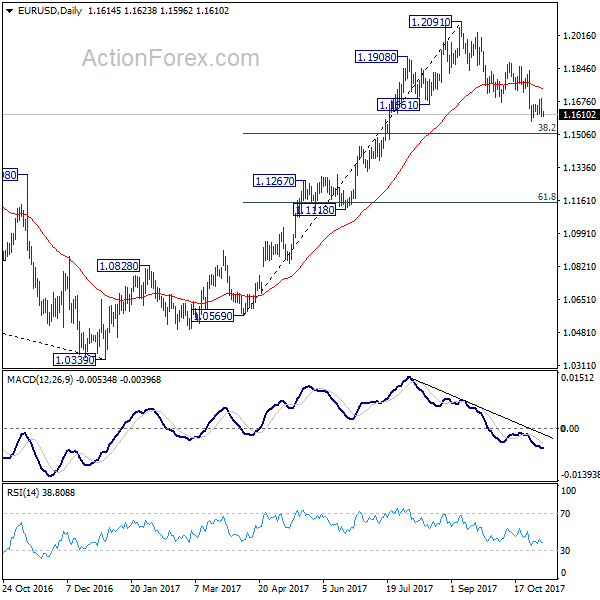

Daily Pivots: (S1) 1.1903; (P) 1.1950 (R1) 1.1975; More….

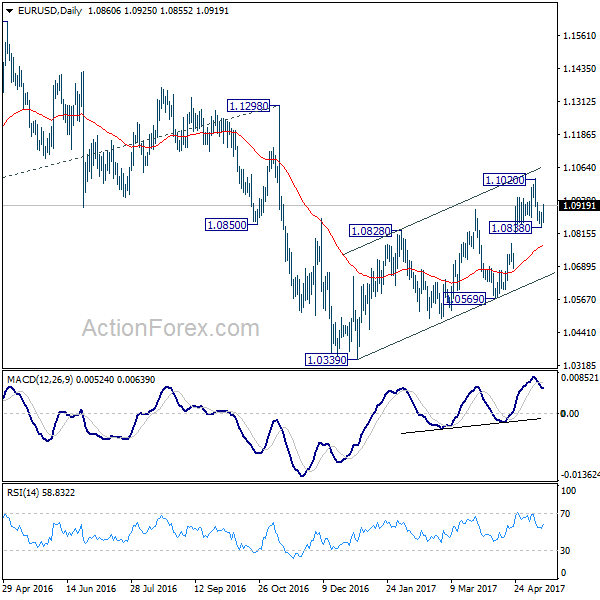

EUR/USD’s recovery from 1.1822 short term bottom could have completed at 1.1995 already, ahead of 38.2% retracement of 1.2413 to 1.1822 at 1.2048. Intraday bias is turned back to the downside for retesting 1.1822 first. Break there will resume whole decline from 1.2555 and target 1.1708 medium term fibonacci level next. In case of another recovery as the correction extends, upside should be limited by 1.2048 to bring fall resumption eventually.

In the bigger picture, current development suggests that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term was formed at 1.2555 already. Decline from there should extend further. Break of 38.2% retracement of 1.0339 to 1.2555 at 1.1708 will target 61.8% retracement at 1.1186. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 55 day EMA (now at 1.2179) holds.