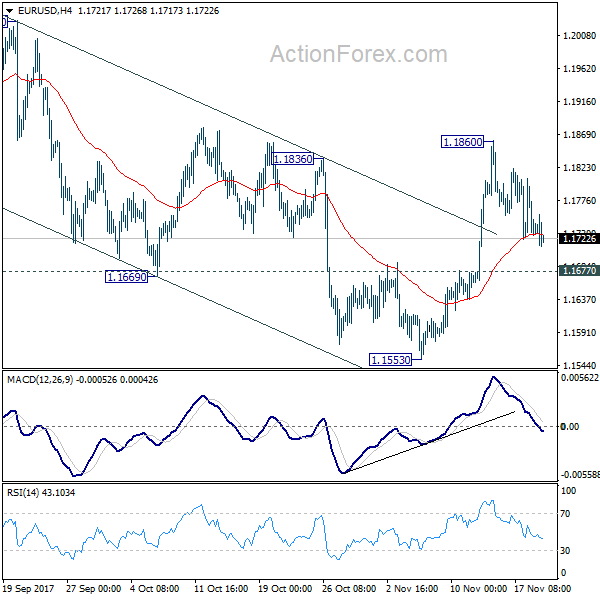

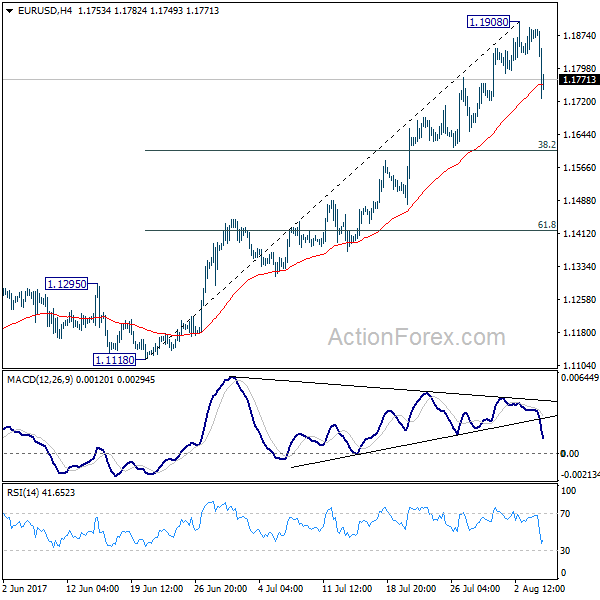

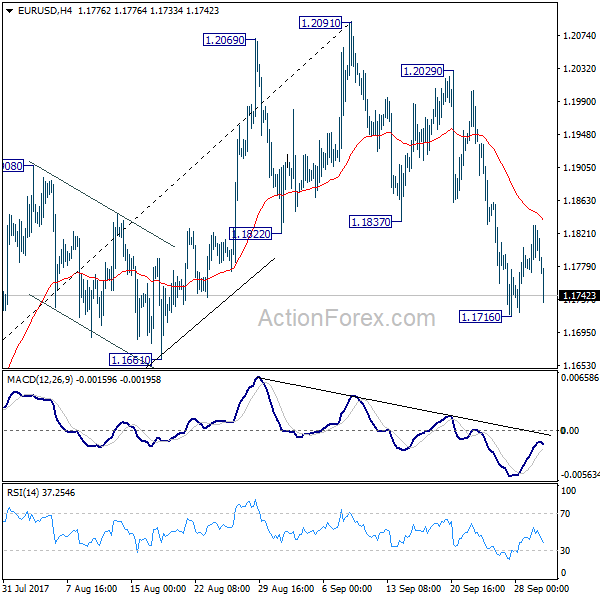

Daily Pivots: (S1) 1.1699; (P) 1.1753 (R1) 1.1786; More….

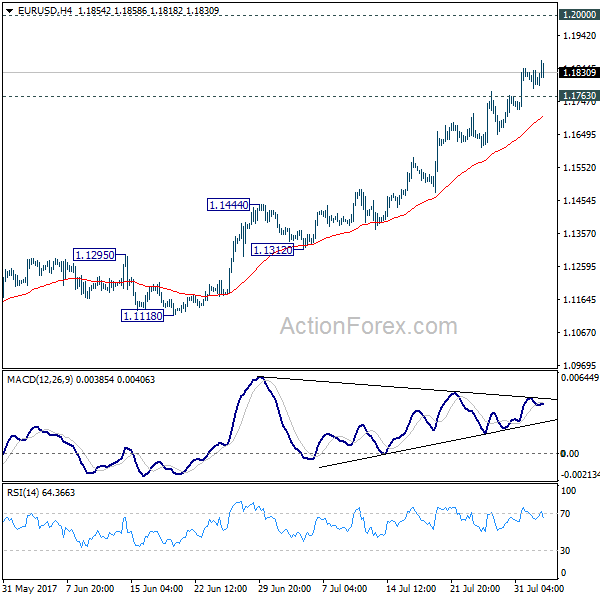

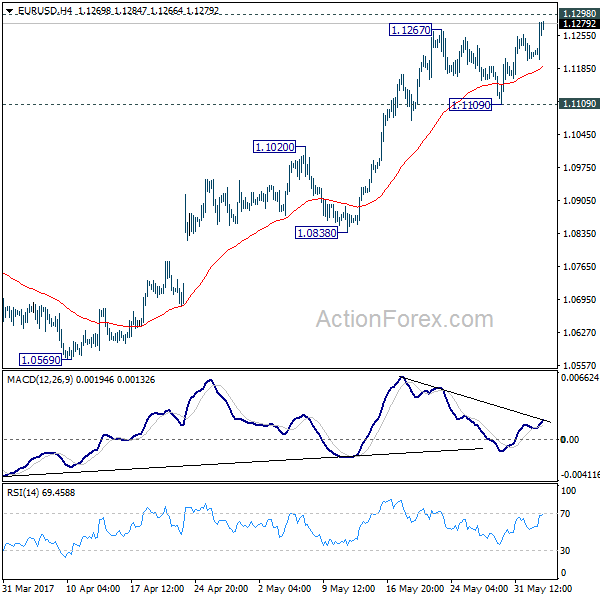

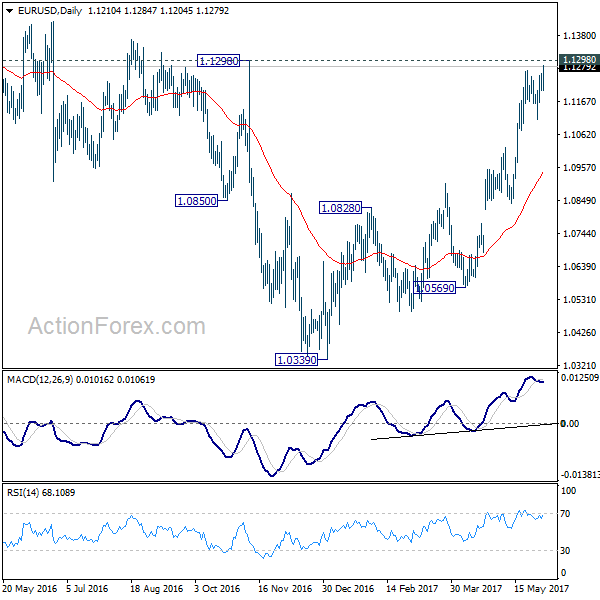

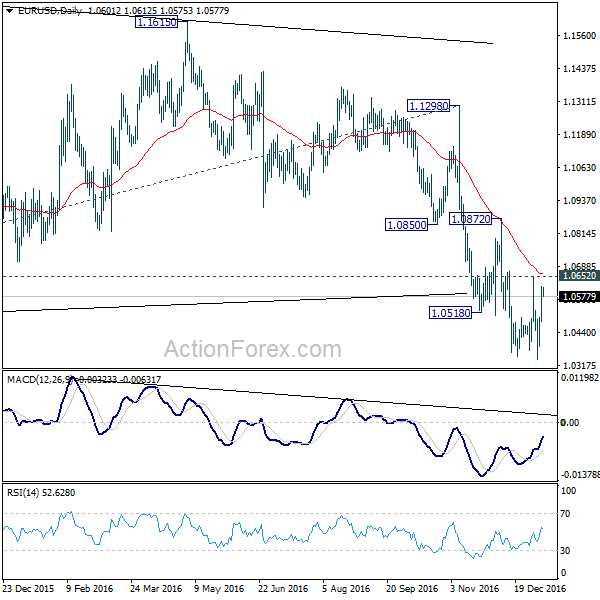

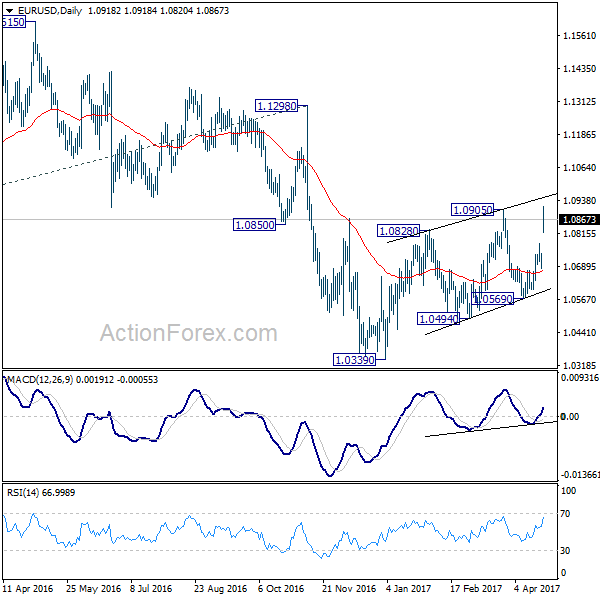

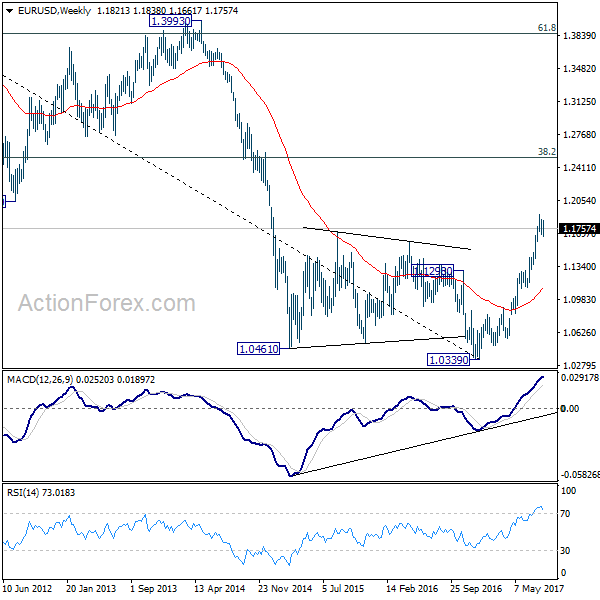

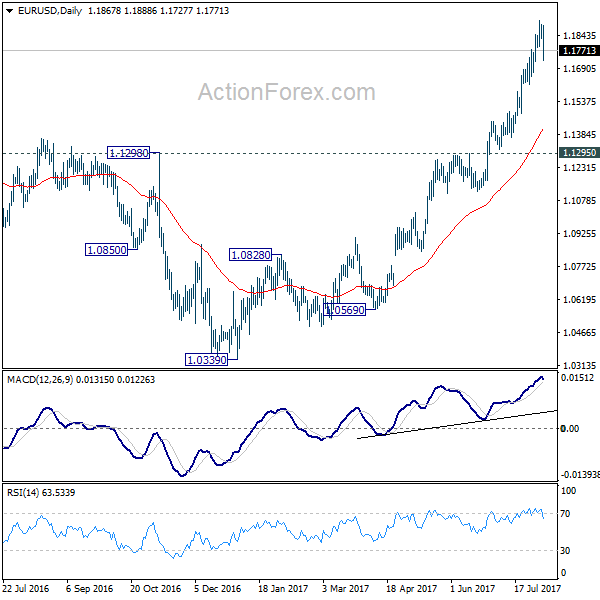

EUR/USD’s choppy decline from 1.1860 extends lower today. But it’s staying well above 1.1677 minor support. Intraday bias remains neutral and another rally is still in favor. As noted before, corrective fall from 1.2091 has completed at 1.1553 already, ahead of 38.2% retracement of 1.0569 to 1.2091 at 1.1510. Above 1.1860 will turn bias to the upside for retesting 1.2091 high. However, break of 1.1677 will dampen this bullish view and turn focus back to 1.1553 low instead.

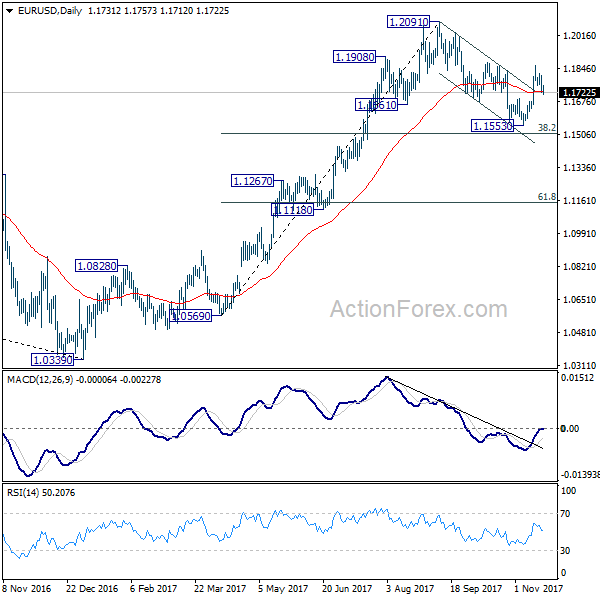

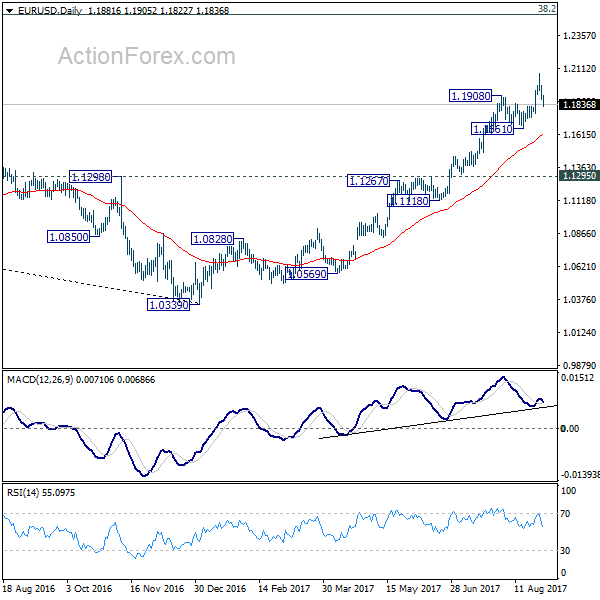

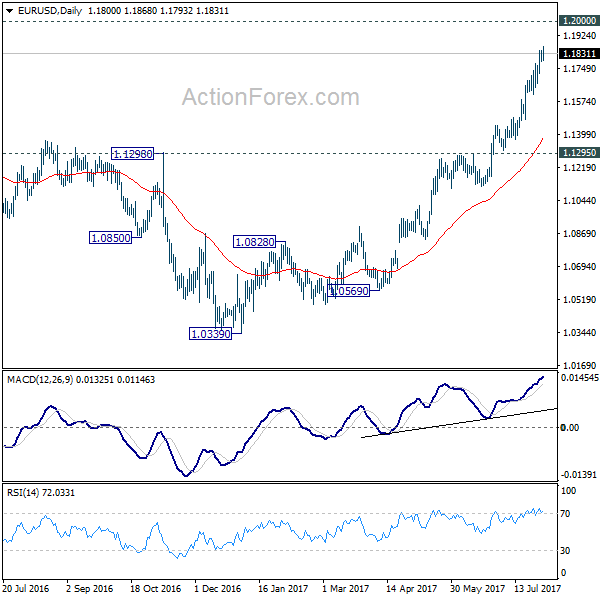

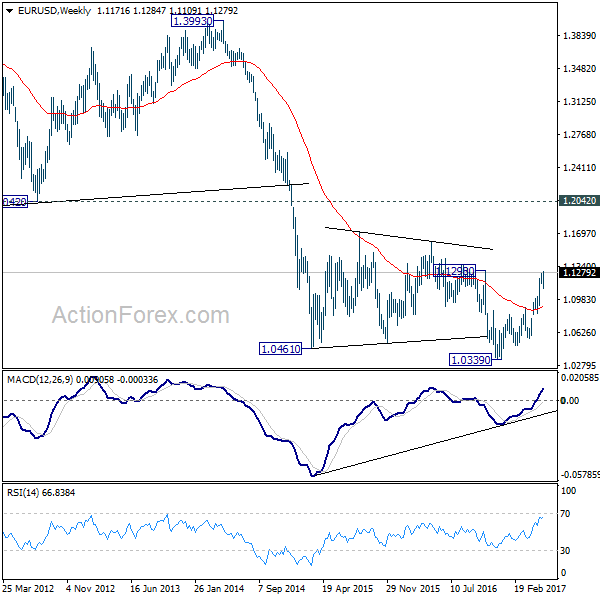

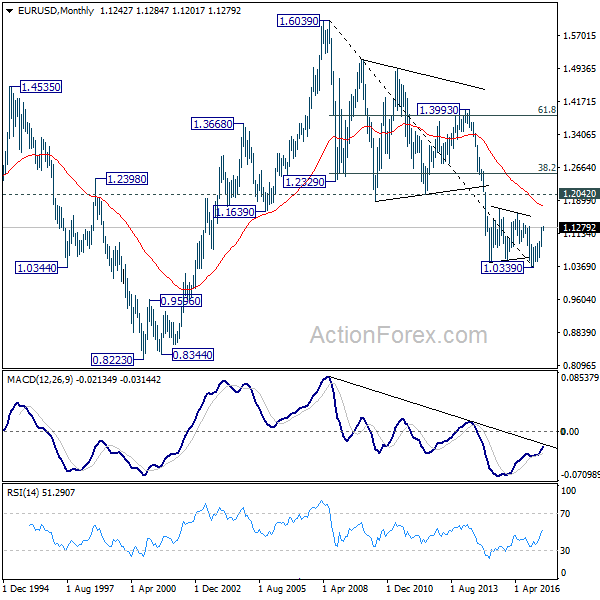

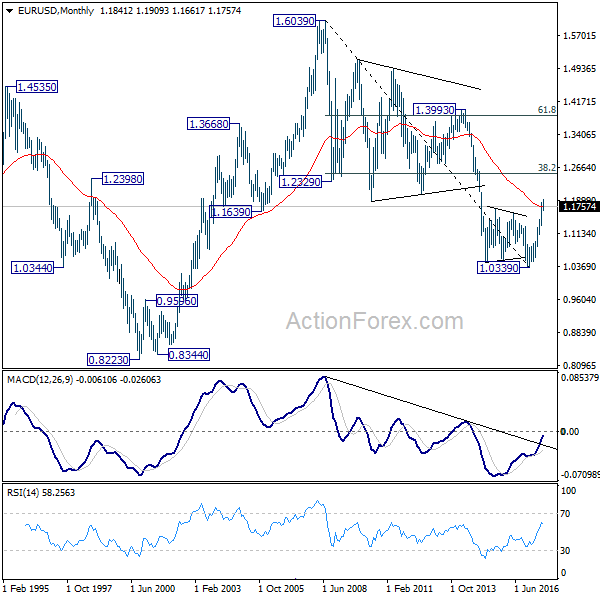

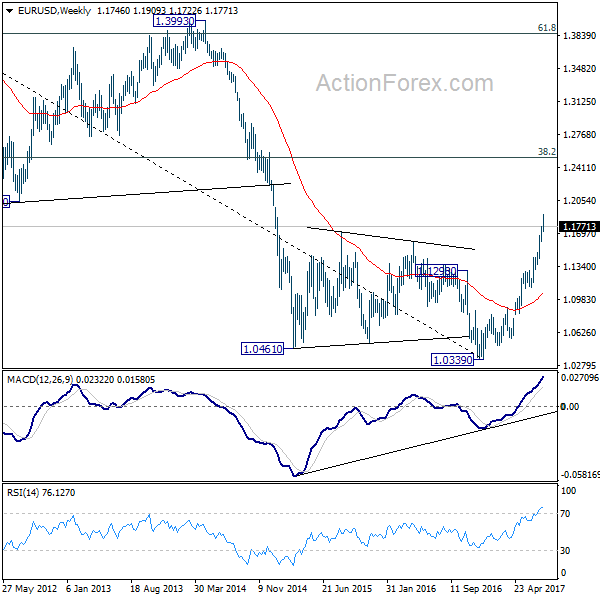

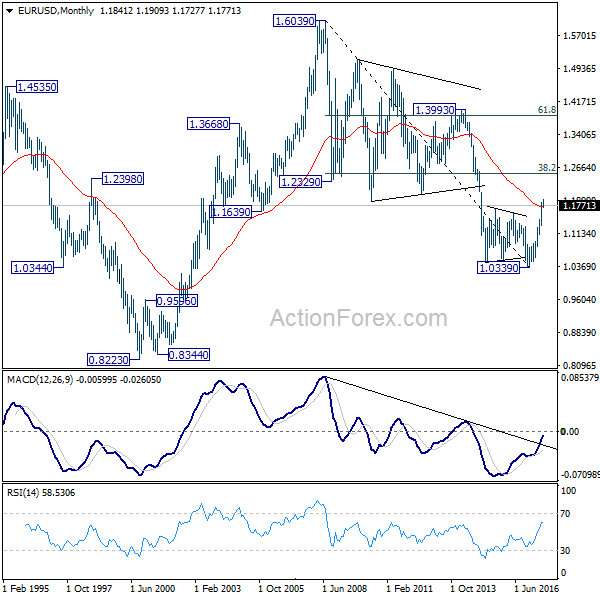

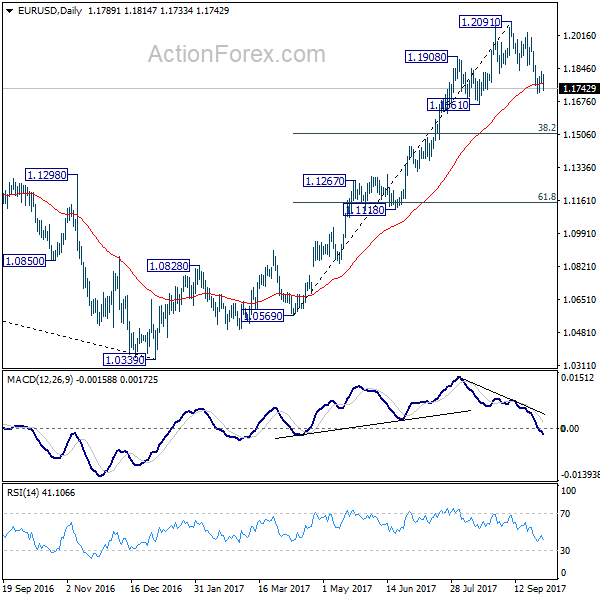

In the bigger picture, rise from 1.0339 medium term bottom is seen as a corrective move for the moment. Therefore, in case of another rally, we’d be cautious on 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 to limit upside and bring reversal. Meanwhile, sustained trading below 55 week EMA (now at 1.1373) will suggest that such medium term rebound is completed and could then bring retest of 1.0339 low.