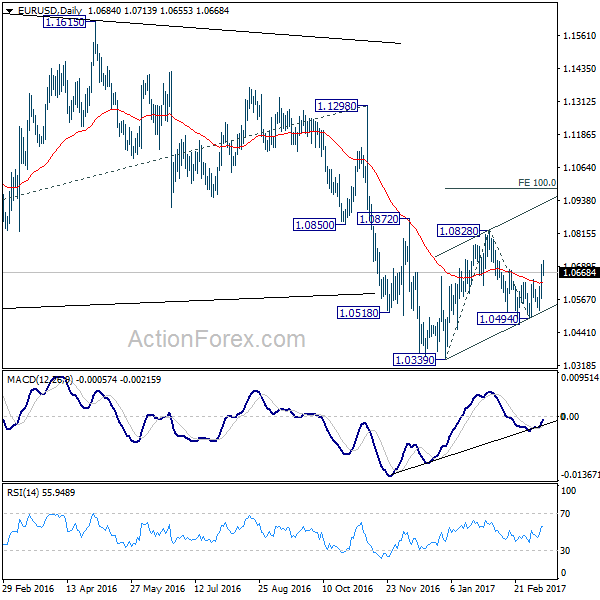

Daily Pivots: (S1) 1.0823; (P) 1.0860; (R1) 1.0889; More…

Intraday bias in EUR/USD stays neutral at this point, as consolidation continues below 1.0984. In case of deeper retreat, downside should be contained by 1.0755 resistance turned support to bring another rally. On the upside, above 1.0894 will resume the rebound from 1.0447 to 61.8% retracement of 1.1274 to 1.0447 at 1.0958 next.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is tentatively seen as the second leg. Hence while further rally could be seen, upside should be limited by 1.1274 to bring the third leg of the pattern. However, break of 1.0447 will resume the fall to 61.8% retracement of 0.9543 to 1.1274 at 1.0199.