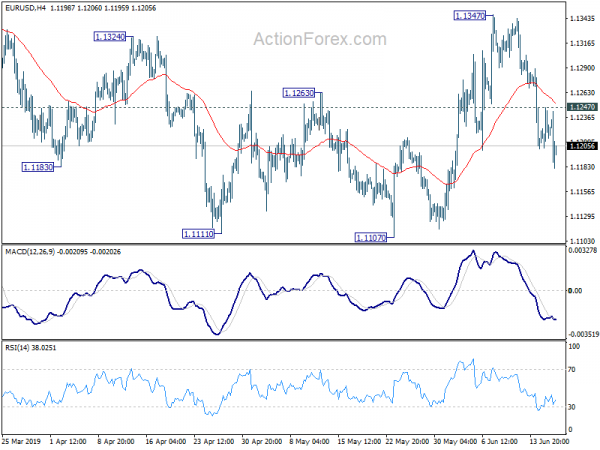

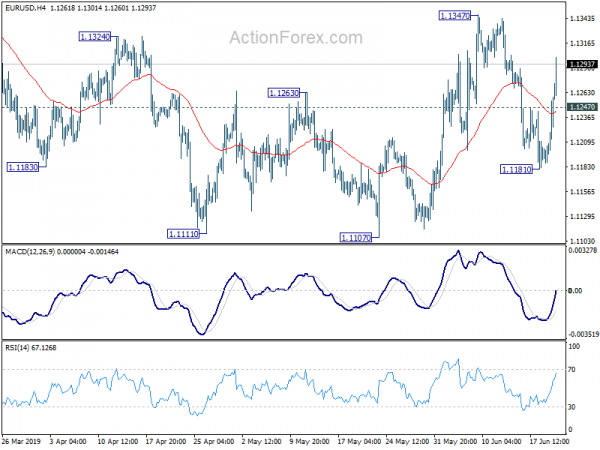

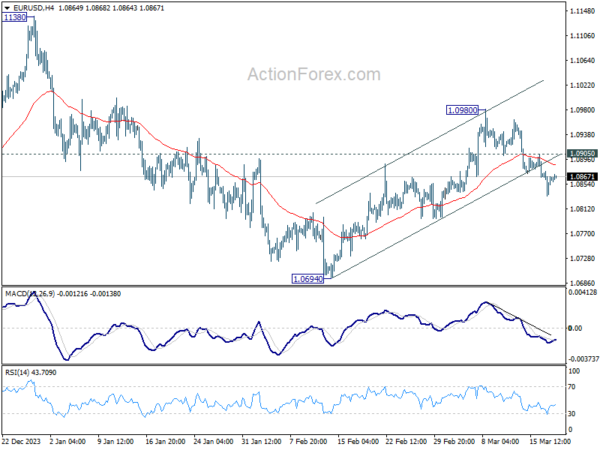

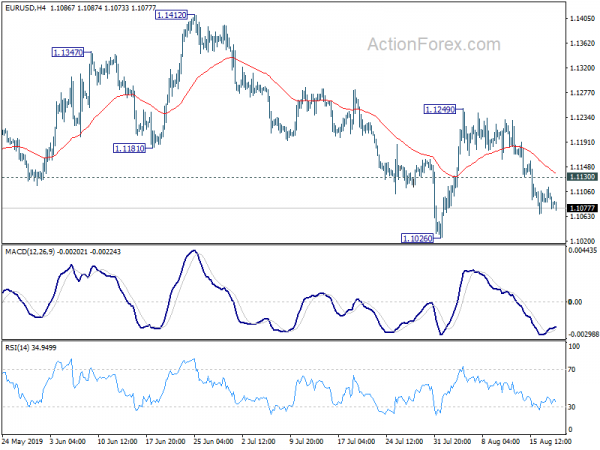

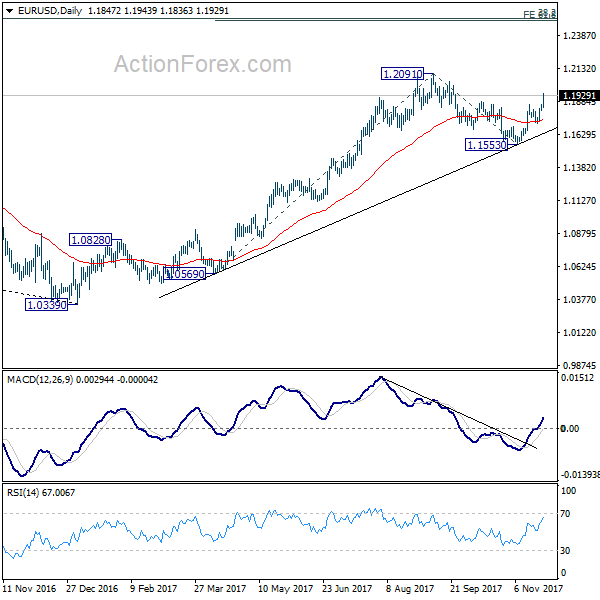

Daily Pivots: (S1) 1.1198; (P) 1.1222; (R1) 1.1242; More……

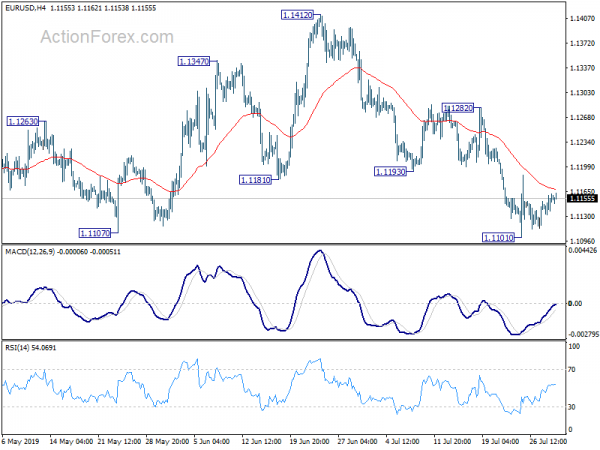

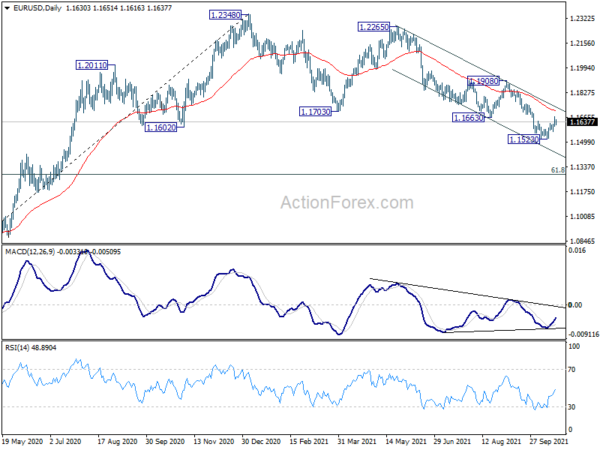

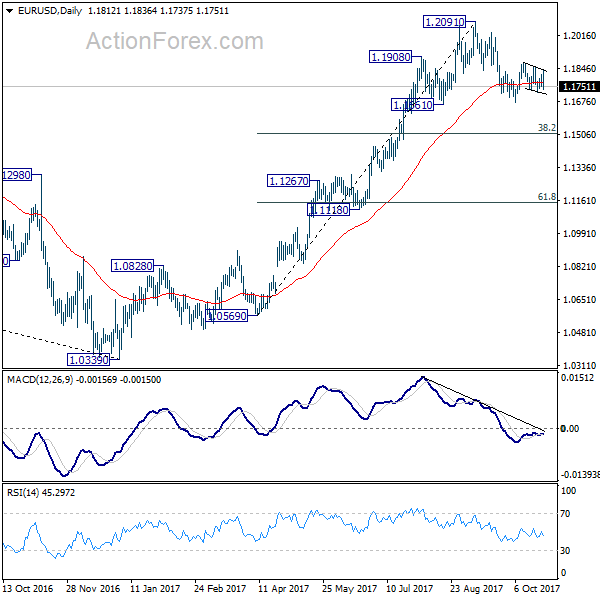

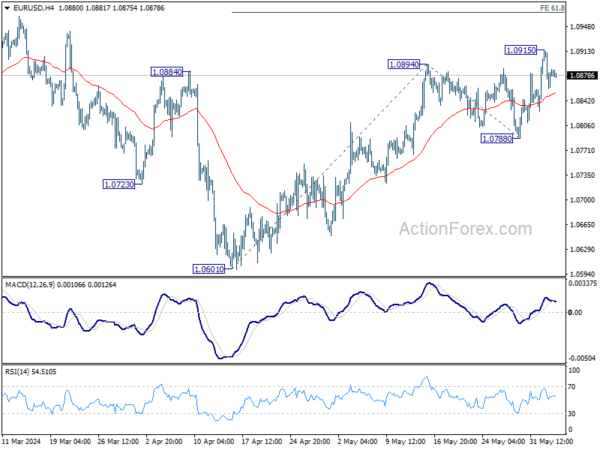

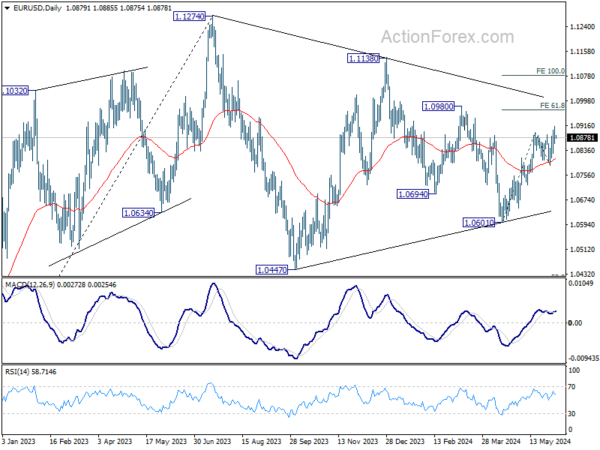

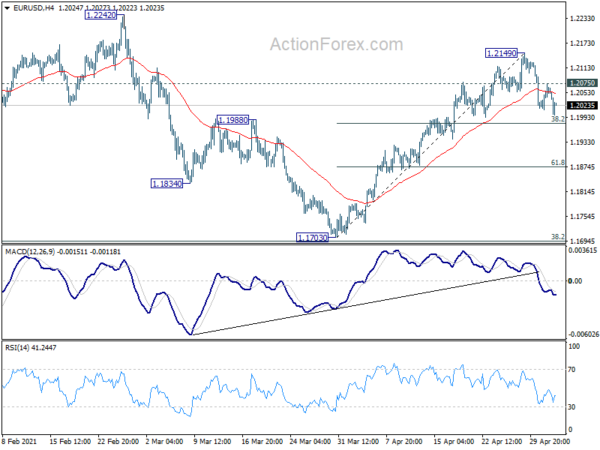

EUR/USD’s fall from 1.1347 extends to as low as 1.1181 so far today. Intraday bias remains on the downside for 1.1107 low. Though, we’d stay cautious on strong support from 1.1107 low to bring rebound. On the upside, above 1.1247 minor resistance will turn bias back to the upside for 1.1347 again.

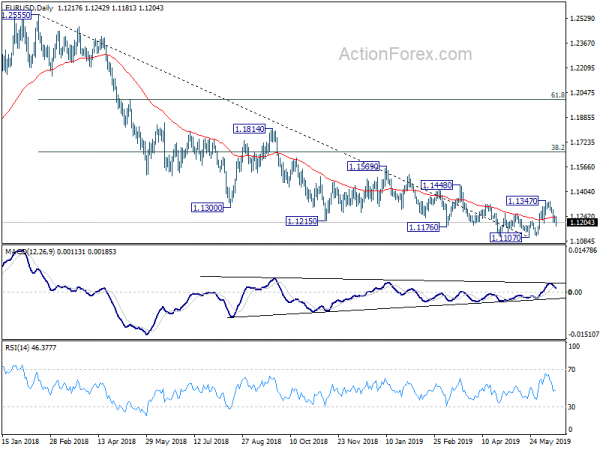

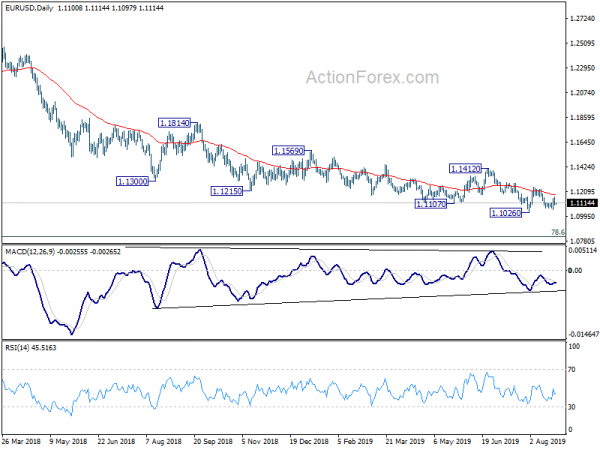

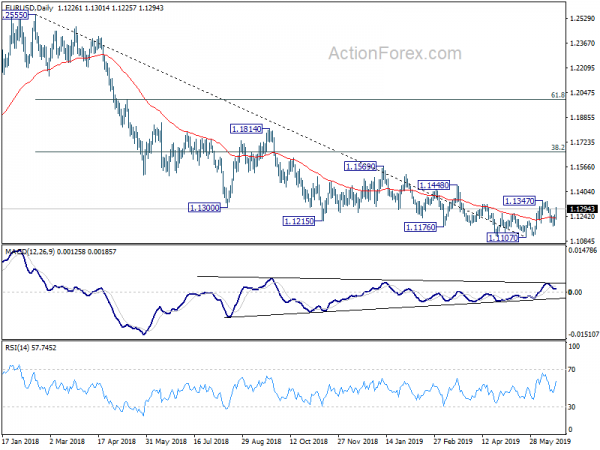

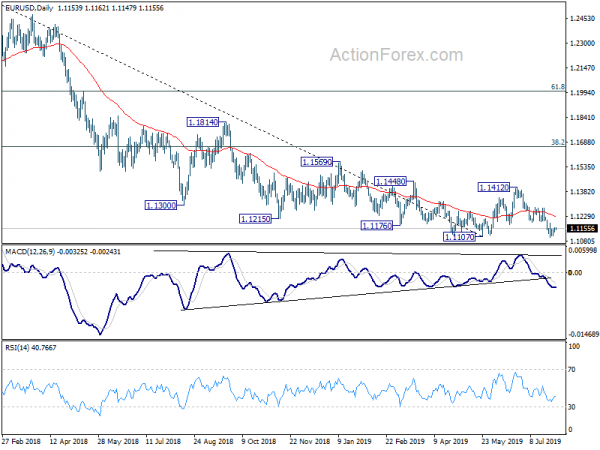

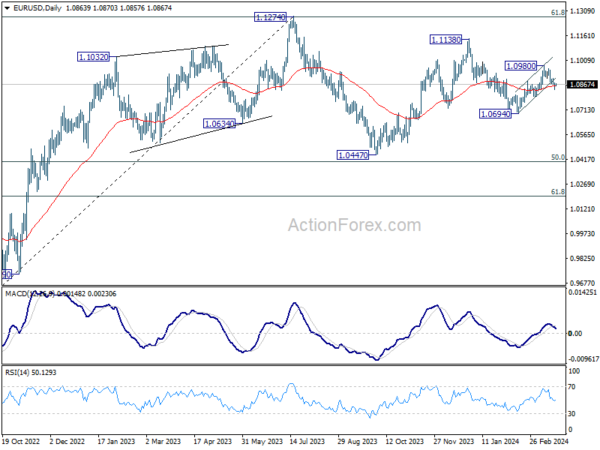

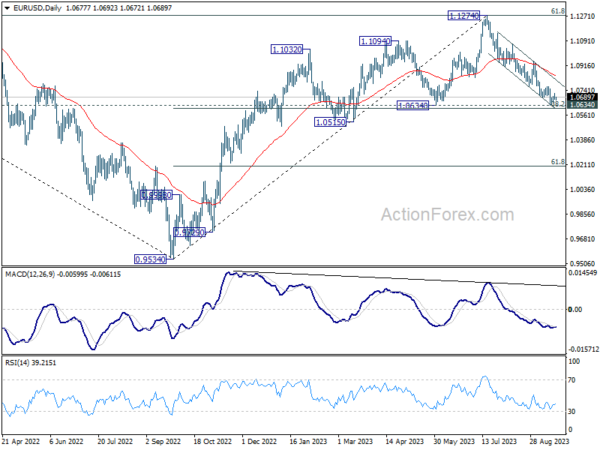

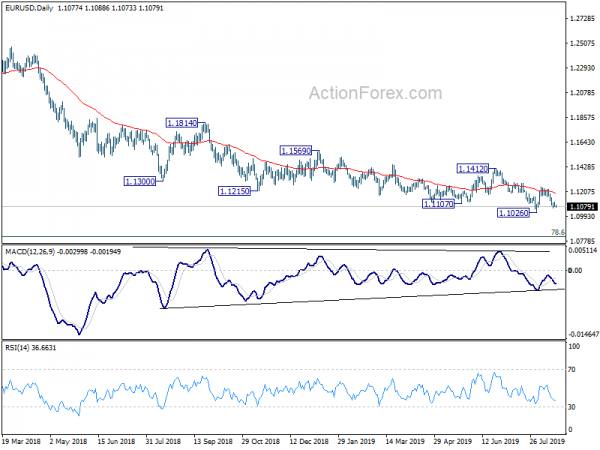

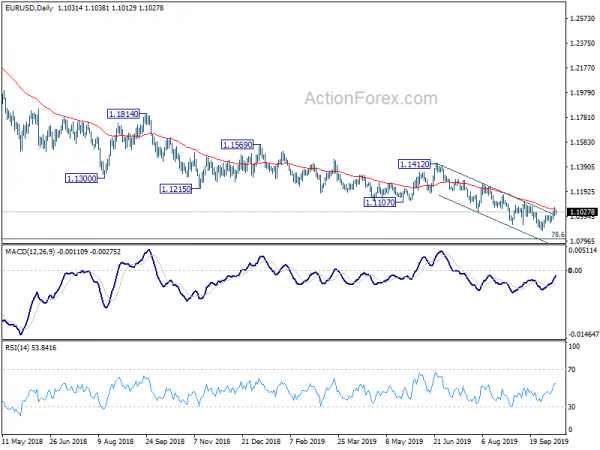

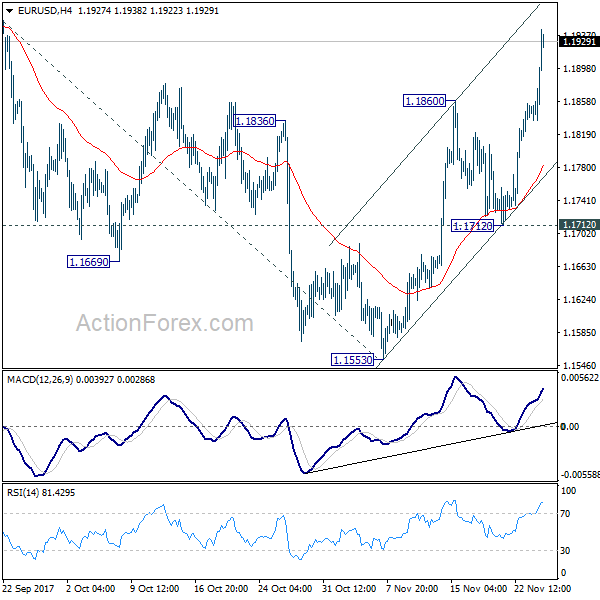

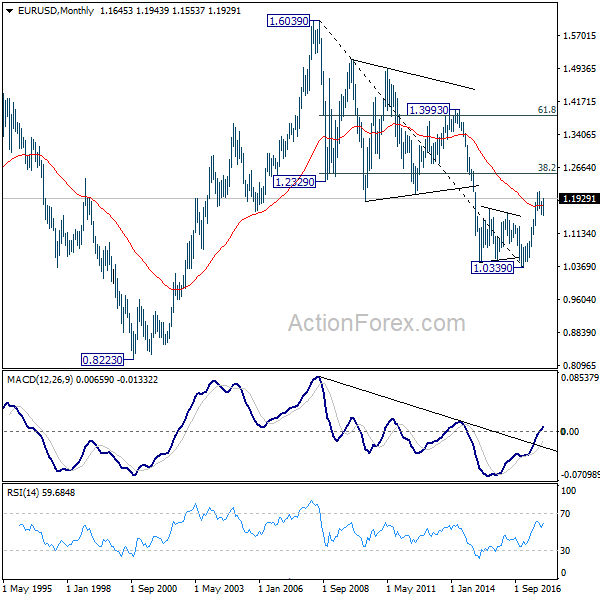

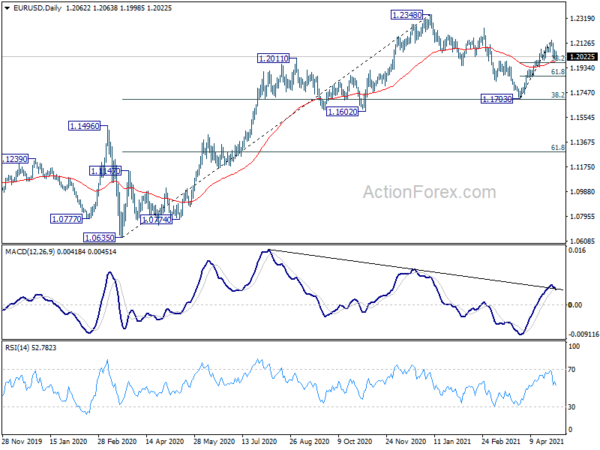

In the bigger picture, considering bullish convergence condition in daily and weekly MACD, a medium term bottom could be in place at 1.1107 after hitting 61.8% retracement of 1.0339 (2016 low) to 1.2555 (2018 high) at 1.1186. Hence, for now, risk will stay on the upside as long as 1.1107 low holds. Break of 1.12347 will extend the rebound towards 38.2% retracement of 1.2555 to 1.1107 at 1.1660. However, sustained break of 1.1107 will confirm resumption of down trend from 1.2555.