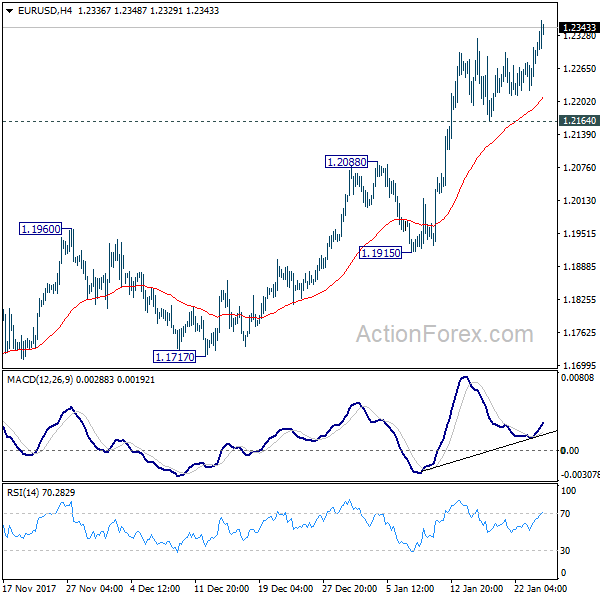

Daily Pivots: (S1) 1.2244; (P) 1.2275 (R1) 1.2328; More….

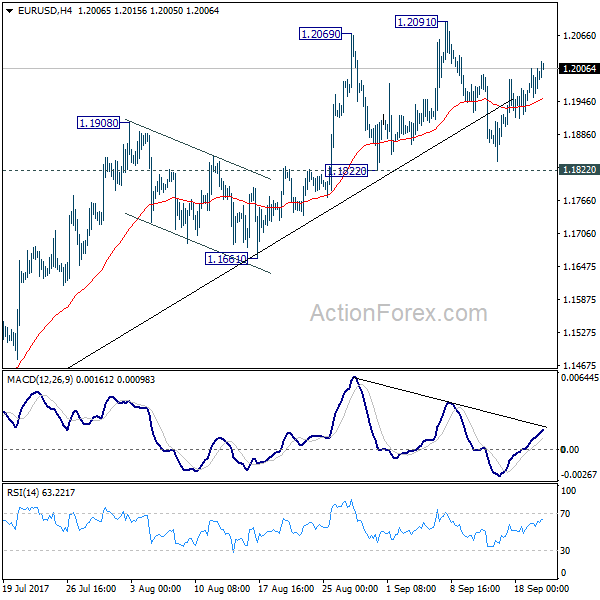

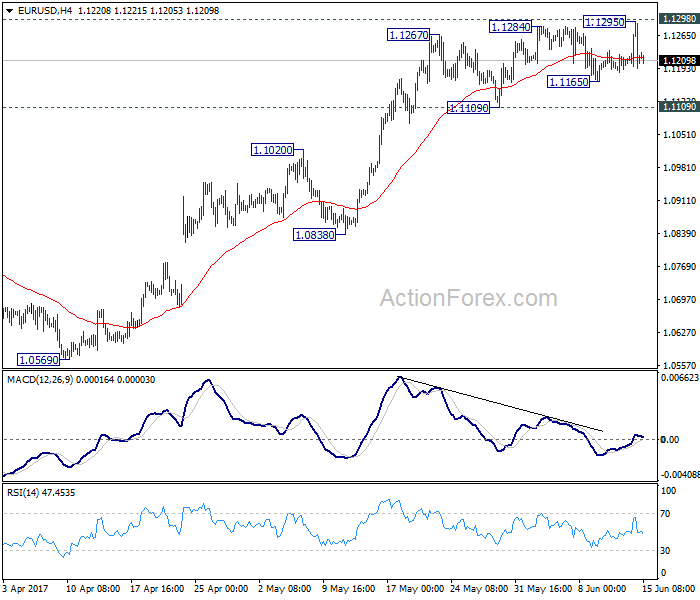

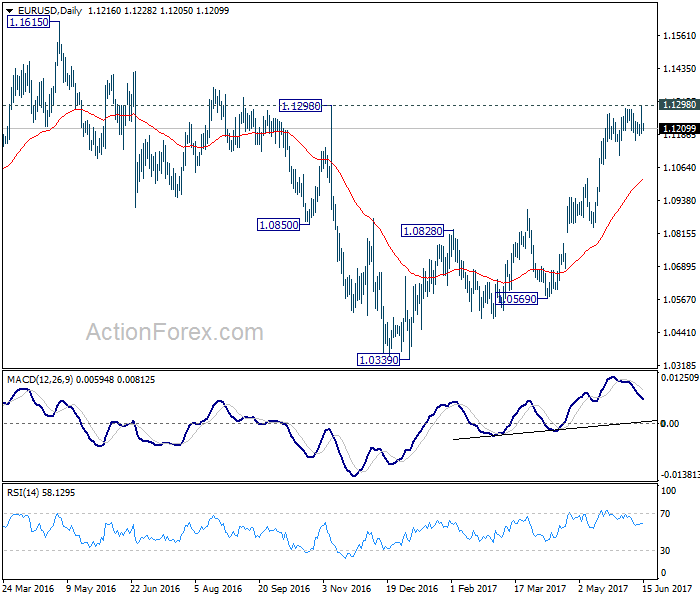

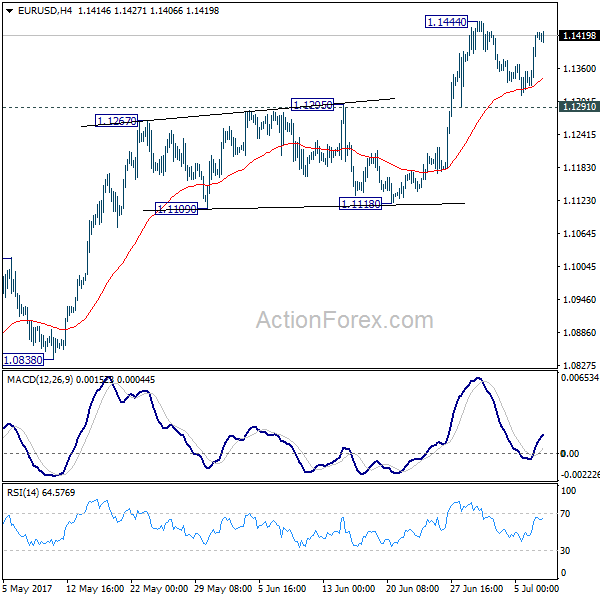

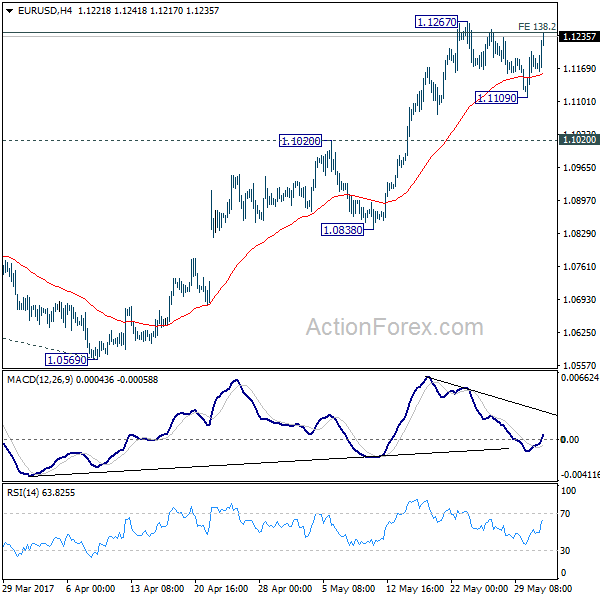

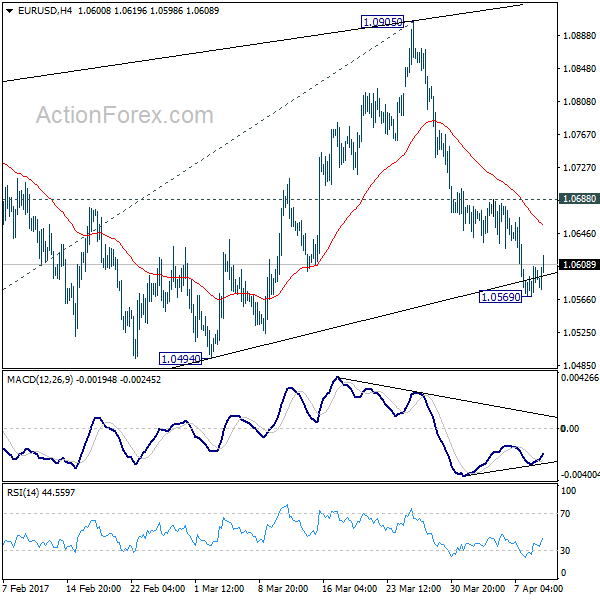

Intraday bias in EUR/USD remains on the upside as medium term rally continues. The pair should target next key fibonacci cluster level at 1.2494/2516. We’d expect strong resistance from there to bring reversal. On the downside, break of 1.2164 support will argue that EUR/USD has topped earlier than expected. In that case, intraday bias will be turned to the downside for 1.1915 support first.

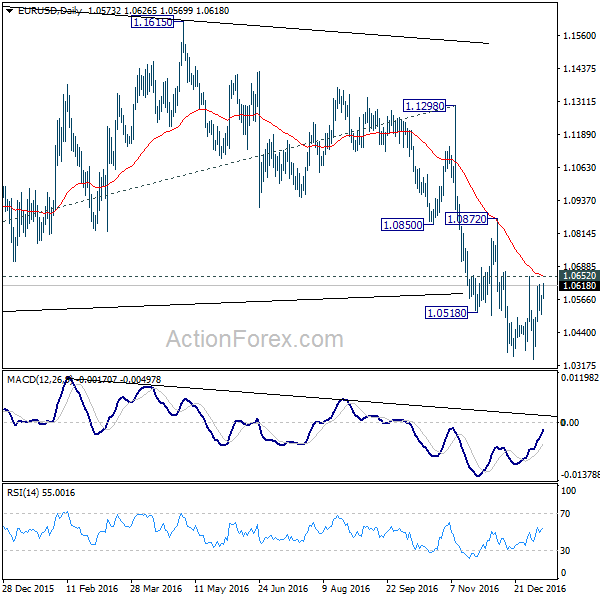

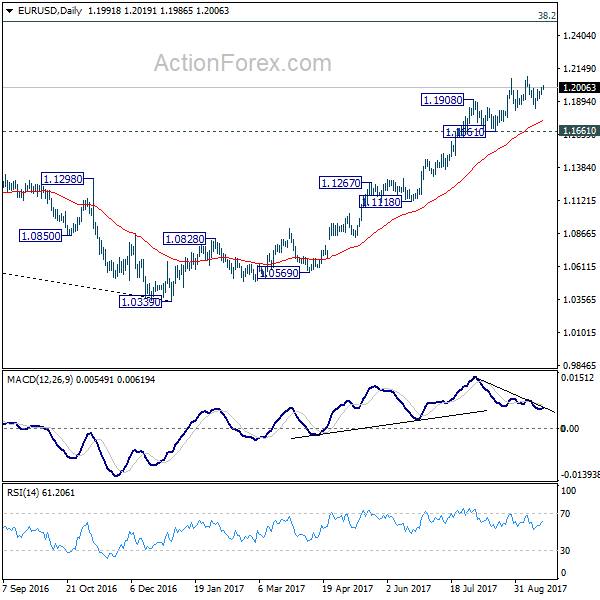

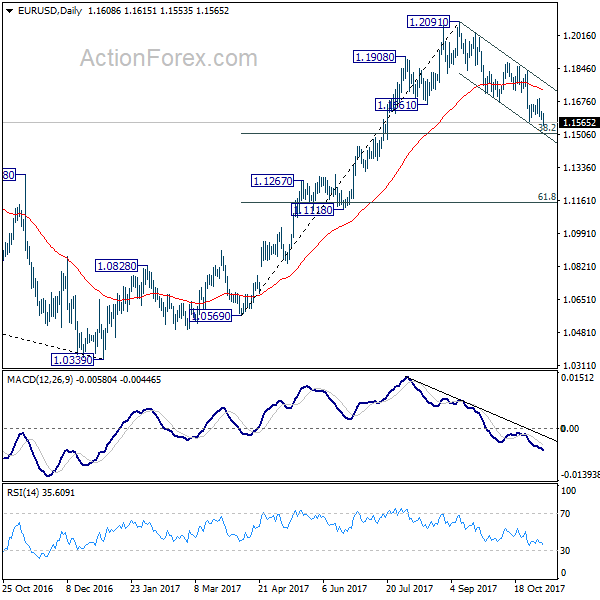

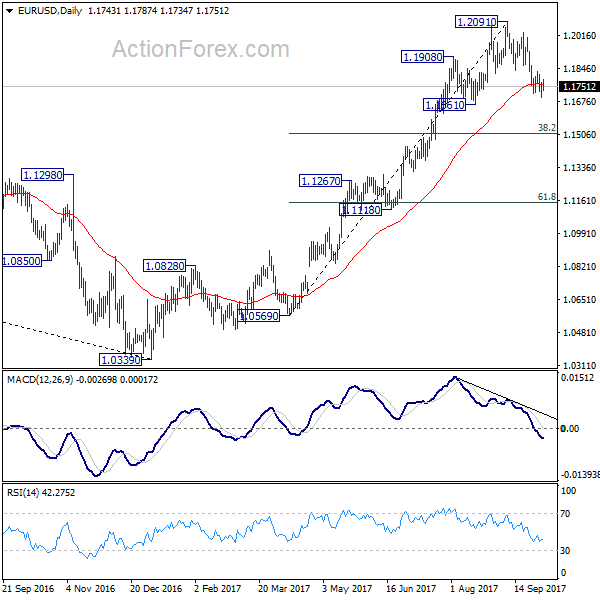

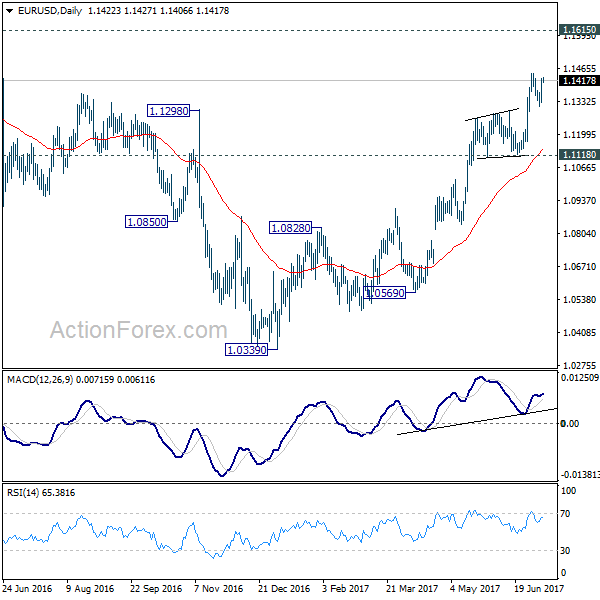

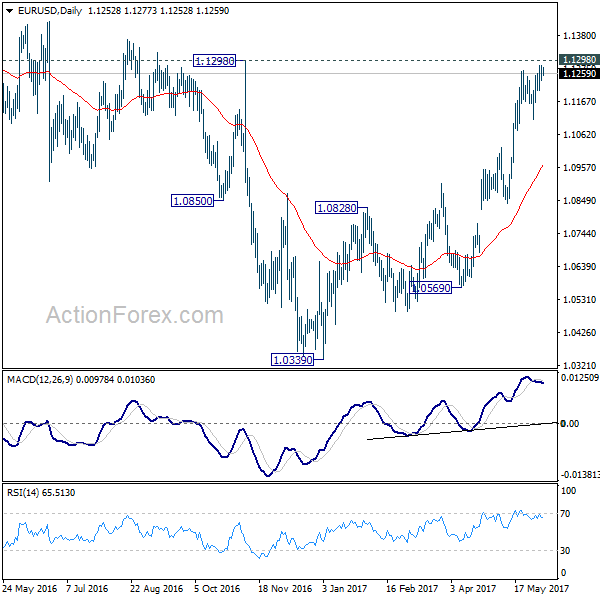

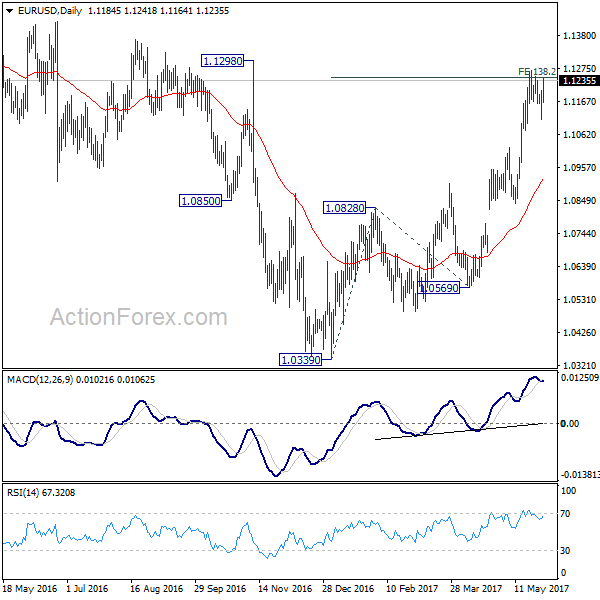

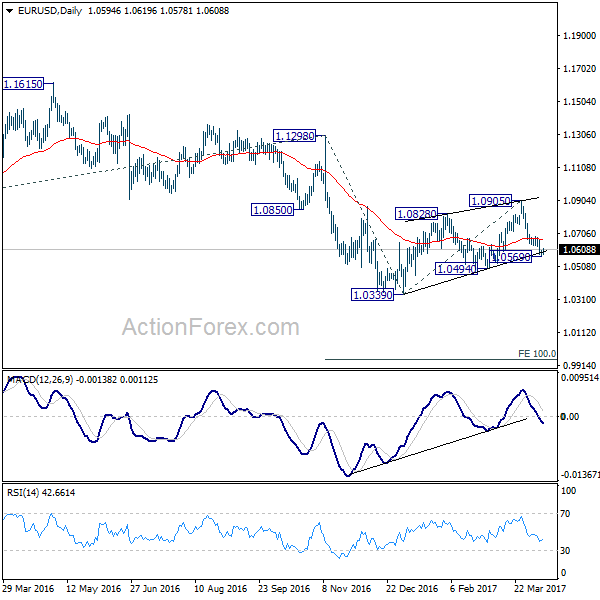

In the bigger picture, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Therefore, in case of further rally, we’d be expect 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. That is also close to 61.8% projection of 1.0569 to 1.2091 from 1.1553 at 1.2494. Break of 1.1553 support will confirm completion of the rise. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.