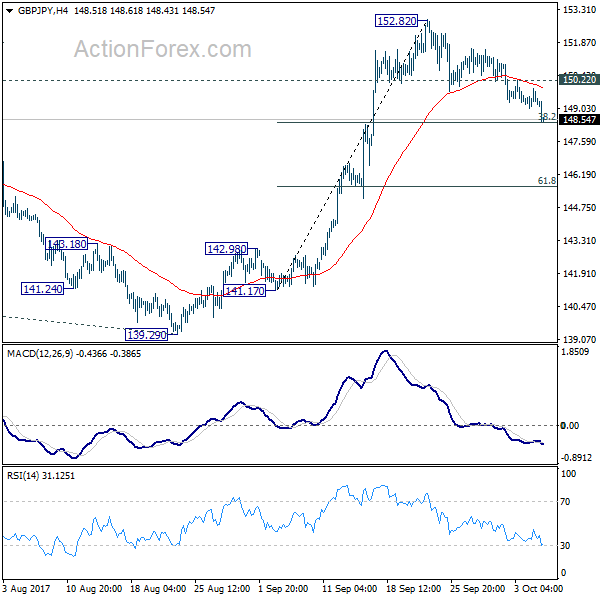

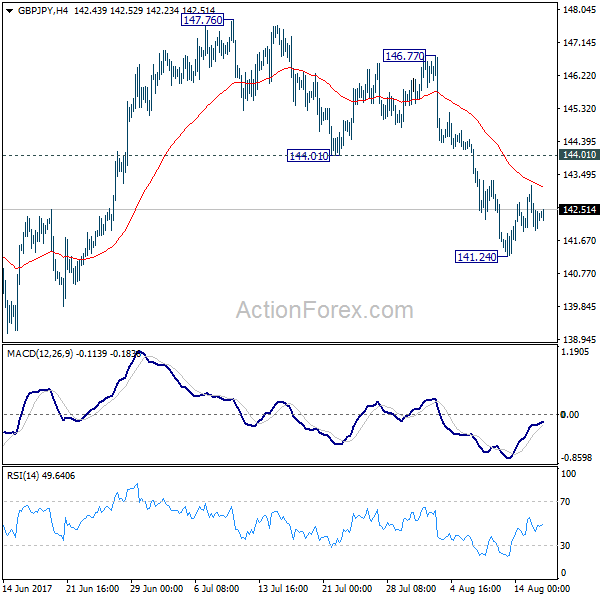

The break of 143.18 resistance in GBP/JPY indicates that fall from 147.76 has completed at 139.29 already, on bullish convergence condition in 4 hour MACD. Intraday bias is now turned back to the upside for 147.76/148.42 resistance zone. Overall, price actions from 148.42 are seen as a sideway consolidation pattern. Break of 141.17 support will turn bias to the downside and bring another fall. But downside should be contained by 135.58 cluster support to bring rebound.

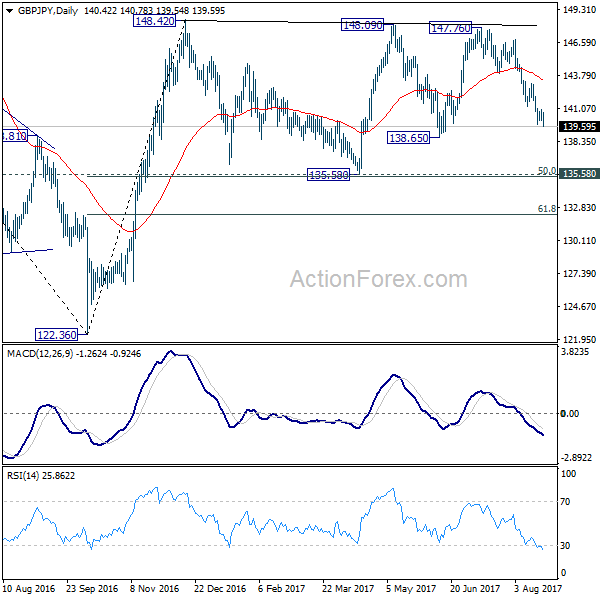

In the bigger picture, the sideway pattern from 148.42 is still unfolding. In case of deeper fall, we’d expect strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside. Medium term rise from 122.36 is expected to resume later. And break of 38.2% retracement of 196.85 to 122.36 at 150.43 will carry long term bullish implications. However, firm break of 135.58/39 will dampen the bullish view and turn focus back to 122.36 low.