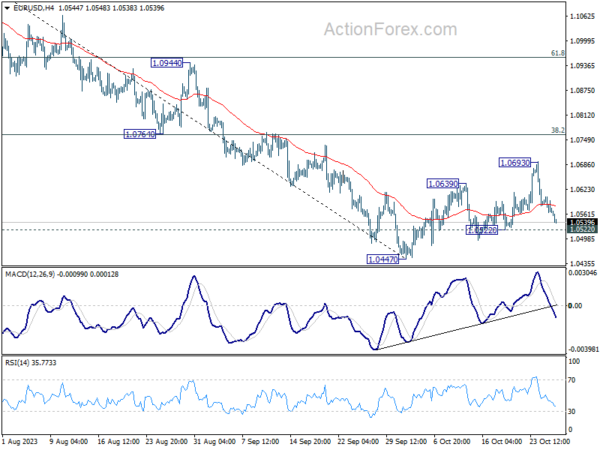

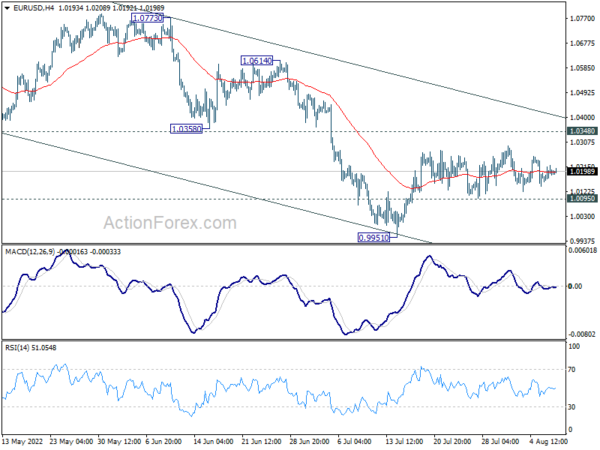

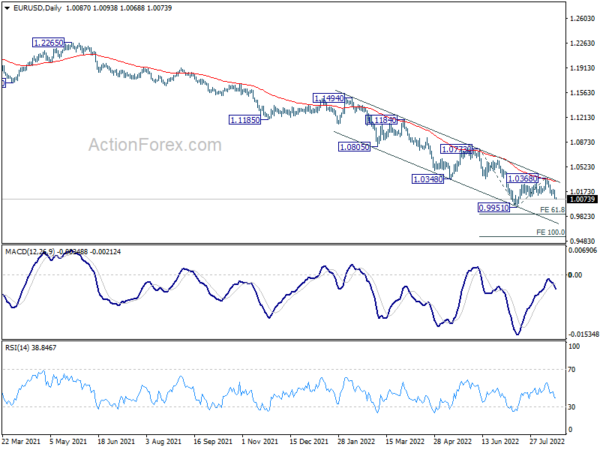

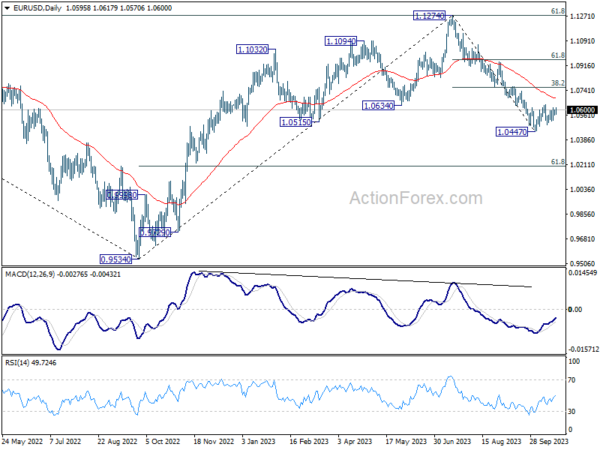

Daily Pivots: (S1) 1.0552; (P) 1.0580; (R1) 1.0593; More…

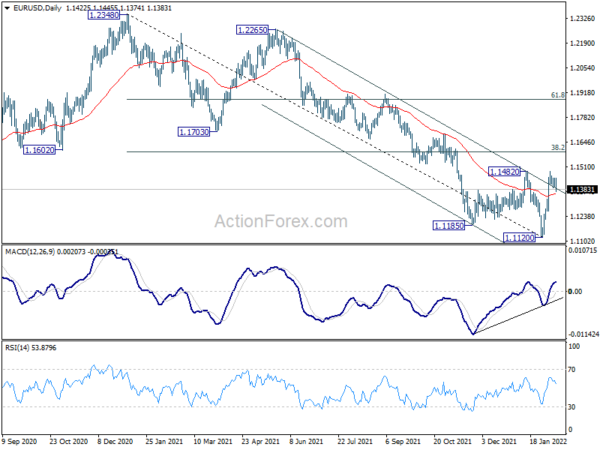

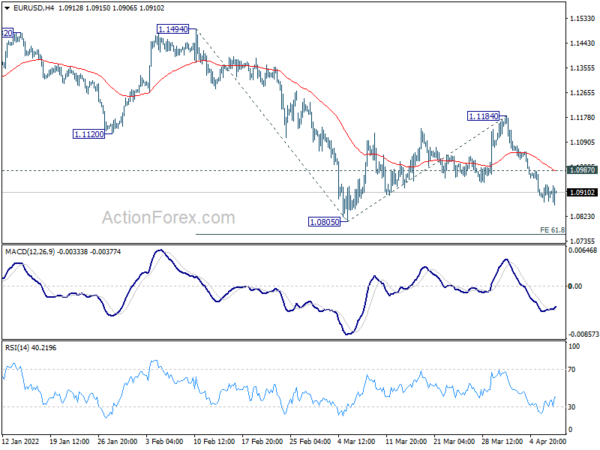

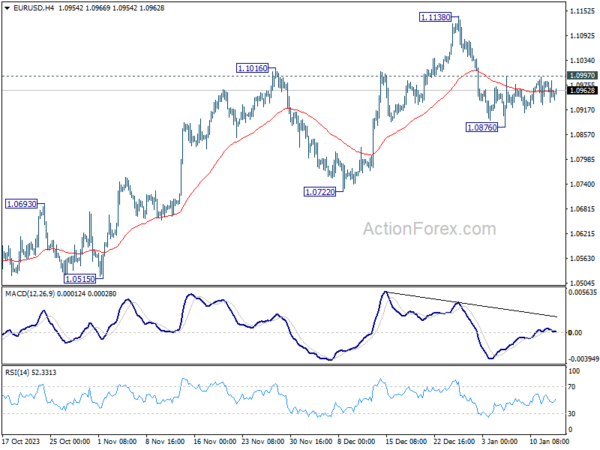

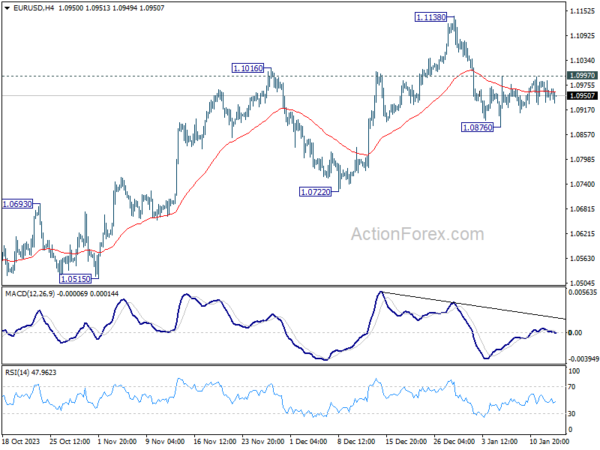

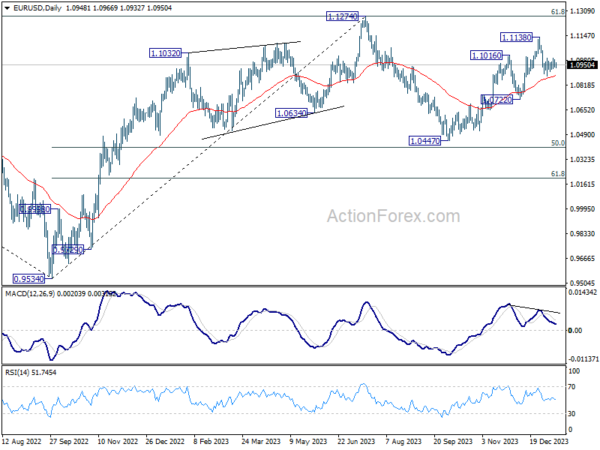

Intraday bias in EUR/USD stays neutral first. On the downside, break of 1.0522 support will confirm rejection by 55 D EMA, and retain near term bearishness. Intraday bias will be back on the downside for 1.0447. Break there will resume larger fall from 1.1274. On the upside, above 1.0693 will resume the rebound from 1.0447 to 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763).

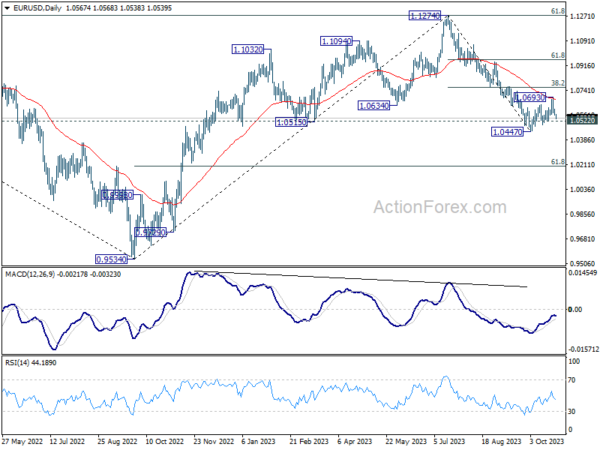

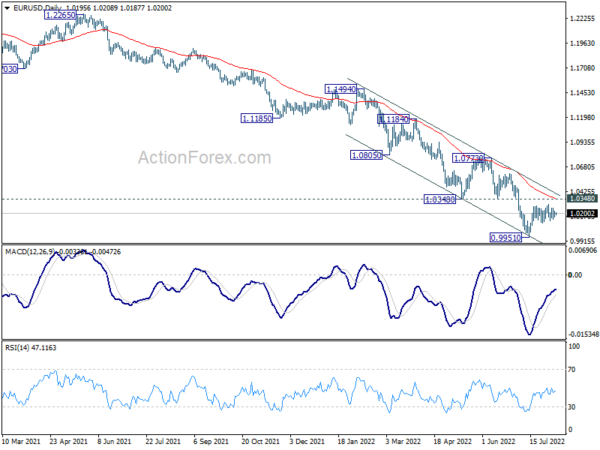

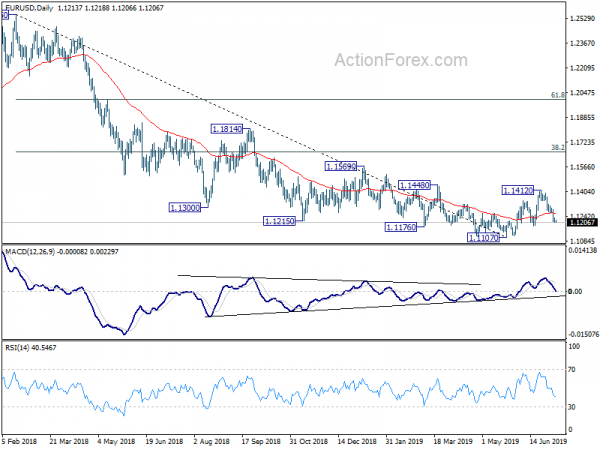

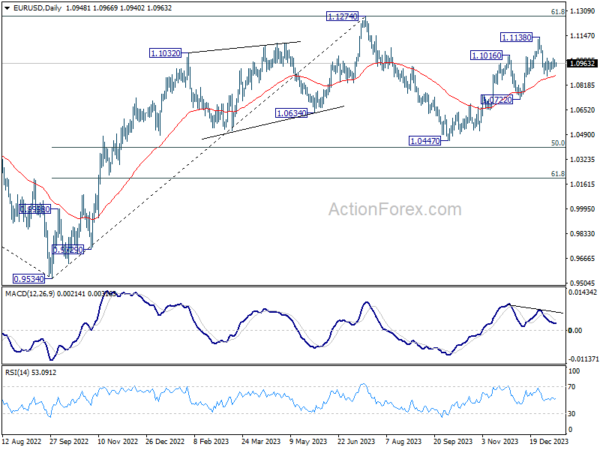

In the bigger picture, fall from 1.1274 medium term top could still be a correction to rise from 0.9534 (2022 low). But chance of a complete trend reversal is rising. In either case, current fall should target 61.8% retracement of 0.9534 to 1.1274 at 1.0199 next. For now, risk will stay on the downside as long as 55 D EMA (now at 1.0684) holds, in case of rebound.