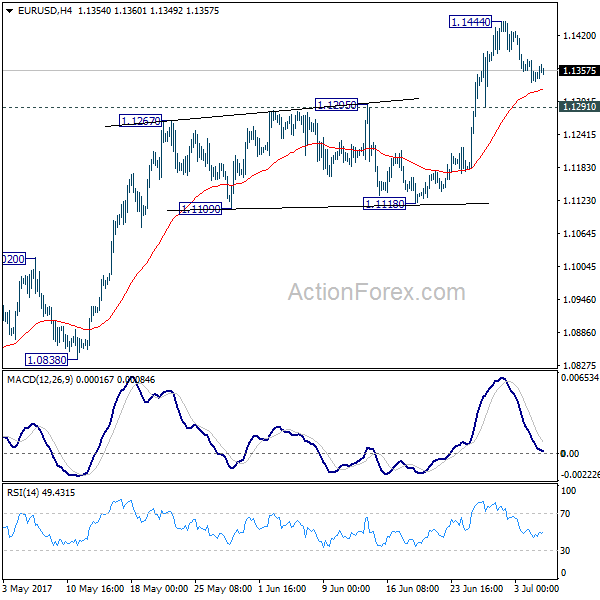

Daily Pivots: (S1) 1.1016; (P) 1.1082; (R1) 1.1209; More…

Intraday bias in EUR/USD remains on the upside as rebound from 1.0635 is in progress. Decisive break of 61.8% retracement of 1.1496 to 1.0635 at 1.1167 will raise the chance of larger trend reversal and turn focus to 1.1496 key resistance. On the downside, break of 1.0953 minor support will turn bias back to the downside for retesting 1.0635 low instead.

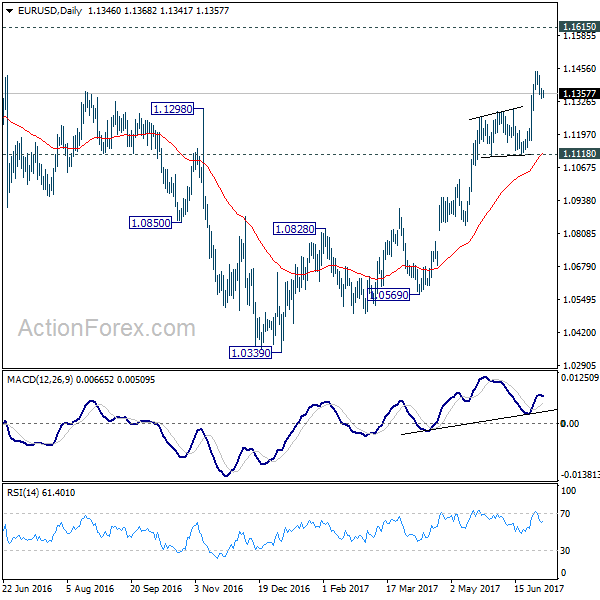

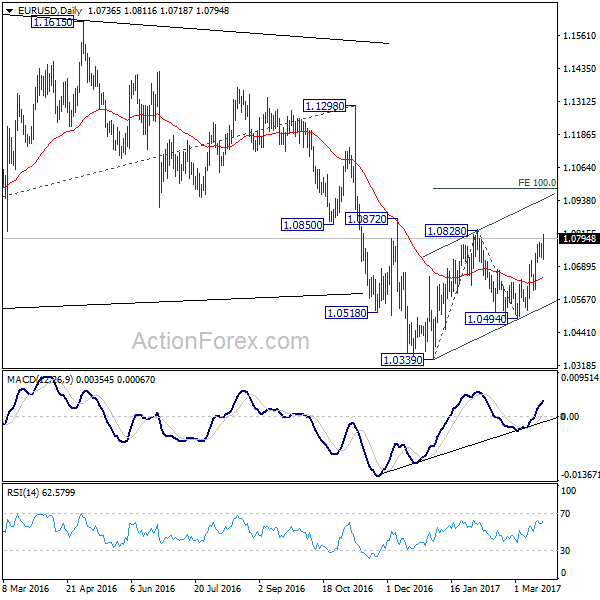

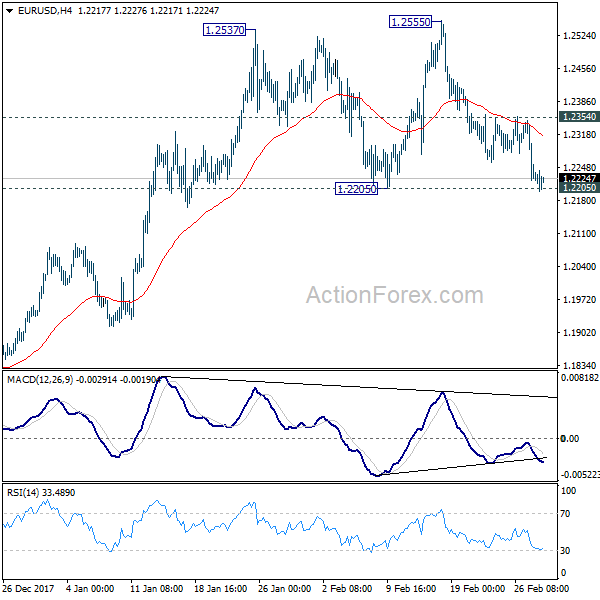

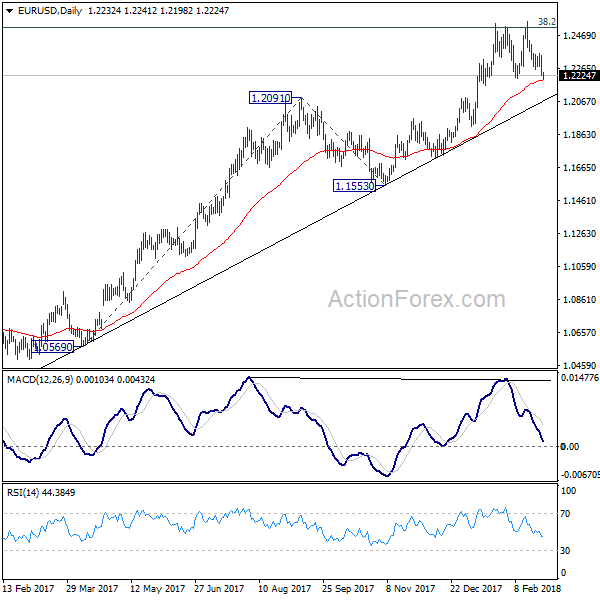

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.