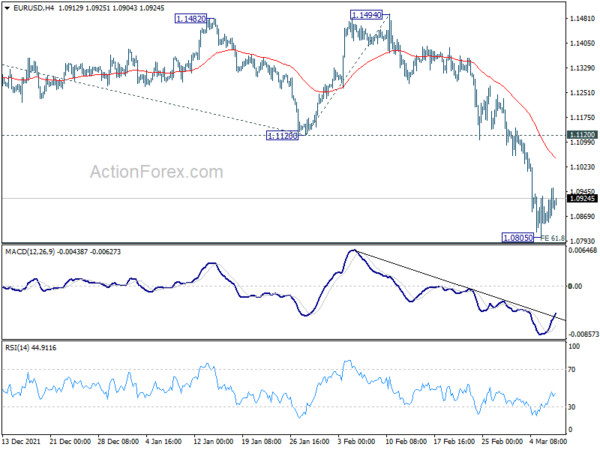

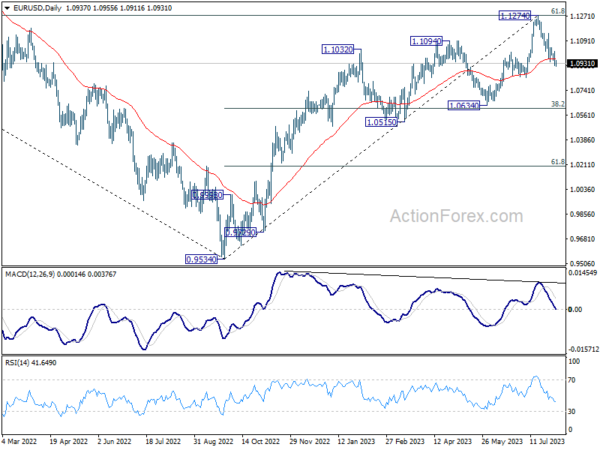

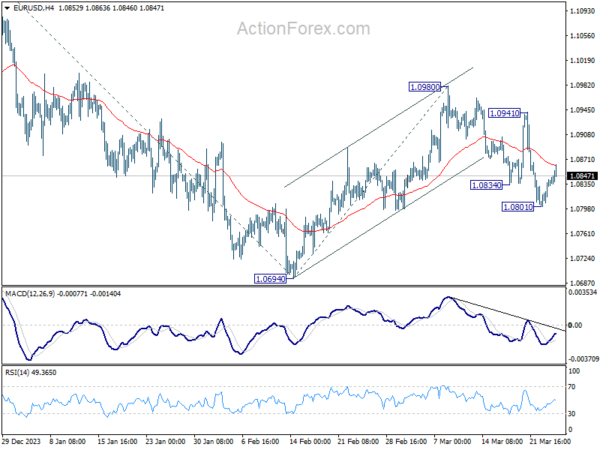

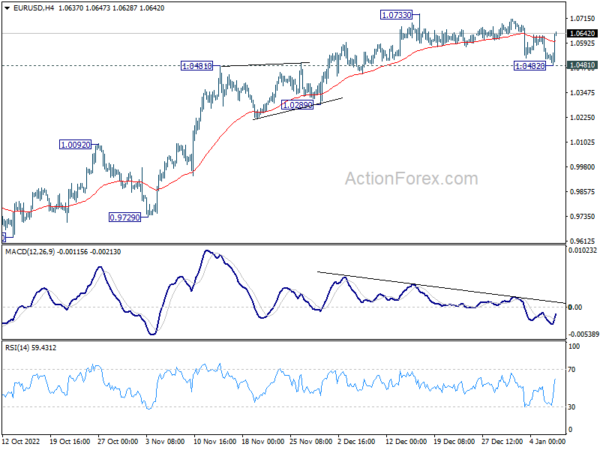

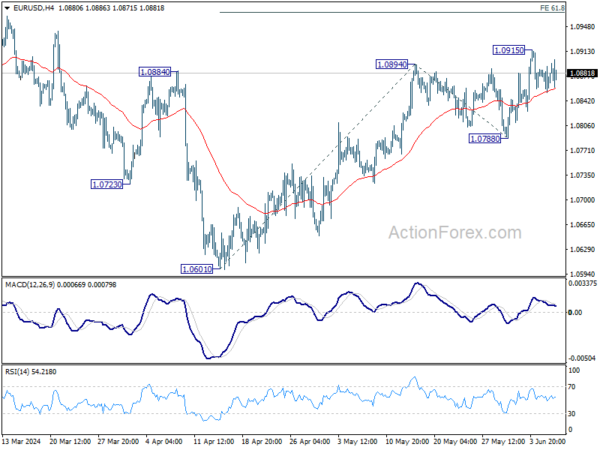

Daily Pivots: (S1) 1.0849; (P) 1.0903; (R1) 1.0958; More…

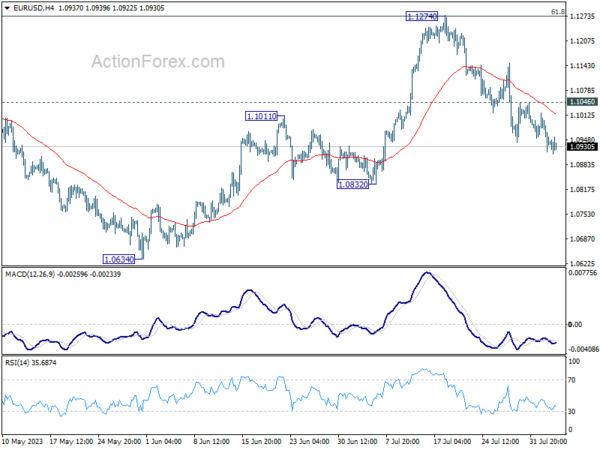

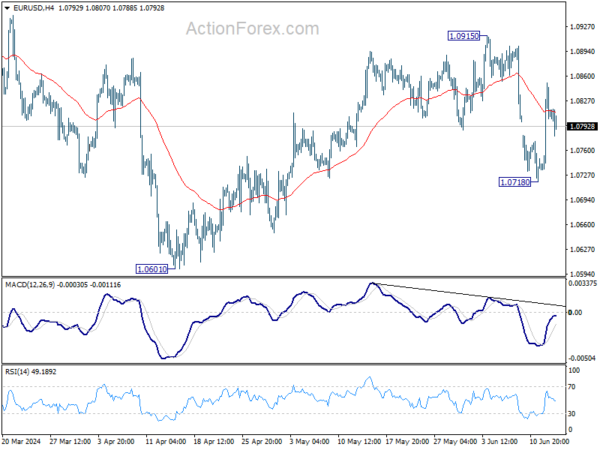

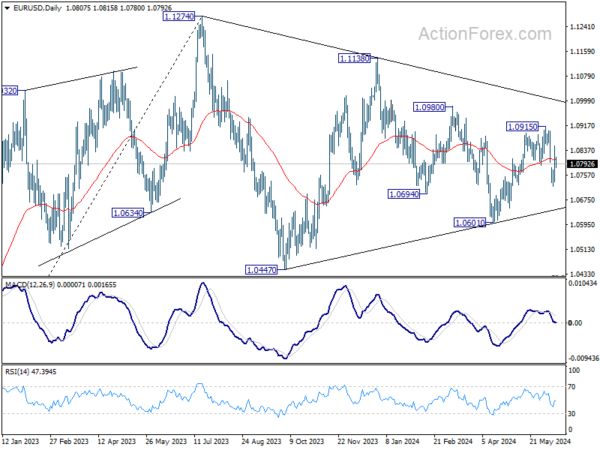

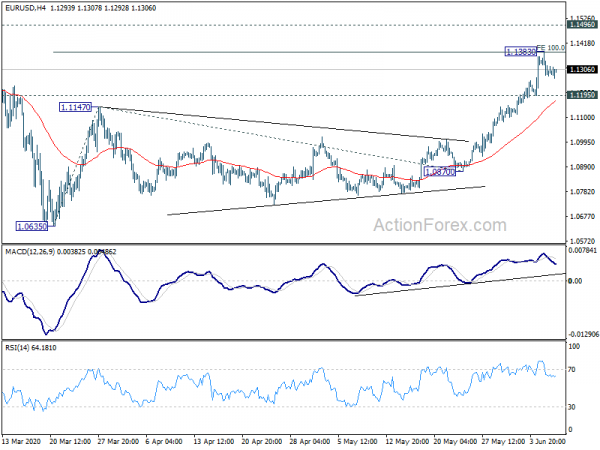

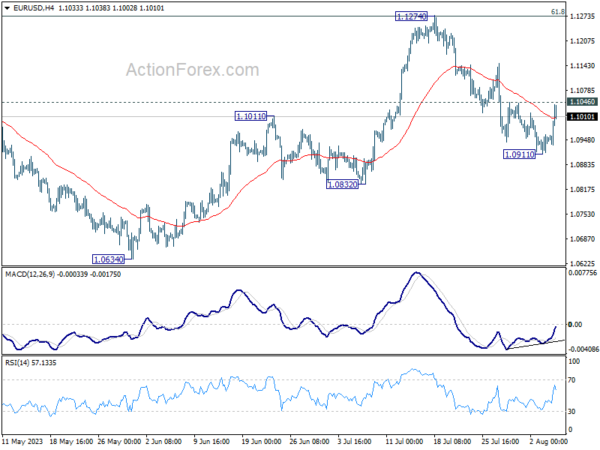

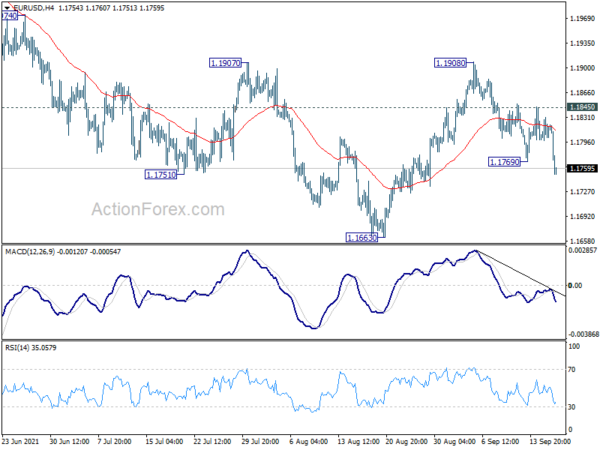

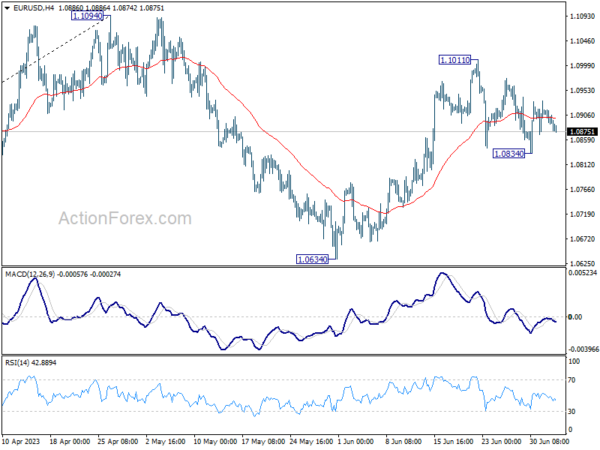

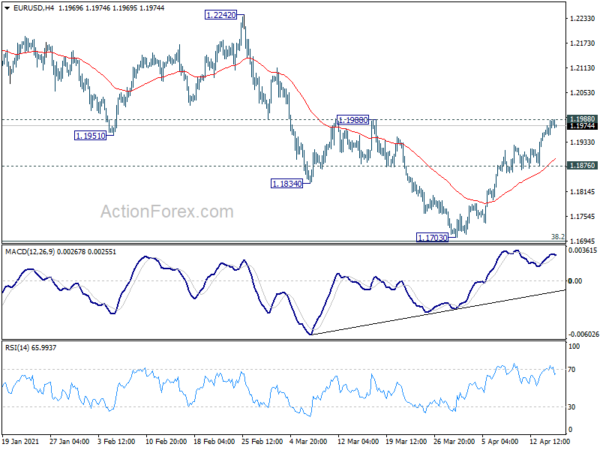

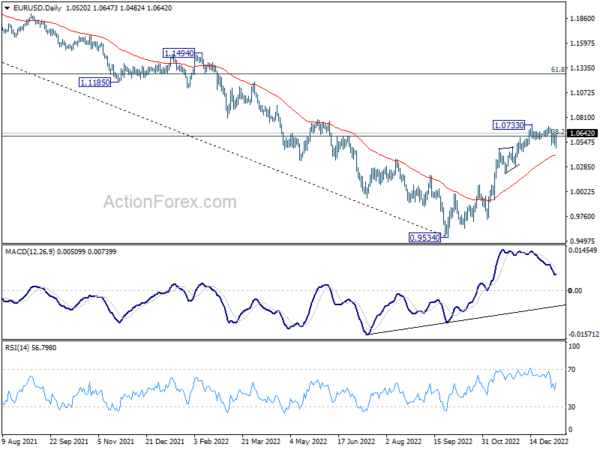

Intraday bias in EUR/USD remains neutral for consolidation above 1.0805 temporary low. Stronger recovery cannot be ruled out. But upside should be limited by 1.1120 support turned resistance to bring down trend resumption. On the downside, firm break of 61.8% projection of 1.2265 to 1.1120 from 1.1494 at 1.0786 will pave they way to 100% projection at 1.0349 next.

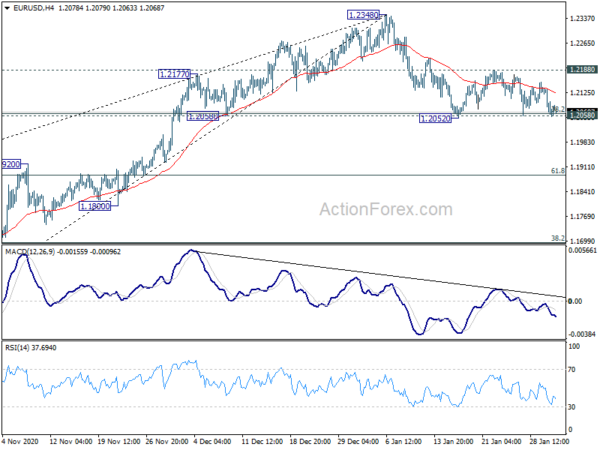

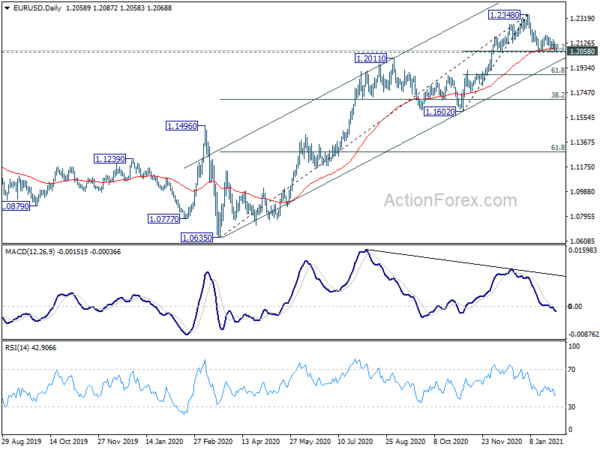

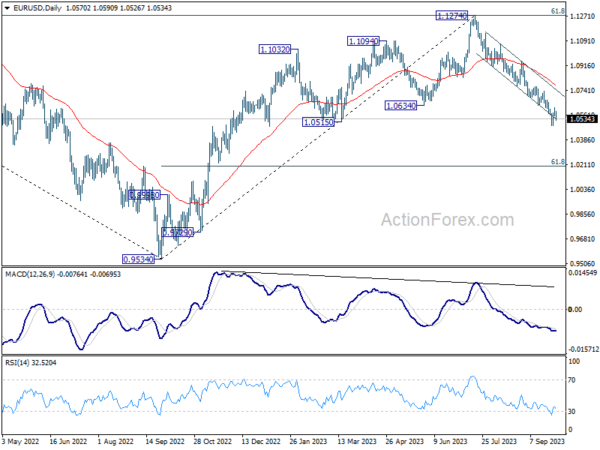

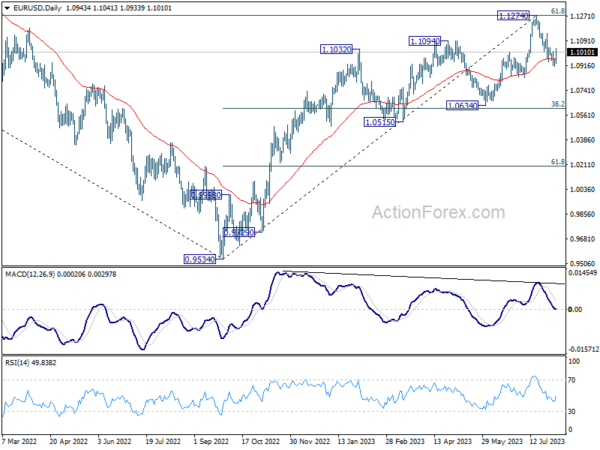

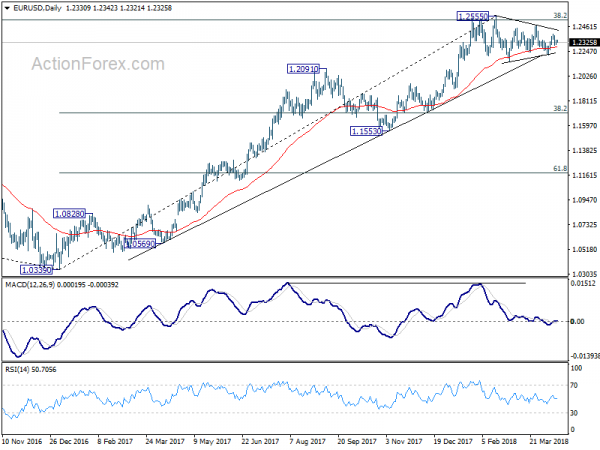

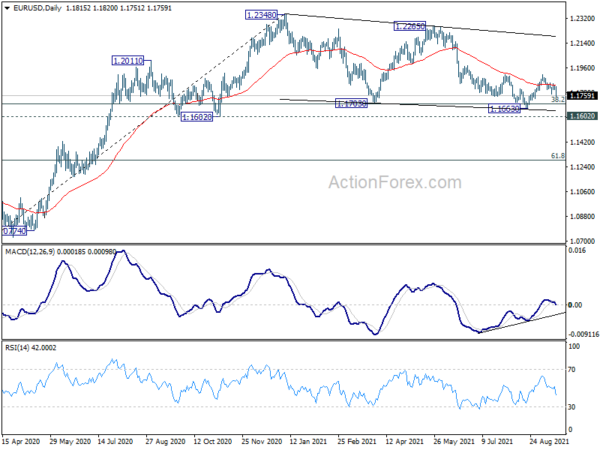

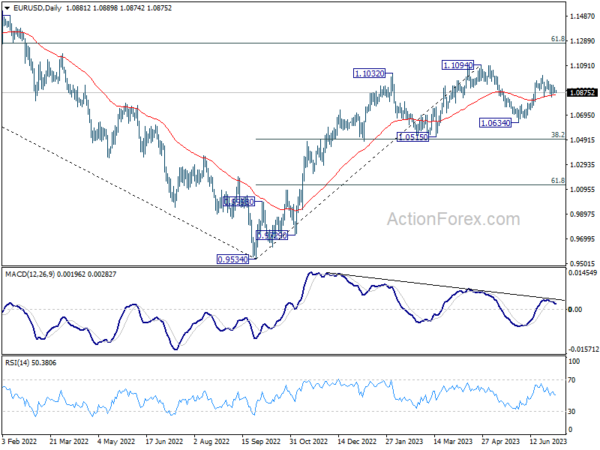

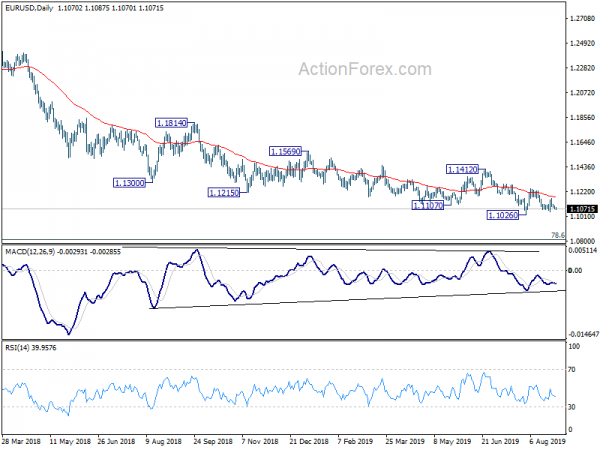

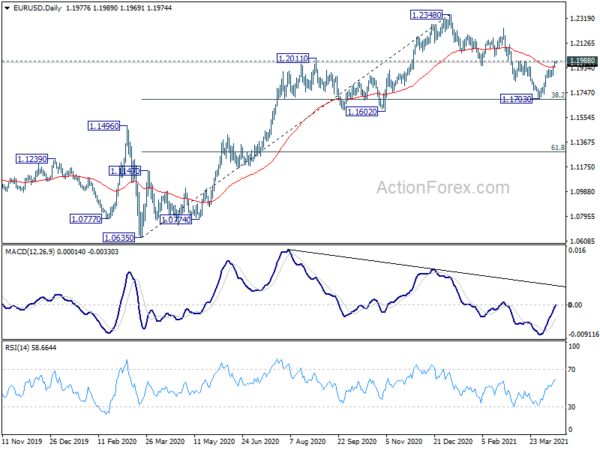

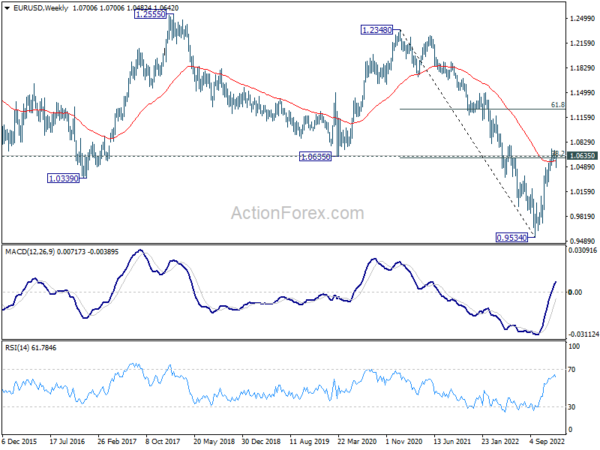

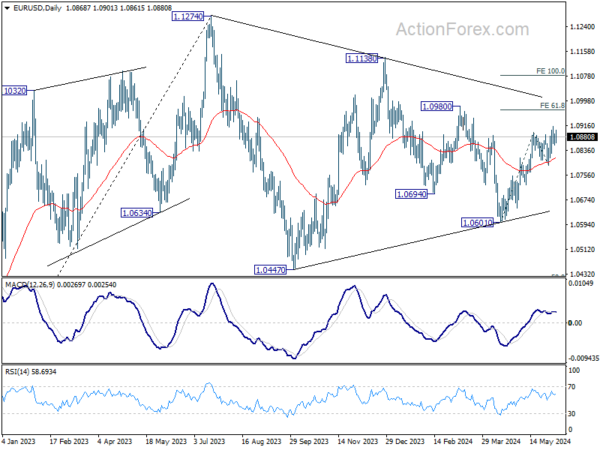

In the bigger picture, the decline from 1.2348 (2021 high) is expected to continue as long as 1.1494 resistance holds. Firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next. Nevertheless, break of 1.1494 will maintain medium term neutral outlook, and extend range trading first.