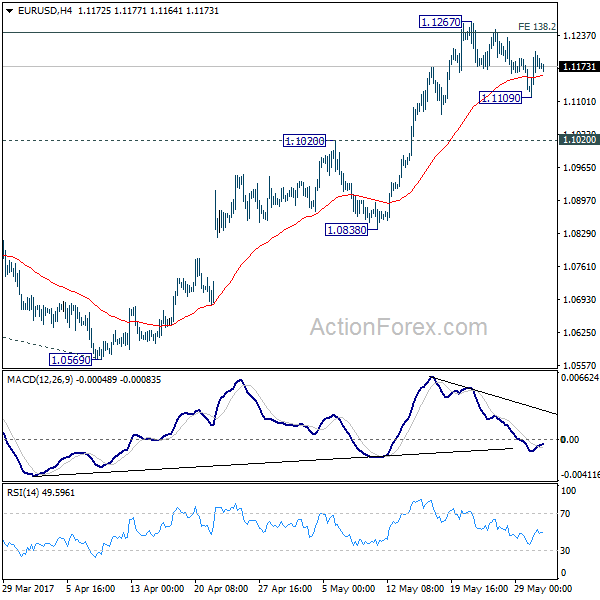

Daily Pivots: (S1) 1.1127; (P) 1.1166 (R1) 1.1223; More….

Intraday bias in EUR/USD remains neutral for the moment as consolidation from 1.1267 continues. Overall, we remain cautious on strong resistance from 1.1245/98 (138.2% projection of 1.0339 to 1.0828 from 1.0569 at 1.1245) to limit upside and bring reversal. But another rise is still mildly in favor as long as 1.1020 resistance turned support holds. Decisive break of 1.1298 will carry larger bullish implication and target 1.1615 resistance next. On the downside, break of 1.1020 will indicate rejection from 1.1245/98 and turn bias to the downside for 1.0838 support.

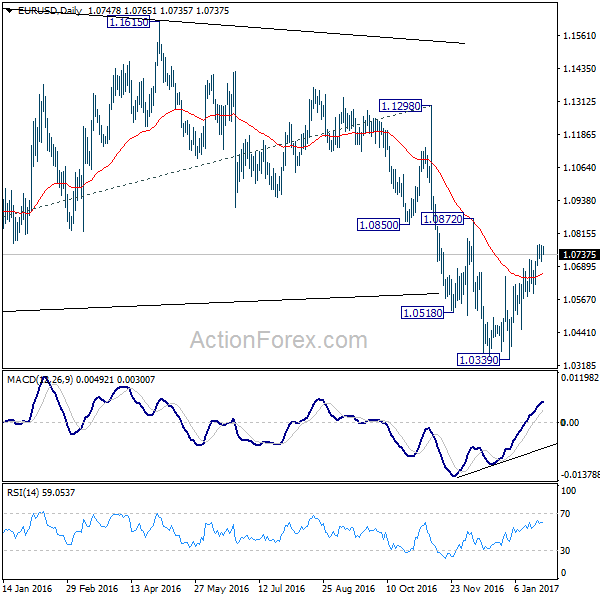

In the bigger picture, the case for medium term reversal continues to build up with EUR/USD staying far above 55 week EMA (now at 1.0888). Also, bullish convergence condition is seen in weekly MACD. Focus will now be on 1.1298 key resistance. Rejection from there will maintain medium term bearishness and would extend the whole down trend from 1.6039 (2008 high). However, firm break of 1.1298 will indicate reversal. In such case, further rally would be seen back to 1.2042 support turned resistance next.