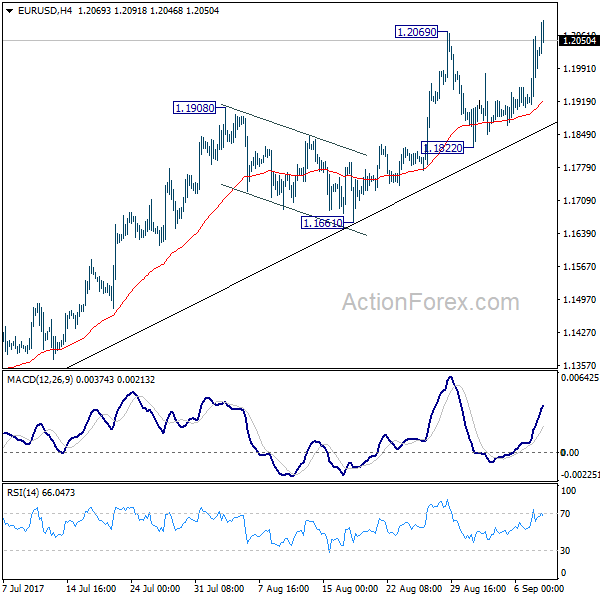

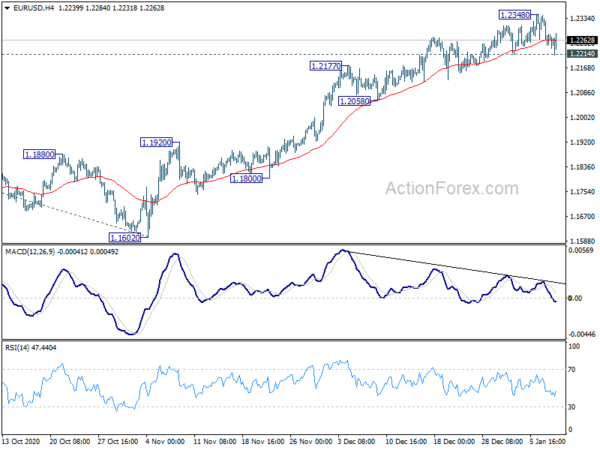

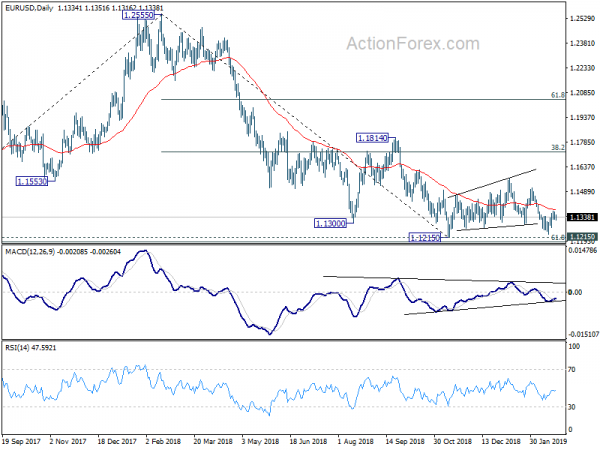

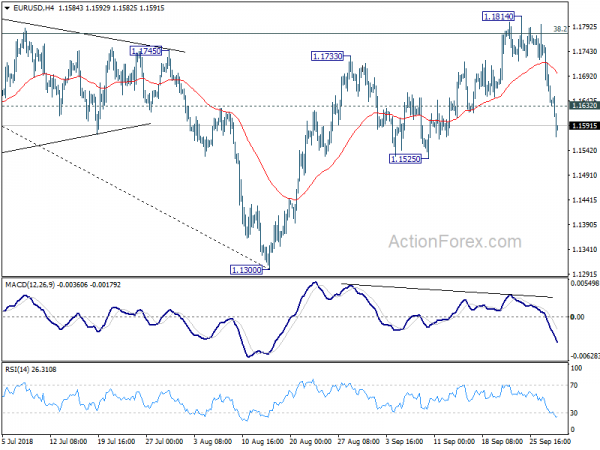

Daily Pivots: (S1) 1.1936; (P) 1.1997 (R1) 1.2082; More…

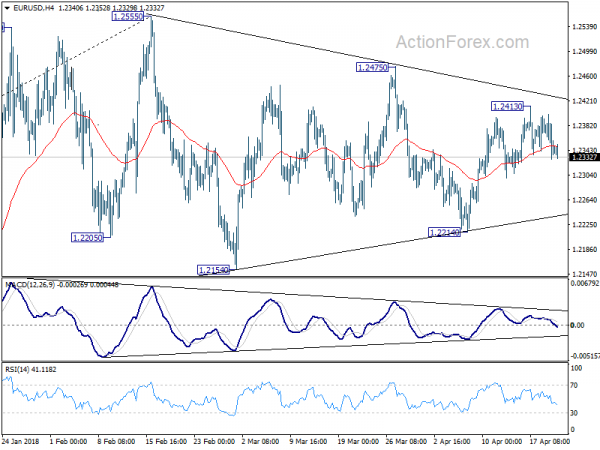

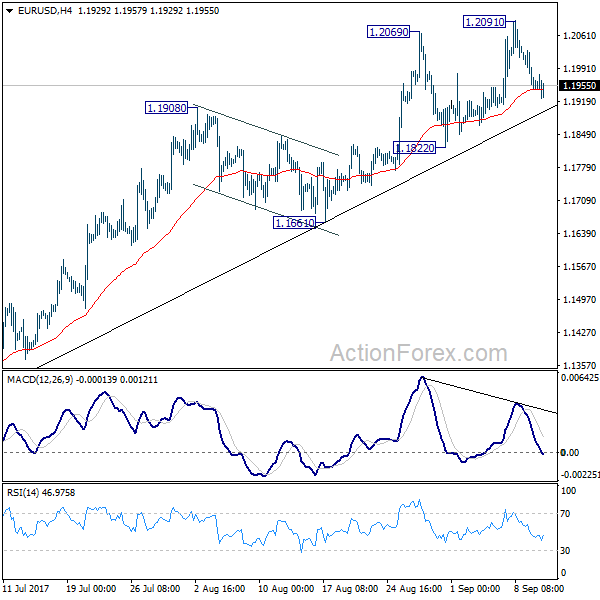

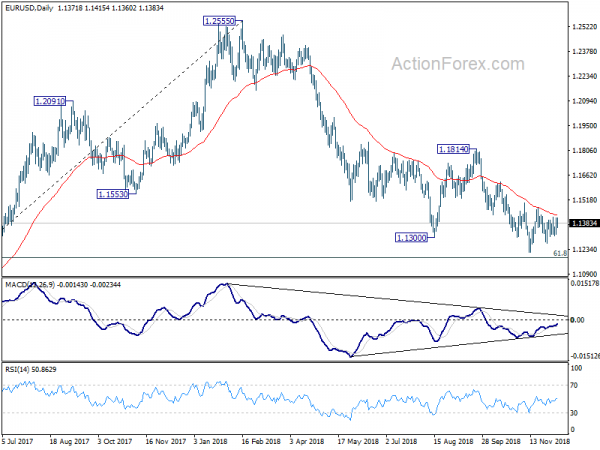

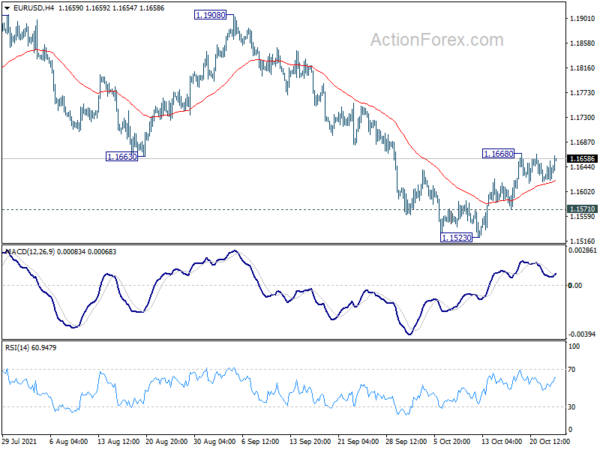

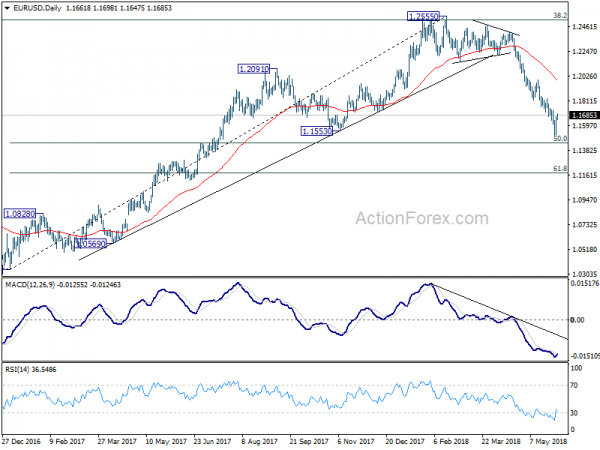

Break of 1.2069 resistance indicates that medium term rise in EUR/USD from 1.0339 is finally resuming. Intraday bias is back on the upside. Current rise should target next key fibonacci level at 1.2516. On the downside, break of 1.1822 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

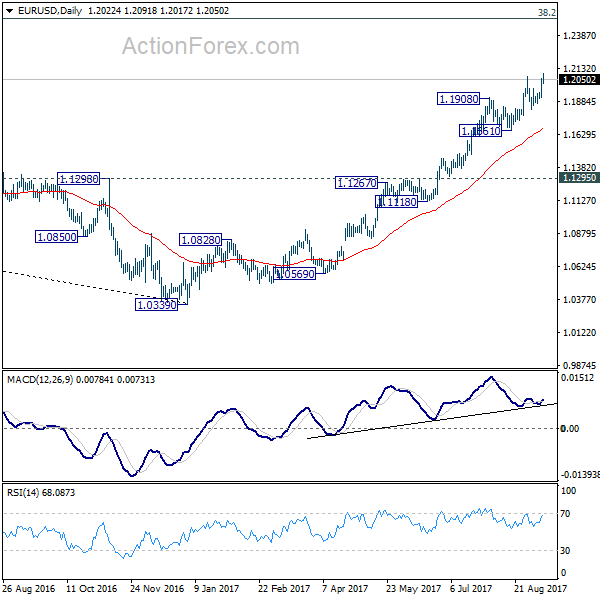

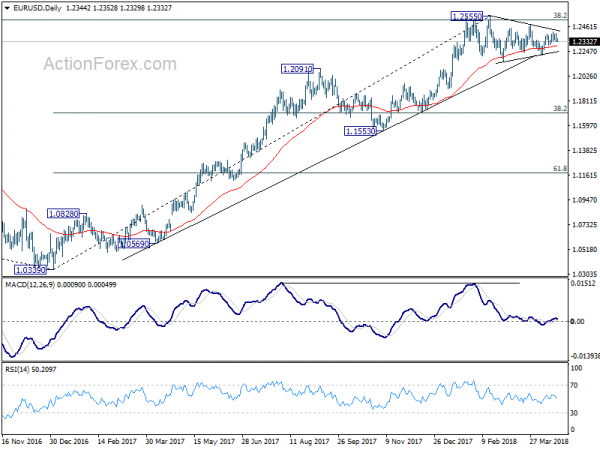

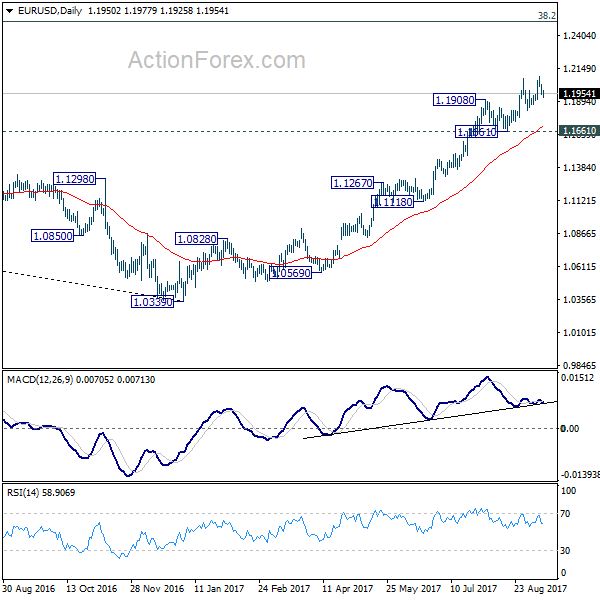

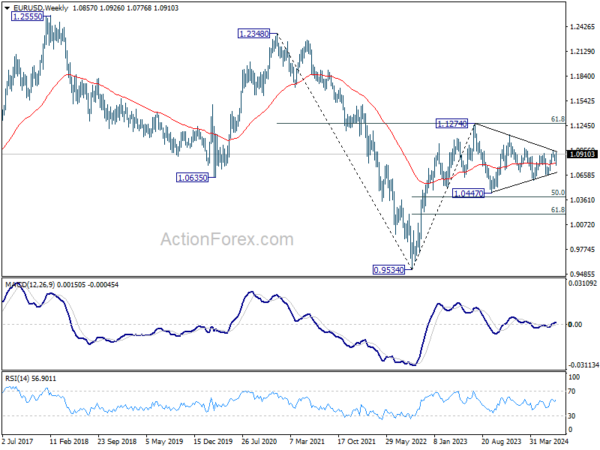

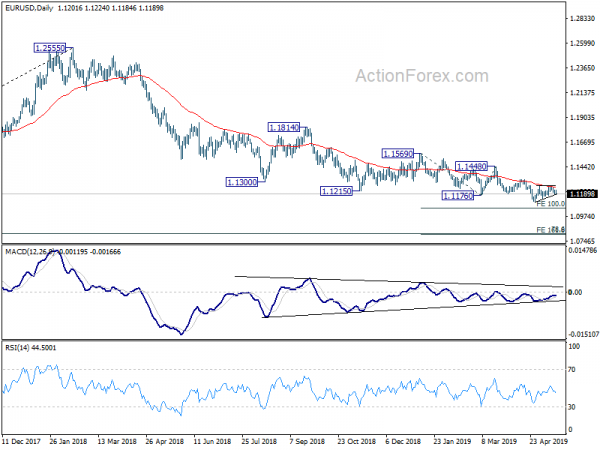

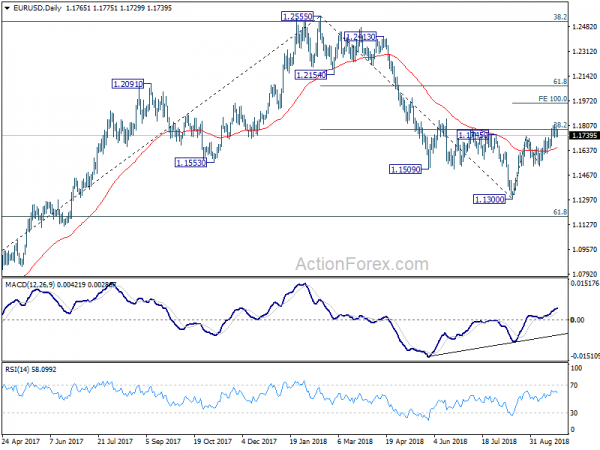

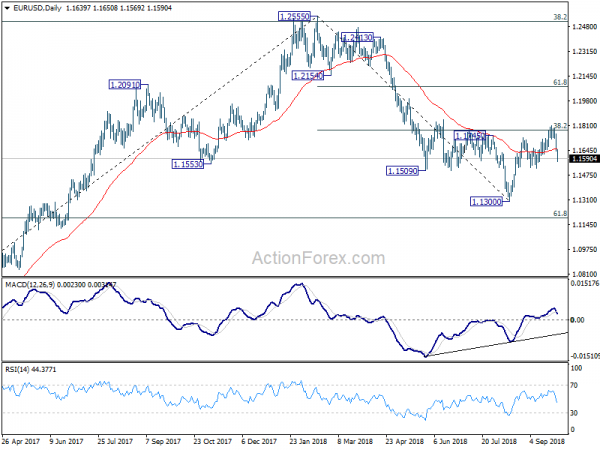

In the bigger picture, an important bottom was formed at 1.0339 on bullish convergence condition in weekly MACD. Sustained trading above 55 month EMA (now at 1.1774) will pave the way to key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. While rise from 1.0339 is strong, there is no confirmation that it’s developing into a long term up trend yet. Hence, we’ll be cautious on strong resistance from 1.2516 to limit upside. For now, medium term outlook will remain bullish as long as 1.1295 support holds, in case of pull back.