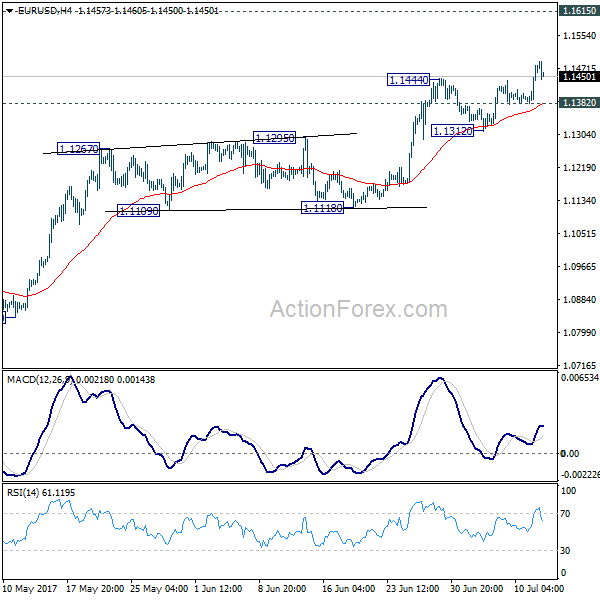

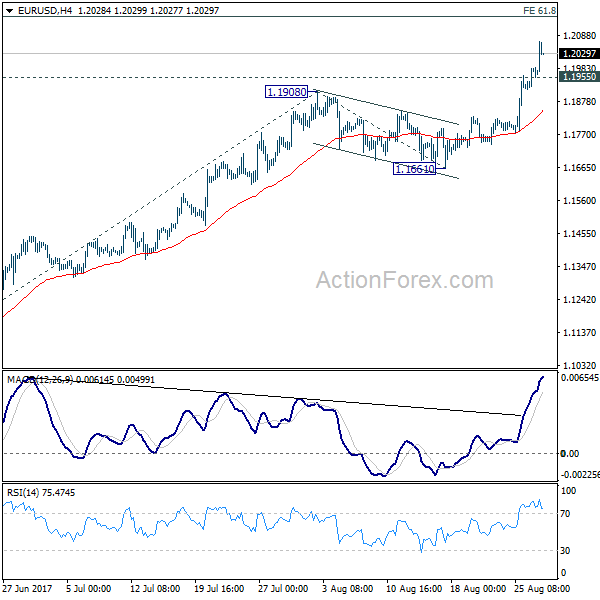

Daily Pivots: (S1) 1.1406; (P) 1.1442 (R1) 1.1503; More…..

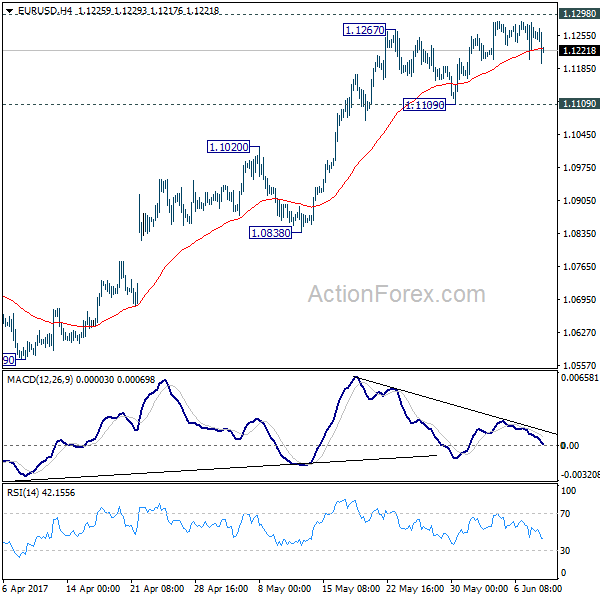

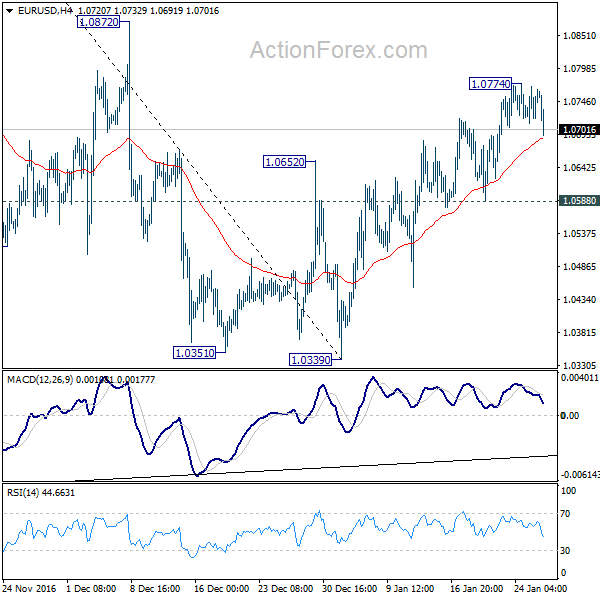

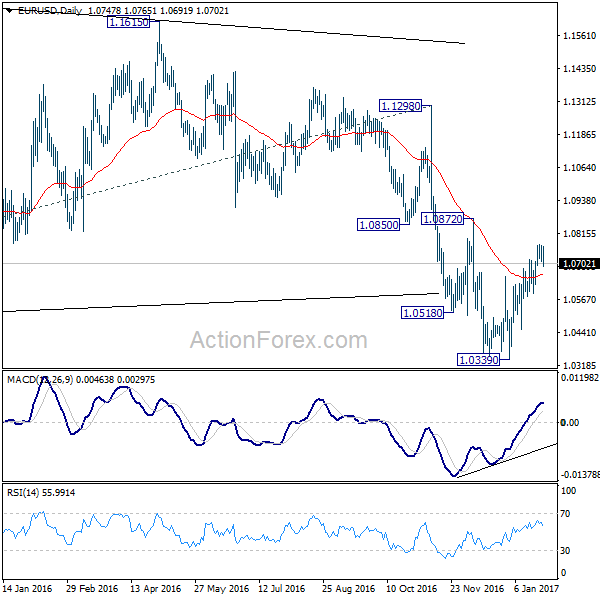

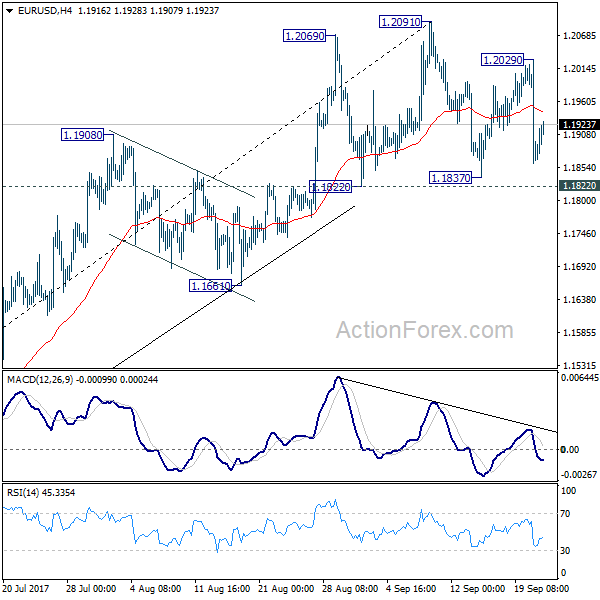

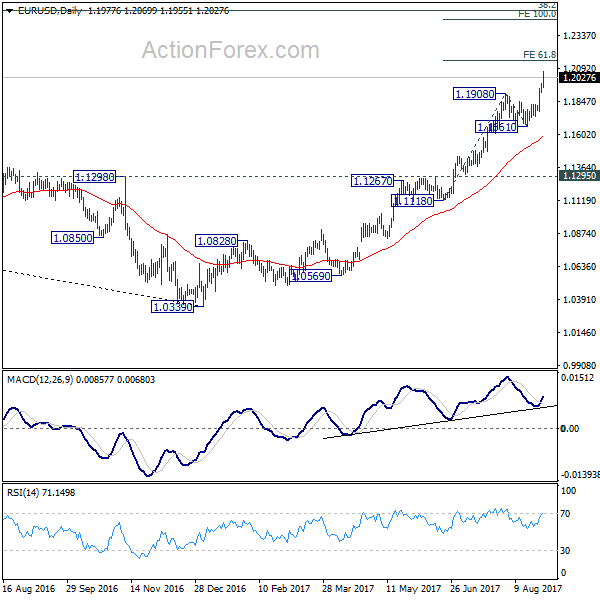

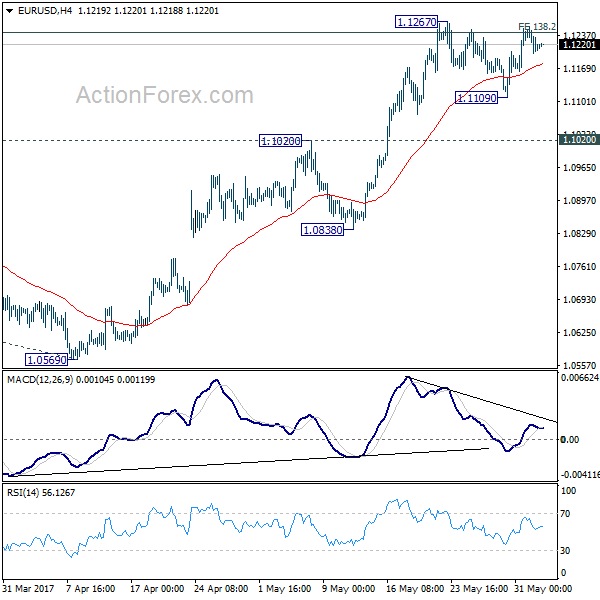

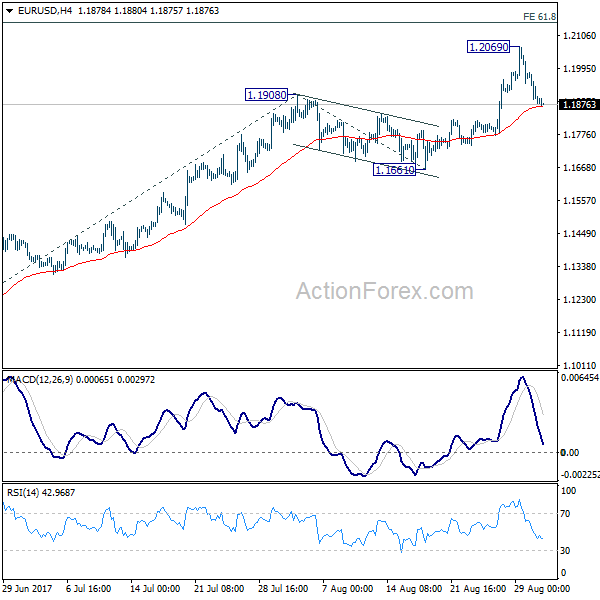

EUR/USD rises to as high as 1.1489 so far as recent rally resumed. Intraday bias is back on the upside. Current rally from 1.0339 low should extend to 1.1615 resistance next. On the downside, however, break of 1.1382 minor support will suggest short term topping, possibly on bearish divergence condition in 4 hour MACD. In such case, lengthier consolidation would be seen before another rally.

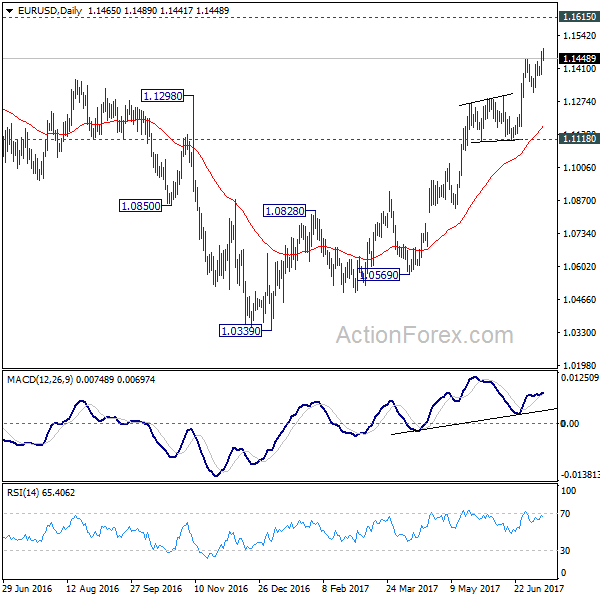

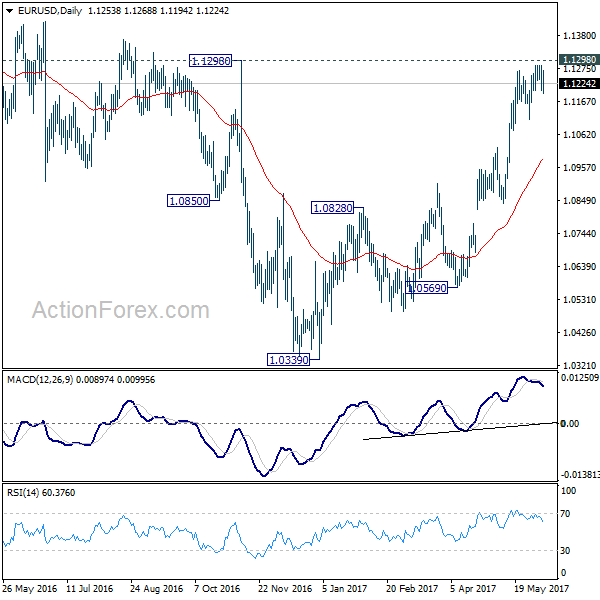

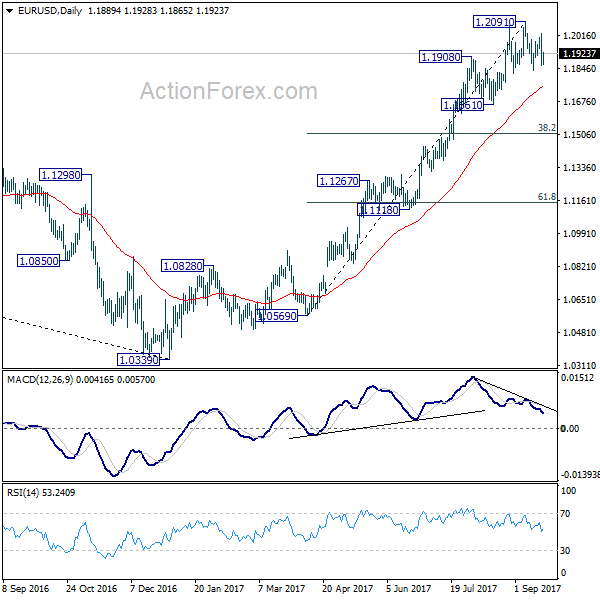

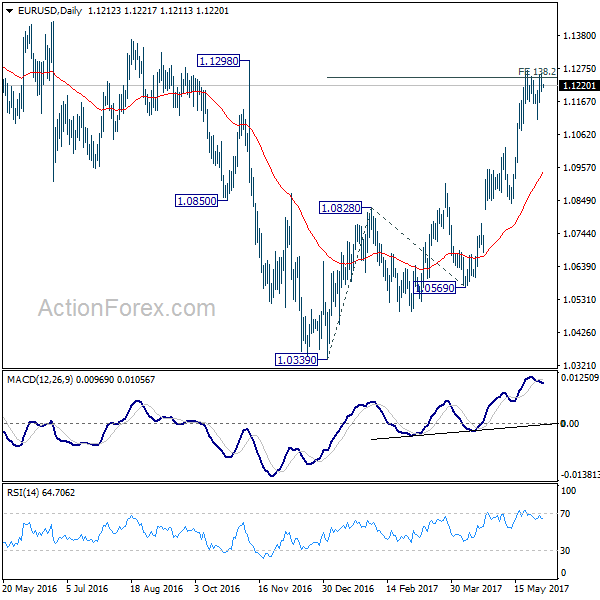

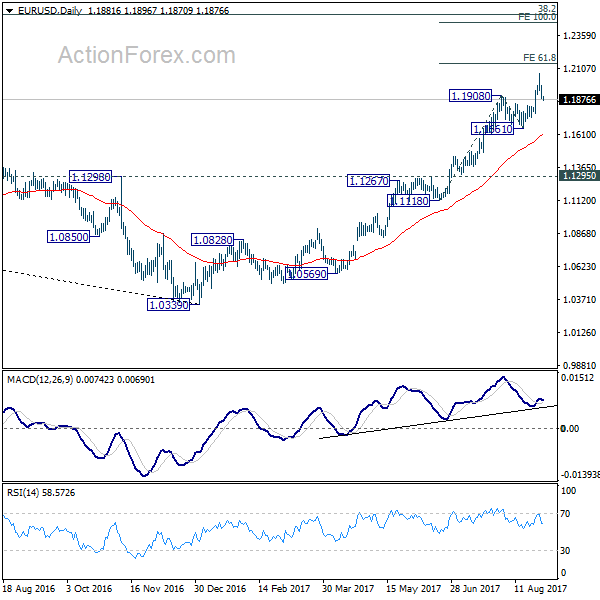

In the bigger picture, the firm break of 1.1298 resistance further affirm medium term reversal. That is an important bottom was formed at 1.0339 on bullish convergence condition in weekly MACD. Further rise would be seen to 55 month EMA (now at 1.1763). Sustained break there will pave the way to 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 next. This will now remain the favored case as long as 1.1118 support holds.