Daily Pivots: (S1) 1.0489; (P) 1.0565; (R1) 1.0603; More…

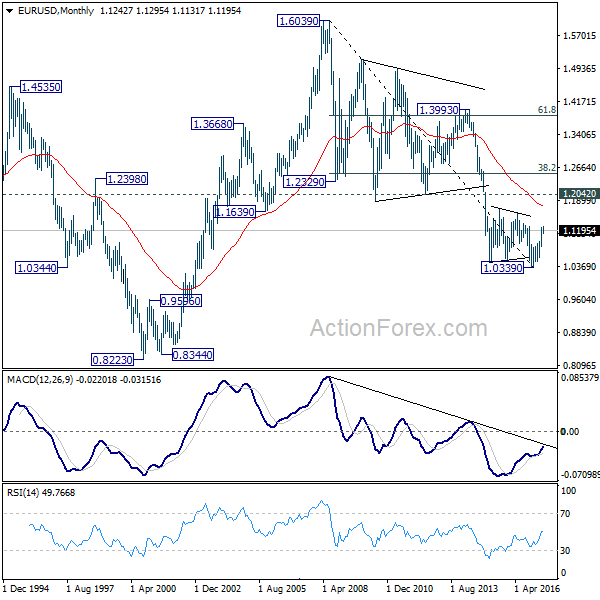

Focus stays on 1.0518 minor support in EUR/USD. Firm break there will confirm that corrective recovery from 1.0447 has completed at 1.0639, after hitting near term falling trend line. Larger decline from 1.1274 should then be resumed through 1.0447 to 1.0119 fibonacci level. On the upside, though, above 1.0639 will resume the recovery to 1.0764 resistance.

In the bigger picture, fall from 1.1274 medium term top could still be a correction to rise from 0.9534 (2022 low). But chance of a complete trend reversal is rising. In either case, current fall should target 61.8% retracement of 0.9534 to 1.1274 at 1.0199 next. For now, risk will stay on the downside as long as 55 D EMA (now at 1.0709) holds, in case of rebound.